When Bailout Vote Failed, Banks Took $155.8 Billion From Fed Lending

December 02 2010 - 2:55PM

Dow Jones News

The peak moment of fear on Wall Street, judging from Federal

Reserve data released Wednesday, was reached Monday, Sept. 29,

2008, when the House of Representatives balked at passing a

historic bailout package, and Wall Street turned to an emergency

Fed facility for $155.8 billion in overnight loans.

That sum was Wall Street's largest daily borrowing during the

crisis from the Fed's Primary Dealer Credit Facility, a program

meant to provide banks with liquidity as panic kept lenders from

delivering the overnight funds Wall Street needs.

As the anxious market waited for word on whether the government

would step in, some major banks were increasing their borrowings

nearly every night, seeking to keep their daily operations going

while the weak got picked off. In a period remembered for drama and

drastic measures, the Fed's data release shows how desperate some

banks were when government aid appeared in doubt -- and how the Fed

may have kept the crisis from getting worse.

The primary dealer credit facility, or PDCF, was established by

the Fed when financial market deteriorated after the collapse of

Bear Stearns Cos. in the spring of 2008. The facility provided

discount-window loans to investment banks, a privilege previously

reserved for more tightly regulated commercial banks. Several banks

have said the Fed programs strengthened the markets, and emphasized

they had paid back their borrowings.

Borrowings from the facility accelerated starting on Sept. 15,

2008, when news broke that Lehman Brothers Holdings had collapsed

and Merrill Lynch had agreed to be bought by Bank of America Corp.

(BAC).

By Monday, Sept. 22, demand for money from the PDCF had climbed

to $99.4 billion, with Morgan Stanley (MS) taking more than $38

billion even as it converted protectively to a bank-holding

company.

As the week went on, the $700 billion rescue plan the Treasury

Department was planning failed to ease concerns. Stocks fell, and

banks kept borrowing.

That Wednesday, the PDCF first topped $100 billion in loans, as

Morgan Stanley took more than $35 billion, Merrill Lynch took $20

billion and Barclays PLC (BCS) sought $14 billion. Goldman took $11

billion, even after announcing that morning Warren Buffett was

investing $5 billion in the company.

Stocks continued to slide, and Sen. John McCain (R., Ariz.)

"suspended" his presidential campaign to focus on the financial

crisis. A separate special Fed auction meant to increase liquidity,

the Term Auction Facility, was tapped for another $75 billion.

The next day, the lending again grew, despite a jump in stocks

as lawmakers reached a "tentative" agreement on the bailout. PDCF

lending that day was $125 billion. Bank of America Corp. (BAC) got

$6 billion, the fifth straight session it increased its

request.

On that Friday, that tentative deal from Congress fell apart,

Washington Mutual Inc. had been seized, and Wall Street borrowed

$152.6 billion from the PDCF.

The huge amount of funding kept the banks afloat as the Treasury

pleaded over the weekend with lawmakers to pass the bailout and as

Citigroup Inc. (C) agreed, with heavy government assistance, to

take over Wachovia Corp., a deal that would ultimately be trumped

by a Wells Fargo & Co. (WFC) bid for Wachovia.

The following Monday morning, the stock market rallied until the

House of Representatives voted down the package in the afternoon.

The Dow Jones Industrial Average plunged a record 777 points and

the banks took more loans, sending the PDCF to its high-water

mark.

Morgan Stanley needed $61 billion. Merrill took $36 billion.

Citi had $15.5 billion while $15 billion went to each of Barclays

and Goldman. Bank of America took $8.3 billion, UBS AG (UBS,

UBSN.VX) $4.1 billion and Mizuho Financial Group Inc. (MFG,

8411.TO) took $343 million.

As Congress reconsidered the bailout, the loan amounts

plateaued. When the bill finally passed on Friday, the loans were

back to $138.8 billion.

By the end of October the PDCF was below $80 billion total and

before 2008 ended, the daily total of loans was less than Morgan

Stanley's single-day draws at the apex.

-By David Benoit, Dow Jones Newswires; 212-416-2458;

david.benoit@dowjones.com

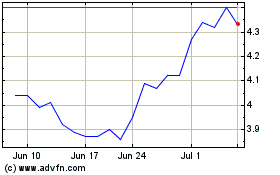

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jun 2024 to Jul 2024

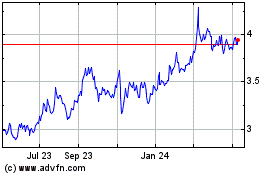

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Jul 2023 to Jul 2024