NEM's $4.8B Project Under Review - Analyst Blog

February 29 2012 - 7:30AM

Zacks

Newmont Mining

Corp.'s (NEM) Minas Conga gold and copper project of

$4.8 billion is under Peru government's 40-day review over concerns

regarding its impact on the local water supply.

The Peru government has appointed

two Spanish engineers to review the project, which was temporarily

suspended in November 2011 following violent demonstrations by

local residents.

The project will provide the

company with significant revenues by the taxes levied on the mined

product. Newmont expects to boost its production at Conga by the

end of 2014 or early 2015.

During the first five years, the

company expects average annual production output of 580,000 ounces

to 680,000 ounces of gold and 155 million to 235 million pounds of

copper.

Newmont owns 51.35% of Conga,

Peru's biggest mining project, while the remaining portion is held

by Compania de Minas Buenaventura SA and the International Finance

Corp. Peru is highly rich in mineral resources and the locals

complain that the mining companies and the government have not done

enough toward the communal development of the regions surrounding

the mines.

Recently, Newmont announced its

fourth-quarter 2011 results. The attributable gold and copper

production was 1.3 million ounces and 47 million pounds,

respectively, in the quarter at costs applicable to sales (CAS) of

$602 per ounce, and $1.58 per pound on a co-product basis.

For fiscal 2012, the company

expects attributable gold production of approximately 5.0 million

to 5.2 million ounces, with attributable copper production of 150

to 170 million pounds. Costs applicable to sales are expected to be

between $625 and $675 per ounce for gold. Costs applicable to

copper sales are expected to be between $1.80 and $2.20 per pound

of copper.

On the other hand, Newmont has

proposed re-location and capacity expansion of the existing lakes

so that the local water supply is not hampered.

Currently the shares of Newmont

retain a Zacks #3 Rank (short-term “Hold” recommendation). The

company competes with the likes of AngloGold Ashanti

Ltd. (AU), Barrick Gold Corporation (ABX)

and Gold Fields Ltd. (GFI).

BARRICK GOLD CP (ABX): Free Stock Analysis Report

ANGLOGOLD LTD (AU): Free Stock Analysis Report

GOLD FIELDS-ADR (GFI): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

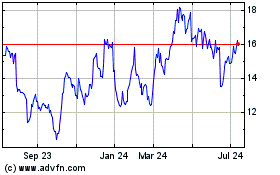

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jun 2024 to Jul 2024

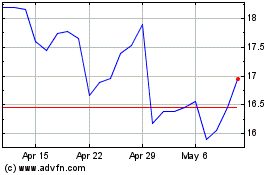

Gold Fields (NYSE:GFI)

Historical Stock Chart

From Jul 2023 to Jul 2024