Ecolab (NYSE:ECL): 2006 THIRD QUARTER HIGHLIGHTS: Record diluted

net income per share, +13% to $0.43 Record sales, +10% to $1.3

billion Double-digit U.S. sales and income propel growth, led by

the Institutional and Pest Elimination Divisions Full year 2006 EPS

range improved to $1.42 to $1.43 Third Quarter and Nine Months

Ended Sept. 30 Third Quarter % Nine Months % 2006� 2005� increase

2006� 2005� increase (Millions, except per share) (unaudited)

(unaudited) � Net Sales $1,278.9� $ 1,164.8� 10% $3,624.8�

$3,393.3� 7% � Operating Income 181.4� 162.4� 12% 465.9� 418.7� 11%

� Pretax Income 170.1� 150.9� 13% 433.4� 383.8� 13% Taxes 59.8�

53.0� 13% 152.0� 135.0� 13% Net Income $110.4� $ 98.0� 13% $281.4�

$248.8� 13% � Diluted Net Income Per Common Share $0.43� $ 0.38�

13% $1.09� $0.96� 14% Diluted Average Shares Outstanding 256.7�

259.9� -1% 257.2� 260.1� -1% Note: Results for both 2005 and 2006

reflect Ecolab's adoption of SFAS 123 (R), which requires the

expensing of stock options, and Ecolab's restatement of prior

period results as part of its transition to this new accounting

standard. Double-digit sales and operating income growth from U.S.

operations led Ecolab�s third quarter results to record levels for

the period ended September 30, 2006. Ecolab's consolidated sales

increased 10% to a record $1.3 billion in the third quarter of

2006. Net income increased 13% to a record $110 million, or $0.43

per diluted share. All financial results presented in this release

include the impact of expensing stock options. Ecolab adopted SFAS

123(R), the accounting standard for expensing stock options, in the

fourth quarter of 2005. As part of the transition to the new

standard, Ecolab restated its earnings per share in line with the

pro forma amounts historically disclosed in the notes to Ecolab�s

financial statements. These restated results were included in

Ecolab�s 2005 annual report and are available at Ecolab�s website

at www.ecolab.com/investor. Commenting on the quarter, Douglas M.

Baker, Jr., Ecolab�s Chairman, President and Chief Executive

Officer said, �We enjoyed a terrific quarter as we benefited from

investments in our sales force, new product innovations, operating

improvements and better pricing. We also continued to make further

competitive gains in the quarter as we demonstrated the strength

and value of our premium service offering. �Our outlook remains

excellent. We are implementing the right actions to deliver strong

growth in 2006 and at the same time ensure we have the right means

to continue driving strong growth for years ahead � expanding our

industry-leading sales and service force; making key investments in

developing our infrastructure, information technology and

differentiated product research and development; and driving our

successful Circle the Customer strategy. In addition, as reflected

by our recent announcements, we continue to aggressively pursue

acquisitions to strengthen and broaden our global customer

offering. We remain focused on driving superior performance, both

for our customers and our shareholders, and are working to improve

our fundamentals to deliver those results. We will continue to

build on our powerful business model to deliver the leading

customer solutions, and through that, we expect to deliver

consistent, reliable and superior growth for years to come.� Third

quarter 2006 sales for Ecolab's United States Cleaning &

Sanitizing operations rose 10% to $562 million, led by double-digit

gains by the Institutional Division, and strong growth from the

Food & Beverage, Professional Products, Textile Care and

Healthcare businesses. Ecolab's United States Cleaning &

Sanitizing operating income rose 15% to $99 million, as the

benefits of the higher sales, cost efficiencies, competitive gains

and better pricing more than offset higher delivered product costs.

United States Other Services sales increased 10% to $108 million in

the third quarter benefiting from continued double-digit gains by

Pest Elimination. Operating income increased 12% to $12 million as

Pest Elimination growth was partially offset by accelerated

investments at GCS. Sales of Ecolab's International operations,

when measured at fixed currency rates, rose 6% to $584 million in

the third quarter. Latin America showed double-digit sales gains,

and Asia Pacific and Canada sales also showed good increases;

Europe recorded a moderate sales gain as weak economic trends in

major central countries slowed results. Fixed currency operating

income rose 3% to $66 million, as sales growth and pricing

initiatives were partially offset by higher delivered product costs

and growth and efficiency investments. When measured at public

currency rates, International sales increased 10% and operating

income grew 7%. Currency translation had a favorable impact on net

income growth of approximately $1.5 million for the third quarter

of 2006. Ecolab reacquired 1.4 million shares of its common stock

during the third quarter. Business Outlook Certain information

presented in this news release, including the following statements,

are forward-looking and based on current expectations. Actual

results may differ materially. These statements do not include the

potential impact of business acquisitions, divestitures, higher

than anticipated raw material price increases or other material

corporate events, which may be completed after the date of this

release. This Business Outlook section should be read in

conjunction with the information on �Forward-Looking Statements� at

the end of this release. Ecolab expects sales for both domestic and

international operations (in fixed currencies) to increase in the

fourth quarter 2006 over the fourth quarter 2005. Gross margins are

expected to rise above 50% and compare favorably with 49.4% last

year. Selling, general and administrative expenses are expected to

approximate the 39% recorded a year ago. Interest expense is

expected to be approximately $13 million. The effective tax rate in

the quarter should be approximately 36%. Overall, currency

translation is expected to benefit fourth quarter earnings. Diluted

earnings per share are expected to be in the $0.33-$0.34 range in

the fourth quarter of 2006. Diluted earnings per share were $0.27

for the fourth quarter of 2005. For the full year ending December

31, 2006, Ecolab continues to expect diluted earnings per share in

the $1.42 -$1.43 range. In 2005, Ecolab reported net income per

share of $1.23. With 2005 sales of $4.5 billion, Ecolab is the

leading global developer and marketer of premium cleaning,

sanitizing, pest elimination, maintenance and repair products and

services for the hospitality, foodservice, healthcare and

industrial markets. Ecolab shares are traded on the New York Stock

Exchange under the symbol ECL. Ecolab news releases and other

investor information are available on the Internet at

http://www.ecolab.com. Ecolab will host a live webcast to review

the second quarter earnings announcement today at 1:00 p.m. Eastern

Time. The webcast will be available to the public on Ecolab's

website at http://www.ecolab.com/investor. A replay of the webcast

will be available at that site through November 3, 2006. Listening

to the webcast requires Internet access, a soundcard and the

Windows Media Player or other compatible streaming media player. If

you do not have the Media Player client installed on your PC, you

may download a free version of Media Player at

www.microsoft.com/windows/windowsmedia/download/default.asp. This

news release contains various �Forward-Looking Statements� within

the meaning of the Private Securities Litigation Reform Act of

1995. These include statements concerning our 2006 fourth quarter

and full year financial and business prospects, including estimated

sales; gross margins; selling, general and administrative expenses;

interest expense; effective tax rates; currency translation; and

earnings per share. These statements, which represent Ecolab�s

expectations or beliefs concerning various future events, are based

on current expectations that involve a number of risks and

uncertainties that could cause actual results to differ materially

from those of such Forward-Looking Statements. Risks and

uncertainties that may affect operating results and business

performance include: the vitality of the foodservice, hospitality,

travel, health care and food processing industries; restraints on

pricing flexibility due to competitive factors, customer or vendor

consolidations, and existing contractual obligations; changes in

oil or raw material prices or unavailability of adequate and

reasonably priced raw materials or substitutes therefor; the

occurrence of capacity constraints or the loss of a key supplier or

the inability to obtain or renew supply agreements on favorable

terms; the effect of future acquisitions or divestitures or other

corporate transactions; our ability to achieve plans for past

acquisitions; the costs and effects of complying with: (i) laws and

regulations relating to the environment and to the manufacture,

storage, distribution, efficacy and labeling of our products, and

(ii) changes in tax, fiscal, governmental and other regulatory

policies; economic factors such as the worldwide economy, interest

rates and currency movements including, in particular, our exposure

to foreign currency risk; the occurrence of (a) litigation or

claims, (b) the loss or insolvency of a major customer or

distributor, (c) war (including acts of terrorism or hostilities

which impact our markets), (d) natural or manmade disasters, or (e)

severe weather conditions or public health epidemics affecting the

foodservice, hospitality and travel industries; loss of, or changes

in, executive management; our ability to continue product

introductions or reformulations and technological innovations; and

other uncertainties or risks reported from time to time in our

reports to the Securities and Exchange Commission. In addition, we

note that our stock price can be affected by fluctuations in

quarterly earnings. There can be no assurances that our earnings

levels will meet investors' expectations. We undertake no duty to

update our Forward-Looking Statements. (ECL-E) � ECOLAB INC.

CONSOLIDATED STATEMENT OF INCOME THIRD QUARTER AND NINE MONTHS

ENDED SEPTEMBER 30, 2006 (unaudited) � Third Quarter Nine Months

(thousands, except per share) 2006� 2005� 2006� 2005� � � Net Sales

$ 1,278,855� $ 1,164,773� $ 3,624,814� $ 3,393,317� � Cost of Sales

625,554� 572,862� 1,786,048� 1,670,903� Selling, General and

Administrative Expenses 471,937� 429,464� 1,372,818� 1,303,728� �

Operating Income 181,364� 162,447� 465,948� 418,686� � Interest

Expense, Net 11,219� 11,529� 32,561� 34,903� � Income before Income

Taxes 170,145� 150,918� 433,387� 383,783� � Provision for Income

Taxes 59,786� 52,960� 151,963� 134,998� � Net Income $ 110,359� $

97,958� $ 281,424� $ 248,785� � Diluted Net Income per Common Share

$ 0.43� $ 0.38� $ 1.09� $ 0.96� � Weighted-Average Common Shares

Outstanding ��Basic 251,573� 255,817� 252,422� 255,854� ��Diluted

256,657� 259,911� 257,183� 260,099� � � 2005 amounts have been

restated for the adoption of SFAS No. 123(R), "Share-Based

Payment". � ECOLAB INC. OPERATING SEGMENT INFORMATION THIRD QUARTER

AND NINE MONTHS ENDED SEPTEMBER 30, 2006 (unaudited) � Third

Quarter Nine Months (thousands) 2006� 2005� 2006� 2005� � Net Sales

United States Cleaning & Sanitizing $ 561,707� $ 510,476� $

1,619,631� $ 1,474,463� Other Services 108,297� 98,315� 306,432�

280,453� Total 670,004� 608,791� 1,926,063� 1,754,916�

International 584,273� 550,197� 1,656,161� 1,570,648� Effect of

Foreign Currency Translation 24,578� 5,785� 42,590� 67,753�

Consolidated $ 1,278,855� $ 1,164,773� $ 3,624,814� $ 3,393,317� �

Operating Income United States Cleaning & Sanitizing $ 98,976�

$ 85,933� $ 264,619� $ 230,198� Other Services 12,466� 11,124�

31,100� 28,945� Total 111,442� 97,057� 295,719� 259,143�

International 66,221� 64,212� 164,604� 153,146� Effect of Foreign

Currency Translation 3,701� 1,178� 5,625� 6,397� Consolidated $

181,364� $ 162,447� $ 465,948� $ 418,686� � � 2005 amounts have

been restated for the adoption of SFAS No. 123(R), "Share-Based

Payment". � ECOLAB INC. CONSOLIDATED BALANCE SHEET SEPTEMBER 30,

2006 � September 30 December 31 September 30 (thousands) 2006�

2005� 2005� (unaudited) (unaudited) � Assets Current assets Cash

and cash equivalents $ 54,192� $ 104,378� $ 165,308� Short-term

investments 125,063� Accounts receivable, net 866,214� 743,520�

801,981� Inventories 354,225� 325,574� 337,518� Deferred income

taxes 65,097� 65,880� 73,844� Other current assets 66,563� 57,251�

68,914� Total current assets 1,406,291� 1,421,666� 1,447,565� �

Property, plant and equipment, net 874,793� 835,503� 837,850� �

Goodwill, net 1,022,119� 937,019� 964,888� � Other intangible

assets, net 222,749� 202,936� 213,635� � Other assets, net 480,924�

399,504� 364,644� � Total assets $ 4,006,876� $ 3,796,628� $

3,828,582� � Liabilities and Shareholders' Equity Current

liabilities Short-term debt $ 190,008� $ 226,927� $ 169,529�

Accounts payable 310,597� 277,635� 264,196� Compensation and

benefits 213,490� 214,131� 199,108� Income taxes 29,178� 39,583�

49,955� Other current liabilities 402,698� 361,081� 383,264� Total

current liabilities 1,145,971� 1,119,357� 1,066,052� � Long-term

debt 542,948� 519,374� 539,019� � Postretirement health care and

pension benefits 342,079� 302,048� 291,343� � Other liabilities

212,759� 206,639� 246,978� � Shareholders' equity 1,763,119�

1,649,210� 1,685,190� � � Total liabilities and shareholders'

equity $ 4,006,876� $ 3,796,628� $ 3,828,582� � � September 30,

2005 amounts have been restated for the adoption of SFAS No.

123(R), "Share-Based Payment". Ecolab (NYSE:ECL): 2006 THIRD

QUARTER HIGHLIGHTS: -- Record diluted net income per share, +13% to

$0.43 -- Record sales, +10% to $1.3 billion -- Double-digit U.S.

sales and income propel growth, led by the Institutional and Pest

Elimination Divisions -- Full year 2006 EPS range improved to $1.42

to $1.43 -0- *T Third Quarter and Nine Months Ended Sept. 30

------------------------------ Third Quarter %

--------------------- 2006 2005 increase ----------- ---------

-------- (Millions, except per share) (unaudited) Net Sales

$1,278.9 $1,164.8 10% Operating Income 181.4 162.4 12% Pretax

Income 170.1 150.9 13% Taxes 59.8 53.0 13% ----------- ---------

-------- Net Income $110.4 $98.0 13% =========== ========= ========

Diluted Net Income Per Common Share $0.43 $0.38 13% Diluted Average

Shares Outstanding 256.7 259.9 -1% Nine Months %

--------------------- 2006 2005 increase ----------- ---------

-------- (Millions, except per share) (unaudited) Net Sales

$3,624.8 $3,393.3 7% Operating Income 465.9 418.7 11% Pretax Income

433.4 383.8 13% Taxes 152.0 135.0 13% ----------- ---------

-------- Net Income $281.4 $248.8 13% =========== =========

======== Diluted Net Income Per Common Share $1.09 $0.96 14%

Diluted Average Shares Outstanding 257.2 260.1 -1% *T -0- *T Note:

Results for both 2005 and 2006 reflect Ecolab's adoption of SFAS

123 (R), which requires the expensing of stock options, and

Ecolab's restatement of prior period results as part of its

transition to this new accounting standard. *T Double-digit sales

and operating income growth from U.S. operations led Ecolab's third

quarter results to record levels for the period ended September 30,

2006. Ecolab's consolidated sales increased 10% to a record $1.3

billion in the third quarter of 2006. Net income increased 13% to a

record $110 million, or $0.43 per diluted share. All financial

results presented in this release include the impact of expensing

stock options. Ecolab adopted SFAS 123(R), the accounting standard

for expensing stock options, in the fourth quarter of 2005. As part

of the transition to the new standard, Ecolab restated its earnings

per share in line with the pro forma amounts historically disclosed

in the notes to Ecolab's financial statements. These restated

results were included in Ecolab's 2005 annual report and are

available at Ecolab's website at www.ecolab.com/investor.

Commenting on the quarter, Douglas M. Baker, Jr., Ecolab's

Chairman, President and Chief Executive Officer said, "We enjoyed a

terrific quarter as we benefited from investments in our sales

force, new product innovations, operating improvements and better

pricing. We also continued to make further competitive gains in the

quarter as we demonstrated the strength and value of our premium

service offering. "Our outlook remains excellent. We are

implementing the right actions to deliver strong growth in 2006 and

at the same time ensure we have the right means to continue driving

strong growth for years ahead - expanding our industry-leading

sales and service force; making key investments in developing our

infrastructure, information technology and differentiated product

research and development; and driving our successful Circle the

Customer strategy. In addition, as reflected by our recent

announcements, we continue to aggressively pursue acquisitions to

strengthen and broaden our global customer offering. We remain

focused on driving superior performance, both for our customers and

our shareholders, and are working to improve our fundamentals to

deliver those results. We will continue to build on our powerful

business model to deliver the leading customer solutions, and

through that, we expect to deliver consistent, reliable and

superior growth for years to come." Third quarter 2006 sales for

Ecolab's United States Cleaning & Sanitizing operations rose

10% to $562 million, led by double-digit gains by the Institutional

Division, and strong growth from the Food & Beverage,

Professional Products, Textile Care and Healthcare businesses.

Ecolab's United States Cleaning & Sanitizing operating income

rose 15% to $99 million, as the benefits of the higher sales, cost

efficiencies, competitive gains and better pricing more than offset

higher delivered product costs. United States Other Services sales

increased 10% to $108 million in the third quarter benefiting from

continued double-digit gains by Pest Elimination. Operating income

increased 12% to $12 million as Pest Elimination growth was

partially offset by accelerated investments at GCS. Sales of

Ecolab's International operations, when measured at fixed currency

rates, rose 6% to $584 million in the third quarter. Latin America

showed double-digit sales gains, and Asia Pacific and Canada sales

also showed good increases; Europe recorded a moderate sales gain

as weak economic trends in major central countries slowed results.

Fixed currency operating income rose 3% to $66 million, as sales

growth and pricing initiatives were partially offset by higher

delivered product costs and growth and efficiency investments. When

measured at public currency rates, International sales increased

10% and operating income grew 7%. Currency translation had a

favorable impact on net income growth of approximately $1.5 million

for the third quarter of 2006. Ecolab reacquired 1.4 million shares

of its common stock during the third quarter. Business Outlook

Certain information presented in this news release, including the

following statements, are forward-looking and based on current

expectations. Actual results may differ materially. These

statements do not include the potential impact of business

acquisitions, divestitures, higher than anticipated raw material

price increases or other material corporate events, which may be

completed after the date of this release. This Business Outlook

section should be read in conjunction with the information on

"Forward-Looking Statements" at the end of this release. Ecolab

expects sales for both domestic and international operations (in

fixed currencies) to increase in the fourth quarter 2006 over the

fourth quarter 2005. Gross margins are expected to rise above 50%

and compare favorably with 49.4% last year. Selling, general and

administrative expenses are expected to approximate the 39%

recorded a year ago. Interest expense is expected to be

approximately $13 million. The effective tax rate in the quarter

should be approximately 36%. Overall, currency translation is

expected to benefit fourth quarter earnings. Diluted earnings per

share are expected to be in the $0.33-$0.34 range in the fourth

quarter of 2006. Diluted earnings per share were $0.27 for the

fourth quarter of 2005. For the full year ending December 31, 2006,

Ecolab continues to expect diluted earnings per share in the $1.42

-$1.43 range. In 2005, Ecolab reported net income per share of

$1.23. With 2005 sales of $4.5 billion, Ecolab is the leading

global developer and marketer of premium cleaning, sanitizing, pest

elimination, maintenance and repair products and services for the

hospitality, foodservice, healthcare and industrial markets. Ecolab

shares are traded on the New York Stock Exchange under the symbol

ECL. Ecolab news releases and other investor information are

available on the Internet at http://www.ecolab.com. Ecolab will

host a live webcast to review the second quarter earnings

announcement today at 1:00 p.m. Eastern Time. The webcast will be

available to the public on Ecolab's website at

http://www.ecolab.com/investor. A replay of the webcast will be

available at that site through November 3, 2006. Listening to the

webcast requires Internet access, a soundcard and the Windows Media

Player or other compatible streaming media player. If you do not

have the Media Player client installed on your PC, you may download

a free version of Media Player at

www.microsoft.com/windows/windowsmedia/download/default.asp. This

news release contains various "Forward-Looking Statements" within

the meaning of the Private Securities Litigation Reform Act of

1995. These include statements concerning our 2006 fourth quarter

and full year financial and business prospects, including estimated

sales; gross margins; selling, general and administrative expenses;

interest expense; effective tax rates; currency translation; and

earnings per share. These statements, which represent Ecolab's

expectations or beliefs concerning various future events, are based

on current expectations that involve a number of risks and

uncertainties that could cause actual results to differ materially

from those of such Forward-Looking Statements. Risks and

uncertainties that may affect operating results and business

performance include: -- the vitality of the foodservice,

hospitality, travel, health care and food processing industries; --

restraints on pricing flexibility due to competitive factors,

customer or vendor consolidations, and existing contractual

obligations; -- changes in oil or raw material prices or

unavailability of adequate and reasonably priced raw materials or

substitutes therefor; -- the occurrence of capacity constraints or

the loss of a key supplier or the inability to obtain or renew

supply agreements on favorable terms; -- the effect of future

acquisitions or divestitures or other corporate transactions; --

our ability to achieve plans for past acquisitions; -- the costs

and effects of complying with: (i) laws and regulations relating to

the environment and to the manufacture, storage, distribution,

efficacy and labeling of our products, and (ii) changes in tax,

fiscal, governmental and other regulatory policies; -- economic

factors such as the worldwide economy, interest rates and currency

movements including, in particular, our exposure to foreign

currency risk; -- the occurrence of (a) litigation or claims, (b)

the loss or insolvency of a major customer or distributor, (c) war

(including acts of terrorism or hostilities which impact our

markets), (d) natural or manmade disasters, or (e) severe weather

conditions or public health epidemics affecting the foodservice,

hospitality and travel industries; -- loss of, or changes in,

executive management; -- our ability to continue product

introductions or reformulations and technological innovations; and

-- other uncertainties or risks reported from time to time in our

reports to the Securities and Exchange Commission. In addition, we

note that our stock price can be affected by fluctuations in

quarterly earnings. There can be no assurances that our earnings

levels will meet investors' expectations. We undertake no duty to

update our Forward-Looking Statements. (ECL-E) -0- *T ECOLAB INC.

CONSOLIDATED STATEMENT OF INCOME THIRD QUARTER AND NINE MONTHS

ENDED SEPTEMBER 30, 2006 (unaudited) Third Quarter Nine Months

----------------------- ----------------------- (thousands, except

per share) 2006 2005 2006 2005 ----------- ----------- -----------

----------- Net Sales $1,278,855 $1,164,773 $3,624,814 $3,393,317

Cost of Sales 625,554 572,862 1,786,048 1,670,903 Selling, General

and Administrative Expenses 471,937 429,464 1,372,818 1,303,728

----------- ----------- ----------- ----------- Operating Income

181,364 162,447 465,948 418,686 Interest Expense, Net 11,219 11,529

32,561 34,903 ----------- ----------- ----------- -----------

Income before Income Taxes 170,145 150,918 433,387 383,783

Provision for Income Taxes 59,786 52,960 151,963 134,998

----------- ----------- ----------- ----------- Net Income $110,359

$97,958 $281,424 $248,785 =========== =========== ===========

=========== Diluted Net Income per Common Share $0.43 $0.38 $1.09

$0.96 Weighted-Average Common Shares Outstanding Basic 251,573

255,817 252,422 255,854 Diluted 256,657 259,911 257,183 260,099

2005 amounts have been restated for the adoption of SFAS No.

123(R), "Share-Based Payment". *T -0- *T ECOLAB INC. OPERATING

SEGMENT INFORMATION THIRD QUARTER AND NINE MONTHS ENDED SEPTEMBER

30, 2006 (unaudited) Third Quarter Nine Months

----------------------- ----------------------- (thousands) 2006

2005 2006 2005 ----------- ----------- ----------- ----------- Net

Sales United States Cleaning & Sanitizing $561,707 $510,476

$1,619,631 $1,474,463 Other Services 108,297 98,315 306,432 280,453

----------- ----------- ----------- ----------- Total 670,004

608,791 1,926,063 1,754,916 International 584,273 550,197 1,656,161

1,570,648 Effect of Foreign Currency Translation 24,578 5,785

42,590 67,753 ----------- ----------- ----------- -----------

Consolidated $1,278,855 $1,164,773 $3,624,814 $3,393,317

=========== =========== =========== =========== Operating Income

United States Cleaning & Sanitizing $98,976 $85,933 $264,619

$230,198 Other Services 12,466 11,124 31,100 28,945 -----------

----------- ----------- ----------- Total 111,442 97,057 295,719

259,143 International 66,221 64,212 164,604 153,146 Effect of

Foreign Currency Translation 3,701 1,178 5,625 6,397 -----------

----------- ----------- ----------- Consolidated $181,364 $162,447

$465,948 $418,686 =========== =========== =========== ===========

2005 amounts have been restated for the adoption of SFAS No.

123(R), "Share-Based Payment". *T -0- *T ECOLAB INC. CONSOLIDATED

BALANCE SHEET SEPTEMBER 30, 2006 September 30 December 31 September

30 (thousands) 2006 2005 2005 ------------ ----------- ------------

(unaudited) (unaudited) Assets Current assets Cash and cash

equivalents $54,192 $104,378 $165,308 Short-term investments

125,063 Accounts receivable, net 866,214 743,520 801,981

Inventories 354,225 325,574 337,518 Deferred income taxes 65,097

65,880 73,844 Other current assets 66,563 57,251 68,914

------------ ----------- ------------ Total current assets

1,406,291 1,421,666 1,447,565 Property, plant and equipment, net

874,793 835,503 837,850 Goodwill, net 1,022,119 937,019 964,888

Other intangible assets, net 222,749 202,936 213,635 Other assets,

net 480,924 399,504 364,644 ------------ ----------- ------------

Total assets $4,006,876 $3,796,628 $3,828,582 ============

=========== ============ Liabilities and Shareholders' Equity

Current liabilities Short-term debt $190,008 $226,927 $169,529

Accounts payable 310,597 277,635 264,196 Compensation and benefits

213,490 214,131 199,108 Income taxes 29,178 39,583 49,955 Other

current liabilities 402,698 361,081 383,264 ------------

----------- ------------ Total current liabilities 1,145,971

1,119,357 1,066,052 Long-term debt 542,948 519,374 539,019

Postretirement health care and pension benefits 342,079 302,048

291,343 Other liabilities 212,759 206,639 246,978 Shareholders'

equity 1,763,119 1,649,210 1,685,190 ------------ -----------

------------ Total liabilities and shareholders' equity $4,006,876

$3,796,628 $3,828,582 ============ =========== ============

September 30, 2005 amounts have been restated for the adoption of

SFAS No. 123(R), "Share-Based Payment". *T

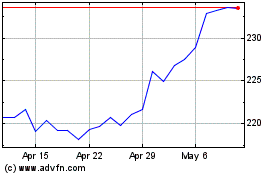

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jun 2024 to Jul 2024

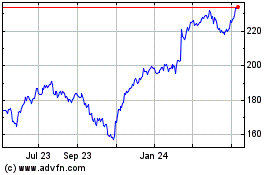

Ecolab (NYSE:ECL)

Historical Stock Chart

From Jul 2023 to Jul 2024