DaVita Beats Estimates - Analyst Blog

August 04 2011 - 8:15AM

Zacks

DaVita Inc. (DVA) reported second-quarter net

operating income of $114.4 million, or $1.17 per share, which

exceeded the Zacks Consensus Estimate by 3 cents. The earnings were

also higher than $110.4 million or $1.06 per share earned in the

comparable quarter of 2010.

Earnings for the year-ago quarter exclude after-tax debt

redemption charges of $2.5 million or 2 cents per share, while the

reported quarter’s earnings exclude after-tax non-cash goodwill

impairment charges of $14.4 million or 14 cents per share.

Net income, including the non-recurring items, was $100 million

or $1.03 per share, showing a decline from $107.9 million or $1.04

per share in the year-ago quarter.

The increased income was attributable to better-than-expected

revenues, reduced operating expenses and strong cash flows of the

company.

Net operating revenues for the reported quarter climbed to $1.71

billion, beating the Zacks Consensus Estimate of $1.64 billion and

surpassing the year-ago revenue of $1.59 billion. Total operating

expenses and charges declined to $1.46 billion from $1.34 billion

in the second quarter of 2010.

Segment wise, revenues from the Dialysis and related

Lab Services segment for the quarter came in at $1.59

billion as against $1.50 billion in the prior-year quarter.

Operating income for the segment increased to $283 million in the

reported quarter from $254 million in the year-ago quarter.

Ancillary services and strategic

initiatives generated revenues of $123 million,

increasing substantially from $93 million in the year-ago quarter.

The segment suffered an operating loss of $25 million in the

reported quarter as against a loss of $2 million in the year-ago

quarter.

DaVita provided administrative services across 1,669 outpatient

dialysis centers serving approximately 131,000 patients as of June

30, 2011. DaVita acquired and opened a total of 27 centers during

the reported quarter.

Total treatments for the reported quarter came in at

approximately 4.8 million. This represents a per day increase of

7.1% over the year-ago quarter. The growth of non-acquired

treatment in the quarter stood at 4.6%.

The company's effective tax rate was 35.7% in the reported

quarter. The third party owners’ income attributable to non-tax

paying entities impacted the effective tax rate. The effective tax

rate attributable to DaVita in the reported quarter was 40.0%.

Financial Update

In the reported quarter operating cash flow was $204 million and

free cash flow was $125 million, both showing sharp declines from

$296 million and $250 million, respectively, in the prior-year

quarter.

Total assets at the end of June were $8.19 billion, up from $

8.11 billion on December 31, 2010. The total long-term debt on June

30, 2011 declined marginally to $4.21 billion from $4.23 billion as

of December 31, 2010.

Stock Update

DaVita repurchased 3.7 million shares for $316.1 million at an

average price of $85.20 during the first half of the year. In

addition, DaVita also repurchased 84,600 shares of common stock

from July 1, 2011 through July 31, 2011 for $7.3 million at an

average price of $85.83.

As a result of these transactions, the remaining board

authorization for share repurchases as of July 31, 2011 is

approximately $358 million.

Acquisition Update

DaVita is expected to complete the acquisition of its competitor

DSI Renal Inc. ("DSI") during the third quarter of 2011. The deal

was announced on February 4, 2011, for approximately $690 million,

subject to customary closing conditions.

DaVita will require the Hart-Scott-Rodino antitrust clearance to

complete the deal. In addition, DaVita believes that it will have

to divest some of its centers as a condition of the transaction.

Credit Suisse Group (CS) is acting as its

financial advisor.

Outlook for 2011

DaVita expects its operating income for the year to be in the

range of $1,080 million to $1,120 million and its operating cash

flows to be in the range of $900 million to $980 million.

For fiscal year 2012, DaVita expects operating income in the

range of $1,200 million to $1,300 million.

Our Take

DaVita is showing sharp earnings growth in both its business

segments coupled with strong expected free cash flow, declining

costs and the potential for meaningful mergers and acquisitions,

which convinces us that the company will continue its growth

story.

Moreover, we believe the acquisition of DSI will provide access

to new areas of work for DaVita in the Midwestern, Southern and

some Western states.

DaVita carries a Zacks #2 Rank, implying a short-term Buy

rating.

CREDIT SUISSE (CS): Free Stock Analysis Report

DAVITA INC (DVA): Free Stock Analysis Report

Zacks Investment Research

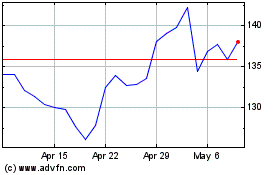

DaVita (NYSE:DVA)

Historical Stock Chart

From May 2024 to Jun 2024

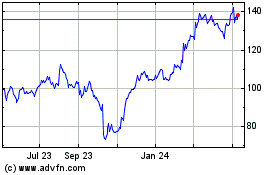

DaVita (NYSE:DVA)

Historical Stock Chart

From Jun 2023 to Jun 2024