Crescent Energy Company (NYSE: CRGY) (“we” or “our”) announced

today that, subject to market conditions, its indirect subsidiary

Crescent Energy Finance LLC (the “Issuer”) intends to offer for

sale pursuant to Rule 144A and Regulation S under the Securities

Act of 1933, as amended (the “Securities Act”), to eligible

purchasers, $750 million aggregate principal amount of Senior Notes

due 2033 (the “Notes”). The Notes will be guaranteed on a senior

unsecured basis by all of the Issuer’s subsidiaries that guarantee

the Issuer’s existing notes and the indebtedness under its

revolving credit facility (the “revolving credit facility”).

The Issuer intends to use the net proceeds from this offering to

fund the cash portion of the consideration for the previously

announced merger (the “Transaction”) with SilverBow Resources, Inc.

(“SilverBow”) and any remaining net proceeds from this offering, at

or following the completion of the Transaction, to repay

SilverBow’s existing indebtedness outstanding at the time of

completion of the Transaction. Pending any specific application,

the Issuer may use a portion of the net proceeds to repay amounts

outstanding under the revolving credit facility.

If (i) the Transaction has not been completed on or prior to May

22, 2025 (the “Outside Date”), or (ii) prior to the Outside Date,

(a) the SilverBow merger agreement is terminated or amended in a

manner that would, in our sole judgment, reasonably be expected to

adversely affect the interests of the holders of the notes in any

material respect, or (b) we have decided that we will not pursue

the consummation of the Transaction or have determined in our sole

discretion that the consummation of the Transaction cannot or is

not reasonably likely to be satisfied by the Outside Date, we will

be required to redeem all of the outstanding notes at a redemption

price equal to 100% of the initial issue price of such notes, plus

accrued and unpaid interest from the date of initial issuance of

such notes to, but not including, the payment date of such

mandatory redemption.

The Notes and the related guarantees have not been registered

under the Securities Act, or any state securities laws, and, unless

so registered, the Notes and the guarantees may not be offered or

sold in the United States except pursuant to an exemption from, or

in a transaction not subject to, the registration requirements of

the Securities Act and applicable state securities laws. The Issuer

plans to offer and sell the Notes only to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act and to persons outside the United States

pursuant to Regulation S under the Securities Act.

About Crescent Energy Company

Crescent Energy Company is a U.S. energy company with a

portfolio of assets concentrated in Texas and the Rockies.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains forward-looking statements within

the meaning of Section 27A of the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended. These

statements are based on current expectations. The words and phrases

“should”, “could”, “may”, “will”, “believe”, “think”, “plan”,

“intend”, “expect”, “potential”, “possible”, “anticipate”,

“estimate”, “forecast”, “view”, “efforts”, “target”, “goal” and

similar expressions identify forward-looking statements and express

our expectations about future events. This communication includes

statements regarding this private placement and the use of proceeds

therefrom, as well as the Transaction, that may contain

forward-looking statements within the meaning of federal securities

laws. We believe that our expectations are based on reasonable

assumptions; however, no assurance can be given that such

expectations will prove to be correct. A number of factors could

cause actual results to differ materially from the expectations,

anticipated results or other forward-looking information expressed

in this communication, including expected timing and likelihood of

completion of the Transaction, including the timing, receipt and

terms and conditions of any required governmental and regulatory

approvals of the Transaction that could reduce anticipated benefits

or cause the parties to abandon the Transaction, the ability to

successfully integrate the businesses, the occurrence of any event,

change or other circumstances that could give rise to the

termination of the merger agreement, the possibility that

stockholders of Crescent may not approve the issuance of new shares

of common stock in the Transaction or that stockholders of

SilverBow may not approve the merger agreement, the risk that the

parties may not be able to satisfy the conditions to the

Transaction in a timely manner or at all, risks related to

disruption of management time from ongoing business operations due

to the Transaction, the risk that any announcements relating to the

Transaction could have adverse effects on the market price of

Crescent’s common stock or SilverBow’s common stock, the risk that

the Transaction and its announcement could have an adverse effect

on the ability of Crescent and SilverBow to retain customers and

retain and hire key personnel and maintain relationships with their

suppliers and customers and on their operating results and

businesses generally, the risk the pending Transaction could

distract management of both entities and they will incur

substantial costs, the risk that problems may arise in successfully

integrating the businesses of the companies, which may result in

the combined company not operating as effectively and efficiently

as expected, the risk that the combined company may be unable to

achieve synergies or it may take longer than expected to achieve

those synergies and other important factors that could cause actual

results to differ materially from those projected, weather,

political, economic and market conditions, including a decline in

the price and market demand for natural gas, natural gas liquids

and crude oil, uncertainties inherent in estimating natural gas and

oil reserves and in projecting future rates of production; our

hedging strategy and results, federal and state regulations and

laws, the impact of pandemics such as COVID-19, actions by the

Organization of the Petroleum Exporting Countries (“OPEC”) and

non-OPEC oil-producing countries, including recent production cuts

by OPEC, the impact of armed conflicts, including in and around

Ukraine and Israel, the impact of disruptions in the banking

industry and capital markets, the timing and success of business

development efforts, including acquisition and disposition

opportunities, our reliance on external manager, cost inflation and

central bank policy changes associated therewith and other

uncertainties. All statements, other than statements of historical

facts, included in this communication that address activities,

events or developments that we expect, believe or anticipate will

or may occur in the future are forward-looking statements. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond our control. Consequently,

actual future results could differ materially from our expectations

due to a number of factors, including, but not limited to, those

items identified as such in the Registration Statement (as defined

below), the most recent Annual Report on Form 10-K and any

subsequently filed Quarterly Reports on Form 10-Q and the risk

factors described thereunder, filed by Crescent Energy Company with

the U.S. Securities and Exchange Commission.

Many of such risks, uncertainties and assumptions are beyond our

ability to control or predict. Because of these risks,

uncertainties and assumptions, you should not place undue reliance

on these forward-looking statements. We do not give any assurance

(1) that we will achieve our expectations or (2) concerning any

result or the timing thereof.

All subsequent written and oral forward-looking statements

concerning this offering, the use of proceeds therefrom, Crescent

Energy Company and the Issuer or other matters and attributable

thereto or to any person acting on their behalf are expressly

qualified in their entirety by the cautionary statements above. We

assume no duty to update or revise their respective forward-looking

statements based on new information, future events or otherwise,

except as required by law.

No Offer or Solicitation

This communication relates to the proposed Transaction between

Crescent and SilverBow. This communication is for informational

purposes only and does not constitute an offer to sell or the

solicitation of an offer to buy any securities or a solicitation of

any vote or approval, in any jurisdiction, pursuant to the

Transaction or otherwise, nor shall there be any sale, issuance,

exchange or transfer of the securities referred to in this document

in any jurisdiction in contravention of applicable law. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act.

Important Additional Information

In connection with the Transaction, on June 13, 2024, Crescent

filed with the SEC a registration statement on Form S-4 (the

“Registration Statement”) to register the shares of Crescent Class

A common stock to be issued in connection with the Transaction. The

Registration Statement includes a joint proxy statement of Crescent

and SilverBow and a prospectus of Crescent. The information in the

Registration Statement is not complete and may not be changed.

Crescent and SilverBow may also file other documents with the SEC

regarding the Transaction. After the Registration Statement is

declared effective, a definitive joint proxy statement/prospectus

will be mailed to the stockholders of Crescent and SilverBow. This

document is not a substitute for the Registration Statement that

has been and the joint proxy statement/prospectus that will be

filed with the SEC or any other documents that Crescent or

SilverBow may file with the SEC or mail to stockholders of Crescent

or SilverBow in connection with the Transaction.

INVESTORS AND SECURITY HOLDERS OF CRESCENT AND SILVERBOW ARE

URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY

STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES

AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL

BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO

THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED

MATTERS.

Investors and security holders will be able to obtain free

copies of the Registration Statement and the joint proxy

statement/prospectus (when available) and all other documents filed

or that will be filed with the SEC by Crescent or SilverBow through

the website maintained by the SEC at http://www.sec.gov. Copies of

documents filed with the SEC by Crescent will be made available

free of charge on Crescent’s website at

https://ir.crescentenergyco.com, or by directing a request to

Investor Relations, Crescent Energy Company, 600 Travis Street,

Suite 7200, Houston, TX 77002, Tel. No. (713) 332-7001. Copies of

documents filed with the SEC by SilverBow will be made available

free of charge on SilverBow’s website at https://sbow.com under the

“Investor Relations” tab or by directing a request to Investor

Relations, SilverBow Resources, Inc., 920 Memorial City Way, Suite

850, Houston, TX 77024, Tel. No. (281) 874-2700. The information

included on, or accessible through, Crescent’s or SilverBow’s

website is not incorporated by reference into this

communication.

Participants in the Solicitation Regarding the

Transaction

Crescent, SilverBow and their respective directors and executive

officers may be deemed to be participants in the solicitation of

proxies in respect to the Transaction.

Information regarding Crescent’s directors and executive

officers is contained in Crescent’s Annual Report on 10-K for the

year ended December 31, 2023 filed with the SEC on March 4, 2024.

You can obtain a free copy of this document at the SEC’s website at

http://www.sec.gov or by accessing Crescent’s website at

https://ir.crescentenergyco.com. Information regarding SilverBow’s

executive officers and directors is contained in the proxy

statement for SilverBow’s 2024 Annual Meeting of Stockholders filed

with the SEC on April 9, 2024. You can obtain a free copy of this

document at the SEC’s website at www.sec.gov or by accessing the

SilverBow’s website at https://sbow.com.

Investors may obtain additional information regarding the

interests of those persons and other persons who may be deemed

participants in the Transaction by reading the joint proxy

statement/prospectus regarding the Transaction when it becomes

available. You may obtain free copies of this document as described

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240612985306/en/

Brandi Kendall IR@crescentenergyco.com

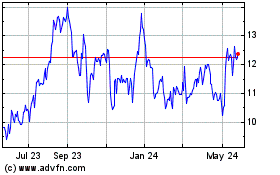

Crescent Energy (NYSE:CRGY)

Historical Stock Chart

From Oct 2024 to Nov 2024

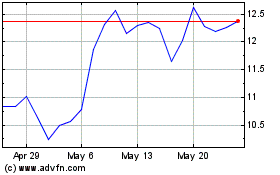

Crescent Energy (NYSE:CRGY)

Historical Stock Chart

From Nov 2023 to Nov 2024