Reserve To Pay Out Most Of Primary Fund's Remaining Assets

January 28 2010 - 2:39PM

Dow Jones News

Reserve Management said it will return most of the cash

remaining in its troubled Primary Fund to investors on or about

Friday.

The New York-based asset manager said Tuesday it will return

$3.4 billion to investors in the once-$63 billion Primary Fund. The

fund lost some of its value on Sept. 16, 2008 after the collapse of

Lehman Brothers Holdings Inc., sparking panic across the

money-market fund industry.

The distribution will be supervised by the U.S. District Court

for the Southern District of New York.

After the distribution, which will be the sixth from the Primary

Fund, 99% of its assets as of the close of business on Sept. 15,

2008, will have been distributed, the company said in a statement

on its website. About $160 million will remain in the fund to cover

management fees and other expenses to the extent such amounts are

approved by the court, the company said. That excludes the fund's

stake in Lehman Brothers' securities, once valued at $785 million,

but now carried at zero.

Robert Skinner, an attorney with Boston law firm Ropes &

Gray, who represents Ameriprise Financial Inc. (AMP) and its

clients in a lawsuit against Reserve Management, said Ameriprise is

pleased that the court's order has prevented the distribution from

taking any longer.

"It's very disappointing that it took 16 months and the court's

involvement in order to make this happen when the Reserve itself

could have chosen to bring about this outcome many, many months

ago," he said.

Reserve Management did not return a call seeking comment.

The Primary Fund's independent trustees had no comment on the

distribution.

In a statement earlier this month, Reserve Management said that

the court will review claims by the fund's adviser and distributor

for management fees and expenses to determine the amount payable

for such expenses out of the fund's assets. A complete statement of

the fund's expenses can't be provided until that review is

complete, it said.

As of Jan. 19, the adviser listed accrued fund expenses of more

than $17.3 million, including $15.1 million in management fees,

about $1.5 million in 12b-1 fees and $682,801 in trustees' fees,

trustees' counsel fees and fees and expenses of the fund's chief

compliance officer.

Skinner said the court continues to review the claims for fees

and expenses and that parties are submitting briefs. "It seems hard

to justify to shareholders a management fee for a fund adviser that

held investors' money hostage for 16 months," he said.

-By Daisy Maxey, Dow Jones Newswires; 212 416 2237;

daisy.maxey@dowjones.com

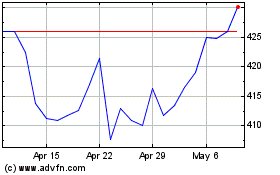

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jul 2023 to Jul 2024