UPDATE: ICE Expands CDS Clearing To Buy-Side, Single Names

December 14 2009 - 11:15AM

Dow Jones News

IntercontinentalExchange Inc. (ICE) reported Monday its ICE

Trust credit-derivatives clearing facility has begun handling

buy-side customer business as the exchange operator expands the

service beyond bank participants.

Atlanta-based ICE also said it has begun clearing single-name

credit derivatives in Europe, expanding beyond the more liquid

index-based products.

The exchange operator is broadening its range of clearing

services for over-the-counter derivatives like credit default swaps

as regulators in the U.S. and Europe consider mandating clearing

for swap transactions.

Clearing, in which a central counterparty serves as the buyer to

every seller and the seller to every buyer, is seen as a way to

reduce risk in the $26.6 trillion credit derivatives market.

Credit derivatives are complex financial instruments structured

to protect against defaults, and the bilateral nature of the market

came under criticism for exacerbating the financial crisis.

ICE's introduction of buy-side clearing services in the U.S.

will let firms such as asset managers, hedge funds and pension

plans clear swap transactions through dealer bank clearing members

of the ICE Trust facility.

Bank-to-bank trading accounts for an estimated 80% of the credit

default swap market, and ICE has cleared this business since

introducing its service in March, so far handling $4.3 trillion in

notional contract value.

Dealer bank members had been waiting on regulatory approval to

begin clearing their buy-side customers' business prior to today's

launch.

ICE reported that 10 buy-side participants were involved in

testing and preparations ahead of Monday's launch, including D.E.

Shaw Group, AllianceBernstein Holding LP (AB) and BlueMountain

Capital Management.

In Europe, ICE received approval to expand its credit default

swap clearing capabilities to include single-name contracts,

beginning with companies in the European utility sector.

ICE's service started out clearing contracts on the North

American CDX index and the European iTraxx index, which consist of

125 companies each, and are more actively traded than single-name

CDS contracts, making them easier to clear.

Two more bank participants signed on to ICE's European CDS

clearing effort, with the addition of BNP Paribas SA (BNPQY,

BNP.FR) and Nomura (NMR, 8604.TO) bringing the number of European

clearing members to 13.

ICE has taken the early lead over rivals in the credit default

swap clearing business, thanks to support from dealer banks.

Frankfurt's Deutsche Boerse AG (DBOEF, DB1.XE) began clearing

credit derivatives in late July via its Eurex Credit Clear service,

although it remains a distant second to ICE, having so far handled

about $140 million in business.

Chicago-based CME Group Inc. (CME) is preparing to launch its

own credit derivatives clearing service, which will handle both

inter-dealer and buy-side transactions, on Tuesday. Clearing entity

LCH.Clearnet SA plans to introduce a France-based CDS service in

January.

ICE officials estimate that the business will earn the exchange

operator about $30 million for 2009, a fraction of the money it

makes from energy products.

-By Jacob Bunge, Dow Jones Newswires; 312-750-4117;

jacob.bunge@dowjones.com

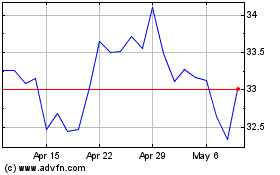

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

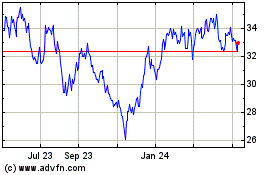

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024