UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 11-K

_____________________________________________

Annual Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934

| | | | | | | | |

| (Mark One) | | |

| þ | | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| | | For the fiscal year ended: December 31, 2022 |

| | |

| OR |

| | |

| o | | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

| | | For the transition period from to . |

Commission file number 001-16583

_____________________________________________

| | | | | |

| A. | Full title of the plans and the address of the plans, if different from that of the Issuer named below: |

| |

| Acuity Brands, Inc. 401(k) Plan |

| Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees |

| Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement |

| | | | | |

| B. | Name of issuer of the securities held pursuant to the plans and the address of the Principal executive office: |

| |

| Acuity Brands, Inc. |

| 1170 Peachtree Street, NE |

| Suite 1200 |

| Atlanta, Georgia 30309 |

Acuity Brands, Inc.

Selected 401(k) and Retirement Plans

Audited Financial Statements and Supplemental Schedule

As of December 31, 2022 and 2021 and for the year ended December 31, 2022

Contents

| | | | | |

| |

| |

| Audited Financial Statements | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

Plan Administrator and Participants

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Atlanta, Georgia

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Acuity Brands, Inc. 401(k) Plan,the Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees and the Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement (the “Plans”) as of December 31, 2022 and 2021, the related statement of changes in net assets available for benefits for the year ended December 31, 2022, and the related notes (collectively, the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plans as of December 31, 2022 and 2021, and the changes in net assets available for benefits for the year ended December 31, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plans’ management. Our responsibility is to express an opinion on the Plans’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plans in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plans are not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plans’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by the Plans’ management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental information in the accompanying Schedule H, Line 4i -Schedule of Assets (Held at End of Year) as of December 31, 2022 has been subjected to audit procedures performed in conjunction with the audit of the Plans’ financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but included supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plans’ management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ BDO USA, LLP

We have served as the Plans’ auditor since 2012.

Atlanta, Georgia

June 29, 2023

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Statements of Net Assets Available for Benefits

As of December 31, 2022

| | | | | | | | | | | | | | | | | | | | |

| | Acuity Brands, Inc. 401(k) Plan | | Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees | | Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement |

| Filing Plan No. | | 033 | | 067 | | 070 |

| Assets: | | | | | | |

| Plan interest in Acuity DC Trust | | $ | 387,777,563 | | | $ | 12,363,418 | | | $ | 17,301,568 | |

| Receivables: | | | | | | |

| Employer contributions | | 329,239 | | | 3,472 | | | 4,989 | |

| Participant contributions | | 83,652 | | | 13,192 | | | 8,254 | |

| Total receivables | | 412,891 | | | 16,664 | | | 13,243 | |

| Notes receivable from participants | | 3,808,986 | | | 713,284 | | | 260,162 | |

| Total assets | | 391,999,440 | | | 13,093,366 | | | 17,574,973 | |

| Liabilities: | | | | | | |

| Accrued expenses | | 84,207 | | | 2,814 | | | 3,779 | |

| Total liabilities | | 84,207 | | | 2,814 | | | 3,779 | |

| Net assets available for benefits | | $ | 391,915,233 | | | $ | 13,090,552 | | | $ | 17,571,194 | |

The accompanying notes are an integral part of these financial statements.

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Statements of Net Assets Available for Benefits

As of December 31, 2021

| | | | | | | | | | | | | | | | | | | | |

| | Acuity Brands, Inc. 401(k) Plan | | Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees | | Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement |

| Filing Plan No. | | 033 | | 067 | | 070 |

| Assets: | | | | | | |

| Plan interest in Acuity DC Trust | | $ | 457,447,679 | | | $ | 15,503,584 | | | $ | 21,687,809 | |

| Receivables: | | | | | | |

| Employer contributions | | 459,667 | | | 6,254 | | | 8,871 | |

| Participant contributions | | 1,211,625 | | | 33,787 | | | 14,410 | |

| Total receivables | | 1,671,292 | | | 40,041 | | | 23,281 | |

| Notes receivable from participants | | 3,720,915 | | | 522,812 | | | 246,226 | |

| Total assets | | 462,839,886 | | | 16,066,437 | | | 21,957,316 | |

| Liabilities: | | | | | | |

| Accrued expenses | | 76,237 | | | 2,646 | | | 3,617 | |

| Total liabilities | | 76,237 | | | 2,646 | | | 3,617 | |

| Net assets available for benefits | | $ | 462,763,649 | | | $ | 16,063,791 | | | $ | 21,953,699 | |

The accompanying notes are an integral part of these financial statements.

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Statements of Changes in Net Assets Available for Benefits

Year Ended December 31, 2022

| | | | | | | | | | | | | | | | | | | | |

| | Acuity Brands, Inc. 401(k) Plan | | Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees | | Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement |

| Filing Plan No. | | 033 | | 067 | | 070 |

| Additions to net assets: | | | | | | |

| | | | | | |

| Interest income on notes receivable | | $ | 195,072 | | | $ | 28,234 | | | $ | 13,790 | |

| Contributions: | | | | | | |

| Participant | | 21,895,288 | | | 855,956 | | | 402,738 | |

| Employer | | 8,939,980 | | | 228,252 | | | 231,652 | |

| Rollover | | 2,111,754 | | | 106,013 | | | — | |

| Total additions | | 33,142,094 | | | 1,218,455 | | | 648,180 | |

| | | | | | |

| Deductions from net assets: | | | | | | |

| Net investment loss from Acuity DC Trust | | 77,856,916 | | | 2,321,114 | | | 2,565,316 | |

| Benefit payments | | 26,333,579 | | | 1,304,559 | | | 2,459,089 | |

| Expenses | | 319,713 | | | 42,232 | | | 10,371 | |

| Total deductions | | 104,510,208 | | | 3,667,905 | | | 5,034,776 | |

| Net decrease before transfers | | (71,368,114) | | | (2,449,450) | | | (4,386,596) | |

| | | | | | |

| | | | | | |

| Plan transfers in (out), net | | 519,698 | | | (523,789) | | | 4,091 | |

| | | | | | |

| Net decrease | | (70,848,416) | | | (2,973,239) | | | (4,382,505) | |

| Net assets available for benefits: | | | | | | |

| Beginning of year | | 462,763,649 | | | 16,063,791 | | | 21,953,699 | |

| End of year | | $ | 391,915,233 | | | $ | 13,090,552 | | | $ | 17,571,194 | |

The accompanying notes are an integral part of these financial statements.

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

Note 1 — Description of the Plans

General

The financial positions and changes in net assets of the Acuity Brands, Inc. 401(k) Plan (the "ABI Plan"), the Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees (the "ABL Plan"), and the Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement (the "Holophane Plan") (collectively, the "Plans") are included in the accompanying financial statements. The investment assets of the Plans are included in the Acuity Brands, Inc. Defined Contribution Plans Master Trust (the "Acuity DC Trust"). The Plans are subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA").

Refer to the respective plan agreement for additional information about the Plans' eligibility, funding, allocation, vesting, and benefit provisions.

Eligibility and Forfeitures

Each of the Plans is a defined contribution plan. The Plans cover substantially all U.S. salaried, commissioned, and union and non-union hourly employees of Acuity Brands, Inc. and its subsidiaries ("Acuity Brands," "we," "our," "us," or the "Company"). Employees of certain unions who have elected not to participate in such Plans are not eligible to participate. Employees may immediately participate upon attaining the age requirement of each respective plan.

The Plans provide that forfeitures of Company contributions may be used to pay plan administrative expenses or reduce future Company contributions. Forfeited nonvested accounts totaled $195,140 and $116,052 at December 31, 2022 and 2021, respectively. Employer contributions were reduced by forfeited nonvested accounts of $558,241 for the year ended December 31, 2022. No plan expenses were paid using forfeited nonvested accounts during the year ended December 31, 2022.

In the event of the cessation of operation of a plant or the discontinuance of a component of our business, plan participants identified for separation from the Company shall automatically become fully vested in employer contributions upon termination.

Administration

Administration of the Plans is the responsibility of our Investment Committee, members of which are designated by the President and Chief Executive Officer of the Company. Certain administrative expenses of the Plans were paid by the Company during the year ended December 31, 2022. The Investment Committee determines the appropriateness of the Plans' investment offerings and monitors investment performance.

Notes Receivable from Participants

Participant loans are reflected as notes receivable from participants on the Statements of Net Assets Available for Benefits. Participants may borrow the lesser of 50% of their vested balance or $50,000 (reduced by the participant's highest outstanding loan balance from the twelve months prior to the loan request). Participants agree to loan repayment terms upon endorsement of the borrowed funds. Participants within the ABI Plan and the ABL Plan may have up to two outstanding general-purpose loans during a calendar year. Participants within the Holophane Plan may have outstanding one general-purpose loan and one residential loan issued for the purchase of a primary residence during a calendar year. The loan interest rate is a fixed rate at the time the loan is taken out. The interest rate is set at one percent above the prime rate, as defined per the plan.

Loan repayments must be substantially equal in amount over the term of the loan and must be made by payroll deduction on an after-tax basis. General-purpose loans must be repaid within five years, and residential loans must be repaid within ten years.

Loan repayments may be suspended at our discretion for a period of not more than twelve months if a participant is on unpaid leave of absence, disability, or military service. Upon return, the loan will be amortized over the remaining initial loan repayment period.

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

Plan Termination

Although we intend for the Plans to be permanent, the Plan agreements provide us the right to discontinue contributions or to terminate the Plans at any time subject to the provisions of ERISA. In the event of a plan termination, participants shall be 100% vested in the balance of their accounts and their proportionate share of any future adjustments or forfeitures.

Parties-In-Interest and Related-Party Transactions

As of December 31, 2022 and 2021, the percentage of the Plans' net assets invested in the common stock of Acuity Brands, Inc. was 1.7% and 2.0%, respectively. As described in Note 2 — Summary of Accounting Policies of the Notes to Financial Statements, the Plans paid certain expenses related to plan operations and investment activity to various service providers. The Plans also have outstanding notes receivable from participants. These transactions are party-in-interest transactions under ERISA.

Vesting

Participants are vested immediately in their contributions and the related earnings. Participants in the ABI Plan and the ABL Plan vest in our contributions to their accounts ratably over a five-year service period. Participants in the Holophane Plan vest in our contributions to their accounts immediately upon the third anniversary of their hire date.

Payments of Benefits

On termination of service due to death, disability, or retirement, participants may elect to receive either a lump sum amount equal to the value of the vested interest in their accounts or annual installments over a ten-year period. For termination of service for other reasons, participants may receive the value of the vested interest in their accounts as a lump-sum distribution.

Participant Accounts

Each participant’s account is credited with the participant’s contributions and our matching contributions, as well as the applicable portion of net earnings/losses generated by the investment fund(s) selected by the participant. Net earnings/losses for each investment fund consist of both realized and unrealized gross earnings/losses, which are adjusted to incorporate fund management expenses specific to each investment fund. Additionally, participants are charged a quarterly administrative recordkeeping fee. We directly pay certain expenses of maintaining the Plans, which are excluded from these financial statements. Fees related to the administration of notes receivable from participants are charged directly to the participant's account. Participants are entitled to the benefits that can be provided from their vested accounts.

Contributions

The basis for determining Company contributions is outlined in the following table: | | | | | |

| Plan Name | Employer Contributions |

| ABI Plan | Matching contribution of 60% up to 6% of participant compensation contributed. New hires are automatically enrolled at 3% contribution to the plan. |

| ABL Plan | Teamsters Local Union 673, IBEW Local 1245, IBEW Local 953, and non-union hourly associates have a matching contribution of 60% up to 6% of participant compensation contributed. |

| IBEW Local 481 associates have a matching contribution of 100% up to 3% of participant compensation contributed. |

| IBEW Local 613, IBEW Local 1048, and Teamsters Local Union 728 associates participating in the plan do not receive an employer contribution. |

| Holophane Plan | USW Local Nos. 4, 105, and 525 - Participating associates hired prior to August 5, 2002 receive an employer matching contribution of 30% up to 6% of compensation contributed, plus an additional basic contribution of 5% of annual compensation. Participating associates hired on or after August 5, 2002 receive an employer matching contribution of 60% up to 6% of compensation contributed. |

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

Under all of the Plans, participants are able to contribute up to 100% of their compensation. Participants direct the investment of their contributions into various investment options offered by the Plans. Additionally, participants who have attained age 50 before the end of the Plan year are eligible to make catch-up contributions. Participants may also contribute amounts representing distributions from other qualified plans. Participants may make traditional or Roth contributions in the Plans. Contributions are subject to certain Internal Revenue Service ("IRS") limitations.

Note 2 — Summary of Accounting Policies

Basis of Accounting

The accompanying financial statements are prepared on the accrual method of accounting in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

Investments

The investments in the Acuity DC Trust are subject to certain administrative guidelines and limitations as to the type and amount of securities held. Fund assets are allocated to selected independent investment managers to invest under these guidelines.

Investments of the Acuity DC Trust are stated at fair value, except for fully benefit-responsive investment contracts, which are recorded at contract value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Refer to Note 3 — Acuity DC Trust and Note 5 — Fair Value Measurements of the Notes to the Financial Statements for further discussion.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the dividend date. Net change includes the Plans' gains and losses on investments bought and sold as well as held during the year.

Contact Value Investments

The Acuity DC Trust holds investments in the Invesco Stable Value Fund, which holds synthetic guaranteed investment contracts ("synthetic GICs") and a diversified portfolio of investments, including units of collective trust funds held in the name of the Acuity DC Trust. The synthetic GICs have features that provide for variable interest crediting rates that are credited to the contract value of the contracts' underlying holdings. The investments in synthetic GICs are deemed to be fully benefit-responsive and are recorded at contract value.

Contract value represents contributions made under the contract plus earnings less member withdrawals and administrative expenses. Members may ordinarily direct the withdrawal and transfer of all or a portion of their investment at contract value. The crediting interest rate is based on a mutually agreed upon formula that resets on a monthly basis depending on the performance of the underlying investments being managed. The crediting interest rate will not be less than 0%.

Certain events limit the ability of the Plans to transact at contract value with the issuers. These events include, but are not limited to, the following: (1) amendments to the Plan documents that materially and adversely affect the risk borne by the contract issuer, unless otherwise approved by the issuers, (2) bankruptcy of the Plans' sponsor or other events that would cause a significant withdrawal from the Plans, or (3) the failure of the Acuity DC Trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA. We do not believe that the occurrence of any event limiting the Plans' ability to transact at contract value with the issuers has occurred or is probable.

The contract issuers can only terminate the contract under very limited circumstances, such as the Company or the investment fund managers breaching any of their material obligations under the agreement, or upon completion of specified periods of time following notice periods. We do not believe it is likely that the contracts will be terminated.

Notes Receivable from Participants

The notes receivable from participants represent participant loans, which are carried at principal amounts outstanding plus accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expense and are expensed when they are incurred. No allowance for credit losses has

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

been recorded as of December 31, 2022 and 2021. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be in default, the participant loan balance is reduced, and a benefit payment is recorded.

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Contributions

Contributions to the Plans from participants, and when applicable, from the Company are recorded in the period that payroll deductions are made from Plan participants.

Payments

Benefit payments are recorded when paid.

Expenses

Investment-related expenses are included within Net depreciation in fair value of investments from Acuity DC Trust on the Statements of Changes in Net Assets Available for Benefits. Additionally, participants are charged a quarterly administrative recordkeeping fee, which is included within Expenses on the Statements of Changes in Net Assets Available for Benefits. Certain investment funds provide for a revenue sharing arrangement with the Plans that provides for a portion of the fund expenses to be credited to the Plans to pay for certain administrative expenses that are incurred by the Plans. The Company directly pays certain expenses of maintaining the Plans, which are excluded from these financial statements. Fees related to the administration of notes receivable from participants and certain administrative fees are charged directly to the participant's account and are included in expenses.

Note 3 — Acuity DC Trust

The Acuity DC Trust is a collective investment of the assets of our participating employee benefit plans. Trust assets are allocated among participating plans by assigning to each plan certain transactions (primarily contributions and benefit payments that can be specifically identified and distributed among all plans) in proportion to the fair value of the assets assigned to each plan, as well as income and expenses resulting from the collective investment of the Trust assets. For the year ended December 31, 2022, net depreciation in investments was $91,650,176. These losses were partially offset by interest income and dividend income of $1,074,821 and $8,069,105, respectively. The fair values of the net assets of the Acuity DC Trust and each plan's interest in those assets as of December 31, 2022 and 2021 are presented below:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Plan’s Interest in Master Trust Balances |

| 2022 | | Plan | | Plan | | Plan |

| Master Trust Balances | | No. 033 | | No. 067 | | No. 070 |

| Mutual funds | $ | 178,185,146 | | | $ | 166,332,685 | | | $ | 3,672,707 | | | $ | 8,179,754 | |

| Self-directed brokerage accounts | 39,416,189 | | | 38,120,745 | | | — | | | 1,295,444 | |

| Acuity stock fund | 7,268,870 | | | 6,815,166 | | | 129,695 | | | 324,009 | |

| Common/collective trusts | 148,034,147 | | | 139,249,026 | | | 6,955,424 | | | 1,829,697 | |

| Total investments at fair value | 372,904,352 | | | 350,517,622 | | | 10,757,826 | | | 11,628,904 | |

| | | | | | | |

| Unallocated cash | 150,119 | | | 123,629 | | | 26,490 | | | — | |

| Accrued income and pending trades | 15,374 | | | 14,318 | | | 973 | | | 83 | |

| Acuity DC Trust at fair value | 373,069,845 | | | 350,655,569 | | | 10,785,289 | | | 11,628,987 | |

| Invesco Stable Value Fund at contract value | 44,372,704 | | | 37,121,994 | | | 1,578,129 | | | 5,672,581 | |

| Plan interest in Acuity DC Trust | $ | 417,442,549 | | | $ | 387,777,563 | | | $ | 12,363,418 | | | $ | 17,301,568 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Plan’s Interest in Master Trust Balances |

| 2021 | | Plan | | Plan | | Plan |

| Master Trust Balances | | No. 033 | | No. 067 | | No. 070 |

| Mutual funds | $ | 378,184,323 | | | $ | 351,194,917 | | | $ | 13,286,975 | | | $ | 13,702,431 | |

| Self-directed brokerage accounts | 43,216,502 | | | 42,134,556 | | | — | | | 1,081,946 | |

| Acuity stock fund | 9,840,640 | | | 9,219,656 | | | 185,501 | | | 435,483 | |

| Common/Collective trusts | 19,988,877 | | | 18,861,152 | | | 632,197 | | | 495,528 | |

| Total investments at fair value | 451,230,342 | | | 421,410,281 | | | 14,104,673 | | | 15,715,388 | |

| | | | | | | |

| Unallocated cash | 481 | | | — | | | 481 | | | — | |

| Accrued income and pending trades | 1,025 | | | 486 | | | 489 | | | 50 | |

| Acuity DC Trust at fair value | 451,231,848 | | | 421,410,767 | | | 14,105,643 | | | 15,715,438 | |

| Invesco Stable Value Fund at contract value | 43,407,224 | | | 36,036,912 | | | 1,397,941 | | | 5,972,371 | |

| Plan interest in Acuity DC Trust | $ | 494,639,072 | | | $ | 457,447,679 | | | $ | 15,503,584 | | | $ | 21,687,809 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Note 4 — Stable Value Fund

The following are the contract values of the synthetic GICs in the Invesco Stable Value Fund:

| | | | | | | | | | | | | | | | | | | | |

| Contract Issuer | | 2022 Contract Value | | Contract Issuer | | 2021 Contract Value |

| Synthetic GICs: | | | | Synthetic GICs: | | |

| Voya | | $ | 6,939,298 | | | Voya | | $ | 6,811,641 | |

| Mass Mutual | | 5,707,894 | | | Mass Mutual | | 5,606,166 | |

| Transamerica | | 8,202,581 | | | Transamerica | | 8,052,670 | |

| Prudential Insurance | | 7,250,508 | | | Prudential Insurance | | 7,131,387 | |

| Pacific Life Insurance | | 7,415,685 | | | Pacific Life Insurance | | 7,277,238 | |

| Nationwide Life Insurance | | 7,277,782 | | | Nationwide Life Insurance | | 7,141,156 | |

| | | | | | |

| Subtotal | | 42,793,748 | | | Subtotal | | 42,020,258 | |

| | | | | | |

| Cash | | 1,578,956 | | | Cash | | 1,386,966 | |

| Total | | $ | 44,372,704 | | | Total | | $ | 43,407,224 | |

Note 5 — Fair Value Measurements

In accordance with Accounting Standards Codification Topic 820, Fair Value Measurement ("ASC 820"), fair value measurements are determined using an exit price based on the assumptions a market participant would use in pricing an asset or liability. ASC 820 establishes a three-tiered hierarchy making a distinction between market participant assumptions based on (i) observable inputs such as quoted prices in active markets (Level 1), (ii) inputs other than quoted prices in active markets that are observable either directly or indirectly (Level 2), and (iii) unobservable inputs that reflect the Plans' best estimate of what market participants would use in pricing an asset or liability including consideration of the risk inherent in the valuation technique and the risk inherent in the inputs to the model (Level 3).

Level 1 (Quoted market prices in active markets for identical assets)

Mutual Funds - valued using the net asset value ("NAV") of shares held at year end as reported by the fund. Mutual funds held by the Acuity DC Trust are open-end mutual funds that are registered with the Securities and Exchange Commission.

Self-Directed Brokerage Accounts - valued at the closing price reported by the fund or in the market where such investments are primarily traded.

Acuity Stock Fund - valued at the last sales price in the market where such securities are primarily traded. If the last sales price is not available, the security is generally valued at the closing bid price obtained from the primary exchange.

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

Our unallocated cash and cash equivalents, which are required to be carried at fair market value and measured on a recurring basis, were $150,119 and $481 as of December 31, 2022 and 2021, respectively.

Assets Excluded from Fair Value Hierarchy

The common/collective trusts held by the Acuity DC Trust are valued using the NAV provided by the trustee, which are based on the fair value of the underlying investments held by a fund less its liabilities. The common/collective trusts NAVs are used as a practical expedient to estimate fair value since it is not probable that the funds will sell the investment for an amount different than the reported NAV. There are currently no redemption restrictions or unfunded commitments on these investments. Generally, redemptions of the fund units for investments in this category may be made each business day, based upon a transaction price per unit that is substantially equivalent to net asset value per share as of the close of the previous business day.

The following tables present information about the Acuity DC Trust's investments that are carried at fair value as of December 31, 2022 and 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value Measurements as of: |

| | December 31, 2022 | | December 31, 2021 |

| | Total Fair Value | | Level 1 | | Total Fair Value | | Level 1 |

| Mutual funds | | $ | 178,185,146 | | | $ | 178,185,146 | | | $ | 378,184,323 | | | $ | 378,184,323 | |

| Self-directed brokerage accounts | | 39,416,189 | | | 39,416,189 | | | 43,216,502 | | | 43,216,502 | |

| Acuity stock fund | | 7,268,870 | | | 7,268,870 | | | 9,840,640 | | | 9,840,640 | |

| Common/collective trust | | 148,034,147 | | | N/A | | 19,988,877 | | | N/A |

| Total investments at fair value | | $ | 372,904,352 | | | | | $ | 451,230,342 | | | |

| | | | | | | | |

No transfers between the levels of the fair value hierarchy occurred during the current plan year. In the event of a transfer in or out of a level within the fair value hierarchy, the transfers would be recognized as of the end of the plan year.

Note 6 — Income Tax Status

The ABI Plan, ABL Plan, and Holophane Plan obtained their latest determination letters on August 12, 2013, July 10, 2013, and May 29, 2014, respectively, in which the IRS stated these plans are qualified under Section 401(a) of the Internal Revenue Code ("IRC"). The Plans have been amended since requesting the latest determination letters, and the plan administrator believes the Plans are currently designed and being operated in compliance with the applicable requirements of the IRC. Thus, the Plans and related trust continue to be tax-exempt. Therefore, no provision for income taxes is included in these financial statements.

U.S. GAAP requires plan management to evaluate uncertain tax positions taken by the Plans. The financial statement impact of a tax position is recognized when the position is more likely than not, based on its technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plans and has concluded that as of December 31, 2022, there are no uncertain positions taken or expected to be taken. The Plans have recognized no interest or penalties related to uncertain tax positions. The Plans are subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Note 7 — Benefits Payable

The following Plans had benefit payments that were approved for payment prior to December 31 but were not paid until subsequent to December 31:

| | | | | | | | | | | | | | | | | | | | |

| Plan No. | | Plan Name | | 2022 | | 2021 |

| 033 | | Acuity Brands, Inc. 401(k) Plan | | $ | 123,629 | | | $ | — | |

| 067 | | Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees | | 26,490 | | | 481 | |

| | | | | | |

These benefit payments represent a reconciling item between the financial statements and Form 5500.

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Notes to Financial Statements

Note 8 — Risks and Uncertainties

The Plans invest in various investment securities. Investment securities are exposed to various risks, such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

Acuity Brands, Inc.

Selected 401(k) and Retirement Plans

Schedule H, Line 4i

Schedule of Assets (Held at End of Year)

December 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Plan Name | | Plan No. | | EIN # | | Identity of Issue * | | Description of Investment Varying Maturity Dates and Interest Rates Ranging from: | | Cost | | Current Value |

| Acuity Brands, Inc. 401(k) Plan | | 033 | | 58-2632672 | | Participant Loans | | 4.25% to 9.25%

(various maturity dates) | | $ | — | | | $ | 3,808,986 | |

| Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees | | 067 | | 58-2632672 | | Participant Loans | | 4.25% to 8%

(various maturity dates) | | — | | | 713,284 | |

| Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement | | 070 | | 58-2632672 | | Participant Loans | | 4.25% - 8%

(various maturity dates) | | — | | | 260,162 | |

___________________________________________

*Represents a party-in-interest

EXHIBIT INDEX

| | | | | | | | |

| Exhibit Number | | Description |

| 23.1 | | | |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plans) have duly caused this annual report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: June 29, 2023

| | | | | | | | |

| Acuity Brands, Inc. 401(k) Plan |

| Acuity Brands Lighting, Inc. 401(k) Plan for Hourly Employees |

| Holophane Division of Acuity Brands Lighting 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement |

| | |

| By: | | Acuity Brands, Inc. |

| | Plan Administrator |

| |

| By: | | /s/ Neil M. Ashe |

| Name: | | Neil M. Ashe |

| Title: | | Chairman, President and Chief Executive Officer |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

Acuity Brands, Inc. Selected 401(k) and Retirement Plans

Atlanta, Georgia

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 (File No. 333-74242 and 333-123999) of Acuity Brands, Inc. of our report dated June 29, 2023, relating to the financial statements and supplemental schedule of Acuity Brands, Inc. 401(k) Plan, Acuity Brands Lightning, Inc. 401(k) Plan for Hourly Employees, and Holophane Division of Acuity Brands Lightning 401(k) Plan for Hourly Employees Covered by a Collective Bargaining Agreement which appear in this Form 11-K for the year ended December 31, 2022.

/s/ BDO USA, LLP

Atlanta, GA

June 29, 2023

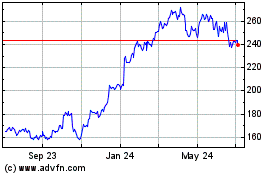

Acuity Brands (NYSE:AYI)

Historical Stock Chart

From Apr 2024 to May 2024

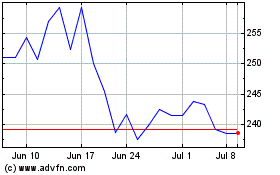

Acuity Brands (NYSE:AYI)

Historical Stock Chart

From May 2023 to May 2024