TechTarget, Inc. (NASDAQ: TTGT) today announced financial

results for the three months ended March 31, 2010.

Total Q1 2010 revenues increased 14% to $21.0 million compared

to Q1 2009. Q1 2010 online revenue increased by 14% to $18.6

million compared to Q1 2009 and represented 88% of total Q1 2010

revenues. Q1 2010 events revenue increased by 13% to $2.5 million

compared to Q1 2009 and represented 12% of total Q1 2010

revenues.

“We are pleased that online revenues grew 14% in the quarter”

said Greg Strakosch, CEO of TechTarget. “We are glad to see that

investments we made during the downturn to grow market share are

starting to materialize as the environment continues to

improve.”

Total Q1 2010 gross profit margin increased to 74% compared to

68% for Q1 2009. Q1 2010 online gross profit margin increased to

76% compared to 70% for Q1 2009.

Net loss was $2.3 million for both Q1 2010 and Q1 2009. Adjusted

net income (net income adjusted for amortization and stock-based

compensation, as further adjusted for the related income tax

impact) for Q1 2010 was $1.0 million compared to $0.6 million for

Q1 2009. Net loss per basic share was $0.06 for both Q1 2010 and Q1

2009. Adjusted net income per share (adjusted net income divided by

adjusted weighted average diluted shares outstanding) for the Q1

2010 was $0.02 compared to $0.01 for Q1 2009.

Adjusted EBITDA (earnings before interest, taxes, depreciation,

and amortization, as further adjusted for stock-based compensation)

for Q1 2010 increased 55% to $2.5 million compared to $1.6 million

for Q1 2009. Q1 2010 adjusted EBITDA was reduced by $0.7 million as

a result of the following nonrecurring items: $0.4 million of

expenses associated with the move into the company’s new corporate

headquarters and $0.3 million associated with the previously

disclosed prior year investigation of an improper accounting

practice.

The Company’s balance sheet and financial position remain

strong. As of March 31, 2010, the Company’s cash and

investments totaled $81.6 million and the company has no

outstanding bank debt.

Recent Company Highlights

- Hired Jeff Wakely as Chief

Financial Officer and Treasurer. In this role, Wakely will have

overall leadership responsibility for the strategy and operations

for all of the Company’s finance and control functions. He will

assume his new role on June 7. Wakely is currently the Chief

Accounting Officer, Vice President of Finance and Assistant

Treasurer at NetScout Systems, Inc. (NASDAQ: NTCT), an industry

leader in network management. When Wakely joined NetScout in 2005,

the company had less than $100 million in revenue. For the fiscal

year ended March 31, 2010, the company’s revenues were $260

million.

- Acquired BeyeNETWORK™, a group

of online technology sites that provide news, expert information

and exclusive resources on the business information management

lifecycle, including business intelligence (BI) best practices,

business analytics, data integration, and data governance. All of

the sites’ content is written by industry experts who share their

experiences and research in a collection of articles, podcasts, and

blogs focused on specific vertical industries.

- Named by BtoB Magazine as one of

the Top 50 Most Powerful BtoB Advertising Venues for the 10th

consecutive year. TechTarget was named #9 on this year’s list.

Other companies in the Top 10 include: Google, The Wall Street

Journal, The National Football League, Yahoo!, CNBC, Financial

Times and Bloomberg/BusinessWeek.

- Announced The TechTarget/Google

Online ROI Summit to be held at the Hilton Metropole in London on

May 26th. There will be expert speakers from TechTarget and Google

as well as customer case studies from EMC and 3PAR. This is the

first time that TechTarget is taking its popular ROI Summit to

Europe, which reflects the growing importance of TechTarget’s

business outside of North America.

Financial Guidance

In the second quarter of 2010, the Company expects total

revenues to be within the range of $24.3 million to $25.3 million;

online revenues within the range of $20.1 million to $20.9 million;

events revenues within the range of $4.2 million to $4.4 million

and adjusted EBITDA to be within the range of $5.0 million to $5.8

million. This Q2 guidance is based on an assumption of

approximately 15% online growth over Q2 2009.

In the Company’s previous prepared remarks, issued on March 10,

2010, it was stated that online growth for 2010 was expected be in

the low double digits; the Company is now providing guidance that

its online growth rate for 2010 is expected to be in the mid-teens.

Additionally, the Company stated in its March 10 prepared remarks

that it expected 2010 event revenue to decline 20-25% from last

year; the Company is now decreasing the expected decline in events

revenue to be only 15-20%. Based on the foregoing revised guidance,

the Company is now increasing its previously stated expectation

regarding the range for annual adjusted EBITDA margins from 18% -

22% to 19% - 23%.

Conference Call and Webcast

TechTarget will discuss these financial results in a conference

call at 5:30 pm (Eastern Time) today (May 10, 2010).

Supplemental financial information and prepared remarks for the

conference call will be posted to the Investor Relations section of

our website simultaneously with this press release.

NOTE: The

prepared remarks will not be read on the conference call. The

conference call will include only brief remarks followed by

questions and answers.

The public is invited to listen to a live webcast of

TechTarget’s conference call, which can be accessed on the Investor

Relations section of our website at

http://investor.techtarget.com/. The conference call can also be

heard via telephone by dialing (888) 713-4218 (US callers) or

617-213-4870 (International callers) ten minutes prior to the

call and referencing participant pass code 72673576 for both

domestic and international callers. Participants may pre-register

for the call at:

https://www.theconferencingservice.com/prereg/key.process?key=P9TTEP8WQ.

Pre-registrants will be issued a pin number to use when dialing

into the live call which will provide quick access to the

conference by bypassing the operator upon connection. (Due to the

length of the above URL, it may be necessary to copy and paste it

into your Internet browser’s URL address field. You may also need

to remove an extra space in the URL if one exists.)

For those investors unable to participate in the live conference

call, a replay of the conference call will be available via

telephone beginning May 10, 2010 at 8:00 p.m. ET through

May 24, 2010 at 11:59 p.m. ET. To listen to the replay, dial

888-286-8010 and use the pass

code 29819772. International callers should dial

617-801-6888 and also use the pass code 29819772 to listen to the

replay. The webcast replay will also be available for replay on

http://investor.techtarget.com/ during the same period.

Non-GAAP Financial

Measures

This release and the accompanying tables include a discussion of

adjusted EBITDA, adjusted net income and adjusted net income per

share, all of which are non-GAAP financial measures which are

provided as a complement to results provided in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). The term “adjusted EBITDA” refers to a financial

measure that we define as earnings before net interest, income

taxes, depreciation, and amortization, as further adjusted to

exclude stock-based compensation. The term “adjusted net income”

refers to a financial measure which we define as net income

adjusted for amortization, and stock-based compensation, as further

adjusted for the related income tax impact of the adjustments. The

term “adjusted net income per share” refers to a financial measure

which we define as adjusted net income divided by adjusted weighted

average diluted shares outstanding. These non-GAAP measures should

be considered in addition to results prepared in accordance with

GAAP, but should not be considered a substitute for, or superior

to, GAAP results. In addition, our definition of adjusted EBITDA,

adjusted net income and adjusted net income per share may not be

comparable to the definitions as reported by other companies. We

believe adjusted EBITDA, adjusted net income and adjusted net

income per share are relevant and useful information because it

provides us and investors with additional measurements to compare

the Company’s operating performance. These measures are part of our

internal management reporting and planning process and are primary

measures used by our management to evaluate the operating

performance of our business, as well as potential acquisitions. The

components of adjusted EBITDA include the key revenue and expense

items for which our operating managers are responsible and upon

which we evaluate their performance. In the case of senior

management, adjusted EBITDA is used as the principal financial

metric in their annual incentive compensation program. Adjusted

EBITDA is also used for planning purposes and in presentations to

our board of directors. Adjusted net income is useful to us and

investors because it presents an additional measurement of our

financial performance, taking into account depreciation, which we

believe is an ongoing cost of doing business, but excluding the

impact of certain non-cash expenses and items not directly tied to

the core operations of our business. Furthermore, we intend to

provide these non-GAAP financial measures as part of our future

earnings discussions and, therefore, the inclusion of these

non-GAAP financial measures will provide consistency in our

financial reporting. A reconciliation of these non-GAAP measures to

GAAP is provided in the accompanying tables.

Forward Looking Statements

Certain matters included in this press release may be considered

to be “forward-looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

Those statements include statements regarding the intent, belief or

current expectations of the company and members of our management

team. All statements contained in this press release, other than

statements of historical fact, are forward-looking statements,

including those regarding: guidance on our future financial results

and other projections or measures of our future performance; our

expectations concerning market opportunities and our ability to

capitalize on them; and the amount and timing of the benefits

expected from acquisitions, from new products or services and from

other potential sources of additional revenue. Investors and

prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking

statements. These statements speak only as of the date of this

press release and are based on our current plans and expectations,

and they involve risks and uncertainties that could cause actual

future events or results to be different than those described in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, those relating to:

market acceptance of our products and services; relationships with

customers, strategic partners and our employees; difficulties in

integrating acquired businesses; and changes in economic or

regulatory conditions or other trends affecting the Internet,

Internet advertising and information technology industries. These

and other important risk factors are discussed or referenced in our

Annual Report on Form 10-K filed with the Securities and

Exchange Commission, under the heading “Risk Factors” and

elsewhere, and any subsequent periodic or current reports filed by

us with the SEC. Except as required by applicable law or

regulation, we do not undertake any obligation to update our

forward-looking statements to reflect future events or

circumstances.

About TechTarget

TechTarget, a leading online technology media company, gives

technology providers ROI-focused marketing programs to generate

leads, shorten sales cycles, and grow revenues. With its network of

more than 80 technology-specific websites and more than 8.5 million

registered members, TechTarget is a primary Web destination for

technology professionals researching products to purchase. The

company is also a leading provider of independent, peer and vendor

content, a leading distributor of white papers, and a leading

producer of webcasts, podcasts, videos and virtual trade shows for

the technology market. Its websites are complemented by numerous

invitation-only events. TechTarget provides proven lead generation

and branding programs to top advertisers including Cisco, Dell,

EMC, HP, IBM, Intel, Microsoft, SAP and Symantec.

(C) 2010 TechTarget, Inc. All rights reserved.

TechTarget and the TechTarget logo are registered trademarks, and

BeyeNETWORK™ is a trademark, of TechTarget. All other trademarks

are the property of their respective owners.

TECHTARGET, INC. Consolidated Balance

Sheets (in $000's) March 31,

December 31, 2010 2009 (Unaudited)

Assets Current assets: Cash and cash equivalents $ 17,491 $

20,884 Short-term investments 56,291 50,496 Accounts receivable,

net of allowance for doubtful accounts 18,360 16,623 Prepaid

expenses and other current assets 1,991 1,929 Deferred tax assets

2,204 2,399 Total current assets 96,337 92,331

Property and equipment, net 5,653 3,760 Long-term investments 7,810

11,177 Goodwill 89,293 88,958 Intangible assets, net of accumulated

amortization 12,087 12,528 Other assets 148 127 Deferred tax assets

5,739 5,182 Total assets $ 217,067 $ 214,063

Liabilities and Stockholders' Equity Current liabilities:

Accounts payable $ 4,497 $ 3,106 Accrued expenses and other current

liabilities 1,472 2,910 Accrued compensation expenses 1,191 808

Income taxes payable - 398 Deferred revenue 9,182

8,402 Total current liabilities 16,342 15,624 Long-term

liabilities: Other liabilities 1,821 575 Total

liabilities 18,163 16,199 Commitments and contingencies - -

Stockholders' equity: Common stock 43 42 Additional paid-in

capital 236,989 233,555 Warrants 2 2 Accumulated other

comprehensive (loss) income (47 ) 8 Accumulated deficit

(38,083 ) (35,743 ) Total stockholders' equity

198,904 197,864 Total liabilities and stockholders' equity $

217,067 $ 214,063

TECHTARGET, INC.

Consolidated Statements of Operations (in $000's, except

share and per share amounts) For the Three

Months

Ended March 31,

2010 2009 (Unaudited) Revenues: Online $

18,561 $ 16,282 Events 2,482 2,190 Total revenues

21,043 18,472 Cost of revenues: Online (1)

4,536 4,880 Events (1) 864 1,081 Total cost of

revenues 5,400 5,961 Gross profit 15,643

12,511 Operating expenses: Selling and marketing (1) 8,913

7,516 Product development (1) 2,185 2,081 General and

administrative (1) 5,495 3,919 Depreciation 525 536 Amortization of

intangible assets 1,135 1,215 Total operating

expenses 18,253 15,267 Operating loss (2,610 )

(2,756 ) Interest income (expense), net 107

(110 ) Loss before provision for income taxes (2,503 )

(2,866 ) Benefit from income taxes (163 ) (558

) Net loss $ (2,340 ) $ (2,308 ) Net loss per common

share: Basic and diluted $ (0.06 ) $ (0.06 ) Weighted

average common shares outstanding: Basic and diluted

42,479,994 41,754,131 (1) Amounts include

stock-based compensation expense as follows: Cost of online revenue

$ 88 $ 234 Cost of events revenue 26 17 Selling and marketing 1,929

1,328 Product development 161 131 General and administrative 1,225

893

TECHTARGET, INC. Reconciliation of Net

Loss to Adjusted EBITDA (in $000's) For the

Three Months

Ended March 31,

2010 2009 (Unaudited) Net

loss $ (2,340 ) $ (2,308

) Interest income (expense), net 107 (110 ) Benefit from

income taxes (163 ) (558 ) Depreciation 525 536 Amortization of

intangible assets 1,135 1,215

EBITDA

(950 ) (1,005 ) Stock-based

compensation expense 3,429 2,603

Adjusted

EBITDA $ 2,479 $ 1,598

TECHTARGET, INC. Reconciliation of Net Loss to

Adjusted Net Income and Net Loss per Diluted Share to Adjusted Net

Income per Share (in $000's, except share and per share

amounts) For the Three Months

Ended March 31,

2010 2009 (Unaudited) Net

loss $ (2,340 ) $ (2,308

) Amortization of intangible assets 1,135 1,215 Stock-based

compensation expense 3,429 2,603 Impact of income taxes

1,234 916

Adjusted net income $ 990

$ 594

Net loss per diluted share $ (0.06 )

$ (0.06 ) Weighted average diluted shares

outstanding 42,479,994 41,754,131

Adjusted net income per share

$ 0.02 $ 0.01 Adjusted weighted

average diluted shares outstanding 44,572,840

42,522,199 Options, warrants and restricted stock,

treasury method included in adjusted weighted average diluted

shares above 2,092,846 768,068

Weighted average

diluted shares outstanding 42,479,994

41,754,131 TECHTARGET, INC.

Financial Guidance for the Three Months Ended June 30, 2010

(in $000's) For the Three Months

Ended June 30, 2010

Range Revenues $ 24,300

$ 25,300 Adjusted

EBITDA $ 5,000 $ 5,800

Depreciation, amortization and stock-based compensation 5,113 5,113

Interest income, net 115 115 Provision for income taxes 607

937

Net loss $ (605 ) $

(135 )

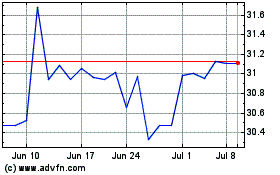

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jun 2024 to Jul 2024

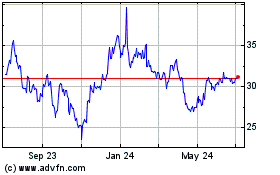

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jul 2023 to Jul 2024