TechTarget, Inc. (NASDAQ: TTGT) today filed its Quarterly

Report on Form 10-Q for the quarter ended September 30,

2009. TechTarget also announced today its results for the third

quarter of 2009, and that the Company’s Audit Committee has

concluded its previously disclosed investigation involving an

improper accounting practice. The accounting practice related to

certain customer credits being improperly removed as liabilities

from the Company’s balance sheet. The Audit Committee conducted the

investigation with the assistance of counsel and forensic

accounting experts. Consistent with the Company’s November 9,

2009 press release, the Audit Committee has concluded that the

improper conduct associated with the accounting practice was

limited to a single individual, who was promptly terminated from

his position upon discovery of the practice. The Audit Committee’s

investigation found no other improper conduct in connection with

any other accounting practice.

To correct the improper accounting related to the customer

credits, the Company has recorded a net adjustment for the quarter

ended September 30, 2009, which increased liabilities by

$967,000 and decreased income before taxes by $967,000. The net

adjustment accumulated over several years and includes $57,000 from

2004 to 2006, $362,000 from 2007, $561,000 from 2008 and ($13,000)

for the nine months ended September 30, 2009. Total

professional fees related to the investigation are approximately

$1.5 million, of which approximately $1.2 million will be recorded

in the 2009 fourth quarter results, with the remaining amount to be

included in the first quarter of 2010.

As a result of filing its Form 10-Q for the quarter ended

September 30, 2009, the Company is now current with its

Securities and Exchange Commission reporting requirements and

believes that it is now in compliance with Nasdaq’s Listing

Rule 5250(c)(1), and the Company expects to receive

confirmation of this compliance from Nasdaq in the coming days.

In addition, the Company is announcing that Eric Sockol has

announced his resignation as Chief Financial Officer of TechTarget.

Mr. Sockol will remain in his role for a brief transition

period while the Company conducts the search for his

replacement.

Third Quarter Results

Total revenue for the third quarter of 2009 was $23.1 million

compared to $27.0 million for the comparable prior year quarter.

Online revenue was $18.2 million compared to $20.4 million for the

third quarter of 2008 and represented 79% of total revenues. Total

gross profit margin was 72% compared to 69% for the comparable

prior year quarter. Online gross profit margin was 74% compared to

73% for the comparable prior year quarter.

Adjusted EBITDA (earnings before interest, taxes, depreciation,

and amortization, as further adjusted for stock-based compensation)

for the third quarter of 2009 was $4.4 million compared to $6.2

million for the comparable prior year quarter. The third quarter of

2009 includes a prior period adjustment of $967,000 which reduced

reported adjusted EBITDA.

Net loss for the third quarter of 2009 was $1.4 million compared

to a net income of $707,000 for the comparable prior year quarter.

Adjusted net income (net income adjusted for amortization and

stock-based compensation, as further adjusted for the related

income tax impact) for the third quarter of 2009 was $2.5 million

compared to $3.6 million for the comparable prior year quarter. The

third quarter of 2009 includes a prior period adjustment which

reduced income before taxes by $967,000 and reduced adjusted net

income by $587,000. Net loss per basic share for the third quarter

of 2009 was ($0.03) compared to net income per basic share of $0.02

for the comparable prior year quarter. Adjusted net income per

share (adjusted net income divided by adjusted weighted average

diluted shares outstanding) for the third quarter of 2009 was $0.06

compared to $0.08 for the comparable prior year quarter.

As of September 30, 2009, TechTarget had $78.6

million of cash, cash equivalents and short and long-term

investments. Outstanding bank debt was $750,000 as of

September 30, 2009. Our net cash, as defined as cash, cash

equivalents and investments less bank debt increased by $11.3

million compared to December 31, 2008.

Updated Financial Guidance

On November 9, 2009, the Company provided the following

financial guidance for the fourth quarter of 2009: total revenues

within the range of $21.8 million to $22.8 million; online revenue

within the range of $19.0 million to $19.8 million; events revenue

to within the range of $2.8 to $3.0 million; and adjusted EBITDA

within the range of $4.5 million to $5.3 million, excluding costs

associated with the investigation into the now-concluded accounting

matter.

The Company is currently undergoing its 2009 audit, but

estimates that its Q4 2009 results will be above the midpoint of

the range for each of the metrics provided, excluding costs

associated with the accounting investigation.

Release of Fourth Quarter and Full Year 2009 Results

The Company expects to complete its annual 2009 audit and file

its Form 10-K for the year ended December 31, 2009 on a

timely basis. TechTarget expects to hold a conference call to

discuss its fourth quarter and full year 2009 results no later than

the first week of March; the exact date and detailed information

for that call will be announced no less than ten days prior to the

call.

Non-GAAP Financial Measures

This press release and the accompanying tables include a

discussion of adjusted EBITDA, adjusted net income and adjusted net

income per share, all of which are non-GAAP financial measures

which are provided as a complement to results provided in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”). The term “adjusted EBITDA”

refers to a financial measure that we define as earnings before net

interest, income taxes, depreciation, and amortization, as further

adjusted for stock-based compensation. The term “adjusted net

income” refers to a financial measure which we define as net income

adjusted for amortization and stock-based compensation, as further

adjusted for the related income tax impact for the specific

adjustments. The term “adjusted net income per share” refers to a

financial measure which we define as adjusted net income divided by

adjusted weighted average diluted shares outstanding. These

Non-GAAP measures should be considered in addition to results

prepared in accordance with GAAP, but should not be considered a

substitute for, or superior to, GAAP results. In addition, our

definition of adjusted EBITDA, adjusted net income and adjusted net

income per share may not be comparable to the definitions as

reported by other companies. We believe adjusted EBITDA, adjusted

net income and adjusted net income per share are relevant and

useful information because it provides us and investors with

additional measurements to compare the Company’s operating

performance. These measures are part of our internal management

reporting and planning process and are primary measures used by our

management to evaluate the operating performance of our business,

as well as potential acquisitions. The components of adjusted

EBITDA include the key revenue and expense items for which our

operating managers are responsible and upon which we evaluate their

performance. In the case of senior management, adjusted EBITDA is

used as the principal financial metric in their annual incentive

compensation program. Adjusted EBITDA is also used for planning

purposes and in presentations to our board of directors. Adjusted

net income is useful to us and investors because it presents an

additional measurement of our financial performance, taking into

account depreciation, which we believe is an ongoing cost of doing

business, but excluding the impact of certain non-cash expenses and

items not directly tied to the core operations of our business.

Furthermore, we intend to provide these non-GAAP financial measures

as part of our future earnings discussions and, therefore, the

inclusion of these non-GAAP financial measures will provide

consistency in our financial reporting. A reconciliation of these

non-GAAP measures to GAAP is provided in the accompanying

tables.

Forward Looking Statements

Certain matters included in this press release may be considered

to be “forward-looking statements” within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

Those statements include statements regarding the intent, belief or

current expectations of the company and members of our management

team. All statements contained in this press release, other than

statements of historical fact, are forward-looking statements,

including those regarding: guidance on our future financial results

and other projections or measures of our future performance; our

expectations concerning market opportunities and our ability to

capitalize on them; and the amount and timing of the benefits

expected from acquisitions, from new products or services and from

other potential sources of additional revenue. Investors and

prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking

statements. These statements speak only as of the date of this

press release and are based on our current plans and expectations,

and they involve risks and uncertainties that could cause actual

future events or results to be different than those described in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, those relating to:

market acceptance of our products and services; relationships with

customers, strategic partners and our employees; difficulties in

integrating acquired businesses; and changes in economic or

regulatory conditions or other trends affecting the Internet,

Internet advertising and information technology industries. These

and other important risk factors are discussed or referenced in our

Annual Report on Form 10-K/A filed with the Securities and

Exchange Commission, under the heading “Risk Factors” and

elsewhere, and any subsequent periodic or current reports filed by

us with the SEC. Except as required by applicable law or

regulation, we do not undertake any obligation to update our

forward-looking statements to reflect future events or

circumstances.

About TechTarget

TechTarget (http://www.techtarget.com), a leading online

technology media company, gives technology providers ROI-focused

marketing programs to generate leads, shorten sales cycles, and

grow revenues. With its network of more than 60 technology-specific

websites and more than 7.5 million registered members, TechTarget

is a primary Web destination for technology professionals

researching products to purchase. The company is also a leading

provider of independent, peer and vendor content, a leading

distributor of white papers, and a leading producer of webcasts,

podcasts, videos and virtual trade shows for the technology market.

Its websites are complemented by numerous invitation-only events.

TechTarget provides proven lead generation and branding programs to

top advertisers including Cisco, Dell, EMC, HP, IBM, Intel,

Microsoft, SAP and Symantec.

(C) 2010 TechTarget, Inc. All rights reserved.

TechTarget and the TechTarget logo are registered trademarks of

TechTarget. All other trademarks are the property of their

respective owners.

TECHTARGET, INC.

Consolidated Balance

Sheets

(in $000’s)

September 30,2009 December

31,2008 (Unaudited) Assets Current assets:

Cash and cash equivalents $ 21,884 $ 24,130 Short-term investments

47,519 42,863 Accounts receivable, net of allowance for doubtful

accounts 15,623 17,622 Prepaid expenses and other current assets

4,604 6,251 Deferred tax assets 2,979 2,959 Total current assets

92,609 93,825 Property and equipment, net 3,502 3,904

Long-term investments 9,247 2,575 Goodwill 88,957 88,958 Intangible

assets, net of accumulated amortization 13,680 17,242 Deferred tax

assets 4,346 3,369 Other assets 93 139

Total assets

$ 212,434 $ 210,012

Liabilities and Stockholders’ Equity Current liabilities:

Current portion of bank term loan payable $ 750 $ 3,000 Accounts

payable 3,322 3,404 Income taxes payable 59 — Accrued expenses and

other current liabilities 1,850 2,908 Accrued compensation expenses

638 702 Deferred revenue 9,273 8,749 Total current liabilities

15,892 18,763 Long-term liabilities: Other liabilities 527

312 Total liabilities 16,419 19,075 Commitments — —

Stockholders’ equity: Preferred stock — — Common stock 42 42

Additional paid-in capital 230,850 221,597 Warrants 2 2 Accumulated

other comprehensive loss 37 (77 ) Accumulated deficit (34,916 )

(30,627 ) Total stockholders’ equity 196,015 190,937

Total liabilities and stockholders’ equity $

212,434 $ 210,012

TECHTARGET, INC.

Consolidated Statements of

Operations

(in $000’s, except share and

per share amounts)

Three Months Ended September30, Nine Months

Ended September30, 2009 2008 2009

2008 (Unaudited) Revenues: Online $ 18,191 $ 20,420 $

52,274 $ 57,701 Events 4,865 5,496 10,991 16,743 Print — 1,080 —

3,430 Total revenues 23,056 26,996 63,265 77,874 Cost of

revenues: Online (1) 4,789 5,462 14,445 16,113 Events (1) 1,741

2,328 4,277 7,078 Print — 580 — 1,758 Total cost of revenues 6,530

8,370 18,722 24,949 Gross profit 16,526 18,626 44,543 52,925

Operating expenses: Selling and marketing (1) 8,644 8,161

24,183 25,490 Product development (1) 2,276 2,788 6,551 8,440

General and administrative (1) 5,486 3,662 13,469 10,915

Depreciation 510 579 1,544 1,884 Amortization of intangible assets

1,166 1,259 3,562 4,071 Total operating expenses 18,082 16,449

49,309 50,800 Operating income (loss) (1,556 ) 2,177 (4,766

) 2,125 Interest income (expense), net 130 248 194 934

Income (loss) before provision for income taxes (1,426 )

2,425 (4,572 ) 3,059 Provision for (benefit from) income

taxes 12 1,718 (283 ) 1,736 Net income (loss) $ (1,438 ) $

707 $ (4,289 ) $ 1,323 Net income (loss) per common share:

Basic $ (0.03 ) $ 0.02 $ (0.10 ) $ 0.03 Diluted $ (0.03 ) $ 0.02 $

(0.10 ) $ 0.03 Weighted average common shares outstanding:

Basic 41,811,821 41,533,020 41,775,152 41,355,812 Diluted

41,811,821 43,116,678 41,775,152 43,393,429

(1) Amounts include

stock-based compensation expense as follows:

Cost of online revenue $ 95 $ 265 $ 407 $ 406 Cost of events

revenue 64 53 117 100 Selling and marketing 1,479 1,057 4,285 3,796

Product development 89 140 352 420 General and administrative 2,521

648 4,331 2,107

TECHTARGET, INC.

Reconciliation of Net Income

(Loss) to Adjusted EBITDA

(in $000’s)

Three Months Ended September30, Nine Months

Ended September30, 2009 2008 2009

2008 (Unaudited) Net income (loss)

$ (1,438 ) $ 707 $

(4,289 ) $ 1,323 Interest income

(expense), net 130 248 194 934 Provision for (benefit from) income

taxes 12 1,718 (283 ) 1,736 Depreciation 510 579 1,544 1,884

Amortization of intangible assets 1,166 1,259 3,562 4,071

EBITDA 120 4,015 340 8,080

Stock-based compensation expense 4,248 2,163 9,492 6,829

Adjusted EBITDA $ 4,368 $ 6,178

$ 9,832 $ 14,909

TECHTARGET, INC.Reconciliation of Net Income (Loss) to

Adjusted Net Income and Net Income (Loss) per Diluted Share

toAdjusted Net Income per Share(in $000's, except

share and per share amounts)

Three Months

EndedSeptember 30,

Nine Months

EndedSeptember 30,

2009 2008 2009 2008 (Unaudited)

Net income (loss) $ (1,438 )

$ 707 $ (4,289 ) $

1,323 Amortization of intangible assets 1,166 1,259 3,562

4,071 Stock-based compensation expense 4,248 2,163 9,492 6,829

Impact of income taxes 1,499 571 3,497 3,728

Adjusted net

income $ 2,477 $ 3,558 $

5,268 $ 8,495 Net income (loss) per

diluted share $ (0.03 ) $

0.02 $ (0.10 ) $ 0.03

Weighted average diluted shares outstanding

41,811,821 43,116,678 41,775,152

43,393,429 Adjusted net income per share

$ 0.06 $ 0.08 $ 0.12

$ 0.20 Adjusted weighted average diluted shares

outstanding 41,811,821 43,116,678

43,939,888 43,393,429

Options, warrants and restricted

stock, treasury method included in adjusted weighted

average diluted shares above

1,721,684 — 1,164,736 —

Weighted average diluted shares

outstanding 41,811,821 43,116,678

41,775,152 43,393,429

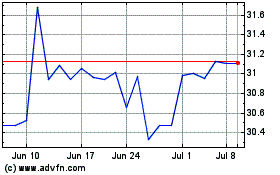

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jun 2024 to Jul 2024

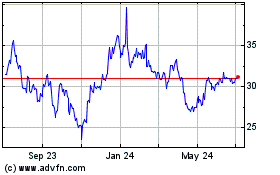

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jul 2023 to Jul 2024