Seanergy Maritime Holdings Corp. (“Seanergy” or the “Company”)

(NASDAQ: SHIP) announced today its financial results for the third

quarter and nine months ended September 30, 2020.

For the quarter ended September 30, 2020, the

Company generated net revenues after voyage expenses of $15.8

million, compared to $15.9 million in the corresponding quarter of

2019. This compares favorably with the 29% decrease in the average

Capesize spot earning s in the third quarter of 2020 versus the

same quarter of 2019. Accordingly, the average Time Charter

Equivalent (“TCE”)1 earned by the fleet during the third quarter of

2020 was $16,219 per vessel per day, a decrease of 19% from $20,143

in the third quarter of 2019. Seanergy recorded net income of $3.6

million in the third quarter, compared to net income of $0.7

million in the same quarter of 2019. Basic net income per share for

the third quarter of 2020 was $0.08. During the quarter, the

Company recognized a $5.2 million gain from the refinancing of a

loan facility at a discount through a new loan facility provided by

a third-party lender.

For the nine-month period ended September 30,

2020 net revenues after voyage expenses amounted to $28.1 million,

an 8.5% decrease compared to $30.7 million in the same period of

2019. The TCE earned during the first nine months of 2020 was

$10,267, representing a 14% decrease from $12,004 in the same

period of 2019, on the back of the historically low earnings

environment of the first half of 2020.

Cash and cash-equivalents, including restricted

cash, as of September 30, 2020 stood at $33.8 million, increased

from $14.6 million as of December 31, 2019. Shareholders’ equity at

the end of the third quarter of 2020 was $86.5 million compared to

$29.9 million at the end of 2019. Third party vessel-secured debt

was $160.1 million at the end of the third quarter of 2020 as

compared to $183.1 million as of December 31, 2019.

__________________1 EBITDA and TCE rate are

non-GAAP measures. Please see the reconciliation below of EBITDA to

net loss and TCE rate to net revenues from vessels, in each case

the most directly comparable U.S. GAAP measure.

Stamatis Tsantanis, the

Company’s Chairman and Chief Executive Officer,

stated:

“We are very pleased to see the third quarter of

2020 turning profitable for Seanergy following one of the worst

six-month periods in recent history of our market. The Capesize

daily rates improved significantly compared to the historically low

first half of the year and that was reflected in the operating

performance of our fleet. Our TCE for the third quarter was

$16,219, improved by 132% from $6,985 in the first six months of

2020. The main factors behind the recent rate improvement were the

increased demand for iron ore in China and the continued recovery

in Brazilian exports. Our commercial performance in the fourth

quarter tracks the BCI index which has averaged at approximately

$20,500 quarter-to-date.

Despite the global short-term uncertainties, we

expect this positive trend to continue in the long run, given the

increasing demand of commodities combined with the lowest Capesize

newbuilding orderbook of the last 15 years. Seanergy is the only

pure-play Capesize company publicly listed in the US and is

well-positioned to capitalize on positive market fundamentals. Our

balanced commercial approach between index-linked time-charters and

spot market exposure and our improved balance sheet offer a strong

competitive advantage.

The COVID-19 global pandemic has affected the

shipping industry and the seafarers onboard our vessels as port

restrictions imposed globally have posed challenges on the timing

and efficacy of crew changes. Through our meticulous planning we

have been able to source solutions for our crew members despite the

global travel restrictions. Our focus continues to be to safeguard

the well-being of our onshore employees and crew members, avoid

disruptions in the day-to-day vessel operations and service our

clients efficiently.

In light of volatile market conditions, we took

actions during the first nine months of 2020 to preserve our

liquidity and strengthen our balance sheet. As a result of these

actions, vessel-secured debt has seen an impressive reduction of

$23 million since the end of 2019, while our trade credit position

has improved by approximately $11.2 million in the same period.

Further to the normal amortization of our senior facilities which

was met in full, the reduction in our third-party debt was

supported by the refinancing of two vessels at a discount, which

resulted in a $5.2 million gain. We remain in discussions with our

lenders regarding our loan facilities expiring in 2020, and have

received positive feedback from our senior lenders to date, as

described further in this release.

Furthermore, within the third quarter of 2020,

we have taken delivery of our eleventh Capesize vessel, a 2005

built Japanese unit, which we agreed to acquire in the second

quarter of the year at what we believe to be a historical low

price. Despite the challenges faced globally in shipping, the

delivery was concluded successfully during a rising market.

Concluding, despite the challenging operating

environment imposed by the evolving pandemic, we have managed to

strongly position Seanergy in a prominent position for what we

believe will be a strong market rebound in the post COVID-19 era.

Our strategic targets of sustainable growth and capital structure

improvement, as means to achieve improved returns for our

shareholders, continue to be in the foreground of all our

initiatives.”

|

|

|

|

|

|

|

|

|

|

|

| Company

Fleet: |

|

Vessel Name |

Vessel SizeClass |

Capacity(DWT) |

Year Built |

Yard |

ScrubberFitted |

Employment Type |

Minimum T/Cduration |

|

Partnership |

Capesize |

179,213 |

2012 |

Hyundai |

Yes |

T/C Index Linked (1) |

3 years |

|

Championship (2) |

Capesize |

179,238 |

2011 |

Sungdong |

Yes |

T/C Index Linked (3) |

5 years |

|

Lordship |

Capesize |

178,838 |

2010 |

Hyundai |

Yes |

T/C Index Linked (4) |

3 years |

|

Premiership |

Capesize |

170,024 |

2010 |

Sungdong |

Yes |

T/C Index Linked (5) |

3 years |

|

Squireship |

Capesize |

170,018 |

2010 |

Sungdong |

Yes |

T/C Index Linked (6) |

3 years |

|

Knightship (7) |

Capesize |

178,978 |

2010 |

Hyundai |

Yes |

T/C Index Linked (8) |

3 years |

|

Gloriuship |

Capesize |

171,314 |

2004 |

Hyundai |

No |

T/C Index Linked (9) |

10 months |

|

Fellowship |

Capesize |

179,701 |

2010 |

Daewoo |

No |

Voyage/Spot |

|

|

Geniuship |

Capesize |

170,058 |

2010 |

Sungdong |

No |

Voyage/Spot |

|

|

Leadership |

Capesize |

171,199 |

2001 |

Koyo – Imabari |

No |

Voyage/Spot |

|

|

Goodship |

Capesize |

177,536 |

2005 |

Mitsui Engineering |

No |

Voyage/Spot |

|

| Total |

|

1,926,117 |

12

years |

|

|

|

|

| |

|

|

| (1) |

|

Chartered by a major European utility and energy company and

delivered to the charterer on September 11, 2019 for a period of

minimum 33 to maximum 37 months with an optional period of about 11

to maximum 13 months. The daily charter hire is based on the BCI.

In addition, the Company has the option to convert to a fixed rate

for a period of between 3 and 12 months, based on the prevailing

Capesize Forward Freight Agreement Rate (“FFA”) for the selected

period. |

| |

|

|

| (2) |

|

Sold to and leased back on a bareboat basis from a major commodity

trading company on November 7, 2018 for a five-year period. We have

a purchase obligation at the end of the five-year period and we

further have the option to repurchase the vessel at any time. |

| |

|

|

| (3) |

|

Chartered by Cargill from November 7, 2018 for a period of 60

months, with an additional period of 24 to 27 months at charterer’s

option. The daily charter hire is based on the BCI plus a gross

daily scrubber premium of $1,740. In addition, the Company has the

option to convert to a fixed rate for a period of between 3 and 12

months, based on the prevailing Capesize FFA for the selected

period. |

| |

|

|

| (4) |

|

Chartered by a major European utility and energy company and

delivered on August 4, 2019 for a period of minimum 33 to maximum

37 months with an optional period of about 11 to maximum 13 months.

The daily charter hire is based on the BCI plus a net daily

scrubber premium of $3,735 until May 2021. In addition, the Company

has the option to convert to a fixed rate for a period of between 3

and 12 months, based on the prevailing Capesize FFA for the

selected period. The Company has exercised such option for the

2-month period of September – October 2020 converting the floating

rate to a fixed daily gross rate of $22,000. |

| |

|

|

| (5) |

|

Chartered by Glencore and was delivered to the charterer on

November 29, 2019 for a period of minimum 36 to maximum 42 months

with two optional periods of minimum 11 to maximum 13 months. The

daily charter hire is based on the BCI plus a net daily scrubber

premium of $2,055. |

| |

|

|

| (6) |

|

Chartered by Glencore and was delivered to the charterer on

December 19, 2019 for a period of minimum 36 to maximum 42 months

with two optional periods of minimum 11 to maximum 13 months. The

daily charter hire is based on the BCI plus a net daily scrubber

premium of $2,055. |

| |

|

|

| (7) |

|

Sold to and leased back on a bareboat basis from a major Chinese

leasing institution on June 28, 2018 for an eight-year period. We

have a purchase obligation at the end of the eight-year period and

we further have the option to repurchase the vessel at any time

following the second anniversary of the delivery under the bareboat

charter. |

| |

|

|

| (8) |

|

Chartered by Glencore and delivered to the charterer on May 15,

2020 for a period of about 36 to about 42 months with two optional

periods of minimum 11 to maximum 13 months. The daily charter hire

is based on the BCI. |

| |

|

|

| (9) |

|

Chartered by a dry bulk charter operator and was delivered to the

charterer on April 23, 2020 for a period of minimum 10 to maximum

14 months. The daily charter hire is based on the BCI. In addition,

the Company has the option to convert to a fixed rate for a period

of between 3 and 12 months, based on the prevailing Capesize FFA

for the selected period. |

| Fleet

Data: |

| |

| (U.S. Dollars in

thousands) |

| |

|

|

|

|

Q3 2020 |

|

Q3 2019 |

|

9M 2020 |

|

9M 2019 |

|

|

Ownership days (1) |

975 |

|

920 |

|

2,795 |

|

2,730 |

|

|

Operating days (2) |

973 |

|

790 |

|

2,737 |

|

2,558 |

|

|

Fleet utilization (3) |

99.8% |

|

85.9% |

|

97.9% |

|

93.7% |

|

|

TCE rate (4) |

$16,219 |

|

$20,143 |

|

$10,267 |

|

$12,004 |

|

|

Daily Vessel Operating Expenses (5) |

$5,984 |

|

$5,247 |

|

$5,573 |

|

$5,032 |

|

| |

|

|

|

|

|

|

|

|

|

|

| (1) |

|

Ownership days are the total number of calendar days in a period

during which the vessels in a fleet have been owned or chartered

in. Ownership days are an indicator of the size of the Company’s

fleet over a period and affect both the amount of revenues and the

amount of expenses that the Company recorded during a period. |

| |

|

|

| (2) |

|

Operating days are the number of available days in a period less

the aggregate number of days that the vessels are off-hire due to

any reason, including dry-dockings, special and intermediate

surveys, lay-up days and unforeseen circumstances. Operating days

include the days that our vessels are in ballast voyages without

having finalized agreements for their next employment. |

| |

|

|

| (3) |

|

Fleet utilization is the percentage of time that the vessels are

generating revenue and is determined by dividing operating days by

ownership days for the relevant period. |

| |

|

|

| (4) |

|

TCE rate is defined as the Company’s net revenue less voyage

expenses during a period divided by the number of the Company’s

operating days during the period. Voyage expenses include port

charges, bunker (fuel oil and diesel oil) expenses, canal charges

and other commissions. The Company includes the TCE rate, a

non-GAAP measure, as it believes it provides additional meaningful

information in conjunction with net revenues from vessels, the most

directly comparable U.S. GAAP measure, and because it assists the

Company’s management in making decisions regarding the deployment

and use of the Company’s vessels and in evaluating their financial

performance. The Company’s calculation of TCE rate may not be

comparable to that reported by other companies. The following table

reconciles the Company’s net revenues from vessels to the TCE

rate. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands of U.S.

Dollars, except operating days and TCE rate) |

| |

| |

|

|

|

|

|

|

|

|

|

|

Q3 2020 |

Q3 2019 |

9M 2020 |

9M 2019 |

| Net revenues

from vessels |

19,651 |

|

23,959 |

|

42,032 |

|

58,730 |

| Less: Voyage expenses |

3,870 |

|

8,046 |

|

13,930 |

|

28,023 |

| Net operating revenues |

15,781 |

|

15,913 |

|

28,102 |

|

30,707 |

| Operating days |

973 |

|

790 |

|

2,737 |

|

2,558 |

| TCE rate |

$16,219 |

$20,143 |

$10,267 |

$12,004 |

| |

|

|

|

|

|

|

| (5) |

|

Vessel operating expenses include crew costs, provisions, deck and

engine stores, lubricants, insurance, maintenance and repairs.

Daily Vessel Operating Expenses are calculated by dividing vessel

operating expenses by ownership days for the relevant time periods.

The Company’s calculation of daily vessel operating expenses may

not be comparable to that reported by other companies. The

following table reconciles the Company’s vessel operating expenses

to daily vessel operating expenses. |

| |

|

|

| |

|

|

(In thousands of U.S. Dollars, except ownership

days and Daily Vessel Operating Expenses)

|

|

Q3 2020 |

Q3 2019 |

9M 2020 |

9M 2019 |

| Vessel

operating expenses |

|

6,399 |

|

4,827 |

|

16,141 |

|

13,842 |

| Less: Pre-delivery expenses |

|

565 |

|

- |

|

565 |

|

104 |

| Vessel operating expenses before pre-delivery expenses |

|

5,834 |

|

4,827 |

|

15,576 |

|

13,738 |

| Ownership days |

|

975 |

|

920 |

|

2,795 |

|

2,730 |

| Daily Vessel Operating

Expenses |

$5,984 |

$5,247 |

$5,573 |

$5,032 |

| |

|

|

|

|

Net Income / (Loss) to EBITDA

Reconciliation:(In thousands of U.S. Dollars)

|

|

Q3 2020 |

|

Q3 2019 |

|

9M 2020 |

|

9M 2019 |

|

|

Net income / (loss) |

3,592 |

|

747 |

|

(16,037 |

) |

(14,796 |

) |

|

Add: Net interest and finance cost |

5,296 |

|

6,097 |

|

16,540 |

|

18,009 |

|

|

Add: Depreciation and amortization |

3,835 |

|

2,990 |

|

11,143 |

|

8,662 |

|

|

Add: Taxes |

- |

|

(27 |

) |

- |

|

32 |

|

|

EBITDA |

12,723 |

|

9,807 |

|

11,646 |

|

11,907 |

|

|

Less: Gain on debt refinancing |

(5,150 |

) |

- |

|

(5,150 |

) |

- |

|

|

Adjusted EBITDA |

7,573 |

|

9,807 |

|

6,496 |

|

11,907 |

|

Earnings Before Interest, Taxes, Depreciation

and Amortization ("EBITDA") represents the sum of net income /

(loss), interest and finance costs, interest income, depreciation

and amortization and, if any, income taxes during a period. EBITDA

is not a recognized measurement under U.S. GAAP. Adjusted EBITDA

represents EBITDA adjusted to exclude the non-recurring gain on

debt refinancing, which the Company believes is not indicative of

the ongoing performance of its core operations.

EBITDA and adjusted EBITDA are presented as we

believe that these measures are useful to investors as a widely

used means of evaluating operating profitability. EBITDA and

adjusted EBITDA as presented here may not be comparable to

similarly titled measures presented by other companies. These

non-GAAP measures should not be considered in isolation from, as a

substitute for, or superior to, financial measures prepared in

accordance with U.S. GAAP.

Interest and Finance Costs to Cash Interest and

Finance Costs Reconciliation:

(In thousands of U.S. Dollars)

|

|

Q3 2020 |

|

Q3 2019 |

|

9M 2020 |

|

9M 2019 |

|

|

Interest and finance costs, net |

(5,296 |

) |

(6,097 |

) |

(16,540 |

) |

(18,009 |

) |

|

Add: Amortization of deferred finance charges |

189 |

|

270 |

|

538 |

|

874 |

|

|

Add: Amortization of convertible note beneficial conversion

feature |

1,457 |

|

907 |

|

3,873 |

|

2,693 |

|

|

Add: Amortization of other deferred charges |

129 |

|

1,457 |

|

430 |

|

2,452 |

|

|

Add: Cash interest waived - related party |

- |

|

- |

|

- |

|

1,164 |

|

|

Cash interest and finance

costs |

(3,521 |

) |

(3,463 |

) |

(11,699 |

) |

(10,826 |

) |

| |

|

|

|

|

|

|

|

|

Third Quarter and Recent

Developments:

Capesize Vessel

Delivery

In August 2020, the Company took delivery of the

M/V Goodship, a 2005, Japanese built Capesize vessel, acquired in

May 2020 from an unaffiliated third party for a gross purchase

price of $11.4 million. The acquisition was funded with cash on

hand, as sourced through its equity capital raising activities in

2020.

Refinancing with Material

Gain

In July 2020, the Company completed a

refinancing transaction of a loan facility secured by the M/V

Gloriuship and M/V Geniuship, that was originally entered into in

September 2015, at a discount. As a result of this refinancing the

Company recognized a $5.2 million gain.

The new loan of $22.5 million was provided by

certain nominees of EnTrust Global as lenders for the purpose of

partly refinancing the settlement amount of $23.5 million under the

loan facility originally entered into in September 2015. The new

facility was fully drawn on July 16, 2020.

Underwritten Public Offering and

Update on Number of Shares Issued and

Outstanding

On August 20, 2020, Seanergy completed an

underwritten public offering of units consisting of (i) one common

share (or one pre-funded warrant in lieu of one common share) and

(ii) one Class E warrant to purchase one common share. The gross

proceeds of the offering, including the subsequent partial exercise

of the overallotment option granted to the underwriters, were

approximately $26.8 million, resulting in net proceeds of

approximately $24.9 million, after deducting underwriting discounts

and commissions and offering expenses payable by Seanergy.

All pre-funded warrants issued in the offering

have been fully exercised and therefore there are no pre-funded

warrants outstanding as of the date of this release.

As of November 17, 2020, the Company has

68,314,985 shares of common stock issued and outstanding.

Update on Bank Debt and

Related-Party Financings

In recent months, the Company has engaged in

productive discussions with UniCredit Bank AG (“UniCredit”) and

Amsterdam Trade Bank N.V. (“ATB”) to extend the maturity of the

UniCredit facility, which currently expires in December 2020, and

to relax certain financial covenants and reduce principal

installments. On September 29, 2020, Seanergy received approvals

from UniCredit and ATB concerning such terms.

The Company has also been engaged in extensive

parallel discussions with Jelco Delta Holding Corp. (“Jelco”), a

related-party entity, to agree on a comprehensive restructuring of

its various subordinated or unsecured debt instruments, including

the settlement of accrued and unpaid interest for the first nine

months of the year. In the context of these discussions, Jelco had

waived the Company’s obligations, including payment obligations

upon maturity of two loan facilities with original maturity dates

of June 30, 2020 and September 27, 2020, and interest payment

obligations totaling approximately $16.0 million, for a period

which expired on November 13, 2020.

Although discussions are ongoing, the Company

has not been able to reach a mutual agreement with Jelco to date.

Upon the expiration of the waiver period on November 13, 2020, the

aforementioned obligations became due and payable. This related

party debt event has triggered cross-default provisions in the

Company’s remaining credit facilities and sale and leaseback

agreements. However, the Company is in active dialogue with its

senior lenders and does not expect that they will pursue any

remedies while discussions are ongoing and as the Company continues

making installment payments on all its senior loan facilities

timely and in full. In contrast with the Company’s senior loans,

which are secured by its vessels, the Jelco facilities do not

represent senior secured obligations of the Company and have

limited remedy rights. The Company intends to continue engaging

with its senior lenders and with Jelco seeking a solution

acceptable to all parties which will be to the best interest of the

Company and its shareholders.

Update on Stock Purchases by the

CEO

As of today, the Company’s Chairman and Chief

Executive Officer, Mr. Stamatis Tsantanis, has purchased 300,000 of

Seanergy’s common shares in accordance with the previously

announced plan for open-market purchases by Mr. Tsantanis. Further

purchases will be announced in subsequent updates.

Annual General Meeting of

Shareholders

The 2020 Annual Meeting of Shareholders was held

on November 16, 2020. At the meeting, the following proposals were

approved and adopted:

- the election of Ms. Christina Anagnostara, as a Class B

Director to serve until the 2023 Annual Meeting of Shareholders;

and

- the ratification of the appointment of Ernst & Young

(Hellas) Certified Auditors-Accountants S.A. as the Company's

independent auditors for the fiscal year ending December 31,

2020.

| |

|

Seanergy Maritime Holdings Corp.Unaudited

Condensed Consolidated Balance Sheets(In thousands of U.S.

Dollars) |

| |

|

|

|

September 30, 2020 |

|

|

December 31,2019* |

|

| ASSETS |

|

|

|

|

|

|

|

Cash and restricted cash |

|

33,820 |

|

|

14,554 |

|

|

Vessels, net |

|

259,964 |

|

|

253,781 |

|

|

Other assets |

|

13,851 |

|

|

14,216 |

|

| TOTAL

ASSETS |

|

307,635 |

|

|

282,551 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Bank debt and other financial liabilities |

|

160,120 |

|

|

183,066 |

|

|

Convertible notes |

|

18,547 |

|

|

14,608 |

|

|

Due to related parties |

|

23,334 |

|

|

24,237 |

|

|

Other liabilities |

|

19,179 |

|

|

30,782 |

|

|

Stockholders’ equity |

|

86,455 |

|

|

29,858 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

307,635 |

|

|

282,551 |

|

| |

|

|

|

|

|

|

| * Derived from the

audited consolidated financial statements as of the period as of

that date |

| |

|

Seanergy Maritime Holdings Corp.Unaudited

Condensed Consolidated Statements of Operations (In thousands

of U.S. Dollars, except for share and per share data, unless

otherwise stated) |

| |

| |

|

Three months endedSeptember 30, |

|

Nine months endedSeptember 30, |

|

| |

|

2020 |

|

2019 |

|

2020 |

|

|

2019 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

Vessel revenues |

|

20,352 |

|

24,806 |

|

43,500 |

|

|

60,765 |

|

|

Commissions |

|

(701 |

) |

(847 |

) |

(1,468 |

) |

|

(2,035 |

) |

| Vessel revenue,

net |

|

19,651 |

|

23,959 |

|

42,032 |

|

|

58,730 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

|

(3,870 |

) |

(8,046 |

) |

(13,930 |

) |

|

(28,023 |

) |

|

Vessel operating expenses |

|

(6,399 |

) |

(4,827 |

) |

(16,141 |

) |

|

(13,842 |

) |

|

Management fees |

|

(270 |

) |

(248 |

) |

(773 |

) |

|

(742 |

) |

|

General and administrative expenses |

|

(1,537 |

) |

(1,017 |

) |

(4,682 |

) |

|

(4,191 |

) |

|

Depreciation and amortization |

|

(3,835 |

) |

(2,990 |

) |

(11,143 |

) |

|

(8,662 |

) |

| Operating income /

(loss) |

|

3,740 |

|

6,831 |

|

(4,637 |

) |

|

3,270 |

|

| Other

expenses: |

|

|

|

|

|

|

|

|

|

|

|

Interest and finance costs |

|

(5,296 |

) |

(6,097 |

) |

(16,540 |

) |

|

(18,009 |

) |

|

Gain on debt refinancing |

|

5,150 |

|

- |

|

5,150 |

|

|

- |

|

|

Other, net |

|

(2 |

) |

13 |

|

(10 |

) |

|

(57 |

) |

| Total other expenses,

net: |

|

(148 |

) |

(6,084 |

) |

(11,400 |

) |

|

(18,066 |

) |

| Net income /

(loss) |

|

3,592 |

|

747 |

|

(16,037 |

) |

|

(14,796 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income / (loss)

per common share, basic |

|

0.08 |

|

0.49 |

|

(0.57 |

) |

|

(20.64 |

) |

| Weighted average number of

common shares outstanding, basic |

|

46,144,608 |

|

1,526,720 |

|

28,118,984 |

|

|

716,844 |

|

| Net income / (loss)

per common share, diluted |

|

0.04 |

|

0.49 |

|

(0.57 |

) |

|

(20.64 |

) |

| Weighted average number of

common shares outstanding, diluted |

|

89,041,036 |

|

1,526,720 |

|

28,118,984 |

|

|

716,844 |

|

| |

|

|

|

|

|

|

|

|

|

|

About Seanergy Maritime Holdings

Corp.

Seanergy Maritime Holdings Corp. is the only

pure-play Capesize ship-owner publicly listed in the US. Seanergy

provides marine dry bulk transportation services through a fleet of

11 Capesize vessels with an average age of about 12 years and

aggregate cargo carrying capacity of approximately 1,926,117

dwt. The Company is incorporated in the Marshall Islands and

has executive offices in Athens, Greece. The Company's common

shares trade on the Nasdaq Capital Market under the symbol "SHIP",

its Class A warrants under "SHIPW" and its Class B warrants under

“SHIPZ”.

Please visit our company website at:

www.seanergymaritime.com

Forward-Looking

Statements

This press release contains forward-looking

statements (as defined in Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended) concerning future events. Words such as "may",

"should", "expects", "intends", "plans", "believes", "anticipates",

"hopes", "estimates" and variations of such words and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks and are based upon

a number of assumptions and estimates, which are inherently subject

to significant uncertainties and contingencies, many of which are

beyond the control of the Company. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, the Company's operating

or financial results; the Company's ability to continue as a going

concern; the Company’s liquidity, including its ability to service

its indebtedness; competitive factors in the market in which the

Company operates; shipping industry trends, including charter

rates, vessel values and factors affecting vessel supply and

demand; future, pending or recent acquisitions and dispositions,

business strategy, areas of possible expansion or contraction, and

expected capital spending or operating expenses; risks associated

with operations outside the United States; and other factors listed

from time to time in the Company's filings with the SEC, its

most recent annual report on Form 20-F. The Company's filings can

be obtained free of charge on the SEC's website at www.sec.gov.

Except to the extent required by law, the Company expressly

disclaims any obligations or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in the Company's expectations with

respect thereto or any change in events, conditions or

circumstances on which any statement is based.

For further information please

contact:

Capital Link, Inc. Daniela Guerrero230 Park

Avenue Suite 1536 New York, NY 10169 Tel: (212) 661-7566 E-mail:

seanergy@capitallink.com

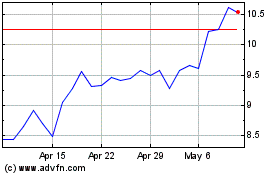

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Jun 2024 to Jul 2024

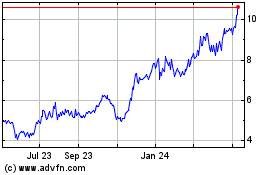

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Jul 2023 to Jul 2024