SAN JOSE, Calif., Jan. 25 /PRNewswire-FirstCall/ -- Sanmina-SCI

Corporation (NASDAQ:SANM), a leading global electronics

manufacturing services (EMS) company, today reported financial

results for its first fiscal quarter ended December 31, 2005. First

Quarter Fiscal 2006 Highlights Include: -- REVENUE OF $2.86

BILLION, WITHIN GUIDANCE OF $2.8-$2.9 BILLION -- NON-GAAP EARNINGS

PER SHARE OF $0.08, WITHIN GUIDANCE OF $0.06-$0.08 -- GAAP EARNINGS

PER SHARE OF $0.04 -- NON-GAAP OPERATING INCOME OF $76.1 MILLION,

UP 21.9% OVER Q4'05 -- NON-GAAP GROSS MARGIN 6.0% For the first

quarter ended December 31, 2005, Sanmina-SCI reported revenue of

$2.86 billion, an increase of 3.5%, from $2.77 billion in the

fourth quarter of fiscal 2005 ended October 1, 2005. Non-GAAP

Financial Results for the Quarter (1): Net income for the first

fiscal quarter of 2006 was $39.6 million, up 26.4% over the fourth

quarter. Diluted earnings per share for the quarter was $0.08.

Operating income was $76.1 million, up 21.9% over the fourth

quarter of fiscal 2005. Operating income as a percentage of revenue

for the quarter was 2.7% versus 2.3% for the prior quarter and 2.5%

for the first quarter of fiscal 2005. Gross profit was $171.1

million, up 11.1% over the fourth quarter of fiscal 2005. Gross

margin was 6.0%, up from the prior quarter of 5.6% and up from 5.4%

in the first quarter of fiscal 2005. GAAP Financial Results for the

Quarter: For the first quarter of fiscal 2006, the company reported

net income of $21.2 million, versus $5.3 million for the fourth

quarter fiscal 2005 and $24.4 million for the same period a year

ago. Diluted earnings per share for the quarter were $0.04. The

GAAP financial statements for the first quarter 2006 included a

one-time favorable income tax adjustment of $64.0 million relating

to previously-accrued income taxes that were reversed as a result

of a settlement reached with the U.S. Internal Revenue Service. The

settlement was in relation to certain U.S. tax audits that were

concluded during the quarter. Notification of approval of the

settlement by the Congressional Joint Committee on Taxation was

received following the filing of the Company's annual report on

Form 10-K for fiscal 2005. Of the $64.0 million adjustment, $27.9

million was recorded as an income tax benefit to earnings. The

remaining $36.1 million was recorded as an adjustment to goodwill

for pre-merger tax items associated with SCI Systems. (Non-GAAP

results exclude this one-time benefit.) FINANCIAL RESULTS (In

thousands, except per share data) Q1:2006 Q4:2005 Q1:2005 GAAP:

Revenue $2,861,797 $2,765,302 $3,252,706 Net Income $21,170 $5,342

$24,366 Earnings per share $0.04 $0.01 $0.05 Non-GAAP:(1) Gross

Profit $171,073 $154,033 $176,967 Gross Margin 6.0% 5.6% 5.4%

Operating Income $76,130 $62,444 $82,168 Operating Margin 2.7% 2.3%

2.5% Net Income $39,581 $31,319 $45,692 Earnings per share $0.08

$0.06 $0.09 (1) Non-GAAP financial results exclude integration and

restructuring costs, impairment charges, other infrequent or

unusual items and non-cash interest and amortization expense. In

addition to the above items, the first quarter of 2006 Non-GAAP

results do not include stock-based compensation expenses. Please

refer to "Non-GAAP Financial Information" below for a discussion of

how the above non-GAAP financial measures are calculated and why we

believe this information is useful to investors. A reconciliation

from GAAP to non-GAAP results is contained in the attached

financial summary and is available on the Investor Relations

section of our website at http://www.sanmina-sci.com/. At December

31, 2005, the Company reported $1.04 billion in cash and cash

equivalents and short-term investments. At quarter-end, the Company

reported a current ratio of 1.8, working capital of $1.79 billion,

and stockholders' equity of $2.4 billion. "This was a good quarter

for Sanmina-SCI as we saw improvements in our business. These

improvements in our first quarter can be attributed in large part

to our continued focus on the fundamentals, improved product mix

and improved operating efficiencies. Though there is still more

work to be done, we do believe the Company is well positioned for

long-term growth," stated Jure Sola, Chairman and Chief Executive

Officer of Sanmina-SCI. Company Outlook The following statements

are based on current expectations. These statements are

forward-looking and actual results may differ materially. Please

refer to the Risk Factors reported in the Company's annual and

quarterly reports on file with the Securities and Exchange

Commission for a description of some of the factors that could

influence the Company's ability to achieve the projected results.

The Company provides the following guidance with respect to its

second fiscal quarter ending April 1, 2006: -- Revenue is expected

to be seasonally down in the range of $2.6 billion to $2.7 billion;

-- Non-GAAP diluted earnings per share to be between $0.05 and

$0.07, excluding stock-based compensation expenses, integration and

restructuring costs, impairment charges, other infrequent or

unusual items and non-cash interest and amortization expense.

Non-GAAP Financial Information In the summary table set forth

above, we present the following non-GAAP financial measures: gross

profit, gross margin, operating income, operating margin, net

income and earnings per share. In computing each of these non-GAAP

financial measures, we exclude charges or gains relating to:

stock-based compensation expenses, restructuring costs (including

employee severance and benefits costs and charges related to excess

facilities and assets), integration costs (consisting of costs

associated with the integration of acquired businesses into our

operations), impairment charges for goodwill and intangible assets,

extraordinary gains or losses, non-cash interest and amortization

expense and other infrequent or unusual items, to the extent

material, which we consider to be of a non-operational nature in

the applicable period. We have furnished these non-GAAP financial

measures because we believe they provide useful supplemental

information to investors in that they eliminate certain financial

items that are of a non-recurring, unusual or infrequent nature or

are not related to the Company's regular, ongoing business.Our

management also uses this information internally for forecasting,

budgeting and other analytical purposes. Therefore, the non-GAAP

financial measures enable investors to analyze the core financial

and operating performance of our Company and to facilitate

period-to-period comparisons and analysis of operating trends. A

reconciliation from non-GAAP to GAAP results is contained in the

attached financial summary and is available on the Investor

Relations section of our website at http://www.sanmina-sci.com/.

Sanmina-SCI provides earnings guidance only on a non-GAAP basis due

to the inherent uncertainties associated with forecasting the

timing and amount of restructuring, impairment and other unusual

and infrequent items. The non-GAAP financial information presented

in this release may vary from non-GAAP financial measures used by

other companies. In addition, non-GAAP financial information should

not be viewed as a substitute for financial data prepared in

accordance with GAAP. Company Conference Call Information

Sanmina-SCI will be holding a conference call regarding this

announcement on Wednesday, January 25, 2006 at 5:00 p.m. ET (2:00

p.m. PT). The access numbers are: domestic 877-273-6760 and

international: 706-634-6605. The conference will be broadcast live

over the Internet. Log on to the live webcast at

http://www.sanmina-sci.com/. Additional information in the form of

a slide presentation is available by logging onto Sanmina-SCI's

website at http://www.sanmina-sci.com/. A replay of today's

conference call will be available for 48-hours. The access numbers

are: domestic 800-642-1687 and international: 706-645-9291, access

code: 4338491. About Sanmina-SCI Sanmina-SCI Corporation is a

leading electronics contract manufacturer serving the

fastest-growing segments of the global electronics manufacturing

services (EMS) market. Recognized as a technology leader,

Sanmina-SCI provides end-to-end manufacturing solutions, delivering

superior quality and support to large OEMs primarily in the

communications, defense and aerospace, industrial and medical

instrumentation, computer technology and multimedia sectors.

Sanmina-SCI has facilities strategically located in key regions

throughout the world. Information about Sanmina-SCI is available at

http://www.sanmina-sci.com/. Sanmina-SCI Safe Harbor Statement The

foregoing, including the discussion regarding the Company's future

prospects, contains certain forward-looking statements that involve

risks and uncertainties, including uncertainties associated with

economic conditions in the electronics industry, particularly in

the principal industry sectors served by the Company, changes in

customer requirements and in the volume of sales to principal

customers, the ability of Sanmina-SCI to effectively assimilate

acquired businesses and achieve the anticipated benefits of its

acquisitions, and competition and technological change. The

Company's actual results of operations may differ significantly

from those contemplated by such forward-looking statements as a

result of these and other factors, including factors set forth in

the Company's fiscal year 2005 Annual Report on Form 10-K filed on

December 29, 2005 and the other reports, including quarterly

reports on Form 10-Q and current reports on Form 8-K, that the

Company files with the Securities Exchange Commission. Condensed

Consolidated Statements of Operations (In thousands, except per

share data) (GAAP) (Unaudited) Three Months Ended December 31, 2005

January 1, 2005 Net sales $2,861,797 $3,252,706 Cost of sales

2,691,700 3,075,739 Gross profit 170,097 176,967 Operating

expenses: Selling, general and administrative 87,689 87,309

Research and development 8,890 7,490 Amortization of intangible

assets 2,233 2,030 Integration costs 175 114 Restructuring costs

35,628 20,425 Total operating expenses 134,615 117,368 Operating

income 35,482 59,599 Interest Income 5,925 3,507 Interest expense

(34,248) (30,056) Other expense, net 1,054 270 Interest and other

expense, net (27,269) (26,279) Income before income taxes 8,213

33,320 Provision for (benefit from) income taxes(1) (12,957) 8,954

Net income $21,170 $24,366 Earnings per share: Basic $0.04 $0.05

Diluted $0.04 $0.05 Weighted-Average Shares used in computing per

share amounts: Basic 524,311 519,205 Diluted 524,703 525,008 (1)

Included a one-time favorable income tax adjustment of $64.0

million relating to previously-accrued income taxes that were

reversed as a result of a settlement reached with the U.S. Internal

Revenue Service. The settlement was in relation to certain U.S. tax

audits that were concluded during the quarter. Notification of

approval of the settlement by the Congressional Joint Committee on

Taxation was received following the filing of the company's Annual

Report on Form 10-K for fiscal 2005. Of the $64 million adjustment,

$27.9 million was recorded as an income tax benefit to earnings.

The remaining $36.1 million was recorded as an adjustment to

goodwill for pre- merger tax items with SCI Systems. Forward

Looking Guidance Three Months Ended April 1, 2006 Net sales $2.6 -

$2.7 billion Non-GAAP earnings per share (1) $.05 - $.07 (1)

Forward looking guidance for the quarter ended April 1, 2006 is

provided only on a non-GAAP basis. The comparable GAAP earnings or

loss per share amount is not accessible due to inherent

difficulties in predicting certain expenses and gains affecting

GAAP earnings or loss, such as the amount and timing of

Sanmina-SCI's restructuring costs, as well as debt security

repurchases, if any, that could result in gains or losses reported

in GAAP earnings. Sanmina - SCI Corporation Condensed Consolidated

Balance Sheets (In thousands) (GAAP) December 31, October 1 2005

2005 (Unaudited) (Derived from audited ASSETS financials) Current

assets: Cash and cash equivalents $1,011,098 $1,068,053 Short-term

investments 28,178 57,281 Accounts receivable, net 1,612,325

1,477,401 Inventories 1,122,773 1,015,035 Deferred income taxes

39,107 42,767 Prepaid expenses and other current assets 104,142

86,620 Total current assets 3,917,623 3,747,157 Property, plant and

equipment, net 606,895 662,101 Goodwill 1,654,126 1,689,198 Other

intangible assets, net 33,658 35,907 Other non-current assets

80,363 81,874 Restricted cash 25,538 25,538 Total assets $6,318,203

$6,241,775 LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Current portion of long-term debt $1,259 $1,439

Accounts payable 1,636,397 1,559,172 Accrued liabilities 353,322

366,920 Accrued payroll and related benefits 141,141 146,687 Total

current liabilities 2,132,119 2,074,218 Long-term liabilities:

Long-term debt, net of current portion 1,635,847 1,644,666 Other

152,774 143,873 Total long-term liabilities 1,788,621 1,788,539

Stockholders' equity: Preferred stock - - Common stock 5,475 5,457

Treasury stock (188,200) (188,519) Additional paid-in capital

5,753,326 5,745,125 Accumulated other comprehensive income 25,623

36,886 Accumulated deficit (3,198,761) (3,219,931) Total

stockholders' equity 2,397,463 2,379,018 Total liabilities and

stockholders' equity $6,318,203 $6,241,775 Sanmina - SCI

Corporation Reconciliation of GAAP to Non-GAAP Measures (in

thousands, except per share data) (Unaudited) Three months ended

December 31, 2005 January 1, 2005 GAAP Gross Profit $170,097

$176,967 GAAP Gross Margin 5.9% 5.4% Adjustments: Stock

compensation expense 976 - Non-GAAP Gross Profit $171,073 $176,967

Non-GAAP Gross Margin 6.0% 5.4% GAAP operating income $35,482

$59,599 GAAP operating margin 1.2% 1.8% Adjustments: Stock

compensation expense 2,612 - Amortization of intangible assets

2,233 2,030 Restructuring and integration costs 35,803 20,539

Non-GAAP operating income $76,130 $82,168 Non-GAAP operating margin

2.7% 2.5% GAAP net income $21,170 $24,366 Adjustments: Stock

compensation expense(1) 2,612 - Amortization of intangible assets

2,233 2,030 Restructuring and integration costs 35,803 20,539

Non-cash interest expense 5 6,645 Tax effect - reversal of

previously accrued income taxes (27,864) - Tax effect of above

items 5,622 (7,888) Non-GAAP net income $39,581 $45,692 GAAP

Earnings Per Share: Basic $0.04 $0.05 Diluted $0.04 $0.05 Non-GAAP

Earnings Per Share: Basic $0.08 $0.09 Diluted $0.08 $0.09

Weighted-Average Shares used in computing GAAP and Non-GAAP

earnings per share amounts: Basic 524,311 519,205 Diluted 524,703

525,008 (1) Total stock compensation expense for the first quarter

of fiscal 2006 was approximately $1.0 million of cost of sales,

$1.5 million of selling and general administrative expense and $0.1

million of research and development expense. First Call Analyst:

FCMN Contact: geri.cookson@sanmina-sci.com DATASOURCE: Sanmina-SCI

Corporation CONTACT: Paige Bombino, Investor Relations of

Sanmina-SCI, +1-408-964-3610 Web site: http://www.sanmina-sci.com/

Copyright

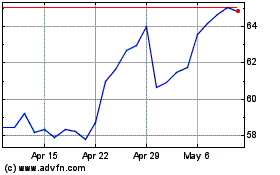

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From May 2024 to Jun 2024

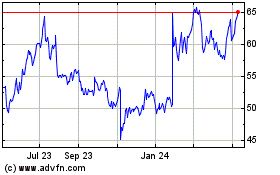

Sanmina (NASDAQ:SANM)

Historical Stock Chart

From Jun 2023 to Jun 2024