O'Reilly Automotive Inc. - Momentum

February 14 2012 - 7:00PM

Zacks

ORLY 021412

O’Reilly Automotive (ORLY)

It’s not just gear-heads that love this Missouri based auto parts

retailer; Wall Street has been driving this stock higher for the

past 8 months straight.

The good news is that O’Reilly continues to deliver results.

They beat EPS estimates last quarter and improved margins

throughout 2011. New car sales are improving, but consumers

are still finding value in their used vehicles and doing minor

repairs themselves. The DIY movement across the US seems to

be getting stronger as well.

But O’Reilly doesn’t just cater to individuals; they deliver parts

to local shops around the country quickly, efficiently and at

competitive prices, which is a large part of their

business.

The question is: can ORLY maintain this momentum into 2012?

Company Description &

Developments

O’Reilly is an automotive parts company founded in 1957 which from

humble beginnings has grown to 3,613 stores around the country with

over 47,000 employees. 100% of their business is focused in

39 states across the US. They are looking to grab market

share by rapidly expanding into new locations; opening 170 new

stores in 2011 with 180 new sites planned for 2012.

During their past report the company painted a bright picture for

2012, which added fuel to the fire burning in their high

performance stock appreciation engine. In the coming year we

should expect to see management focused on brand strength,

efficiency and expansion.

They also plan on increasing media reach with an advertising plan

that includes the introduction of television along with print, a

strong radio advertising schedule and the continued involvement in

sports and motorsports sponsorships.

Financial Profile &

Earnings

O’Reilly is a mid-cap ($10.68 billion) company that is trading at

about 21 times trailing earnings (P/E). Looking forward,

Zacks Consensus Estimates are calling for that number to drop

closer to 18 with no change in price over the next year.

O’Reilly became a Zacks Rank #1 Strong Buy on Valentine’s

Day.

The parts company reported a quarterly sales decrease of 9% at

their last earnings report. Annual sales were still up 7%

compared to 2010 with total sales of roughly $5.78 billion in

FY2011. ORLY earnings rose from $2.95 per share in FY2010 to

$3.71 in FY2011. O’Reilly is expected to earn $4.49 per share

in FY2012 according to the Zacks Consensus Estimate.

For the quarter, sales increased $81 million, comprised of a $43

million increase in comp store sales, a $38 million increase in

non-comp store sales, a $2 million increase in non-comp non-store

sales and a $2 million decrease from closed stores compared to

2010.

For the year, ticket (receipt) average drove the increase as DIY

ticket count was under pressure for much of the year. They believe

the increase in ticket average was the result of professional sales

growing faster than DIY sales and product mix tending towards hard

parts, both of which carry a higher ticket average.

Moving Forward

O’Reilly’s sales guidance for 2012 is $6.15 billion to $6.25

billion. With comparable store sales growth guidance at 3% to 6%,

the bulk of which is coming from strong growth in the professional

side of the business, especially in the acquired markets.

They see DIY growth a little slower this year.

For the first quarter, they see diluted earnings per share coming

in between $0.99 to $1.03. For the full year, diluted EPS guidance

is $4.27 to $4.37 per share.

O’Reilly also saw free cash flow improve 134% to $791 million for

2011 with anticipation of $600 to $650 million in 2012.

To date, O’Reilly has bought back 16 million shares with an average

price of $61.63. In 2012, the company intends to continue executing

their programs with $362 million of cash on the balance sheet as

well as additional free cash flow generated during the year.

Market Performance &

Technicals

The word momentum may be the only way to describe O’Reilly’s stock

for the better part of the past year. Since early August the

stock has risen about 50% and has remained above its 50- and

200-day moving averages for the majority of that move, indicating a

fairly constant and strong trend.

Like most of the market, ORLY is consolidating just under its

52-week high of $85.32. Even yesterday’s lackluster retail

data couldn’t hold the stock down, but a market reversal would most

certainly influence its bullish momentum. As a

consumer-driven stock, we need to continue to see growth or at the

very least stability in economic data.

ORLY has exceeded the S&P 500’s performance by over 43% in the

past year, but has fallen about 3% short of its bullish moves over

the past 3 months.

Jared A Levy is the Momentum Stock Strategist for Zacks.com. He is

also the Editor in charge of the market-beating Zacks Whisper

Trader Service.

O REILLY AUTO (ORLY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

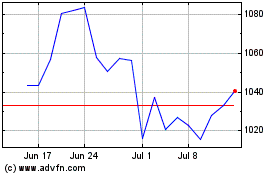

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From May 2024 to Jun 2024

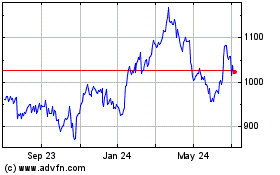

O Reilly Automotive (NASDAQ:ORLY)

Historical Stock Chart

From Jun 2023 to Jun 2024