Balanced View on CF Industries - Analyst Blog

February 24 2014 - 3:00PM

Zacks

On Feb 20, we issued an updated

research report on CF Industries (CF). While the

fertilizer company should benefit from lower natural gas costs in

North America, we are concerned about pricing pressure, high debt

level and near-term challenges in its phosphate business.

CF Industries, a Zacks Rank #3

(Hold) stock, posted better-than-expected fourth-quarter 2013

results on Feb 18 with both revenues and adjusted earnings beating

the respective Zacks Consensus Estimate. However, revenues and

profit fell year over year on lower fertilizer pricing. The company

saw declines across its nitrogen and phosphate businesses in the

quarter.

CF Industries should benefit from

favorable natural gas costs in North America and a solid start to

the domestic planting season. Moreover, the company has a strong

cash flow profile, which allows it to return value to shareholders

and invest in growth initiatives.

Low-cost North American natural

gas has been an advantage for CF Industries. The company’s Nitrogen

segment is enjoying the benefit of abundant natural gas supply.

Moreover, CF Industries is expected to benefit from strong U.S.

corn plantations.

Moreover, the acquisition of

Viterra Inc.'s 34% interest in the Medicine Hat nitrogen facility

underscores CF Industries’ strategy to invest in lucrative

projects. Following the acquisition, CF Industries’ annual

marketable nitrogen volume rose by roughly 270,000 net tons of

ammonia and 275,000 tons of urea. The company also remains on track

with its capacity expansion projects in Louisiana and Iowa. It

plans to spend roughly $2 billion on capacity expansion projects

this year.

However, CF Industries faces

intense price competition from both domestic and foreign fertilizer

producers. The prices of its products are highly sensitive to

demand and supply. CF Industries is also exposed to volatility in

raw material costs and has significant debt.

While CF Industries is divesting

its Phosphate unit to Mosaic (MOS), weakness in

this business is expected to sustain in the near term. Phosphate

prices are expected to remain constrained due to weak international

demand, especially from India. Unfavorable subsidy for phosphate

products is hurting Indian phosphate imports. Moreover, oversupply

in the market, especially from Chinese export producers, is putting

pressure on the urea market and pricing.

Key Picks from the

Sector

Other companies in the basic

materials sector worth considering include Methanex

Corporation (MEOH) and The Scotts Miracle-Gro

Co. (SMG). While Methanex holds a Zacks Rank #1 (Strong

Buy), Scotts Miracle-Gro retains a Zacks Rank #2 (Buy).

CF INDUS HLDGS (CF): Free Stock Analysis Report

METHANEX CORP (MEOH): Free Stock Analysis Report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

SCOTTS MIRCL-GR (SMG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

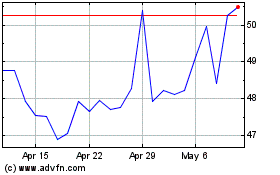

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jun 2024 to Jul 2024

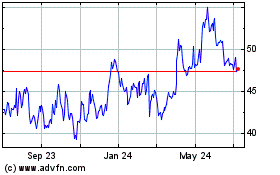

Methanex (NASDAQ:MEOH)

Historical Stock Chart

From Jul 2023 to Jul 2024