Iron Mountain Sells Digital Assets - Analyst Blog

May 19 2011 - 8:30AM

Zacks

A leading information management

company, Iron Mountain Inc. (IRM)

recently announced its intention to sell key assets of its digital

division including archiving, eDiscovery and online backup to

Autonomy Corporation plc for $380 million in cash.

The transaction is subject to

regulatory review and customary closing conditions and is expected

to close within 45 to 60 days.

However, Iron Mountain will retain

its software escrow business, which is currently a part of its

Worldwide Digital Business segment and other technology services

such as its Digital Record Centers for Images and Medical

Images.

The divestiture is a part of Iron

Mountain’s comprehensive strategic plan, which was announced on

April 19, 2011. Iron Mountain was forced to undertake a strategic

review regarding the digital business, which has recently been up

against a number of challenges.

We believe the divestiture of the

under performing digital assets will help Iron Mountain focus on

its core business.

Further, Iron Mountain has

undertaken a number of initiatives to enhance stockholders’ value

going forward. This includes sustaining its dominant position in

the domestic market and significantly improving its international

portfolio.

Iron Mountain expects to return

approximately $2.2 billion to shareholders by 2013, through share

repurchases and dividends. The company also formed a special

committee to evaluate financing, capital and tax strategies

including its plan of converting into a Real Estate Investment

Trust (REIT).

By executing on its comprehensive

strategic plan, Iron Mountain expects to achieve after-tax ROIC of

11.0% in 2013, up from 7.7% in 2010. Iron Mountain expects to

achieve adjusted OIBDA margin of 32.0%, while lowering its capital

spending to approximately 6.0% of revenue by 2013.

First Quarter

Recap

Iron Mountain reported earnings per

share (EPS) of 26 cents in the first quarter of fiscal 2011,

missing the Zacks Consensus Estimate by a penny.

Revenues increased 3.0% year over

year to $799.0 million, surpassing the Zacks Consensus Estimate of

$794.0 million. Revenues were primarily aided by an internal growth

rate of 1.0%. Acquisitions and foreign currency fluctuations

contributed 1.0% to revenue growth in the quarter.

Iron Mountain projects revenue

growth in the range of 3.0% to 5.0% (previous guidance 2.0% to

4.0%) for full-year 2011, primarily based on internal revenue

growth of 0-2%.

The company forecasts adjusted

OIBDA in the range of negative 1.0% to positive 2.0% for fiscal

2011. Iron Mountain expects earnings per share in the range of

$1.16 to $1.24, reflecting a year-over-year growth of 1.0% to 8.0%

(previous guidance $1.21 to $1.30).

The company expects capital

expenditure of $235.0 million (previous guidance $245.0 million)

and free cash flow in the range of $375 million to $410 million for

fiscal 2011.

Recommendation

We maintain our Neutral

recommendation on a long-term basis (6-12 months) due to weak

internal growth and volatile foreign exchange rates, partially

offset by Iron Mountain’s promising product portfolio and strong

market share.

Iron Mountain faces stiff

competition from Anacomp Inc., Cintas

Corporation (CTAS) and privately held SOURCECORP, Inc.

Iron Mountain holds a Zacks #3

Rank, which implies a short-term 'Hold' rating (for the next 1-3

months).

CINTAS CORP (CTAS): Free Stock Analysis Report

IRON MOUNTAIN (IRM): Free Stock Analysis Report

Zacks Investment Research

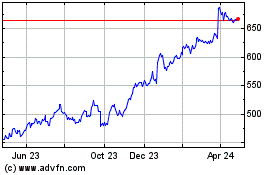

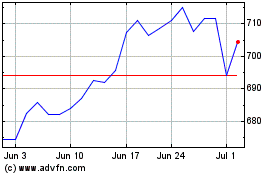

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From May 2024 to Jun 2024

Cintas (NASDAQ:CTAS)

Historical Stock Chart

From Jun 2023 to Jun 2024