Form 8-K - Current report

January 05 2024 - 5:00PM

Edgar (US Regulatory)

false000168006200016800622023-12-212023-12-21

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 21, 2023

ACM Research, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

001-38273

|

|

94-3290283

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

42307 Osgood Road, Suite I

|

|

|

|

Fremont, California

|

|

94539

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (510) 445-3700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

ACMR

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934:Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected

not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The shares of our operating subsidiary ACM Research (Shanghai), Inc. (“ACM

Shanghai”) are listed on the Sci-Tech innovation board (the “STAR Market”) of the Shanghai Stock Exchange (the “SSE”). In accordance with the SSE’s rules governing the STAR

Market, ACM Shanghai filed with the SSE a Record of December 2023 Investor Relations Activity (the “Record”). The SSE posted the Record to the SSE’s website on December 21, 2023. A copy of the Record is attached as Exhibit 99.1 hereto.

| Item 9.01 |

Financial Statements and Exhibits.

|

|

Exhibit

|

|

Description

|

| |

|

|

|

|

|

Record of December 2023 Investor Relations Activity filed by ACM Research (Shanghai), Inc. with the Shanghai Stock Exchange on December 21, 2023

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the XBRL document)

|

* Unofficial English translation of original document prepared in Mandarin Chinese.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

|

ACM RESEARCH, INC.

|

| |

|

|

By:

|

/s/ Mark McKechnie

|

|

|

|

Mark McKechnie

|

|

|

Chief Financial Officer and Treasurer

|

|

Dated: January 5, 2024

|

|

|

3

Exhibit 99.1

|

Stock Code: 688082

|

Short Name: ACMSH

|

ACM Research (Shanghai), Inc.

Record of Investor Relations Activities

No.: 2023-05

|

Categories of investor relations activities

|

|

✓Specific object survey

|

☐Analyst meeting

|

|

|

☐Media interview

|

☐Performance briefing

|

|

|

☐Press conference

|

☐Roadshow

|

|

|

☐Site visit

|

☐Others

|

|

|

Date

|

|

December 19, 2023

|

|

|

Venue

|

|

Conference call

|

|

|

Participants of the listed company

|

|

Chairman: HUI WANG

General Manager: JIAN WANG

Person in Charge of Financial Matters: LISA YI LU FENG

Board Secretary: MINGZHU LUO

|

|

|

Summary of investor relations activities

|

|

I. Company Introduction: The leadership of ACM Research (Shanghai), Inc. (the “Company”) gave a brief introduction to the Company’s current business development and operating performance and answered questions of concern

from investors.

II. Q&A

1. Can you update us on the progress of the two new products on the customer side, and whether they are

expected to generate revenue next year?

A: We expect to soon deliver one PECVD equipment to a customer, and believe that next year our PECVD equipment will attract

multiple customers, including those in the storage and logic sectors. We believe our PECVD equipment is fully backed by independent intellectual property (IP) rights and represents our differentiated technology route. In both domestic and

international markets, we believe there is a strong customer demand for equipment featuring this differentiated technology, which is crucial for competing with top-tier global enterprises.

|

|

|

|

Our Track equipment is performing well in customer-side verification, and we hope to complete integration process tests with

lithography equipment by the middle of next year. Moreover, we are continuing our efforts on attracting new customers, with several negotiations underway. Next year, we expect our focus will be introducing KrF equipment into the market

while concurrently advancing the development of ArF immersion system.

2. With the end of the current production expansion phase by domestic semiconductor manufacturers, will the

Company still be able to maintain its high growth rate over the next 2-3 years? And how do you view the future competitive landscape of the semiconductor equipment market?

A: We are planning for continued growth in revenue from our cleaning equipment in 2024. We believe this, combined with the ramping

up of production of our electroplating and furnace tube equipment, provides a positive environment for next year’s performance. In 2025 and 2026, we expect revenue contribution from our new PECVD equipment and Track tools, which together

with a growing overall market for these two equipment categories, may enable us to continue growing our revenue. Longer term, our growth is expected to benefit from ongoing expansion into overseas markets, with a strategic goal to balance

our revenue between domestic and international markets.

|

|

|

|

Looking ahead, as the semiconductor industry moves towards

globalization, we believe the market for semiconductor equipment will inevitably become globally competitive. We expect our commitment to developing technologies with independent intellectual property rights will remain a cornerstone of

our competitiveness in the industry.

3. Could you provide an overview of the expected orders for the Company next year?

A: Overall, we expect 2024 sales to grow versus 2023, as we are observing a strong demand for equipment stemming from the

production expansion of downstream manufacturers. As a core supplier of cleaning equipment in China, we believe the Company is positioned to secure large orders during this expansion. We see our wet bench equipment, copper plating and

furnace tube equipment as key growth drivers for next year. We are also expecting an increase in customer adoption of our furnace tube equipment by the end of this year. Furthermore, we believe that our CO2 and single wafer high-temperature

sulfuric acid technology tools can contribute as growth drivers.

|

|

|

|

4. How is the R&D focus distributed among the Company’s R&D team of over 700 members?

A: In general, a majority of our R&D team is dedicated to the development of cleaning equipment, which is a diverse and

significant segment for us, including high temperature sulfuric acid and CO2 technologies that involve a large portion of our R&D personnel. Additionally, copper plating, PECVD, furnace tube, and Track equipment each receive

considerable attention from our R&D team, with a relatively balanced distribution across these four segments. We are firmly committed to developing differentiated technologies in our R&D efforts, positioning ourselves to actively

engage in the global market competition in the future.

5. What is the Company’s market share in China’s electroplating equipment market? How about the overseas

market expansion on electroplating equipment next year?

A: We estimate our Company holds approximately 30% of the market share in China’s electroplating market. Looking at the global

market, we believe the electroplating industry is sizable and experiencing rapid growth. We have now secured overseas demo orders for our front-end copper plating equipment. Moving forward, we plan to expand our market outreach for copper

plating equipment into other regions including Europe, the United States, and Singapore.

6. In light of new competitors entering the domestic electroplating market, how do you perceive the

competition in this segment?

A: The technology for copper plating equipment is primarily dominated by a few industry leaders, including the Company, which we

believe has built strong technical patent barriers. Given these patent restrictions, we believe it is challenging for new competitors to quickly circumvent them, making it difficult for them to pose a competitive threat to the established

market.

|

|

|

|

7. What will the gross margin of the Company’s furnace tube equipment be?

A: The gross margin of our furnace tube equipment varies depending on the specific type, with ALD equipment generally having a

relatively higher margin. Additionally, these margins can be influenced by the specific sales market conditions. Overall, we expect that the comprehensive gross margin for our furnace tube equipment to be within the range of 40% to 45% in

the future.

8. Could you provide an overview of the current business climate in the equipment market? What are the

anticipated prospects for the Company in the overseas market next year?

A: The overall demand in 2023 for the international (i.e. non-mainland China) market has been relatively low. However, we expect

some improvement in international market demand in the second half of next year.

|

|

|

|

At present, two of our tool categories are under verification with a U.S. customer. Additionally, we have received an order from

this customer for a second set of bevel and backside cleaning equipment, which we expect to deliver by the end of the first quarter of next year. Meanwhile, we are discussing additional equipment types with this U.S. customer, and we hope

to deepen the relationship and become a more strategic supplier in the future. In the overseas market, there is a greater emphasis on differentiated technology. We believe our independently developed, patented IP with distinct features is

likely to give us a competitive edge in the global market.

9. Can you introduce the composition of the Company’s core R&D team?

A: In technology development, our primary focus is to maintain independent control over our patents, ensuring the integrity and

uniqueness of our IP through a differentiated technological approach. Our R&D team is built through a combination of internal training programs and strategic recruitment directly from our customer side.

10. How do you think of the domestic environment for semiconductor equipment patents in China?

A: We believe China’s substantial investment in the semiconductor industry marks an inevitable shift towards a global market orientation for the

semiconductor sector. This evolution highlights the critical need for the semiconductor sector to develop proprietary, differentiated patented technologies to compete on a global scale. As such, we believe the respect and protection of

patented technologies will continue to be a fundamental trend in the future development of the domestic market.

|

|

Encl.: List of Participants

|

Institution Name

|

|

DH Fund

|

|

power pacific

|

|

Bosera Fund

|

|

Boyu Investment

|

|

Fullgoal Fund

|

|

ICBC Credit Suisse

|

|

Franklin Templeton Sealand Fund

|

|

GH SHINING ASSET MANAGEMENT

|

|

GFUND

|

|

Sinolink Securities

|

|

CPIC

|

|

Haitong Securities

|

|

Harmon Tronics Investment

|

|

China Everwin Asset Management Co., Ltd.

|

|

HSBC Jintrust

|

|

JYAN ASSET MANAGEMENT

|

|

Harvest Fund

|

|

CCB Principal

|

|

Minsheng Tonghui Insurance Asset Management

|

|

Nanhua Fund

|

|

PUYUAN AMC

|

|

PICC Asset

|

|

Ruiyi Asset

|

|

Foresight Fund

|

|

Sumitomo Mitsui DS Capital Management Hong Kong Branch

|

|

SWS MU Fund Management

|

|

Western Securities

|

|

Maxwealth Fund

|

|

Zhonghai Fund

|

|

Lombarda China Fund

|

|

China Securities

|

|

China Post Securities

|

* * *

The following information is provided in connection with the furnishing of the above Record of December 2023 Investor Relation Activity of

ACM Research (Shanghai), Inc. (“ACMSH”) (the “Record”) pursuant to the Current Report on Form 8-K reporting requirements of ACM Research, Inc.:

Forward-Looking Statements

Information presented in the Record includes forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. All statements contained in the Record that do not relate to matters of historical fact should be considered forward-looking statements. Forward-looking statements are based on ACMSH management’s current expectations and

beliefs, and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties

include, but are not limited to, the following, any of which could be exacerbated even further by the continuing COVID-19 outbreak in China and globally: anticipated customer orders or identified market opportunities may not grow or develop as

anticipated; customer orders already received may be postponed or canceled; ACMSH may be unable to obtain the qualification and acceptance of its delivered tools when anticipated or at all, which would delay or preclude ACMSH’s recognition of

revenue from the sale of those tools; suppliers may not be able to meet ACMSH’s demands on a timely basis; ACMSH’s technologies and tools may not gain market acceptance; ACMSH may be unable to compete effectively by, among other things,

enhancing its existing tools, adding additional production capacity and engaging additional major customers; ACMSH may incur significant expenses long before it can recognize revenue from new products, if at all, due to the costs and length of

research, development, manufacturing and customer evaluation process cycles; volatile global economic, market, industry and other conditions could result in sharply lower demand for products containing semiconductors and for ACMSH’s products

and in disruption of capital and credit markets; ACMSH’s failure to successfully manage its operations, including its inability to hire, train, integrate and manage additional qualified engineers for research and development activities; and

trade regulations, including those recently published by the U.S. Department of Commerce imposing certain restrictions on equipment shipments and business practices with China-based semiconductor manufacturers, currency fluctuations, political

instability and war, all of which may materially adversely affect ACMSH due to its substantial non-U.S. customer and supplier base and its substantial non-U.S. manufacturing operations. A further description of these risks, uncertainties and

other matters can be found in filings ACM Research, Inc. makes with the U.S. Securities and Exchange Commission. Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results

and events currently expected by ACMSH. ACMSH undertakes no obligation to publicly update these forward-looking statements to reflect events or circumstances that occur after the date hereof or to reflect any change in its expectations with

regard to these forward-looking statements or the occurrence of unanticipated events.

v3.23.4

Document and Entity Information

|

Dec. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 21, 2023

|

| Entity File Number |

001-38273

|

| Entity Registrant Name |

ACM Research, Inc.

|

| Entity Central Index Key |

0001680062

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3290283

|

| Entity Address, Address Line One |

42307 Osgood Road

|

| Entity Address, Address Line Two |

Suite I

|

| Entity Address, City or Town |

Fremont

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94539

|

| City Area Code |

510

|

| Local Phone Number |

445-3700

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACMR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

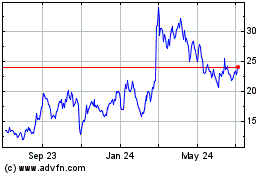

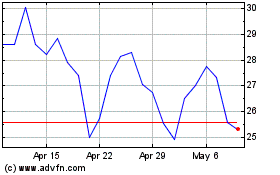

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Apr 2023 to Apr 2024