IGEN can make a mark in the

usage-based auto insurance space through its patented technology

for measuring and scoring driver performance and behavior.

June 30, 2020 -- InvestorsHub NewsWire -- via EmergingGrowth.com -- Auto stocks are back in

focus, thanks to the momentum in names such as Nikola Corp

(NASDAQ: NKLA), Hertz Global (NYSE: HTZ) and Tesla (NASDAQ: TSLA). iGEN Network

Corporation (OTCMKTS: IGEN) has been on a tear in the

past few weeks in sympathy with the high flying auto stocks but

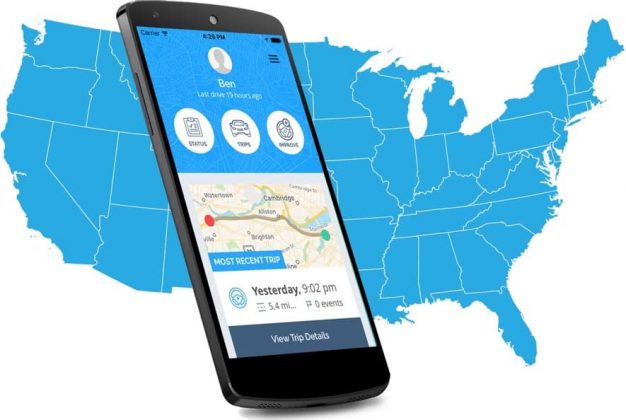

also has a few tricks up its sleeve. IGEN has an IoT

application that monitors auto consumer’s behaviors that provides

real time updates, analysis of driver behavior, and stolen vehicle

protection. The overall IoT market is projected to

reach $82.8 billion by 2020

with a CAGR of 26.7%. The connected car market is

projected to reach $212.7 billion by 2027 and growing at a 22.3%

CAGR. These trends in the marketplace are driving

innovation forward at an accelerated pace. The carmakers

all want more apps to distinguish themselves from the

competition. IGEN is uniquely positioned to ride the

wave of 3 hyper growing markets yet remain recession

proof.

Electric Car Market – Hypergrowth

TSLA is a no brainer. Although valuation does seem frothy, over

the long-term investors are more likely to make money betting for

and not against TSLA. NKLA, however, is a bit dicey. The electric

car maker, which focuses on tractor-trailer, has been widely

popular largely as a result of the CEO’s upbeat messaging. The

CEO Trevor Milton has warned Ford he’s looking to outsell its

popular F-150 pickups. However, once reality sets in, the

shorts could make a lot of money on NKLA, which seems to have

gotten ahead of itself. The same applies to HTZ. Its bankrupt and

the balance sheet is controlled by creditors, meaning investors who

stake their money for the long-term are likely to get

burned.

Connected Car – Insurance Apps

Usage based auto insurance is where insurance quotes are

generated based on recent driving history rather than demographics,

age and location. The insurance company installs a tracking device

on the car or provides a smartphone app that monitors the driver’s

behavior (for example noting if the driver engages in hard braking,

sharp turns and flooring the gas pedal). The data that is collected

is used to generate a quote that gives a fairer representation of

the risk. This can translate to lower premiums and other discounts,

assuming the driver’s behavior merits this.

More insurance companies are embracing this model, including the

larger ones, because an insurance quote based on recent driving

history is both good for the insurance company and the policy

holder. Users get a discount, but insurers get policy renewals. In

insurance, the big money is in the renewals, since a user is less

likely to shift to another insurer if they renew their original

policy at a price point they see as a bargain.

Progressive Corp (NYSE: PGR), one the largest insurers in

the U.S., offers its customers discounts based on their driving

through “Snapshot,” an app that tracks users driving and offers

discounts to safe drivers. The app works in the background of your

smartphone.

Root Insurance, a privately held auto insurer, uses technology in

smartphones to measure driving behavior such as braking, speed of

turns, driving times, and route regularity. Root determines who is

a safe driver and who isn’t. By only insuring safe drivers, Root

can offer more affordable rates. In a CNBC feature, Root says

that its customers can get rates up to 52 per cent lower than

previous insurers thanks to the usage-based insurance model.

Tellingly, though private, Root Insurance is now valued at

$3.65 billion after a $350 million funding round last year,

the largest single venture capital

round ever in the State of Ohio at the time. The

4-year-old auto insurer has raised a cumulative $523 million in VC

and another $100 million in debt, underlining the investment

appetite in the usage-based auto insurance space.

Importance of IoT

IoT, in its most basic definition, simply refers to a computer

ecosystem with devices that can transfer data over networks to

other devices without the need for human-to-human or

human-to-computer interaction. One way of looking at IoT is as

a type of Internet where, instead of two or more humans sitting on

either side of a laptop or phone sending and receiving information,

it is machines doing that to each other via other machines.

In many ways, IoT is the precursor to prevailing currents of

thought in high-tech areas like Artificial Intelligence and Machine

Learning, where the size of the opportunity in monetary terms could

be as much as ten times Microsoft (MSFT), according to Bill Gates as quoted on Forbes

magazine .

“If you invent a breakthrough in artificial intelligence,

so machines can learn, that is worth 10 Microsofts.” — Bill Gates,

as quoted on Forbes.

IoT continues to witness spectacular growth.

Researchandmarkets.com, in its just released Global Internet of

Things Market Insights Report 2020, notes that the sector worldwide

could post a 31.4% compounded annual

growth rate, growing by $876.5 billion.

The report states that the widespread availability of

smartphones, tablets and the declining price of connected devices

rank as some of the key factors driving adoption of IoT. According

to QYResearch, the global IoT market is expected to reach $1

trillion by 2025, with 5G networks expected to play a key role in

unlocking this value.

In view of its healthy growth outlook, the IoT space presents a

great investment opportunity for investors currently looking for

dependable bets in high growth areas within tech.

iGen Core Business – Recession Proof

IGEN, which is a fully reporting company in the U.S. and Canada,

is in the recession proof business of vehicle tracking and fleet

management, serving both businesses and individuals across the U.S.

However, just because the underlying business is recession proof

doesn’t mean it’s not lucrative.

Organizations and individuals that use vehicle tracking and

fleet management services regard them as essential services and

have no problem paying via subscription, putting IGEN in a very

favourable position in terms of the relative ease of generating new

revenue.

The company operates under three distinct brands.

- “Nimbo Tracking” which

focuses on real-time GPS tracking solutions for new and used car

dealerships. Car tracking for an auto dealership is an essential

service, just like insurance, meaning customer retention is strong

in the sector.

- “CU track” which

focuses on tracking solutions for credit unions and other financial

institutions. Today it is normal for financial institutions that

offer auto loans to install a tracker in the vehicle as part of the

loan agreement. Every auto loan that is approved is literally a

sale booked for companies like IGEN, since car tracking is now a

standard requirement for loan approval across the asset finance

industry.

- “Medallion GPS

Pro” which focuses on tracking solutions for commercial

fleet owners. The platform allows fleet owners to also manage their

assets and monitor their drivers to ensure they are behaving in a

way that promotes the security and safety of the assets and their

own personal safety.

In terms of operations IGEN is in a good space. Its customers,

who are largely auto dealers, financial institutions, and

commercial fleet owners, see the services it offers as an essential

service. They pay via subscriptions, with some of them signing

multi-year deals and a good number of them renewing these deals –

car tracking service providers are essentially like lawyers; you

only change them if something has gone terribly wrong.

IGEN’s services are all cloud-based, meaning it is by default a

high margin business. For the year ended Dec 31, 2019, the company

reported a 41% gross profit margin

in its 10-K. This means for every $100 it made in revenue, $41

stayed in the business. However, this impressive gross profit

margin, and the halving of net losses to $479,073 compared to

$1,175,320 in the previous year, were the only positives in last

year’s financials. During the year, revenue was down 40% to

$723,819.

The slump in 2019 may be a point of concern for investors but

there are strong indications that this trend could be reversed this

year. The company is on an ambitious sales drive that could

fundamentally shift its fortunes going forward, underlining the

huge upside potential in the stock.

Strong rebound in sales

CU Trak, the product line focusing on GPS tracking solutions for

credit unions, is off to a strong start having been launched just

last year. IGEN recently signed a sales and marketing agreement

with Michigan Credit Union Service Corporation, a wholly owned

subsidiary of the Michigan Credit Union League, one of the oldest

and most established trade associations for credit unions

in the U.S with roots in the pre- World War II era.

“MCULSC’s partnership with IGEN gives us an exciting opportunity

to continue providing the relevant products and services

Michigan credit unions need to be successful,” said MCUL &

Affiliates CEO Dave Adams in a joint press

release. This deal gives IGEN an opportunity to grow its

CU Trak customer pipeline in Michigan through MCULSC’s network,

which includes all the leading credit unions in the State of

Michigan.

During last year’s launch of CU Trak, the company secured orders

from Puerto Rico based Credit Unions and the Organization of

Americas, suggesting warm reception by the market and the

possibility of similar success in Michigan where the agreement with

MCULSC presents an immense opportunity to access even more credit

unions.

MCUL has over 5.3 million members

represented. CU Trak, which is sold via Sprint’s IOT

factory, is priced at $399, indicating the incredible sales

potential this deal presents. If IGEN converts just 10,000 members,

which realistically shouldn’t be a tall order considering it is

riding on the expansive network and strong influence of MCUL, it

will generate sales of at least $4 million in the course of this

deal. This deal essentially presents a real chance to grow the

business around 10x from 2019 sales. This potential doesn’t seem to

be fully priced into the stock, the current bullish run

notwithstanding.

Another deal that could have a huge impact on sales is the

recently signed three-year exclusive partnership

agreement with County Executives of America, which represents

over 700 counties across the U.S. Through the deal, IGEN will offer

Medallion GPS Pro, its fleet tracking and management solution, in

all 700 counties where County Executives of America has

jurisdiction. CEA, on its part, has endorsed Medallion GPS, opening

a path to new business for IGEN in the public sector.

“The Counties and Consolidated City/Counties have some of the

largest fleets of automobiles, trucks, motorized equipment and

school buses in the United States. The care for this equipment is a

very large expense to the taxpayer and it’s our duty to help secure

and maintain these valuable assets,” said Michael Griffin,

Executive Director of the County Executives of America.

According to IGEN CEO Neil Chan, the deal with County Executives of

America presents an opportunity to bring Medallion GPS Pro to an

“estimated 350,000 assets.” This is of course a highly bullish

outlook that assumes IGEN will be able to convert the entire

addressable market presented by this deal, which is

unlikely.

A more reasonable conversion rate would be 50%, which with an

addressable market of 350,000 assets, works out to 175,000 assets.

This is still a good number by any measure, considering the

subscriptions are on annual basis and the deal runs for three

years.

Medallion GPS Pro is particularly promising in view of the fresh

investments by major players in fleet management. Ford

(NYSE: F) is the latest to augment its

offering in the fleet management space. It recently launched

FordTelematics, a web-based software platform and subscription

service designed to grant fleet managers easy access to important

connected vehicle data. This will help commercial vehicle customers

optimize their fleets and make them even more efficient.

Competition is good for IGEN because it shows there is sustained

demand for web-based fleet management services.

IGEN’s sales outlook is highly promising and it is likely that

it will record a strong rebound in sales this year in view of the

strategic partnerships it has in place with CEA and MCUL, as well

as pre-existing plans to broaden its sales channels beyond

telecommunications company Sprint, its main sales partner. IGEN

last year contracted two new distributors (REMCOOP and Wireless

Business Consultants), meaning its customer pipeline will expand

beyond what it had last year. With its high gross profit margins, a

boost in sales will translate into more cash staying in the

business, creating shareholder value and attracting long-term

investors. Long term investors are good for a stock because they

buy and hold more than they sell, creating value for all

stockholders.

Usage based auto insurance

Longer-term, the real opportunity for IGEN appears to be in

usage-based auto insurance. IGEN already has credit unions as its

customers. This vital inroad into the financial services sector may

give it a real opportunity to sign up insurance companies as its

clients. Last year, IGEN took ownership of a patent for measuring

and scoring driver performance and behavior. This patented

technology is useful for fleet owners who want to promote driver

safety. It also competitively positions IGEN in the fast-growing

usage-based auto insurance space.

IGEN can make a mark in the usage-based auto insurance space

through its patented technology for measuring and scoring driver

performance and behavior. Its technology doesn’t need the driver’s

smartphone to work, which is a good selling point considering the

privacy concerns that come with collecting drivers’ data over their

smartphones. The partnerships it has with financial institutions

should provide a good entry point into this promising market.

Investors should look out for news and updates on this patented

technology.

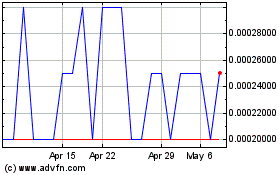

Massive Insider Purchases

The insider buying by the CEO and his VP, as well as the CEO’s

own track record make it a good speculative play. The

CEO, Neil Chan, bought 17 million shares at

0.0025 while his VP, Abel Sierra, bought 10 million shares at the

same price. At current prices the stock is up 72% from the

price the two executives bought it, highlighting the bullish

momentum these big transactions have triggered in the

market. Neil Chan is an ex Motorola Managing Director and

career technologist with over three decades experience. He is

credited with bringing a startup to $400 million in annual revenues

in 3 years.

Some investors see insider buying as a strong buy signal.

Usually, insiders who buy stock must wait at least six months

before selling their stock, making it improbable that a CEO and

other top executives would buy stock in large quantities and submit

necessary regulatory filings without well-founded optimism about

the company’s near-term and longer-term prospects.

Conclusion

IGEN has cleared most of its convertible notes from last year

and is sitting with 717 million shares issued. They are

authorized to issue 1.49 billion shares but it seems like

their need for capital has quieted as they shift toward large

revenue growth. With the threat of dilution diminished

investors have found the courage to step back into this name

following in the footsteps of the insider buying. IGEN’s core

business is recession proof yet it has great prospects with respect

to revenue generation in view of its subscription model, its

innovative products and the strategic sales and marketing

agreements it has signed so far. Its patented technology for

measuring and scoring driver performance and behavior could also

unlock new opportunities in the lucrative usage-based

auto-insurance space in coming years. This stock is being lifted by

three hypergrowth sectors, large insider purchases, and top line

revenue growth.

EmergingGrowth.com is a leading independent small

cap media portal with an extensive history of providing

unparalleled content for the Emerging Growth markets and companies.

Through its evolution, EmergingGrowth.com found a niche in identifying

companies that can be overlooked by the markets due to, among other

reasons, trading price or market capitalization. We look for strong

management, innovation, strategy, execution, and the overall

potential for long- term growth. Aside from being a trusted

resource for the Emerging Growth info-seekers, we are well known

for discovering undervalued companies and bringing them to the

attention of the investment community. Through our parent Company,

we also have the ability to facilitate road shows to present your

products and services to the most influential investment banks in

the space.

This article was written by a guest contributor and solely

reflects his/her opinions. All information contained herein

as well as on the EmergingGrowth.com website

is obtained from sources believed to be reliable but not guaranteed

to be accurate or all-inclusive. The statements in this article are

not that of, nor have they been verified by, or are the

opinion of, EmergingGrowth.com. All material is for

informational purposes only, and should not be construed as an

offer or solicitation to buy or sell securities. The information

includes certain forward-looking statements, which may be affected

by unforeseen circumstances and / or certain risks. Please

consult an investment professional before investing in anything

viewed within.

In addition, please make sure you read and understand the Terms

of Use, Privacy Policy and the Disclosure posted on

the EmergingGrowth.com website.

SOURCE: EmergingGrowth.com

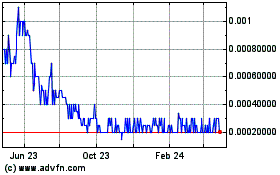

iGen Networks (CE) (USOTC:IGEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

iGen Networks (CE) (USOTC:IGEN)

Historical Stock Chart

From Sep 2023 to Sep 2024