Current Report Filing (8-k)

March 20 2020 - 12:02PM

Edgar (US Regulatory)

0000004962false00000049622020-03-202020-03-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 20, 2020

AMERICAN EXPRESS COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York

|

|

1-7657

|

|

13-4922250

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

200 Vesey Street,

New York, New York 10285

(Address of principal executive offices and zip code)

(212) 640-2000

(Registrant's telephone number, including area code)

|

|

|

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Shares (par value $0.20 per Share)

|

|

AXP

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

The following information is furnished under Item 7.01 – Regulation FD Disclosure:

As described in our Annual Report on Form 10-K for the year ended December 31, 2019, American Express Company (“American Express”, “we,” “us” or “our”) allocates discount revenue and certain other revenues among our reportable operating segments using a transfer pricing methodology. Within the Global Consumer Services Group and Global Corporate Services reportable operating segments, discount revenue generally reflects the issuer component of the overall discount revenue generated by each segment’s Card Members; within the Global Merchant and Network Services reportable operating segment, discount revenue generally reflects the network and acquirer component of the overall discount revenue. In addition, interest expense in our reportable operating segments represents an allocated funding cost based on a combination of segment funding requirements and internal funding rates.

During the first quarter of 2020, we made certain enhancements to 1.) our transfer pricing methodology related to the sharing of revenues between our card issuing, network and merchant businesses, and 2.) our methodology related to the allocation of certain funding costs primarily related to our Card Member loan and Card Member receivable portfolios. These enhancements resulted in certain changes to Non-interest revenues and Interest expense within Total revenues net of interest expense and Operating expenses within Total expenses across our reportable operating segments. These changes have no impact on our Consolidated Results of Operations.

The enhancements related to the allocation of certain funding costs also resulted in a change to our Net interest income divided by Average Card Member loans metric and Net Interest Yield on Average Card Member loans, a non-GAAP measure, within our reportable operating segments. The consolidated Net Interest Yield on Average Card Member loans, a non-GAAP measure, also changed for American Express Company.

All these changes have been applied beginning the first quarter of 2020 and prior period amounts have been revised to conform to the new presentation.

Certain preliminary and other information reflecting these revisions is attached to this report as Exhibit 99.1 and is incorporated herein by reference. Such information is being furnished in order to assist investors in understanding how our reportable operating segments results would historically have been presented had such results been reported. Such information does not represent a restatement of previously issued consolidated financial statements, but rather represents a reclassification among our reportable operating segments and does not impact our Net income, Earnings per share, Total assets, Stockholders’ equity or regulatory capital for any of the previously reported periods.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit

|

Description

|

|

99.1

|

|

|

104

|

The cover page of this Current Report on Form 8-K, formatted as inline XBRL.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN EXPRESS COMPANY

|

|

|

|

(REGISTRANT)

|

|

|

|

|

|

|

|

By:

|

/s/ Tangela S. Richter

|

|

|

|

Name: Tangela S. Richter

|

|

|

|

Title: Corporate Secretary

|

Date: March 20, 2020

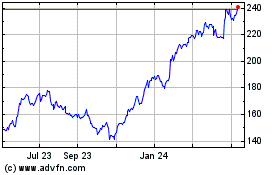

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

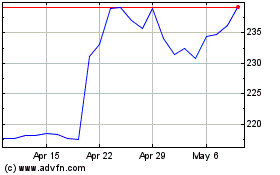

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024