AbbVie Strikes Deal to Buy Allergan for About $63bn

June 25 2019 - 9:43AM

Dow Jones News

By WSJ City

AbbVie has reached a deal to buy Allergan for about $63bn, as

two big drugmakers bet a combination will deliver new sources of

growth they have struggled to find on their own.

KEY FACTS

--- The takeover is worth $188 a share in cash and stock.

--- The price represents a 45% premium over Allergan's closing

price on Monday.

-- Buying Allergan would help AbbVie dominate the $8bn-plus

market for Botox and other beauty drugs.

--- That comes as AbbVie braces for the end of patent protection

for the world's top-selling drug, Humira.

--- Allergan's nearly $16bn in yearly revenue would give AbbVie

another source of cash to hunt for a new generation of

products.

Why This Matters

Lately, Wall Street has been clamouring for change at Allergan,

with its shares trading at a fraction of their peak of more than

$330 in the summer of 2015. Analysts have been saying the company

could split into two pieces but few expected CEO Brent Saunders to

pull off a sale, especially at such a lofty premium.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

June 25, 2019 09:28 ET (13:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

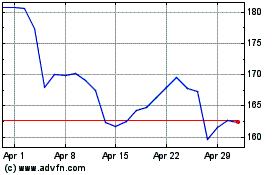

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Apr 2023 to Apr 2024