AmEx Profit Climbs As Cardholders Spend -- WSJ

April 19 2018 - 3:02AM

Dow Jones News

By AnnaMaria Andriotis and Maria Armental

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 19, 2018).

American Express Co. reported a 31% increase in first-quarter

profit, driven by a pickup in card holder spending and

borrowing.

The company reported profit of $1.63 billion, or $1.86 a share.

Revenue, net of interest expense, rose 12% to $9.72 billion.

Analysts surveyed by FactSet had projected a profit of $1.71 a

share on $9.13 billion in revenue.

The dollar amount of purchase transactions on AmEx cards

increased 10% from a year prior, adjusting for foreign exchange,

marking the biggest increase in billed business growth for the

company since the third quarter of 2014.

The acceleration appears in large part to be the result of

improved consumer sentiment. "There's clearly something going on

with increased confidence and increased spending" in particular

with more affluent customers, said Jeffrey Campbell, AmEx's finance

chief, on the company's earnings call Wednesday.

The company raised its revenue growth guidance to at least 8%

for 2018, up from a 7% to 8% range. It also said it expects

earnings per share to be at the high end of the $6.90 to $7.30

range it previously stated.

AmEx is focusing on rebuilding its capital, which took a hit

from charges related to the U.S. tax overhaul. A roughly $2.6

billion charge in the fourth quarter of 2017 pushed the company

into its first quarterly loss in a quarter-century, and AmEx

suspended share buybacks for the first half of the year. Quarterly

dividends remain unchanged. Mr. Campbell, on Wednesday's call, said

the company feels "confident that [it] will resume share

repurchases in the second half of the year."

Shares, which have outperformed the market over the past 12

months with a 26% gain, rose 3.5% to $98.45 in after-hours

trading.

AmEx changed chief executives in February after longtime chief

Kenneth Chenault retired, handing over the reins to AmEx veteran

Stephen Squeri. The company is continuing to pursue two of the

bigger strategies put into motion under Mr. Chenault: boosting

revenue by increasing lending to customers and separately lowering

the fees it charges merchants when customers use their cards to pay

for purchases.

On the merchant side, AmEx "discount" revenue from swipe fees

increased 9% from a year prior to $5.9 billion even as its average

swipe-fee rate fell 0.06 percentage point from a year prior to

2.37%. That is part of a broader effort under way at the company to

gain more merchant acceptance and to close the gap it currently has

with Visa and Mastercard.

The company continues to push into lending in the U.S. and

abroad, a departure from its core focus on affluent consumers who

pay their monthly bills in full. Card member loans totaled $72.8

billion world-wide, up 14% from a year prior and slightly down from

the preceding quarter. Loan balances in the U.S. increased 13% from

a year prior to $63.9 billion. That exceeded the rate at which

credit card debt is rising nationwide. In February, total U.S.

credit-card debt increased about 5.5% from a year prior, according

to the latest data from the Federal Reserve.

Loan losses and the amount of money the company set aside to

cover future losses both increased. Its global loan net write-off

rate -- including principal, interest and fees -- edged up to 2.4%

from 2.2% in the preceding quarter and 2.0% a year earlier. Its

total loan loss provisions increased 35% from a year prior to $775

million. AmEx chief Mr. Squeri said in a company statement that

"credit indicators are in line with our expectations."

Expenses rose 9% from the year-ago period, though they were 3%

lower than the preceding quarter. AmEx expenses paid out as

card-members rewards, which includes points redeemed for hotels and

airfare, reached $2.35 billion, its largest single expense and up

3.8% from the fourth quarter of 2017.

An increase in lending should bode well for AmEx and other card

issuers in a rising rate environment. Mr. Campbell, however, in

discussing the company's floating rate debt, said on the earnings

call that the company recently has seen compression in the spread

between its funding rates and the prime rate, "which is putting

more pressure on net interest yields than we had originally

anticipated."

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 19, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

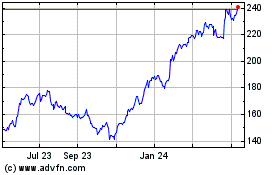

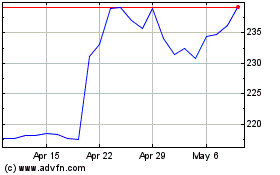

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024