By Jennifer Smith

Trucking companies anxious to hire more drivers but facing a

slim pipeline of new recruits aren't finding much to encourage them

at James Rumsey Technical Institute in Martinsburg, W.Va.

Enrollment in commercial-driving courses at the school dropped

to its lowest point in about 15 years this winter, a signal that

the industry's attempts to sell workers on truck driving haven't

gained much traction.

"Recruiters said all the schools were down this winter," said

instructor Michael Timmer, although he added that more students are

trickling in as the weather warms.

U.S. freight volumes are surging on the back of strong economic

growth, as retailers and manufacturers hire more trucks to haul

imports from seaports to distribution centers and raw materials to

factories. But the flow of new truck drivers is lagging far behind

the roaring freight market.

With unemployment at a nearly two-decade low, the downsides of

life behind the wheel are making recruitment tough. Many workers

are opting for construction or energy jobs that offer more time at

home or better pay. The trucking workforce is aging, and young

people who may want to try trucking have to wait until the are 21

years old to get an interstate commercial driver's license.

"I get a lot of guys out of high school. They come down for an

interview, I say come back and talk when you're 21," said Mr.

Timmer. "I rarely see them again."

Big-rig life can be grueling and lonesome. Truckers can spend up

to 11 hours a day behind the wheel, often bunked down in cramped

berths and subsisting on truck-stop food. The work takes a toll on

drivers' health: Almost 70% of long-haul drivers are obese,

according to a 2010 federal government survey.

Turnover at companies is high, with long-haul truckers often

hopping from one fleet to another in search of better wages or

working conditions.

There are roughly 1.67 million commercial truck drivers in the

U.S. Between 400,000 and 500,000 of those are long-haul truckers --

the toughest to recruit and retain, according to Kristen Monaco, a

researcher with the Bureau of Labor Statistics. Those figures don't

include the thousands of self-employed drivers who own their own

trucks.

The labor pool isn't growing much despite a blizzard of

help-wanted ads and inducements from trucking firms looking to

profit from the freight market rebound that began last summer. The

Commercial Vehicle Training Association, which represents driving

schools that typically train some 50,000 drivers each year,

estimates enrollment in 2017 rose by about 2% from the year

before.

The trucking sector added 5,600 jobs in February, the biggest

such jump since 2015. But companies that typically compete for

workers from the same pool as truckers hired at a faster clip:

Construction payrolls swelled by 61,000, while manufacturing gained

31,000 jobs.

The result is that carriers can't expand their fleets, and more

companies can't get their cargo moved on time. General Mills Inc.

said in an earnings call in March that its freight costs on the

spot market for truck transportation were near a 20-year high,

joining a growing lineup of retailers and manufacturers that have

pointed to higher costs and lost business from transportation

constraints.

Many trucking companies have raised pay and are offering signing

bonuses, but those efforts haven't yet gained much traction among

new recruits.

"The problem is, it's a shrinking market" for recruits, said

Michael Gerdin, chief executive of Heartland Express Inc., which

has more than 3,000 trucks. The company raised driver pay 5% last

fall, but "there are more [drivers] leaving the industry than

coming in," he said.

The average age of a for-hire long-haul trucker was 49 years old

in 2014, the most recent data available, up from 42 in 2002,

according to the American Trucking Associations, an industry

group.

Another hurdle: people seeking commercial licenses generally

have to pay for their own training, which can cost anywhere from

$2,000 to $8,000, or tie themselves to a trucking fleet that

operates its own schools or reimburses tuition for drivers who

commit to staying on for a certain period. Some financial aid is

available through federal programs.

Transportation research firm FTR estimates carriers overall will

add about 50,000 drivers in 2018. But the industry will need to add

between 150,000 and 200,000 drivers over the next year and a half

to replace people leaving trucking and to meet new demand, the firm

says.

About 40% of student hires at Covenant Transportation Group

Inc., a Chattanooga, Tenn.-based truckload carrier, leave before

completing three months on the job, said Rob Hatchett, the

company's vice president of communications and recruiting. "Until

they get in the truck and do it, they don't really know," Mr.

Hatchett said. "Experienced drivers, they know what they're getting

into."

(END) Dow Jones Newswires

April 03, 2018 08:14 ET (12:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

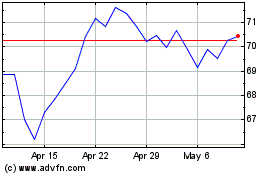

General Mills (NYSE:GIS)

Historical Stock Chart

From Aug 2024 to Sep 2024

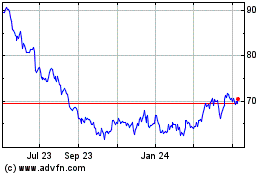

General Mills (NYSE:GIS)

Historical Stock Chart

From Sep 2023 to Sep 2024