British American Tobacco 2017 Profit Soars on Reynolds American Acquisition

February 22 2018 - 3:13AM

Dow Jones News

By Carlo Martuscelli

British American Tobacco PLC (BATS.LN) said Thursday that pretax

profit increased more than fourfold in 2017 on gains related to the

acquisition of Reynolds American Inc. (RAI).

The producer of Lucky Strike and Dunhill cigarettes posted a

pretax profit of 29.59 billion pounds ($41.30 billion) for the year

ended Dec. 31 compared with GBP6.25 billion in the previous-year

period. Revenue increased 38% to GBP20.29 billion.

Net profit was GBP37.53 billion, up from GBP4.65 billion the

year before.

The sharp increase in profit was attributable to the acquisition

of Reynolds American, which resulted in a gain of GBP23.29 billion

pounds, as well as deferred tax credits from U.S. tax reform.

Profit from operations was GBP6.48 billion compared with GBP4.66

billion the year before.

BAT said the company had established a new strategic portfolio

of brands that combined its existing Global Drive Brand portfolio,

with the strategic brands that were part of RAI, which include

Camel, Newport and Natural American Spirit, as well as its

reduced-risk products.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

February 22, 2018 02:58 ET (07:58 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

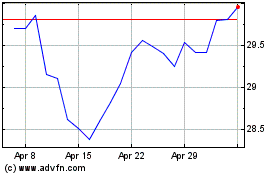

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

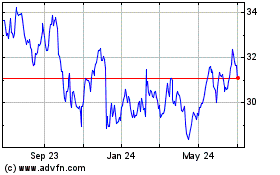

British American Tobacco (NYSE:BTI)

Historical Stock Chart

From Apr 2023 to Apr 2024