J&J Resumes Talks With Swiss Drugmaker Actelion -- WSJ

December 22 2016 - 3:02AM

Dow Jones News

By Austen Hufford

Johnson & Johnson re-entered acquisition talks with Actelion

Ltd., both companies said Wednesday.

J&J said last week that it had bowed out of the bidding, and

Actelion said that it was "engaged in discussions with another

party" without giving more detail. The Wall Street Journal reported

last week that the party was Sanofi , citing people familiar with

the matter.

Wednesday, J&J said it had entered into "exclusive

negotiations" to the rare-disease drugmaker, indicating that other

potential suitors had left the process. People familiar with the

matter have said a deal could value Actelion at as much as $30

billion.

A representative from Sanofi declined to comment.

Actelion specializes in treatments for a rare disorder known as

pulmonary arterial hypertension. The Swiss drug company reported

revenue of 2.1 billion Swiss francs ($2.1 billion) and a profit of

552 million Swiss francs last year.

Actelion shares rose 6.4% as J&J shares fell 0.4%. Sanofi

shares fell 0.6%.

J&J has been trying to reassure Wall Street that it can

withstand looming competition to its drug Remicade, an autoimmune

therapy that had $4.5 billion in U.S. sales last year. J&J has

said it has several drugs in the late stages of development, but a

deal for Actelion would help J&J quickly plug the lost

sales.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

December 22, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

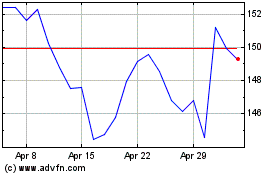

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

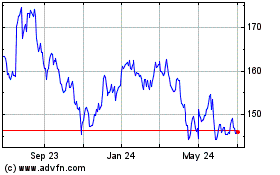

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024