Alibaba Profit, Revenue Increase -- Update

May 05 2016 - 8:49AM

Dow Jones News

By Alyssa Abkowitz in Beijing and Anne Steele

in New York

Chinese e-commerce giant Alibaba Group Holding Ltd. said

Thursday its fiscal fourth quarter net profit surged 86% from a

year earlier, boosted by disposal gains on investments and

businesses.

Alibaba said net profit for the three months ended March 31 rose

to 5.37 billion yuan (US$832 million) from 2.89 billion yuan a year

earlier. Revenue rose 39% to 24.18 billion yuan from 17.43 billion,

beating analysts' expectations of 23.2 billion yuan.

Gross merchandise volume -- a key metric that determines the

growth rate of e-commerce companies -- fell to 742 billion yuan at

the end of March from 964 billion yuan at the end of December,

which included Alibaba's biggest retail day, Singles Day. That

number includes shipping costs and confirmed, but not successfully

closed, orders. Mobile GMV accounted for 73% of total GMV, up from

51% a year earlier.

Despite robust revenue growth, Alibaba continues to face

headwinds. Competitor JD.com Inc. has been gaining market share,

with its revenue growth outpacing Alibaba for the past six

quarters. At the same time, Alibaba continues to throw money at

deals such as its recent $1 billion investment in Southeast Asian

e-commerce startup Lazada Group and its $266 million purchase of

Hong Kong-based newspaper South China Morning Post. Some investors

have questioned how several of the e-commerce giant's tie-ups fit

into the company's overall strategy and it also continues to face

criticism on its handling of counterfeit goods on its

platforms.

"Competition may have an impact on the company's growth," said

Henry Guo, an analyst at ITG Investment Research, referring to

Alibaba's ventures into on-demand services such as food delivery

and travel.

Shares in the company added 4.9% premarket to $79.50. The stock

had fallen 4.7% over the past year amid concerns of an economic

slowdown in China. Despite those concerns, Alibaba has seen growth

in sales and number of users, and online shopping has remained

resilient through the first quarter, analysts at Nomura Securities

said in a recent note.

"We showcase resiliency and growing clout of Chinese consumers,"

Maggie Wu, chief financial officer, said in a statement.

During the quarter, growth in China's rural landscape increased,

with Alibaba having a presence in more than 14,000 rural villages,

up from 12,000 villages during the previous quarter. Cross-border

imports continued to help transaction volume on Tmall Global, with

more than 100 international brands, including Costco and Macy's,

bringing goods to Chinese consumers, Alibaba said. The company also

made strides in cloud computing business, with revenue increasing

to 1.1 billion yuan, up 175% year over year.

Alibaba said it repurchased and canceled 5.8 million shares for

about $365 million in the fourth quarter.

Write to Alyssa Abkowitz at alyssa.abkowitz@wsj.com and Anne

Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 05, 2016 08:34 ET (12:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

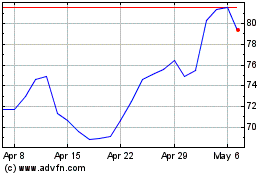

Alibaba (NYSE:BABA)

Historical Stock Chart

From Aug 2024 to Sep 2024

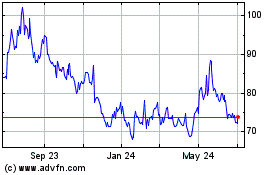

Alibaba (NYSE:BABA)

Historical Stock Chart

From Sep 2023 to Sep 2024