U.S. Treasury's Lew Challenges EU on Corporate Tax Investigations

February 11 2016 - 8:10AM

Dow Jones News

WASHINGTON—The U.S. stepped up a spat with European officials

over their investigations of U.S. companies' tax practices, warning

in a letter from the Treasury secretary that they are creating a

"disturbing" precedent.

U.S. Treasury Secretary Jack Lew in the Thursday letter asked

European officials to rethink the investigations, saying they

"undermine the well-established basis of mutual cooperation and

respect that many countries have worked so hard to develop and

preserve." U.S. companies whose tax practices are under

investigation include Apple Inc. and Amazon.com Inc. Non-U.S.

companies have also been affected.

European regulators have been investigating whether individual

countries' tax breaks for certain companies violate rules against

excessive "state aid." If deemed illegal, European officials could

then press the countries to recover corporate funds related to the

tax breaks.

In the letter to European Commission President Jean-Claude

Juncker, Mr. Lew said those investigations appear to be

"disproportionately" targeting U.S. companies and seeking much more

money in those instances. In some cases, Mr. Lew wrote, the

Europeans are trying to target income they have no right to

tax.

The EU "appears to be adopting an entirely new legal theory and

applying it retroactively in a broad and sweeping manner," Mr. Lew

wrote in his first extensive comments on the EU-U. S. tax dispute.

"This raises serious concerns about fundamental fairness and the

finality of tax rulings throughout the entire European Union."

The EU rejected accusations it was discriminating against U.S.

companies in their tax probes.

"EU law applies indiscriminately to all companies operating in

Europe—there is absolutely no bias against U.S. companies,"

European Commission spokesman Ricardo Cardoso said.

"In its state aid decisions on tax rulings to-date, the

commission has ordered member states to recover unpaid taxes mostly

from European companies," he added.

EU officials have said they didn't think the investigations into

the tax practices would make Europe a less attractive destination

for companies to invest in because the bloc's single market of 500

million consumers remains a major draw.

The EU investigations and potential taxes on U.S.-based

companies represent a risk to the U.S. tax base. The more taxes

U.S. companies pay overseas after investigations, the more U.S.

foreign tax credits they get and the less money the U.S. might get

if and when they repatriate foreign profits. While Mr. Lew is

taking the side of U.S. companies in one respect, he said he is

concerned about U.S. companies' ability to book profits in low-tax

countries and leave them there.

Mr. Lew testified Wednesday at the Senate Finance Committee and

the issue didn't come up. In January, four members of that panel,

including Chairman Orrin Hatch (R., Utah) asked Mr. Lew to consider

applying a little-known section of the tax code that would allow

the U.S. to impose retaliatory double taxes on European citizens

and companies.

Mr. Lew's letter mentions congressional concerns but not the

double tax.

Natalia Drozdiak contributed to this article.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

February 11, 2016 07:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

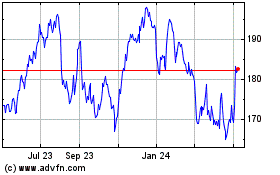

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

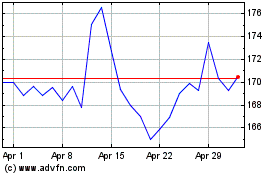

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024