UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Shanda Games

Limited

(Name of Issuer)

Class A Ordinary Shares, par value US$0.01 per share

(Title of Class of Securities)

81941U105**

(CUSIP

Number)

Yang Yanhua

Shanghai Buyout Fund L.P.

2802, 689 Guangdong Road, Huangpu District

Shanghai, the People’s Republic of China

(86) 21 2321 9721

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

June 25, 2015

(Date of Event Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box: ¨

Note. Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

| ** |

This CUSIP applies to the American Depositary Shares, evidenced by American Depositary Receipts, each representing two Class A ordinary shares. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of

the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

13D

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Shanghai Buyout Fund L.P. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

Not applicable. |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

|

(8) |

|

Shared voting power

0 |

|

(9) |

|

Sole dispositive power

0 |

|

(10) |

|

Shared dispositive power

0 |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

0 |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) x |

| (13) |

|

Percent of class represented by amount

in Row (11) 0.0% |

| (14) |

|

Type of reporting person (see

instructions) PN |

|

|

|

|

|

|

|

| (1) |

|

Name of

reporting person Haitong M&A Capital Management (Shanghai) Co.,

Ltd. |

| (2) |

|

Check the appropriate box if a member

of a group (see instructions)

(a) x (b) ¨ |

| (3) |

|

SEC use only

|

| (4) |

|

Source of funds (see instructions)

Not applicable. |

| (5) |

|

Check box if disclosure of legal

proceedings is required pursuant to Item 2(d) or 2(e) ¨ |

| (6) |

|

Citizenship or place of

organization The People’s Republic of

China |

| Number of

shares beneficially

owned by each

reporting person

with |

|

(7) |

|

Sole voting power

0 |

|

(8) |

|

Shared voting power

0 |

|

(9) |

|

Sole dispositive power

0 |

|

(10) |

|

Shared dispositive power

0 |

| (11) |

|

Aggregate amount beneficially owned by each reporting person

0 |

| (12) |

|

Check if the aggregate amount in Row

(11) excludes certain shares (see instructions) x |

| (13) |

|

Percent of class represented by amount

in Row (11) 0.0% |

| (14) |

|

Type of reporting person (see

instructions) CO |

Introduction.

This statement on Schedule 13D/A (this “Statement”) amends the previous Schedule 13D filed by Shanghai Buyout Fund L.P. and Haitong

M&A Capital Management (Shanghai) Co., Ltd. with the Securities and Exchange Commission on September 11, 2014, as amended and supplemented by the Amendment No. 1 filed under Schedule 13D/A on September 25, 2014, the Amendment

No. 2 filed under Schedule 13D/A on March 20, 2015, and the Amendment No. 3 filed under Schedule 13D/A on April 16, 2015 (the “Original 13D”) with respect to Shanda Games Limited (the “Issuer”). Except as

amended and supplemented herein, the information set forth in the Original 13D remains unchanged. Capitalized terms used herein without definition have meanings assigned thereto in the Original 13D.

Item 2. Identity and Background.

Item 2 is

hereby amended and restated as follows:

(a)-(c) This Statement is being filed jointly by and on behalf of (a) Shanghai Buyout

Fund L.P., a limited partnership organized under the laws of the People’s Republic of China (“Haitong LP”), and (b) Haitong M&A Capital Management (Shanghai) Co., Ltd., a company established under the laws of the

People’s Republic of China (“Haitong GP,” together with and Haitong LP, the “Reporting Persons”).

Haitong

LP’s principal business is making equity investments in private and public companies. Haitong LP’s principal business address, which also serves as its principal office, is 2802, 689 Guangdong Road, Huangpu District, Shanghai, the

People’s Republic of China. Haitong LP is a 27% shareholder of Hai Sheng Tong and holds 100% dispositive and voting power over all the outstanding equity interests in Hai Sheng Tong.

Haitong GP’s principal business is acting as the general partner of Haitong LP. Haitong GP’s principal business address, which also

serves as its principal office, is Room A201-1, Tower A, Building 16, No.99 Huanhuxiyi Road, Nanhuixincheng City, Pudong New Area, Shanghai, the People’s Republic of China. Haitong GP is the sole general partner of Haitong LP.

Haitong Capital Investment Co., a company established under the laws of the People’s Republic of China (“Haitong Capital”), is

the controlling shareholder of Haitong GP. Haitong Capital’s principal business is making equity investments in companies and funds and providing management and consultancy services in connection with equity investments. Haitong Capital’s

principal business address, which also serves as its principal office, is Room 07-12, 26F, 689 Guangdong Road, Huangpu District, Shanghai, the People’s Republic of China.

Haitong Securities Co., Ltd., a company established under the laws of the People’s Republic

of China (“Haitong Securities”) is the sole shareholder of Haitong Capital. Haitong Securities is a financial service firm providing securities brokerage, investment consultancy, and investment banking services. Haitong Securities’

principal business address, which also serves as its principal office is 689 Guangdong Road, Huangpu District, Shanghai, the People’s Republic of China. The shares of Haitong Securities are listed on the Shanghai Stock Exchange.

(d) None of the Reporting Persons has been convicted in a criminal proceeding the past five years (excluding traffic violations or similar

misdemeanors).

(e) During the past five years, none of the Reporting Persons was a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws

or finding mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source

or Amount of Funds or Other Consideration.

Item 3 is hereby amended and restated as follows:

Not applicable.

Item 4. Purpose of Transaction.

Item 4 is hereby amended and restated as follows:

On January 27, 2014, Shanda Interactive Entertainment Limited (“Shanda Interactive”) and Primavera Capital (Cayman) Fund I L.P.

(“Primavera”) (together with Shanda Interactive, the “Initial Consortium” and each member in the Initial Consortium, a “Initial Consortium Member”) entered into a consortium agreement (the “Initial Consortium

Agreement”). Under the Initial Consortium Agreement, the Initial Consortium Members agreed, among other things, (i) to jointly deliver a preliminary non-binding proposal to the board of directors of the Issuer (the “Board”) to

acquire the Issuer in a going-private transaction (the “Initial Consortium Transaction”), (ii) to deal exclusively with each other with respect to the Initial Consortium Transaction until the earlier of (x) nine months after the

date thereof, and (y) termination of the Initial Consortium Agreement by all Initial Consortium Members, (iii) to use their reasonable efforts and cooperate in good faith to arrange debt financing to support the Initial Consortium

Transaction, and (iv) to cooperate and proceed in good faith to negotiate and consummate the Initial Consortium Transaction.

On

January 27, 2014, Shanda SDG Investment Limited (“SDG”), a wholly-owned subsidiary of Shanda Interactive, and Primavera entered into a share purchase agreement (the “Primavera Share Purchase Agreement”) pursuant to which SDG

sold, and Primavera purchased, 28,959,276 Class A Ordinary Shares (the “Primavera Purchase Shares”) at US$2.7625 per Class A Ordinary Share. The purchase and sale of the Primavera Purchase Shares was completed on

February 17, 2014.

On April 18, 2014, SDG and Perfect World Co., Ltd. (“Perfect World”) entered into a share purchase

agreement (the “PW Share Purchase Agreement”) pursuant to which SDG sold, and Perfect World purchased, 30,326,005 Class A Ordinary Shares (the “PW Purchase Shares”) at US$3.2975 per Class A Ordinary Shares. The purchase

and sale of the PW Purchase Shares was completed on May 16, 2014.

Concurrently with the execution of the PW Share Purchase

Agreement, Shanda Interactive, Primavera and Perfect World entered into an adherence agreement (the “PW Adherence Agreement”), pursuant to which Perfect World became a party to the Initial Consortium Agreement and joined the Initial

Consortium.

On April 25, 2014, FV Investment Holdings (“FV Investment”), which is an affiliate of FountainVest Partners,

Shanda Interactive, Primavera and Perfect World entered into an adherence agreement (the “FV Adherence Agreement”), pursuant to which FV Investment became a party to the Initial Consortium Agreement and joined the Initial Consortium.

On May 19, 2014, CAP IV Engagement Limited (“Carlyle”), which is an affiliate of Carlyle Asia Partners IV, L.P., Shanda

Interactive, Primavera, Perfect World and FV Investment entered into an adherence agreement (the “Carlyle Adherence Agreement”), pursuant to which Carlyle became a party to the Initial Consortium Agreement and joined the Initial

Consortium.

On August 31, 2014, SDG and Orient Finance Holdings (Hong Kong) Limited, a company incorporated under the laws of Hong

Kong (“Orient HK”) entered into a share purchase agreement (the “Orient Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Orient HK agreed to purchase, 123,552,669 Class A Ordinary Shares (the “Orient

Purchase Shares”) at US$3.45 per Class A Ordinary Share (the “Orient Purchase Price”) subject to the terms and conditions thereof. Pursuant to the Orient Share Purchase Agreement, if (i) a going-private transaction occurs

within one year of the closing date of the sale of the Orient Purchase Shares where Orient HK is part of the buyer consortium and the Going-private Price is higher than the Orient Purchase Price, or (ii) a going-private transaction occurs

within one year of the closing date of the sale of the Orient Purchase Shares where Orient HK is not part of the buyer consortium due to its own decision or election without SDG’s written consent and the Going-private Price is higher than the

Orient Purchase Price, Orient shall pay SDG the shortfall between the Orient Purchase Price and the Going-private Price with respect to all the Orient Purchase Shares. Pursuant to the Orient Share Purchase Agreement, if a going-private transaction

is not consummated within one year of the closing date of the sale of the Orient Purchase Shares solely due to SDG’s failure to vote in favor of such going-private transaction, SDG shall repurchase the Orient Purchase Shares at a per share

price equal to the Orient Purchase Price. The purchase and sale of the Orient Purchase Shares was completed on September 23, 2014.

On September 1, 2014, Perfect World, FV Investment and Carlyle withdrew from the Initial Consortium pursuant to a withdrawal notice (the

“Withdrawal Notice”).

On September 1, 2014, Shanda Interactive, Primavera and Orient HK entered into an adherence

agreement (the “Orient Adherence Agreement”), pursuant to which Orient HK became a party to the Initial Consortium Agreement and joined the Initial Consortium.

On September 1, 2014, SDG and Haitong LP entered into a share purchase agreement (the “Haitong Share Purchase Agreement I”)

pursuant to which SDG agreed to sell, and Haitong agreed to purchase, 48,152,848 Class A Ordinary Shares (the “Haitong Purchase Shares”) at US$3.45 per Class A Ordinary Share subject to the terms and conditions thereof. The

purchase and sale of the Haitong Purchase Shares was completed on September 23, 2014.

Concurrently with the execution of the Haitong

Share Purchase Agreement I, Primavera, Perfect World and Haitong LP entered into a share purchase agreement (the “Haitong Share Purchase Agreement II”), pursuant to which Haitong agreed to purchase 28,959,276 and 30,326,005 Class A

Ordinary Shares (collectively, the “Haitong Secondary Purchase Shares”) from Primavera and Perfect World, respectively. The purchase and sale of the Haitong Secondary Purchase Shares was completed on September 23, 2014. In connection

with the transaction, SDG, Primavera and Perfect World entered into a consent and release dated as of September 1, 2014 (the “Consent and Release”), pursuant to which all remaining obligations of Primavera and its affiliates and SDG

and its affiliates under the Primavera Share Purchase Agreement, and all remaining obligations of Perfect World and its affiliates and SDG and its affiliates under the PW Share Purchase Agreement, as applicable, automatically terminated upon

consummation of the transaction.

On September 1, 2014, Shanda Interactive, Primavera and Haitong LP entered into an adherence

agreement (the “Haitong Adherence Agreement”), pursuant to which Haitong LP became a party to the Initial Consortium Agreement and joined the Initial Consortium.

On September 1, 2014, SDG and Ningxia Zhongyincashmere International Group Co., Ltd, a company formed under the laws of the People’s

Republic of China (“Ningxia”) entered into a share purchase agreement (the “Ningxia Share Purchase Agreement”) pursuant to which SDG agreed to sell, and Ningxia agreed to purchase, 80,577,828 Class A Ordinary Shares (the

“Ningxia Purchase Shares”) at US$3.45 per Class A Ordinary Share subject to the terms and conditions thereof. The purchase and sale of the Ningxia Purchase Shares was completed on September 23, 2014.

On September 1, 2014, Shanda Interactive, Primavera and Ningxia entered into an adherence agreement (the “Ningxia Adherence

Agreement”), pursuant to which Ningxia became a party to the Initial Consortium Agreement and joined the Initial Consortium.

On

September 1, 2014, Primavera withdrew from the Initial Consortium pursuant to a withdrawal notice (the “Primavera Withdrawal Notice”). From and after September 1, 2014, references to the “Initial Consortium” or the

“Initial Consortium Members” should include Shanda Interactive, Ningxia, Orient HK and Haitong, and should not include Perfect World, FV Investment, Carlyle or Primavera.

On October 27, 2014, the exclusivity period under the Initial Consortium Agreement expired. On October 28, 2014, Shanda Interactive

and Ningxia entered into a letter agreement (the “Exclusivity and Release Letter”), pursuant to which (i) Shanda Interactive and Ningxia agreed to continue to work exclusively with each other until November 25, 2014 to undertake

a going private transaction involving the Company; (ii) Ningxia agreed to release Shanda Interactive and its affiliates from any and all liabilities or claims relating to, among other things, the Initial Consortium Agreement, the Initial

Consortium Transaction and any proposal or offer of similar transactions; and (iii) Ningxia agreed to indemnify Shanda Interactive and its affiliates against any and all liabilities or claims relating to, among other things, the Initial

Consortium Agreement, the Initial Consortium Transaction and any proposal or offer of similar transactions, and Shanda Interactive’s negotiation, execution, delivery and performance of the Exclusivity and Release Letter.

On November 24, 2014, Orient HK and Orient Hongtai (Hong Kong) Limited, a company incorporated under the laws of Hong Kong,

(“Hongtai HK”) entered into a share purchase agreement (the “Hongtai Share Purchase Agreement”), and Orient HK and Orient Hongzhi (Hong Kong) Limited, a company incorporated under the laws of Hong Kong (“Hongzhi HK”),

entered into a share purchase agreement (the “Hongzhi Share Purchase Agreement”), pursuant to which Hongtai HK and Hongzhi HK purchased, 61,776,334 Class A Ordinary Shares and 61,776,335 Class A Ordinary Shares, respectively,

from Orient HK.

On November 25, 2014, SDG, Ningxia, Zhongrong Shengda Investment Holdings (Hong Kong)

Company Limited, a company established under the laws of Hong Kong (“Zhongrong Shengda”), and Yili Shengda Investment Holdings (Hong Kong) Company Limited, a company formed under the laws of Hong Kong (“Yili Shengda”) entered

into a share purchase agreement (the “SDG Class B Share Purchase Agreement”), pursuant to which each of Zhongrong Shengda and Yili Shengda agreed to purchase 48,759,187 Class B Ordinary Shares from SDG. The purchase and sale under the SDG

Class B Share Purchase Agreement were completed on the same day (the “Closing”). As a result, all of the Class B Ordinary Shares held by SDG immediately prior to the Closing have been transferred to Zhongrong Shengda and Yili Shengda, and

SDG no longer beneficially owns any ordinary shares of the Issuer.

On December 5, 2014, Ningxia Yilida Capital Investment Limited

Partnership, an affiliate of Yili Shengda (“Ningxia Yilida”) and Ningxia (together with Ningxia Yilida, the “Second Consortium,” and each member of the Second Consortium, a “Second Consortium Member”) entered into a

consortium agreement (the “Second Consortium Agreement”). Under the Second Consortium Agreement, the Second Consortium Members agreed, among other things, (i) to acquire the Issuer in a going private transaction (the “Second

Consortium Transaction”), (ii) to deal exclusively with each other with respect to the Second Consortium Transaction until the earlier of (x) February 6, 2015, and (y) termination of the Second Consortium Agreement, and

(iii) to cooperate and proceed in good faith to negotiate and consummate the Second Consortium Transaction. The Second Consortium Members intended to acquire the Issuer at a price of US$6.90 in cash per ADS (each representing two Class A

Ordinary Shares) or $3.45 in cash per Class A or Class B Ordinary Share. Pursuant to its terms, the Second Consortium Agreement terminated automatically on February 6, 2015 upon the expiration of the exclusivity period.

On March 16, 2015, Ningxia Yilida, Ningxia, Hongtai HK, Hongzhi HK and Hao Ding (together with Ningxia Yilida, Ningxia, Hongtai HK and

Hongzhi HK, the “Third Consortium,” and each member of the Third Consortium, a “Third Consortium Member”), entered into a consortium agreement (the “Third Consortium Agreement”). Under the Third Consortium Agreement,

the Third Consortium Members agreed, among other things, (i) to acquire the Issuer in a going private transaction (the “Third Consortium Transaction”), (ii) to deal exclusively with each other with respect to the Third Consortium

Transaction until the earlier of (x) April 30, 2015, and (y) termination of the Third Consortium Agreement, and (iii) to cooperate and proceed in good faith to negotiate and consummate the Third Consortium Transaction.

On April 3, 2015, the Issuer entered into an agreement and plan of merger (the “Merger Agreement”) with Capitalhold Limited, a

Cayman Islands company (“Parent”) and Capitalcorp Limited, a Cayman Islands company and a wholly-owned subsidiary of Parent (“Merger Sub”). Pursuant to the Merger Agreement, Merger Sub will be merged with and into the Issuer (the

“Merger”), with the Issuer surviving the Merger and becoming a wholly-owned subsidiary of Parent as a result of the Merger. At the effective time of the Merger, each of the Issuer’s Class A Ordinary Shares issued and outstanding

immediately prior to the effective time of the Merger (including Ordinary Shares represented by ADSs) will be cancelled in consideration for the right to receive $3.55 per Ordinary Share or US$7.10 per ADS, in each case, in cash, without interest

and net of any applicable withholding taxes, except for (i) the Ordinary Shares held by each of Yili Shengda, Zhongrong Shengda, Zhongrong, Hongtai HK, Hongzhi HK, and Hao Ding (such shareholders, the “Rollover Shareholders,” and such

Ordinary Shares, the “Rollover Shares”), and any Ordinary Shares held by Parent, the Issuer or any of their subsidiaries immediately prior to the effective time of the Merger, each of which will be cancelled without payment of any

consideration or distribution therefor, and (ii) Ordinary Shares owned by holders who have validly exercised and not effectively withdrawn or lost their rights to dissent from the Merger pursuant to Section 238 of the Companies Law of the

Cayman Islands, which Ordinary Shares will be cancelled at the effective time of the Merger for the right to receive the fair value of such Ordinary Shares determined in accordance with the provisions of Section 238 of the Companies Law of the

Cayman Islands. The Merger is subject to the approval of the Issuer’s shareholders and various other closing conditions.

Concurrently with the execution of the Merger Agreement, the Rollover Shareholders entered into a support agreement (the “Support

Agreement”) with Parent, pursuant to which the Rollover Shareholders agreed, among other things, that (i) each of them will vote the Rollover Shares in favor of the authorization and approval of the Merger Agreement and the transactions

contemplated thereunder, including the Merger, and (ii) the Rollover Shares will be cancelled without payment of any consideration or distribution therefor at the effective time of the Merger.

Concurrently with the execution of the Merger Agreement, each of Ningxia Zhongrong Legend Equity

Investment Partnership Enterprise (Limited Partnership), a partnership established under the laws of the People’s Republic of China (“Zhongrong Legend”), Ningxia Silkroad equity Investment Partnership Enterprise (Limited Partnership)

(“Ningxia Silkroad”), and Zhengjun Equity Investment Partnership Enterprise (Limited Partnership) (“Zhengjun Investment”), a PRC limited partnership and an affiliate of Ningxia Yilida, entered into an adherence agreement

(individually, the “Zhongrong Legend Adherence Agreement,” the “Ningxia Silkroad Adherence Agreement,” and the “Zhengjun Investment Adherence Agreement”) with the existing Third Consortium Members, pursuant to which

each of Zhongrong Legend, Ningxia Silkroad and Zhengjun Investment became a party to the Third Consortium Agreement and joined the Third Consortium.

Concurrently with the execution of the Merger Agreement, each of Zhongrong Legend, Ningxia Silkroad and Zhengjun Investment entered into an

equity commitment letter (individually, the “Zhongrong Legend Equity Commitment Letter,” the “Ningxia Silkroad Commitment Letter,” and the “Zhengjun Investment Commitment Letter”) with Parent, pursuant to which each of

Zhongrong Legend, Ningxia Silkroad and Zhengjun Investment undertook to fund the transactions contemplated under the Merger Agreement through cash contributions in Parent from each of them or their affiliates.

Concurrently with the execution of the Merger Agreement, each of Zhongrong Legend, Ningxia Silkroad and Zhengjun Investment entered into a

limited guarantee (individually, the “Zhongrong Legend Limited Guarantee,” the “Ningxia Silkroad Limited Guarantee,” and the “Zhengjun Investment Limited Guarantee”) in favor of the Issuer with respect to, among other

things, a portion of the payment obligations of Parent and Merger Sub corresponding to the cash contributions committed by each of Zhongrong Legend, Ningxia Silkroad and Zhengjun Investment as set out in their respective equity commitment letters.

On June 25, 2015, in a privately negotiated transaction, Lihai Investment Center (Shanghai) L.P., a limited partnership organized

under the laws of the PRC (“Lihai”), Haitong LP, Xizang Runda Resource Ltd., a PRC company (“Xizang Runda”), Shanghai Hai Sheng Tong Investment Co, Ltd., a company organized under the laws of the P.R.C, (“ Hai Sheng

Tong”) and Hao Ding International Limited, a BVI business company (“Hao Ding”) entered into a share purchase agreement (the “Lihai Share Purchase Agreement”), pursuant to which Lihai agreed to acquire 100% equity interests

of Hai Sheng Tong from Haitong LP and Xizang Runda, which collectively and directly own the 100% equity interests of Hai Sheng Tong, which directly owns the 100% equity interests of Hao Ding. The aggregate purchase price paid by Lihai for the

transaction was RMB 2,964,000,000 (approximately $477,206,312). The transaction closed on June 30, 2015, and the parties have filed appropriate documentation to obtain governmental approval for the share transfer. As a result, Lihai, through

Hai Sheng Tong, beneficially owns 100% of the equity interest of Hao Ding, which directly owns 107,438,129 Class A Ordinary Shares, which is the sole asset of Hao Ding. Hao Ding is the sole asset of Hai Sheng Tong.

Liyou Investment Management (Shanghai) Company Limited, a company organized under the laws of the PRC, and Huatong Holding Group Company

Limited, a company organized under the laws of the PRC, are the ordinary general partners of Lihai and have the joint authority to vote and dispose of the securities owned by Lihai. Orient Securities Capital Company Limited, a company organized

under the laws of the People’s Republic of China serves as the administrative general partner of Lihai and has no such authority to vote or dispose, and, accordingly, it has no beneficial ownership interest in the securities owned by Lihai.

If the Merger is completed, the ADSs would be delisted from the NASDAQ Global Select Market and the Issuer’s obligations to file

periodic report under the Exchange Act would be terminated.

In addition, consummation of the Merger could result in one or more of the

actions specified in clauses (a)-(j) of Item 4 of Schedule 13D, including the acquisition or disposition of securities of the Issuer, a merger or other extraordinary transaction involving the Issuer, a change to the Board (as the board of

the surviving company in the merger) to consist solely of persons to be designated by the Merger, and a change in the Issuer’s memorandum and articles of association to reflect that the Issuer would become a privately held company. No assurance

can be given that the Merger will be consummated.

Descriptions of the Initial Consortium Agreement, the Primavera Share Purchase Agreement, the PW

Share Purchase Agreement, the PW Adherence Agreement, the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient Share Purchase Agreement, the Haitong Share Purchase Agreement I, the Ningxia Share Purchase Agreement, the Orient

Adherence Agreement, the Haitong Adherence Agreement, the Ningxia Adherence Agreement, the Withdrawal Notice, the Primavera Withdrawal Notice, the Haitong Share Purchase Agreement II, the Consent and Release, the Exclusivity and Release Letter, the

SDG Class B Share Purchase Agreement, the Second Consortium Agreement, the Third Consortium Agreement, the Merger Agreement, the Support Agreement, the Zhongrong Legend Adherence Agreement, the Ningxia Silkroad Adherence Agreement, the Zhengjun

Investment Adherence Agreement, the Zhongrong Legend Equity Commitment Letter, the Ningxia Silkroad Equity Commitment Letter, the Zhengjun Investment Equity Commitment Letter, the Zhongrong Legend Limited Guarantee, the Ningxia Silkroad Limited

Guarantee ,the Zhengjun Investment Limited Guarantee, and Lihai Share Purchase Agreement in this Statement are qualified in their entirety by reference to such above-mentioned agreements, copies of which are filed as Exhibits 7.03, 7.04, 7.05,

7.06, 7.07, 7.08, 7.09, 7.10, 7.11, 7.12, 7.13, 7.14, 7.15, 7.16,7.17, 7.18, 7.19, 7.20, 7.21, 7.22, 7.23, 7.24, 7.25, 7.26, 7.27, 7.28, 7.29, 7.30, 7.31, 7.32, 7.33, and 7.34 hereto and incorporated herein by reference in their entirety.

Item 5. Interest in Securities of the Issuer.

Item 5(a) – (b) is hereby amended and restated as follows:

Item 5 is hereby amended and restated as follows:

(a) – (b) As a result of the transactions disclosed herein, the Reporting Persons no longer own any securities of the Company or

have sole or shared power to vote, direct the vote, dispose or direct the disposition with respect to any securities of the Company, and therefore their obligation to file further amendments to this Statement has terminated.

(c) Except as set forth in Item 3 above, the Reporting Persons have not effected any transaction in the Class A Ordinary Shares of the Company

during the past 60 days.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 is hereby amended and restated as follows:

Descriptions of the Initial Consortium Agreement, the Primavera Share Purchase Agreement, the PW Share Purchase Agreement, the PW Adherence

Agreement, the FV Adherence Agreement, the Carlyle Adherence Agreement, the Orient Share Purchase Agreement, the Haitong Share Purchase Agreement I, the Ningxia Share Purchase Agreement, the Orient Adherence Agreement, the Haitong Adherence

Agreement, the Ningxia Adherence Agreement, the Withdrawal Notice, the Primavera Withdrawal Notice, the Haitong Share Purchase Agreement II, the Consent and Release, the Exclusivity and Release Letter, the SDG Class B Share Purchase Agreement, the

Hongtai Share Purchase Agreement, the Hongzhi Share Purchase Agreement, the Second Consortium Agreement, the Third Consortium Agreement, the Merger Agreement, the Support Agreement, the Zhongrong Legend Adherence Agreement, the Ningxia Silkroad

Adherence Agreement, the Zhengjun Investment Adherence Agreement, the Zhongrong Legend Equity Commitment Letter, the Ningxia Silkroad Equity Commitment Letter, the Zhengjun Investment Equity Commitment Letter, the Zhongrong Legend Limited Guarantee,

the Ningxia Silkroad Limited Guarantee, the Zhengjun Investment Limited Guarantee, and the Lihai Share Purchase Agreement in this Statement under Item 4 are incorporated herein by reference in their entirety.

Item 7. Material to Be Filed as Exhibits.

Item 7 is hereby amended and supplemented by adding Exhibit 7.34 to the end thereof:

|

|

|

| Exhibit 7.34 |

|

Lihai Share Purchase Agreement dated June 25, 2015 |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true,

complete and correct.

Dated: July 1, 2015

|

|

|

|

|

| Shanghai Buyout Fund L.P. |

| By Haitong M&A Capital Management (Shanghai) Co., Ltd., its general partner |

|

|

| By: |

|

/s/ Yang Yanhua |

|

|

Name: |

|

Yang Yanhua |

|

|

Title: |

|

Chairwoman of the Board |

|

| Haitong M&A Capital Management

(Shanghai) Co., Ltd. |

|

|

| By: |

|

/s/ Yang Yanhua |

|

|

Name: |

|

Yang Yanhua |

|

|

Title: |

|

Chairwoman of the Board |

Exhibit 7.34

SHARE PURCHASE AGREEMENT

THIS SHARE PURCHASE AGREEMENT (this “Agreement”), is entered into by and among the parties listed below on

June 25, 2015, in Shanghai, the People’s Republic of China (“China”).

| (1) |

Lihai Investment Center (Shanghai) L.P. (the “Purchaser”), a limited partnership registered and established in Shanghai, China, with its registered address at 55 Xili Road, Room

1545A, 15th Floor, Shanghai Free-Trade Zone, Shanghai, China; |

| (2) |

Shanghai Buyout Fund L.P. (“Shanghai Buyout Fund”), a partnership registered and established in Shanghai, China, with its registered address at 99 Huanhu Xiyi Road, Building 16, No. A, Room A201-1,

Nanhui Xincheng Town, Pudong New District, Shanghai, China; |

| (3) |

Xizang Runda Energy Company limited (“Xizang Runda”, together with Shanghai Buyout Fund, the “Seller”), a company registered and established in Xizang, China, with its registered

address at Headquarters Economy Building, 189 Jinzhu Xi Road, Development Area, Lhasa, Xizang, China; |

| (4) |

Shanghai Hai Sheng Tong Investment Co., Ltd., a company registered and established in Shanghai, China with its registered capital as One Billion Five Hundred Million (1,500,000,000) RMB (the

“Target Company”), with its registered address at 26 Jiafeng Road, Room 652, 6th Floor, Shanghai Free-Trade Zone, Shanghai, China. |

| (5) |

Haoding International Co., Ltd., a company registered and established in British Virgin Islands (“Haoding”). |

The above parties are sometimes refer to individually as a “Party” and are collectively referred to herein as the “Parties.”

Whereas:

| (i) |

The Seller holds all of the issued and outstanding capital stock of the Target Company, and the Target Company holds all of the issued and outstanding capital stock of Haoding. |

| (ii) |

Shanda Games Limited is a company registered and established in Cayman Islands (“Shanda Games”), and Haoding holds 107,438,129 Class A common shares of Shanda Games, which constitutes 20%

of Shanda Games’ issued and outstanding capital stock. |

| (iii) |

The Purchaser intends to acquire all of the issued and outstanding capital stock of the Target Company from the Seller (the “Target Shares”) for the purpose of

(the “Transaction Purpose”) indirectly acquiring 107,438,129 Class A common shares of Shanda Games (the “Shanda Games Shares”). |

| (iv) |

The Seller intends to transfer all of the equity interest it holds in the Target Company and the Shanda Games Shares it indirectly holds subject to the terms and conditions set forth in this Agreement.

|

Therefore, the Parties to this Agreement agree as follows:

The Seller hereby agrees to transfer to the Purchaser the Target Shares

it holds according to the terms and conditions set forth in this Agreement, and the Purchaser hereby agrees to purchase the Target Shares from the Seller subject to the terms and conditions set forth in this Agreement in order to acquire the Shanda

Games Shares.

| 2.1 |

The consideration for purchasing the Target Shares under this Agreement shall be Two Billion Nine Hundred Sixty Four Million (2,964,000,000) RMB (the “Total Consideration”), and

the Purchaser shall pay the Total Consideration to Seller pursuant to this Agreement. |

| 2.2 |

Payment of the Total Consideration |

| |

(a) |

The Purchaser shall make full payment of the Total Consideration within thirty (30) days after the execution of this Agreement. |

| |

(b) |

The amount that the Purchaser shall pay as prescribed in Article 2.2 of this Agreement shall constitute the entire consideration for the Purchaser and its designated party to purchase the Target Shares. The

Purchaser shall have no other obligation to make any additional payment, cost, expense, or any other consideration to the Seller, the Target Company, Haoding, and the Seller’s other affiliated parties or any other third parties arising from the

transactions contemplated by this Agreement. |

| 3. |

Seller’s Representations and Arrangements during the Transition Period |

| 3.1 |

From the execution date of this Agreement to the date when the Purchaser directly holds 100% equity interest in the Target Company and indirectly holds the Shanda

Games Shares (the “Closing Date”, and such period, the “Transition Period”), the Seller, the Target Company and Haoding shall jointly ensure and warrant that: |

| |

(a) |

Without consent of the Purchaser, neither the Seller, the Target Company nor Haoding shall, in any manner, directly or indirectly transfer Shanda Games Shares to any third party who is not the Purchaser. Haoding

shall own the Shanda Games Shares free and clear of any share holding entrustment, pledge or other security interests or encumbrances. Haoding, when holding the Shanda Games Shares, shall comply with all applicable laws, by-laws, contracts,

agreements or covenants which are binding upon Haoding and its shareholders. Except for holding the Shanda Games Shares, Haoding shall not conduct any other business. Except for the loan agreement dated October 30, 2014 according to which

China Merchants Bank Co. (“CMB”), Ltd. made a loan to Haoding in the amount of Two Hundred and Thirty Two Million Five Hundred Thousand U.S. dollars ($232,500,000) (secured by the cash in the same amount deposited by the Target Company

with CMB), Haoding shall not incur any indebtedness or make any investment. |

| |

(b) |

The Target Company shall own all of the issued and outstanding capital stock of Haoding free and clear of any share holding entrustment, pledge, security interests or other encumbrances; the Target Company, when holding

the Shanda Games Shares, shall comply with all applicable laws, by-laws, contracts, agreements or covenants which are binding upon the Target Company and its shareholders. Except for holding the shares of Haoding, the Target Company shall not

conduct any other business, and shall not create any creditor’s right or indebtedness or make any investment. |

| 3.2 |

During the Transition Period, the Seller, the Target Company, Haoding and any of their affiliates, officers, directors, representatives or agents shall not engage in any material contact with any party other than the

Purchaser in connection with any similar transactions as prescribed in this Agreement, or make or continue any negotiation, understanding, arrangement or agreement with any other parties in connection therewith. |

| 3.3 |

During the Transition Period the Seller shall immediately inform the Purchaser in writing in the event that the Seller discovers any information related to the Target Company, Haoding, or the Target Shares or Shanda

Games Shares is inconsistent with the Seller’s representations, warranties and convents in this Agreement, or any information that may adversely affect the Transaction Purpose in this Agreement, |

| 4. |

Seller’s Presentations and Obligations |

| 4.1 |

Within ten business days after the Purchaser pays the Total Consideration pursuant to Article 2.2 herein, the Seller, the Target Company and Haoding shall: (1) update the registration at the local registration

authority to reflect the Purchase as 100% shareholder of the Target Company; (2) complete all registration changes reflecting resignation of the board members of the Target Company designated by the Purchaser and the change of the Board of

Directors of Haoding; (3) provide the Purchaser with certified list of director, certified list of shareholder, the then current certificate of good standing and the then current certificate of incumbency of the Target Company; (4) provide

the Purchaser with certified list of director, the then current certificate of good standing and the then current certificate of incumbency of Haoding. If the above procedures can not be completed within the ten business days period due to reasons

not attributable to the Seller, such ten business days shall be extended accordingly. |

| 4.2 |

In order not to affect the consummation of the share transfer provided for herein, the Seller shall cooperate with the Purchaser in making any public disclosure with respect to the transaction in accordance with

applicable laws, provided that the Purchaser shall deliver all necessary materials and executes all necessary documents. |

| 5. |

Representations, Warranties and Covenants |

| 5.1 |

The Seller, the Target Company and Haoding acknowledge that the Purchaser’s execution of the Agreement relies on the warranties and representations made by the Seller, the Target Company and Haoding. The Seller,

the Target Company and Haoding hereby represent, warrant and covenant, jointly and severally, to the Purchaser as follow: |

| |

(a) |

All warranties written in Annex One shall be true, correct and complete as of the execution date of this Agreement and the Closing Date and not contain any untrue statement of a material fact or omit to state a material

fact required to be stated therein or necessary in order to make the statements made therein not misleading. |

| |

(b) |

Except Shengda Games Shares, the Seller, the Target Company and Haoding represent and warrant that the Target Company and Haoding have no interest in any other companies, enterprises, groups or investments. Except the

loan agreement dated October 30, 2014 according to which CMB made a loan to Haoding in the amount of Two Hundred and Thirty Two Million Five Hundred Thousand U.S. dollars ($232,500,000) (secured by the cash in the same amount deposited by the

Target Company with CMB), the Target Company and Haoding do not have any indebtedness or encumbrances. On the Closing Date, the Target Company and Haoding do not have any indebtedness or encumbrances. |

| |

(c) |

Neither any failure nor any delay by the Purchaser in exercising any right under this Agreement with respect to any untrue, misleading, or breached representations or warranties known to the Purchaser will operate as a

waiver of such right, power or privilege. The closing of the transaction shall not constitute any waiver in any manner in connection with the Purchaser’s rights. |

| |

(d) |

Unless provided for herein to the contrary, each warranty is separate and independent, and is not restricted by any other warranties or any other terms herein, nor is it restricted by the inference therefrom.

|

| |

(e) |

The Seller, the Target Company and Haoding hereby acknowledge and agree that none of them shall be released from its respective obligations herein due to any false, inaccurate or omitted representation or advice in

connection with any representations or warranties provided or given by the company, its officers, its employees or its consultants. |

| |

(f) |

Each of the Seller, the Target Company and Haoding represents and warrant that it shall not breach (or allow or cause to breach) any warranties (if made at the Closing Date) prior to the Closing Date, or conduct any

actions or omissions that make any warranties inaccurate or misleading (if made in that manner). |

| |

(g) |

Notwithstanding the other provisions of the Agreement, each of the Seller, the Target Company and Haoding shall pay its income tax in connection with the transaction and in compliance with relevant laws.

|

| 5.2 |

Representations, Warranties and Covenants of the Purchaser |

| |

(a) |

Under the applicable laws, the Purchaser has all necessary corporate power and authority to execute and deliver this Agreement and perform its obligations hereunder. |

| |

(b) |

The execution this Agreement by the representative of the Company has been duly and validly authorized by all necessary corporate action |

| |

(c) |

The execution and performance of this Agreement by the Purchaser will not violate any applicable laws or any decisions, orders, contracts, agreements or other commitments binding upon the Purchaser. |

| |

(d) |

The Purchaser shall use its best effort to assist in obtaining and/or making any necessary approval and/or registration procedures in connection with this Agreement, including providing necessary documents and

materials. |

| 6.1 |

Upon the execution of this Agreement, without limiting the rights of the Purchaser or otherwise affect the Purchaser’s ability to claim for damages based on other grounds, if any warranties is violated (depending

on circumstances) or proved to be untrue or misleading, the Seller, the Target Company and Haoding shall jointly and severally pay to the Purchaser: |

| |

(a) |

Necessary payment of monies, to put the Purchaser in the situation as if the warranties had not been violated or (depending on circumstances) the warranties were true and not misleading, and |

| |

(b) |

Any and all costs and expenses in connection with or arising out of the above-mentioned violation, and any and all potential costs (including disbursement of legal fee and its own clients’ legal fee, financial

adviser fee and fees for other professionals), expenses or other responsibilities incurred before or after any of the following actions due to any violations: (i) any legal proceedings brought by the Purchaser claiming that any warranties have

been violated or is untrue or misleading, and the Purchaser prevails; or (ii) enforcement of any settlement or decision in connection with such claim. |

| 6.2 |

Subject to the terms of this Agreement, the Seller, the Target Company and Haoding shall jointly and severally indemnify the Purchaser and hold the Purchaser harmless against any loss, indebtedness or cost (including,

but not limited to reasonable legal expenses) it may directly or indirectly suffer due to, as a result of, incurred by or based on the Seller/Haoding/Target Company’s incompliance with any warranties made herein. |

| 6.3 |

The Seller, the Target Company and Haoding hereby severally and jointly, unconditionally, irrevocably, duly and effectively represent and warrant to the Purchaser that, when requested by the Purchaser, the Seller, the

Target Company and Haoding will indemnify the Purchaser (depending on circumstances) against any and all damages, loss and liabilities (including, but not limiting to losses resulting from adverse effect on operations) arising out of the following

situations, and at all times ensure the Purchaser receives such indemnification: |

| |

(a) |

Any and all administrative fine or penalty imposed by any competent authority or judicial department upon the Target Company or Haoding subsequent to the Closing Date which result from any material contracts executed by

the Target Company or Haoding prior to the Closing Date that are void or voidable under applicable laws, including, but not limited to damages based on loss of business resulting from such fines, penalties and denial of market access.

|

| |

(b) |

Any obligations and liabilities resulting from any defects or deficiency of any necessary corporate certificate or intellectual property certificate of the Target Company and Haoding as of the Closing date necessary for

the business operation of the Target Company under applicable laws, rules and regulations. |

| |

(c) |

Decrease in the asset value resulting from any loss of tax or tax related indebtedness of the Target Company and Haoding, or any damages or charges against any member of the Purchaser’s group of companies resulting

from any tax liabilities due to any revenue, profit, or income of the Target Company and Haoding on or before the Closing Date, or the action, omission, or any transaction of the Seller, the Target Company or Haoding on or before the Closing Date.

|

| |

(d) |

Any damages, loss or liabilities resulting from litigations, arbitrations or other administrative procedures involving the Target Company or Haoding with a third party due to any events prior to the Closing Date (except

for any proceedings brought by the Purchaser or any counterclaims brought by the defendant in such case). |

| 7.1 |

In the event the Seller does not or refuses to perform its obligations under Article 4.1 of this Agreement, or delay to perform its obligations under such articles for more than ten (10) business day after such

obligation are due, or there is other fundamental breach on the part of the Seller that frustrates the purpose of this Agreement, the Seller shall be deemed to have committed a fundamental breach of, and the Purchaser shall be entitled to terminate

this Agreement. |

| 8.1 |

If, at any time, the Purchaser discovers any facts, incidents, or events (regardless of whether it exists or occurs at or before the execution of this Agreement, or arises or occurs thereafter) that constitutes any of

the followings, the Purchaser may send a written notice to the Seller, to re-negotiate any terms of this Agreement (including the consideration), or terminate this Agreement: |

| |

(a) |

any material breach of the terms of this Agreement by the Seller, the Target Company or Haoding; |

| |

(b) |

any material breach of any warranties herein based upon the then existing facts and circumstances ; or |

| |

(c) |

Owning the equity interest of Haoding by the Purchaser or owning the equity interest of the Shanda Games Shares have caused or may cause material adverse affect on the Purchaser. |

| 8.2 |

If, at any time, the Seller discovers any facts, incidents, or events (regardless of whether it exists or occurs at or before the execution of this Agreement, or arises or occurs thereafter) that constitutes any of the

followings, the Seller may send a written notice to the Purchaser, to re-negotiate any terms of this Agreement (including the consideration), or terminate this Agreement: |

| |

(a) |

any material breach of the terms of this Agreement by the Purchaser; |

| |

(b) |

any material breach of any warranties herein by the Purchaser, based upon the then existing facts and circumstances. |

| 8.3 |

If this Agreement is terminated according to this Article, there shall be no liability or obligation on the part of any Party; provided that (a) any such termination shall not relieve any party from liability for

obligations which exist prior to this Agreement or shall survive the termination of this Agreement pursuant to the terms of this Agreement. |

| 9. |

Governing Laws and Dispute Resolution |

This agreement shall be governed by, and construed in accordance with, the

internal laws of the State of New York.

Disputes referred to in this Article means any dispute as to the validity,

interpretation, enforceability, or breach of this Agreement and any disputes as to the change, recession, or termination of this Agreement. In the event of any dispute arising out of or in any way connected with this Agreement, the Parties shall

endeavor to resolve the matter through friendly negotiation. In case no settlement is reached, the dispute shall be submitted to Shanghai International Economic and Trade Arbitration Commission for arbitration in accordance with its rules in effect

at the time of applying for arbitration. The place of arbitration shall be Shanghai, China. The decision of the commission shall be final and binding upon all parties.

All notices, consents, requests, instructions, and other communications hereunder will

be in writing and shall be deemed duly sent, made and given: (a) upon receipt if delivered personally; (b) 48 hours following the date mailed when mailed by registered or certified mail, postage prepaid (72 hours following the date mailed

when mailed to a foreign address by registered air mail); (c) when sent by reputable courier and (d) when sent by fax, at the following addresses:

If to the Seller, the Target Company and Haoding:

|

|

|

| Address: |

|

689 Guangdong Road, Room 2802, Huangpu District, Shanghai, China |

| Attention: |

|

Pu Hu |

If to the Purchaser:

|

|

|

| Address: |

|

Beiyi Road, Economic Development Disctrict, Shangyu, Zhejiang |

| Attention: |

|

Zhengshan Yan |

| Fax: |

|

86-575-82208079 |

The Seller, the Target Company and Haoding shall be jointly liable for any and

all obligations of this Agreement.

Except specifically provided for in this Agreement, each Party shall pay its own

tax, fees of attorneys, accountants, financial advisors, appraisers, technical experts and other similar fees. Fees not expressly provided for by applicable laws shall be borne equally by the Seller and the Purchaser.

| 10.4 |

Publicity and Confidentiality |

The Parties to this Agreement agree that the existence and

content of this Agreement and any trade secret, proprietary information or customer information of the Parties disclosed during the negotiation, execution or performance of the Agreement and any other relevant information or non-public information

of any parties (“Confidential Information”) shall be kept in strict confidence. Any notices sent to a third party or other expected publicity and promotion in connection with this Agreement, shall be jointly planned and coordinated

by the Seller, the Target Company, Haoding and the Purchaser (except in the event a Party hereto is required to make disclosure to any regulatory body, securities exchange, other government body or professional advisor). Without the prior written

consent of the other Party, neither Party shall disclose any Confidential Information. The Parties agree to cooperate with the other Parties in compliance with all applicable laws.

Not exercising or delay in exercising any powers, rights or privileges hereunder by

any Party does not constitute a waiver thereof. Exercising one of or partially exercising any of such powers, rights or privileges does not exclude exercise of or further exercise of those powers, rights or privileges or of any other powers, rights

or privileges.

If any term of this Agreement is found to be invalid or unenforceable, unless

such invalidity or unenforceability violates the intent or other terms of this Agreement, it cannot affect the validity and enforceability of any other terms of this Agreement; provided that, the term found invalid or unenforceable does not

constitute an undividable part of this Agreement, or that it cannot be definitely separated. Such invalidity or unenforceability shall not affect the validity and enforceability of any other terms of this Agreement, and each of these terms shall be

regarded as valid, enforceable, concluded or adopted in the manners and to the extent permitted by law.

This Agreement is written in Chinese and may be executed by the Parties in

counterparts, each of which shall be deemed to be an original and binding upon all Parties.

[the remainder of this page is left blank

intentionally]

IN WITNESS WHEREOF, each of the Parties hereto has executed this Agreement as of the date first above set forth.

|

| SELLER: |

| Shanghai Buyout Fund L.P. |

| (SEAL) |

|

| /s/ Yanhua Yang |

| AUTHORIZED REPRESENTATIVE: YANHUA YANG |

|

| Xizang Runda Energy Company limited |

| (SEAL) |

|

| /s/ Xiaoxiang Wang |

| AUTHORIZED REPRESENTATIVE: XIAOXIANG WANG |

|

| TARGET COMPANY: |

| Shanghai Hai Sheng Tong Investment Co., Ltd. |

| (SEAL) |

|

| /s/ Jing Liu |

| AUTHORIZED REPRESENTATIVE: JING LIU |

|

| Haoding: |

| HAODING International Co., Ltd. |

| (SEAL) |

|

| /s/ Jing Liu |

| AUTHORIZED REPRESENTATIVE: JING LIU |

|

| PURCHASER: |

| Lihai Investment Center (Shanghai) L.P. |

| (SEAL) |

|

| /s/ Bo Chen |

| AUTHORIZED REPRESENTATIVE: BO CHEN |

Annex 1

Warranties

The Seller, the Target

Company and Haoding hereby, jointly and severally, warrant, represent and covenant to the Purchaser, and these representations, warranties and covenants take effect on and continue onwards from the date of execution of this Stock Purchase Agreement.

| |

(1) |

Target Shares constitute 100% of all of the issued and outstanding equity interest of the Target Company. The Target Shares have been fully paid and such payment is in compliance with the relevant provisions of laws and

regulations of the People’s Republic of China. |

| |

(2) |

The Seller beneficially owns the Target Shares and has the right to dispose of the Target Shares, including selling and transferring the full legal right and beneficial ownership of the Target Shares to the Purchaser.

|

| |

(3) |

The Target Shares are free and clear of any and all preemptive right, right of first refusal, mortgages, charge, pledges, liens or other kinds of mortgage, pledge or property encumbrances, are not affected by such

encumbrances, and no agreement or covenant providing or creating such encumbrances has been made. |

| |

(1) |

The Target Company owns 100% shares of all of the issued and outstanding shares of Haoding, and the Target Company’s capital contribution has been fully paid. |

| |

(2) |

The Target Company beneficially owns shares of Haoding, and has the right to dispose of the Target Shares, including selling and transferring the full legal right and beneficial ownership of the Target Shares to the

Purchaser. |

| |

(3) |

Shares of Haoding are free and clear of any and all preemptive right, right of first refusal, mortgage, charge, pledge, lien or other kinds of mortgage, pledge or property encumbrances, are not affected by such

encumbrances, and no agreement or covenant providing or creating such encumbrances has been made. |

| |

(1) |

The Shanda Games Shares owned by Haoding represent 20% of all of the issued and outstanding capital stock of Shanda Games, and Haoding’s capital contribution has been fully paid. |

| |

(2) |

Haoding beneficially owns the Shanda Games Shares, and has the right to dispose of the Shanda Games Shares, including selling and transferring the full legal right and beneficial ownership of the Shanda Games Shares to

the Purchaser. |

| |

(3) |

Shanda Games Shares owned by Haoding are free and clear of any and all preemptive right, right of first refusal, mortgage, charge, pledge, lien or other kinds of mortgage, pledge or property encumbrance, are not

affected by such encumbrances, and no agreement or covenant providing or creating these encumbrances has been made. |

| |

(1) |

The Seller is a limited partnership duly organized and validly existing under the laws of the People’s Republic of China, and has the full capacity to execute on its own behalf and perform this Agreement according

to the applicable laws. |

| |

(2) |

All obligations of the Seller in this Agreement are legal, valid and binding. |

| |

(3) |

Neither execution nor performance of this Agreement by the Seller will conflict with or result in a breach or violation of any term or provision of any relevant law, requirement, agreement, or regulation, or any

contracts or obligations binding upon the Seller or any of its assets. |

| |

(1) |

The Target Company is a limited company duly organized and validly existing under the laws of the place of registration, and has the full capacity to execute on its own behalf and perform this Agreement according to the

applicable laws. |

| |

(2) |

All obligations of the Target Company in this Agreement are legal, valid and binding. |

| |

(3) |

Neither execution nor performance of this Agreement by the Target Company will conflict with or result in a breach or violation of any term or provision of any law, requirement, agreement, regulation, or any contracts

or obligations binding upon the Target Company or any of its assets. |

| |

(1) |

Haoding is a limited company duly organized and validly existing under the laws of the place of registration, and has the full capacity to execute on its own behalf and perform this Agreement according to the applicable

laws. |

| |

(2) |

All obligations of Haoding in this Agreement are legal, valid and binding. |

| |

(3) |

Neither execution nor performance of this Agreement by Haoding will conflict with or result in a breach or violation of any term or provision of any law, requirement, agreement, regulation, or any contracts or

obligations binding upon Haoding or any of its assets. |

| 7. |

Accurate and adequate document |

| |

(1) |

The Seller, the Target Company and Haoding have submitted all documents and information that are relevant to this transaction, and those about the Target Shares, the shares of Haoding and the Shanda Games Shares that

may affect the Purchaser’s judgment. |

| |

(2) |

Any information in this Agreement (including representations) and all documents, data and information provided by the Seller, the Target Company and Haoding to the Purchaser are true, accurate and not misleading in all

respects at any time. |

| 8. |

Compliance with Statutory Requirements |

Since its formation, both the Target Company or

Haoding have complied with all the applicable laws, rules and regulations without any violation.

Except for the loan agreement dated October 30, 2014 according to

which CMB made a loan to Haoding in the amount of Two Hundred and Thirty Two Million Five Hundred Thousand U.S. dollars ($232,500,000) (secured by the cash in the same amount deposited by the Target Company with CMB), there is no debt or liability

(including existing debts and contingent debts created by warranty, pledge or other forms of guaranty by the Target Company or Haoding) between the Target Company and Haoding or any payment, tax, fee, expense or cost which shall be paid to a third

party.

| 10. |

All representations and warranties stated above in this attachment shall be deemed as representations and warranties based on the then existing facts made on the date immediately following the Closing Date.

|

[the remainder of this page is left blank intentionally]

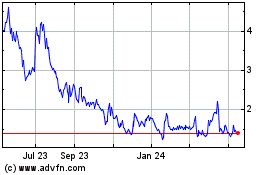

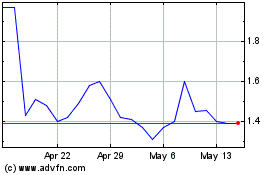

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Aug 2024 to Sep 2024

GameSquare (NASDAQ:GAME)

Historical Stock Chart

From Sep 2023 to Sep 2024