Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

December 2014

Vale S.A.

Avenida Graça Aranha, No. 26

20030-900 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F x Form 40-Fo

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes o No x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes o No x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes o No x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

FREE TRANSLATION FROM THE PORTUGUESE

MINUTES OF THE EXTRAORDINARY GENERAL SHAREHOLDERS’

MEETING OF VALE S.A., HELD ON DECEMBER 23RD, 2014.

LISTED COMPANY

CORPORATE TAX CODE (CNPJ) # 33,592,510/0001-54

BOARD OF TRADE REGISTRATION (NIRE) # 33,300,019,766

01 - DATE, TIME AND VENUE:

At Vale’s office, located at Avenida das Américas 700, 2nd floor, room 218 (auditorium), Città America, Barra da Tijuca, in the City of Rio de Janeiro, State of Rio de Janeiro, on December 23rd, 2014, at 11:00 a.m.

02 - PANEL:

Chairman: Mr. Eduardo de Oliveira Rodrigues Filho

Secretary: Ms. Mariangela Daniele Maruishi Bartz

03 - ATTENDANCE AND QUORUM:

Attended by the shareholders representing 55,2% of the voting capital, as recorded in the Shareholders Attendance Ledger, thereby confirming the required quorum for the Extraordinary General Shareholders’ Meeting to be properly constituted in order to deliberate on the matters listed in the Agenda.

Also present are Mr. Luciano Siani Pires, Vale Executive Officer responsible for Finance and Investor Relations Areas; Mr. Carlos Correa, the representative of KPMG Auditores Independentes, a specialized company which prepared a valuation reports of both Sociedade de Mineração Constelação de Apolo S.A (“Apolo”) and Vale Mina do Azul S.A. (“VMA”), pursuant to §1º of Article 8 of Law #6,404/76 (“Brazilian Corporate Law”); and Mr. Aníbal Moreira dos Santos and Mr. Arnaldo José Vollet, effective members of the Fiscal Council, pursuant to Article 164 of the Brazilian Corporate Law.

3

Table of Contents

Continuation of the Minutes of the Extraordinary General Shareholders’ Meeting

held on December 23rd, 2014.

04 - SUMMONS:

Notices duly published in the Valor Econômico and Jornal do Commercio on November 18, 19 and 20, 2014, and in the Rio de Janeiro Official State Gazette on November 18, 19 and 24, 2014, with the following agenda:

4.1. The Approval for the Protocols and Justifications of the Consolidations of Sociedade de Mineração Constelação de Apolo S.A (“Apolo”) and of Vale Mina do Azul S.A. (“VMA”), into Vale, both wholly owned subsidiaries of Vale, pursuant to articles 224 and 225 of the Brazilian Corporate Law;

4.2. To ratify the appointment of KPMG Auditores Independentes, the experts hired to appraise the values of both Apolo and VMA;

4.3. To decide on the Appraisal Reports, prepared by the expert appraisers;

4.4. The Approval for the consolidation of both Apolo and VMA into Vale, without a capital increase or the issuance of new Vale shares; and

4.5. To ratify the appointment of members of the Board of Directors, duly nominated during the Board of Directors meetings held on April 14, 2014 and on May 29, 2014, in accordance with §10 of article 11 of Vale’s By-Laws.

05 - READING OF DOCUMENTS:

The reading of the following documents was unanimously waived as the content of the same was already known to all the shareholders: (i) the Convening Notice; (ii) the Protocols and Justifications of the Consolidations of Apolo and of VMA into Vale; (iii) the Appraisal Reports prepared by KPMG Auditores Independentes; (iv) the Fiscal Council’s Reports; (v) the Annex 21 to CVM Instruction No. 481/09 and the KPMG Auditores Independentes Services Agreement dated as of 10.02.2014; (vi) the Manual for participation in the Extraordinary General Meeting, with information regarding the nominated members of the Board of Directors, in accordance with items 12.6 to 12.10 of CVM Instruction No. 480/09.

Therefore, after discussion and comments by the shareholders on the above-mentioned documents, the following resolutions were made:

06 - RESOLUTIONS:

The following resolutions were approved by all voting shareholders, not counting, however, the dissensions.

6.1. by the shareholders, unanimously, the present written minutes were approved in a summarized form as well as the respective publication of the same, omitting the signatures of the present shareholders, pursuant to article 130, §§1º and 2º, of the Brazilian Corporate Law;

4

Table of Contents

6.2. by the majority of the shareholders, the Protocols and Justifications of the Consolidations of Apolo and of VMA into Vale, both wholly owned subsidiaries of Vale;

6.3. by the majority of the shareholders, the ratification of the appointment of KPMG Auditores Independentes, the experts hired, pursuant to article 8º of the Brazilian Corporate Law, which performed the valuation of the assets of both Apolo and VMA. Upon prior consultation, KPMG Auditores Independentes accepted the engagement and is able to deliver the Appraisal Reports relating to the shareholders’ equities of Apolo and VMA to be transferred to Vale’s assets;

6.4. by the majority of the shareholders, the Appraisal Reports of both Apolo and VMA prepared by KPMG Auditores Independentes;

6.5. by the majority of the shareholders, the consolidation into Vale of its wholly owned subsidiaries Apolo and VMA, without a capital increase or the issuance of new Vale shares, at their respective net book values as per the balance sheets at September 30, 2014, with the transfer of their assets to Vale. With the consolidation of Apolo and VMA into Vale, the latter unconditionally assumes all properties, rights and obligations of Apolo and VMA, of a legal or conventional order, under the terms of current legislation;

6.6. by the majority of the shareholders, the ratification of the nomination approved by the Board of Directors members, of Messrs. (i) HIROYUKI KATO, Japanese, married, economist, bearer of passport No. TH6135863, resident and domiciled at 1-19-18-1209, Shibuya, Shibuya-ku, Tokyo, Japan, as member of the Board of Directors; (ii) SÉRGIO ALEXANDRE FIGUEIREDO CLEMENTE, Brazilian, married, bank clerk, bearer of identity card No. SSP/SP 55.799.633-8, enrolled with the Individual Taxpayers Register (CPF/MF) under No. 373.766.326/20, resident and domiciled in the City of São Paulo, State of São Paulo, with commercial address at Cidade de Deus s/nº, Prédio Vermelho, 4th floor, in the City of Osasco, State of São Paulo, as member of the Board of Directors; (iii) PAULO ROGÉRIO CAFFARELLI, Brazilian, married, federal public servant, bearer of identity card No. SSP-PR 3.381.390-2, enrolled with the Individual Taxpayers Register (CPF/MF) under No. 442.887.279-87, resident and domiciled in Brasília, Federal District, with commercial address at Treasury Department, Esplanada dos Ministérios, bloco “P”, 4th floor, Brasília, Federal District, as member of the Board of Directors; and (iv) ISAO FUNAKI, Japanese, married, Bachelors of Commercial Science, bearer of foreign identity card (RNE) No. V301898-L, enrolled with the Individual Taxpayers Register (CPF/MF) under No. 829.540.970-00, resident and domiciled in the City of Rio de Janeiro, State of Rio de Janeiro, with commercial address at Praia do Flamengo No. 200, 14th floor, in the City of Rio de Janeiro, State of Rio de Janeiro, as an alternate member of the Board of Directors for Mr. Hiroyuki Kato. The Board of Directors members now appointed declare that, according to article 147 of the Brazilian Corporation Law, are entirely able to exercise their duties and their mandate will least until the 2015 Annual General Shareholders’ Meeting.

5

Table of Contents

For the purposes of article 146, paragraph 2nd, of the Brazilian Corporation Law, the member of the Board of Directors. Mr. HIROYUKI KATO, has appointed Mr. ISAO FUNAKI, qualified above, as his attorney-in-fact.

07 - ADJOURNMENT

These Minutes were read and then approved and signed.

We hereby declare that this is a true copy of the Minutes of the Meeting contained in the Vale’s corporate records.

Rio de Janeiro, December 23rd, 2014.

|

|

|

|

|

Eduardo de Oliveira Rodrigues Filho

Chairman |

|

Mariangela Daniele Maruishi Bartz

Secretary |

6

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A. |

|

|

(Registrant) |

|

|

|

|

|

|

By: |

/s/ Rogerio Nogueira |

|

Date: December 23, 2014 |

|

Director of Investor Relations |

7

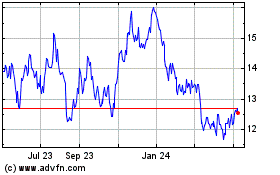

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to Apr 2024

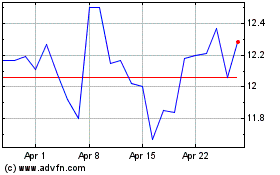

Vale (NYSE:VALE)

Historical Stock Chart

From Apr 2023 to Apr 2024