TIDMVP.

Press Release 26 November 2013

Vp plc

("Vp" or the "Group" or the "Company")

Interim Results

Vp plc, the equipment rental specialist, today announces its Interim

Results for the six months ended 30 September 2013.

Highlights

Profit before tax and amortisation increased 17% to

-- GBP12.8 million (2012: GBP11.0 million)

Revenues of GBP91.3 million, 9% ahead (2012: GBP84.0

-- million)

Return on capital employed 13.9% (2012: 13.2%)

--

Profit margins improved once again to 14.0% (2012:

-- 13.0%)

Capital investment in rental fleet 46% higher than

-- the prior year at GBP18.3 million

Acquisitions of GBP4.6 million

--

Interim dividend increased to 3.6 pence per share

--

Solid balance sheet with strong operational cash flow

--

Jeremy Pilkington, Chairman of Vp plc, commented:

"The Group has produced another excellent set of results with profits,

margins, return on capital and earnings per share all strongly ahead.

Substantial capital investment in the rental fleet and the acquisition

of Mr Cropper in September demonstrates our confidence in the

opportunities for growth. The Board believes the Group is very well

placed to continue to deliver further progress for the year as a whole

and beyond."

- Ends -

Enquiries:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 405

jeremypilkington@vpplc.com

Neil Stothard, Group Managing Director Tel: +44 (0) 1423 533 445

neil.stothard@vpplc.com

Allison Bainbridge, Group Finance Director Tel: +44 (0) 1423 533 445

allison.bainbridge@vpplc.com www.vpplc.com

Media enquiries:

Abchurch Communications

Sarah Hollins / Shabnam Bashir / Jamie Hooper Tel: +44 (0) 20 7398 7719

jamie.hooper @abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

I am very pleased to report another set of excellent results for the six

months to 30 September 2013. Profit before tax and amortisation

increased by 17% to GBP12.8 million (2012: GBP11.0 million) on revenues

ahead by 9% at GBP91.3 million (2012: GBP84.0 million). Return on

capital employed improved to 13.9% (2012: 13.2%) and profit margins

improved once again to 14.0% (2012: 13.0%). Basic earnings per share

rose to 25.73 pence (2012: 21.63 pence).

Although uncertainties and challenges remain, we have seen a notable

improvement in sentiment in certain key market sectors in the UK,

particularly within residential and infrastructure investment. This has

contributed to the significantly improved performances at Groundforce,

UK Forks and Hire Station as reviewed in more detail below.

The scale of opportunities is reflected in the capital investment in

rental fleet which was over 46% higher than the prior year at GBP18.3

million. We also completed the acquisition of Mr Cropper, the UK's

leading pile cropping rental company, in September 2013 for a

consideration of GBP4.6 million. Strong operating cash flow absorbed

this investment whilst holding period end net borrowings to GBP56

million (2012: GBP50 million).

Your board is declaring the payment of an increased interim dividend of

3.6 pence per share (2012: 3.25 pence per share) payable on 3 January

2014 to shareholders on the register as at 6 December 2013.

Review of Operations

Groundforce

Groundforce delivered another strong result with operating profits more

than 12% ahead at GBP4.6 million (2012: GBP4.1 million) on revenues of

GBP20.8 million (2012: GBP18.2 million). Pleasingly this performance

was based on solid contributions from across the product range and all

regions of the UK. Once again, we benefitted from the water companies'

AMP5 work programmes as they gathered further momentum.

Our European activity has developed in line with expectations and whilst

still relatively small, it continues to make progress and the future

prospects that exist for this business remain promising.

Mr Cropper, the pile breaker rental business acquired at the beginning

of September 2013, has been successfully integrated within the division

and has delivered very satisfactory results in its first two months of

trading.

UK Forks

UK Forks delivered an excellent performance with profits 59% ahead of

last year at GBP1.5 million (2012: GBP1.0 million), on revenues 20%

ahead at GBP8.4 million (2012: GBP7.0 million). The business has

experienced strong and sustained demand, particularly from residential

construction and we have made further significant investment in growing

the rental fleet in response to high levels of utilisation.

Whilst the market remains competitive, particularly amongst the larger

customers, we see further opportunities for growth especially as the

volume of residential completions progresses back towards more normal

historic levels.

Airpac Bukom

As anticipated, but disappointingly, profits at Airpac Bukom reduced to

GBP0.7 million (2012: GBP1.3 million) on revenues flat at GBP9.6 million

(2012: GBP9.6 million).

The quieter trading conditions experienced by Airpac Bukom in the

previous financial year continued into the first quarter with delays to

Liquefied Natural Gas ("LNG") projects in the Asia Pacific region and

subdued demand from the North Sea fabric maintenance market, further

exacerbated by the safety related helicopter groundings. Pleasingly

however, we saw a much improved trend into the second quarter with

trading levels recovering strongly. With an improved outlook in LNG

related activity and stronger trading generally, we expect the business

to maintain this improving trend.

Torrent Trackside

Torrent Trackside delivered profits of GBP1.5 million (2012: GBP1.7

million) on revenues relatively flat at GBP10.6 million (2012: GBP10.5

million) and whilst there has been a small reduction in margin, trading

levels remain positive moving into the second half of the year.

Network Rail's procurement processes are being restructured in advance

of the new five year investment programme (CP5) which commences in April

2014. We are fully engaged with this process and are well placed to

support the successful contractors.

With the rail market continuing to attract sustained investment,

Torrent's market leading offer places the business in a strong position

to make further progress.

TPA

Profits at TPA improved 7% to GBP2.7 million (2012: GBP2.5 million) on

revenues marginally ahead at GBP9.8 million (2012: GBP9.5 million).

Demand from transmission upgrade work and a strong performance from the

European activity contributed to this result. Within the UK, careful

contract selection in the events market and robust cost management has

delivered further improvements in margins. In Germany, the transmission

and wind power sectors have, as anticipated, recovered well in the first

half of the year.

Hire Station

Hire Station produced excellent first half results with profits 59%

ahead at GBP2.7 million (2012: GBP1.7 million) on revenues up 9% at

GBP31.9 million (2012: GBP29.3 million).

All sectors of the business; Tools, ESS Safeforce and MEP, reported

improved profits.

The tool business has responded positively to growth and margin

initiatives, with the branch network continuing to be strengthened. ESS

Safeforce has enjoyed a buoyant first half, with ongoing capital

investment to support strong demand. MEP has extended its branch

network to improve national coverage and expanded its product offering.

Outlook

These are an excellent set of results which reflect the ability of an

outstanding team to cope equally well with challenges and opportunities.

Everyone in the Group should be justifiably proud of their achievement.

With sentiment in certain key sectors of the UK economy improving and

with some of the wider structural threats receding, we believe the Group

is very well placed to continue to deliver further progress for the year

as a whole and beyond.

Jeremy Pilkington

Chairman

26 November 2013

Condensed Consolidated Income Statement

For the period ended 30 September 2013

Six months to 30 Six months to 30 Full year to

Note Sep 2013 Sep 2012 31 Mar 2013

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Revenue 3 91,253 84,021 167,034

Cost of sales (65,378) (60,214) (124,791)

Gross profit 25,875 23,807 42,243

Administrative

expenses (12,677) (11,898) (23,377)

Operating profit 3 13,198 11,909 18,866

Net financial

expenses (931) (1,368) (2,464)

Profit before

amortisation and

taxation 12,794 10,963 17,351

Amortisation of

intangibles (527) (422) (949)

Profit before

taxation 12,267 10,541 16,402

Income tax expense 4 (2,206) (2,196) (3,353)

Net profit for the

period 10,061 8,345 13,049

Basic earnings per

share 7 25.73p 21.63p 33.62p

Diluted earnings

per share 7 23.55p 19.96p 30.84p

Dividend per share 8 3.60p 3.25p 12.25p

Interim dividends

proposed / paid

(GBP000) 1,439 1,278 1,278

Final dividend

paid (GBP000) 3,520 3,159 3,159

Condensed Consolidated Statement of Comprehensive Income

For the period ended 30 September 2013

Six months Six months Full year

to to to

31 Mar

30 Sep 2013 30 Sep 2012 2013

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Profit for the period 10,061 8,345 13,049

Other comprehensive income:

Items that will not be reclassified to profit or loss

Actuarial gains on defined benefit pension scheme - - 697

Tax on items taken direct to equity - - (166)

Impact of tax rate change (86) (52) (42)

Foreign exchange translation difference (100) (166) 45

Items that may be subsequently reclassified to profit

or loss

Effective portion of changes in fair value of cash

flow hedges 480 183 196

Other comprehensive income 294 (35) 730

Total comprehensive income for the period 10,355 8,310 13,779

Condensed Consolidated Statement of Changes in Equity

For the period ended 30 September 2013

Six months Six months Full year

to to to

31 Mar

30 Sep 2013 30 Sep 2012 2013

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Total comprehensive income for the period 10,355 8,310 13,779

Tax movements to equity 1,383 795 1,258

Impact of tax rate change (80) (10) (42)

Share option charge in the period 904 781 1,225

Net movement relating to Treasury Shares and shares

held by Vp Employee Trust (613) 1,170 (1,922)

Dividends to shareholders (3,520) (3,159) (4,437)

Change in equity during the period 8,429 7,887 9,861

Equity at the start of the period 100,922 91,061 91,061

Equity at the end of the period 109,351 98,948 100,922

Condensed Consolidated Balance Sheet

At 30 September 2013

31 Mar

Note 30 Sep 2013 2013 30 Sep 2012

(unaudited) (audited) (unaudited)

GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 5 117,883 110,577 114,474

Goodwill 6 35,575 33,989 33,989

Intangible assets 6 6,053 5,290 5,817

Employee benefits 268 80 -

Total non-current assets 159,779 149,936 154,280

Current assets

Inventories 5,508 5,679 5,223

Trade and other receivables 45,139 33,256 36,336

Cash and cash equivalents 4,858 8,712 5,932

Total current assets 55,505 47,647 47,491

Total assets 215,284 197,583 201,771

Current liabilities

Interest bearing loans and

borrowings (50) (24,000) (26,000)

Income tax payable (2,565) (1,539) (2,748)

Trade and other payables (37,561) (34,838) (36,798)

Total current liabilities (40,176) (60,377) (65,546)

Non-current liabilities

Interest bearing loans and

borrowings (61,003) (30,000) (30,000)

Employee benefits - - (827)

Deferred tax liabilities (4,754) (6,284) (6,450)

Total non-current liabilities (65,757) (36,284) (37,277)

Total liabilities (105,933) (96,661) (102,823)

Net assets 109,351 100,922 98,948

Equity

Issued capital 2,008 2,008 2,309

Capital redemption reserve 301 301 -

Share premium 16,192 16,192 16,192

Hedging reserve (314) (794) (807)

Retained earnings 91,137 83,188 81,227

Total equity attributable to equity

holders of parent 109,324 100,895 98,921

Minority interest 27 27 27

Total equity 109,351 100,922 98,948

Condensed Consolidated Statement of Cash Flows

For the period ended 30 September 2013

Six months Six months Full year

Note to to to

31 Mar

30 Sep 2013 30 Sep 2012 2013

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit before taxation 12,267 10,541 16,402

Adjustment for:

Pension fund contributions in excess of service cost (188) (219) (429)

Share based payment charges 904 781 1,225

Depreciation 5 10,833 10,396 21,173

Amortisation of intangibles 527 422 949

Net financial expense 931 1,368 2,464

Profit on sale of property, plant and equipment (1,305) (1,301) (2,569)

Operating cash flow before changes in working capital

and provisions 23,969 21,988 39,215

Decrease / (increase) in inventories 208 (340) (796)

(Increase)/decrease in trade and other receivables (10,279) (1,339) 1,741

Decrease in trade and other payables (300) (1,745) (401)

Cash generated from operations 13,598 18,564 39,759

Interest paid (990) (1,394) (2,504)

Interest received 7 9 20

Income tax paid (1,749) (1,551) (3,809)

Net cash from operating activities 10,866 15,628 33,466

Investing activities

Proceeds from sale of property, plant and equipment 4,144 3,936 9,609

Purchase of property, plant and equipment (17,157) (15,149) (29,635)

Acquisition of businesses (net of cash and overdrafts) (4,503) (4,117) (4,117)

Net cash from investing activities (17,516) (15,330) (24,143)

Cash flows from financing activities

Purchase of Treasury Shares and own shares by Employee

Trust (613) (6,675) (9,767)

Repayment of loans (54,000) (3,000) (5,000)

New loans 61,000 13,000 13,000

Payment of hire purchase and finance lease liabilities - (1) (1)

Dividends paid 8 (3,520) (3,159) (4,437)

Net cash used in financing activities 2,867 165 (6,205)

Net (decrease)/increase in cash and cash equivalents (3,783) 463 3,118

Effect of exchange rate fluctuations on cash held (71) (113) 12

Cash and cash equivalents at beginning of period 8,712 5,582 5,582

Cash and cash equivalents at end of period 4,858 5,932 8,712

Notes to the Condensed Financial Statements

1. Basis of Preparation

Vp plc (the "Company") is a company domiciled in the United Kingdom.

The Condensed Consolidated Interim Financial Statements of the Company

for the half year ended 30 September 2013 comprise the Company and its

subsidiaries (together referred to as the "Group").

This interim announcement has been prepared in accordance with the

Disclosure and Transparency Rules of the UK Financial Services Authority

and the requirements of IAS34 ("Interim Financial Reporting") as adopted

by the EU. The accounting policies applied are consistent for all

periods presented and are in line with those applied in the annual

financial statements for the year ended 31 March 2013, which were

prepared in accordance with International Financial Reporting Standards

("IFRS") as adopted by the EU.

The interim announcement was approved by the Board of Directors on 25

November 2013.

The Condensed Consolidated Interim Financial Statements do not include

all the information required for full annual Financial Statements.

The comparative figures for the financial year ended 31 March 2013 are

extracted from the Company's statutory accounts for that financial year.

Those accounts have been reported on by the Company's auditor and

delivered to the Registrar of Companies. The report of the auditor was

(i) unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without qualifying

their report, and (iii) did not contain a statement under section 498

(2) or (3) of the Companies Act 2006.

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and liabilities,

income and expenses. The estimates and associated assumptions are based

on historical experience and various other factors that are believed to

be reasonable under the circumstances; these form the basis of the

judgements relating to carrying values of assets and liabilities that

are not readily apparent from other sources. Actual results may differ

from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that

period, or in the period of the revision and future periods if the

revision affects both current and future periods.

As stated in the year end accounts, the Group continues to be in a

healthy financial position. Since the year end net debt has increased by

GBP10.9 million to GBP56.2 million. The Group's total banking

facilities are GBP70 million, including an overdraft facility. The

Board has evaluated these facilities and the associated covenants on the

basis of current forecasts, taking into account the current economic

climate and an appropriate level of sensitivity analysis. On this basis

the Directors have a reasonable expectation that the Group has adequate

resources to continue in operation for the foreseeable future and to

manage its business risks. For this reason the going concern basis has

been adopted in the preparation of these financial statements.

2. Risks and Uncertainties

There are a number of risks and uncertainties which could have a

material impact on the Group's performance.

The principal risks faced by the Group, and the activities undertaken to

mitigate them, as at 31 March 2013 were set out on page 25 of the 31

March 2013 Financial Statements. Nothing has occurred since these

Financial Statements were published to change the Group's view on these

risks. The Group's exposure to risk is therefore considered by the Board

to be within normal parameters and represents an acceptable level of

risk.

3. Summarised Segmental Analysis

Revenue Operating Profit

Sept 2013 Sept 2012 Sept 2013 Sept 2012

GBP000 GBP000 GBP000 GBP000

Groundforce 20,818 18,197 4,628 4,123

UK Forks 8,408 7,022 1,518 957

Airpac Bukom 9,646 9,560 679 1,315

Torrent Trackside 10,633 10,452 1,487 1,709

TPA 9,826 9,518 2,707 2,529

Hire Station 31,922 29,272 2,706 1,698

91,253 84,021 13,725 12,331

Amortisation (527) (422)

13,198 11,909

4. Income Tax

The effective tax rate of 18.0% in the period to 30 September 2013 (30

September 2012: 20.8%) is made up of two elements. Firstly, an estimated

underlying tax rate of 22.4% (30 September 2012: 23.8%) which reflects

the current standard rate of tax of 23%, as adjusted for estimated

permanent differences for tax purposes offset by gains covered by

exemptions. Secondly there is a release of GBP0.5m (4.4%) from the

deferred tax balance as a result of the enacted changes in the future UK

corporation tax rate from 23% to 20% in future periods.

5. Property, Plant and Equipment

Sept 2013 Sept 2012 Mar 2013

GBP000 GBP000 GBP000

Carrying amount 1 April 110,577 110,680 110,680

Additions 19,542 14,085 25,285

Acquisitions 1,458 2,798 2,798

Depreciation (10,833) (10,396) (21,173)

Disposals (2,839) (2,635) (7,040)

Effect of movements in exchange rates (22) (58) 27

Closing carrying amount 117,883 114,474 110,577

The value of capital commitments at 30 September 2013 was GBP10,010,000

(31 March 2013 GBP2,943,000).

6. Goodwill and intangibles

On 3 September 2013 Vp plc acquired the share capital of Mr Cropper

Limited for GBP4.6 million and the business and net assets of the

acquired company have been transferred to Vp plc. The acquisition has

been consolidated into these results using provisional completion

figures. On this basis the fair value of net assets acquired was GBP3.0

million including intangibles of GBP1.3 million leaving goodwill of

GBP1.6 million.

7. Earnings Per Share

Earnings per share have been calculated on 39,104,381 shares (2012:

38,579,093 shares) being the weighted average number of shares in issue

during the period. Diluted earnings per share have been calculated on

42,730,495 shares (2012: 41,810,258 shares) adjusted to reflect

conversion of all potentially dilutive ordinary share options. Basic

earnings per share before the amortisation of intangibles was 26.77

pence (2012: 22.46 pence) and was based on an after tax add back of

GBP406,000 (2012: GBP321,000). Diluted earnings per share before

amortisation of intangibles was 24.49 pence (2012: 20.73 pence).

8. Dividends

The Directors have declared an interim dividend of 3.60 pence (2012:

3.25 pence) per share payable on 3 January 2014 to shareholders on the

register at 6 December 2013. The dividend proposed at the year end was

subsequently approved at the AGM in July and GBP3,520,000 was paid in

the period (2012 paid: GBP3,159,000). The cost of dividends in the

Statement of Changes in Equity is after adjustments for the interim and

final dividends waived by the Vp Employee Trust in relation to the

shares it holds for the Group's share option schemes.

9. Analysis of Net Debt

As at Cash Acquisition As at

1 Apr 13 Flow 30 Sep 13

GBP000 GBP000 GBP000 GBP000

Cash in hand and at bank less

overdrafts 8,712 (3,951) 97 4,858

Revolving credit facilities (54,000) (7,000) - (61,000)

Finance leases and hire purchases - - (53) (53)

(45,288) (10,951) 44 (56,195)

The Group's bank facilities comprise a GBP35 million committed three

year revolving credit facility which expires in May 2016, a GBP30

million committed four and a half year revolving credit facility

expiring in October 2017 and overdraft facilities totalling GBP5

million.

10. Related Party Transactions

Transactions between Group Companies, which are related parties, have

been eliminated on consolidation and therefore do not require

disclosure.

11. Forward Looking Statements

The Chairman's Statement includes statements that are forward looking in

nature. Forward looking statements involve known and unknown risks,

assumptions, uncertainties and other factors which may cause the actual

results, performance or achievements of the Group to be materially

different from any future results, performance or achievements expressed

or implied by such forward looking statements. Except as required by

the Listing Rules and applicable law, the Company undertakes no

obligation to update, review or change any forward looking statements to

reflect events or developments occurring after the date of this report.

Responsibility statement of the directors in respect of the half-yearly

financial report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by the EU

-- the interim management report includes a fair review of the

information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being related

party transactions that have taken place in the first six months of the

current financial year and that have materially affected the financial

position or performance of the entity during that period; and any

changes in the related party transactions described in the last annual

report that could do so.

By order of the Board

26 November 2013

The Board

The Directors who served during the 6 months to 30 September 2013 were:

Jeremy Pilkington (Chairman)

Neil Stothard

Allison Bainbridge

Peter Parkin (resigned 23 July 2013)

Steve Rogers

Phil White (appointed 15 April 2013)

Independent Review Report to Vp plc

Introduction

We have been engaged by the Company to review the condensed set of

financial statements in the half-yearly financial report for the six

months ended 30 September 2013 which comprises the condensed

consolidated interim income statement, the condensed consolidated

interim statement of comprehensive income, the condensed consolidated

interim balance sheet, the condensed consolidated interim statement of

changes in equity, the condensed consolidated interim cash flow

statement and the related explanatory notes. We have read the other

information contained in the half-yearly financial report and considered

whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of financial

statements.

This report is made solely to the Company in accordance with the terms

of our engagement to assist the Company in meeting the requirements of

the Disclosure and Transparency Rules ("the DTR") of the UK's Financial

Conduct Authority ("the UK FCA"). Our review has been undertaken so

that we might state to the Company those matters we are required to

state to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility to

anyone other than the company for our review work, for this report, or

for the conclusions we have reached.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been

approved by, the Directors. The Directors are responsible for preparing

the half-yearly financial report in accordance with the DTR of the UK

FCA.

As disclosed in note 1, the annual financial statements of the Group are

prepared in accordance with IFRSs as adopted by the EU. The condensed

set of financial statements included in this half-yearly financial

report has been prepared in accordance with IAS 34 Interim Financial

Reporting as adopted by the EU.

Our responsibility

Our responsibility is to express to the Company a conclusion on the

condensed set of financial statements in the half-yearly financial

report based on our review.

Scope of review

We conducted our review in accordance with International Standard on

Review Engagements (UK and Ireland) 2410 Review of Interim Financial

Information Performed by the Independent Auditor of the Entity issued by

the Auditing Practices Board for use in the UK. A review of interim

financial information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially less

in scope than an audit conducted in accordance with International

Standards on Auditing (UK and Ireland) and consequently does not enable

us to obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the

half-yearly financial report for the six months ended 30 September 2013

is not prepared, in all material respects, in accordance with IAS 34 as

adopted by the EU and the DTR of the UK FCA.

Lindsey Crossland

For and on behalf of KPMG Audit Plc

Chartered Accountants

Leeds

26 November 2013

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Vp PLC via Globenewswire

HUG#1745657

http://www.vpplc.com

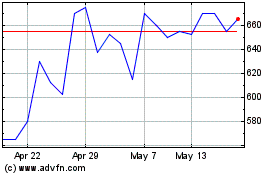

Vp (LSE:VP.)

Historical Stock Chart

From Jun 2024 to Jul 2024

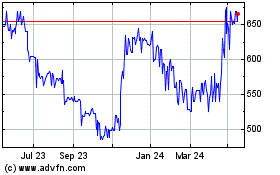

Vp (LSE:VP.)

Historical Stock Chart

From Jul 2023 to Jul 2024