Placing

February 27 2006 - 3:03AM

UK Regulatory

RNS Number:9582Y

VASTox plc

27 February 2006

27 February 2006

VASTox plc ("VASTox" or the "Company")

Placing of 5,903,955 New Ordinary Shares to raise #10.45 million

and Pre-close update

Oxford, UK, 27 February 2006 - VASTox (AIM: VOX), a leading chemical genomics

company, today announces it has successfully raised #10.45 million in a placing

of New Ordinary Shares to institutional investors. The new funds will be used by

the Company to accelerate the development of its lead therapeutic programme in

Duchenne muscular dystrophy (DMD), for which it announced promising preclinical

results earlier this year.

The Placing has been fully underwritten by Evolution Securities Limited.

Highlights:

* Placing of 5,903,955 new Ordinary Shares (the "New Ordinary Shares")

at a placing price of 177p raising #10.45 million (before expenses) for the

Company.

* Funds raised to be used to accelerate the development of the Company's

lead DMD programme.

* Company expects to announce revenues of not less than #0.5 million for

its services division for the year ended 31 January 2006.

* 1,500,000 Existing Ordinary Shares placed on behalf of certain founder

shareholders (the "Selling Founder Shareholders").

Professor Stephen Davies, Chairman of VASTox, comments:

"Our positive preclinical results for the Company's DMD programme represented a

significant breakthrough in the development of a potentially effective treatment

of DMD and for the Company. This fundraising now provides VASTox with the means

to accelerate the development of this programme while still allowing the Company

to maintain its development timetable around its other research programmes as

planned."

A circular containing a notice of an extraordinary general meeting convened for

9.00 a.m. on 22 March 2006 (the "EGM") has today been sent to shareholders of

the Company ("Shareholders") outlining the terms of the proposed conditional

placing of the New Ordinary Shares and the Exisiting Ordinary Shares (the "

Placing") and seeking Shareholder approval to, inter alia, enable the Directors

to allot the New Ordinary Shares in connection with the Placing.

This summary should be read in conjunction with, and is subject to, the full

text of the attached announcement.

Enquiries:

VASTox Office: +44 (0) 1235 443 910

Steven Lee, PhD, CEO Mobile: +44 (0) 7766 913 898

Darren Millington, Head of Finance

Citigate Dewe Rogerson +44 (0) 20 7638 9571

David Dible, Mark Swallow, Valerie Auffray

Evolution Securities

Matt Wood +44 (0) 20 7071 4300

This announcement contains forward-looking statements. Forward-looking

statements can be identified by words such as "anticipates", "intends", "plans",

"seeks", "believes", "estimates", "expects" and similar references to future

periods, or by the inclusion of forecasts or projections.

Forward-looking statements are based on the Company's current expectations and

assumptions regarding its business, the economy and other future conditions.

Because forward-looking statements relate to the future, by their nature, they

are subject to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. The Company's actual results may differ materially

from those contemplated by the forward-looking statements. The Company cautions

you therefore that you should not rely on any of these forward-looking

statements as statements of historical fact or as guarantees or assurances of

future performance. Important factors that could cause actual results to differ

materially from those in the forward-looking statements include factors included

in this announcement and regional, national, global political, economic,

business, competitive, market and regulatory conditions.

Placing of 5,903,955 New Ordinary Shares and 1,500,000 existing Ordinary Shares

1. Introduction and summary

VASTox is a chemical genomics group that discovers and develops proprietary new

drugs and provides a range of screening and chemistry services to the life

sciences industry.

Since the Company's business commenced in January 2003, VASTox has established

four drug discovery programmes. The Company's most advanced programme is focused

on developing a new treatment for Duchenne Muscular Dystrophy ('DMD') based on

the up-regulation of the protein utrophin. A second programme in Spinal Muscular

Atrophy ('SMA') is also progressing well and two additional programmes in

multi-drug resistance and osteoarthritis have also been initiated.

Supporting VASTox' drug discovery efforts is a range of chemical genomics and

synthetic chemistry services that it offers to third parties for their own drug

discovery programmes. The revenue of the Company and its subsidiaries (the "

Group") associated with these services is growing strongly through increasing

numbers of profitable service contracts with pharmaceutical, biotechnology and

agrochemical companies. The Group aims to continue providing these services with

the intention of developing more substantial and longer-term partnerships in the

future.

VASTox' genomics technology uses zebrafish (Danio rerio) and fruitflies

(Drosophila melanogaster) to allow high-volume screening of small molecule drug

candidates. This approach generates data that is highly predictive of efficacy

and toxicity in humans, while having the potential to dramatically decrease the

time and cost of drug discovery and development.

The proceeds of the placing of New Ordinary Shares of #10.45 million (before

expenses) will enable the Group to accelerate the development of the DMD

programme without jeopardising existing or future drug discovery programmes. In

addition, the Directors believe that increasing the cash resources of the Group

will allow VASTox to negotiate with any potential licensees or partners from a

position of greater strength.

The placing of 5,903,955 New Ordinary Shares at a price of 177 pence per Placing

Share ("the Placing Price") is conditional, inter alia, upon (i) the passing of

the resolutions set out in the notice convening the EGM (the "Resolutions"); and

(ii) admission of the New Ordinary Shares to trading on AIM becoming effective

("Admission"). The Placing has been fully underwritten by Evolution Securities

Limited ("Evolution Securities").

2. Drug discovery programmes

VASTox currently manages four in-house drug discovery and development programmes

in both niche and broad therapy areas. The most advanced drug programme is

focused on developing a small molecule therapy for the treatment of DMD, a

congenital disease, affecting only boys, which is caused by the body's inability

to produce sufficient amounts of the protein dystrophin. This protein is

essential for healthy muscle tissue and a lack of dystrophin leads to a

deterioration in muscle strength throughout the body. DMD patients rarely live

beyond 30 as their heart and diaphragm muscles eventually stop working. There

are estimated to be approximately 30,000 DMD patients in the developed world and

there is currently no effective treatment for this disease.

VASTox' approach to this disease has been to focus on developing a drug that

makes the patient's own body produce increased amounts of the protein utrophin.

Utrophin is a naturally occurring protein which is present in all people at low

levels. Increasing the amount of utrophin in muscles has been shown to

compensate for a lack of dystrophin.

The effect of this protein has been extensively studied by VASTox' co-founder

and member of the Group's Scientific Advisory Board (the "SAB"), Professor Kay

Davies FRS, and has been shown to be efficacious in animal models of DMD (mdx

mouse). The Directors believe that this offers a promising scientific approach

to the treatment of this disease. The Group has exclusive rights to the relevant

patents relating to up-regulation of utrophin.

The Group's second drug discovery programme in neuromuscular disorders is

focused on SMA. This disease is estimated to affect approximately 50,000

patients in the developed world and, as with DMD, is similarly caused by the

malfunctioning of a gene.

SMA causes a fault in the neuromuscular junction which prevents electrical

signals reaching muscles. Through lack of use, these muscles atrophy, leading to

death at an early age. In the most severe form of SMA, patients rarely live

beyond two years old. The Group's remaining drug discovery programmes are

related to multi-drug resistant infections (in particular the role of the enzyme

N-acetyl transferase) and osteoarthritis. These programmes are at an earlier

stage of development and are currently at the primary screening stage.

Through the Group's Scientific Advisory Board, VASTox has access to a wide range

of academics in a number of research institutions. The Directors believe that

the Group is well placed to in-licence promising technologies and drug discovery

programmes at an early stage. The Group's management team regularly reviews new

drug discovery and technology opportunities with a view to establishing new

programmes in areas of commercial interest.

3. Background to and reasons for the placing of New Ordinary Shares

VASTox has focused on DMD as a therapy area because the Directors believe that

the Group has both the scientific expertise and commercial skills to make

significant value from this programme. The Directors believe the potential

market size for a therapy in DMD to be a very attractive one, that is, worth at

least $800 million per annum. Furthermore, the Directors believe that because

DMD is a deadly disease in young people and there is currently no cure, it is

aligned with the key positive health economic arguments for treatment.

The Group's approach to DMD is based on extensive research by VASTox'

co-founder, Professor Kay Davies FRS, who was the first to publish research

suggesting that up-regulating utrophin could compensate for a lack of dystrophin

in DMD patients. This replacement approach to treating DMD now has wide

scientific acceptance.

On 24 January 2006, the Group announced the discovery of a number of small

molecules that had shown in vivo up-regulation of utrophin. This is the first

time the result has been shown with small, drug-like, molecules and allows the

Group, to begin optimising the chemical 'hits' which could lead to the

development of a medicine.

The Directors believe that to capitalise on this early positive result, the

Group should accelerate the development of the DMD programme, with the aim of

selecting a lead drug candidate by Q4 2007, followed by the commencing of phase

I clinical trials within two years. The Directors forecast that #10 million of

new funds will be required to accelerate the development of the DMD programme to

a clinical proof of concept, that is, a point during the phase II clinical

trials where the efficacy of the drug candidate is clear. Current plans indicate

that this point should be reached in the second half of 2008.

Whilst the Group currently has sufficient funds to accelerate the DMD programme,

the Directors believe that this would materially impact the development of the

Group's other drug discovery programmes, in particular SMA. It would also

prevent the Group from initiating new drug discovery programmes. Both of these

consequences, in the opinion of the Directors, are not in the long term

interests of Shareholders.

The Directors believe that a placing of New Ordinary Shares will be in the best

interests of the Group as this will allow an acceleration of the DMD programme

without jeopardising progress in the Group's current and future drug discovery

programmes.

4. Use of proceeds

The net proceeds of the placing of New Ordinary Shares will:

* Allow the Group to recruit high calibre staff with experience in

drug development and clinical trial design, suitable candidates for some of the

positions having already been identified;

* Fund regulatory, legal and patent-related costs necessarily incurred

to protect the Group's developing intellectual property assets;

* Fund all pre-clinical chemistry and biology stages in the

development of a DMD lead drug candidate;

* Fund phase I clinical trials in healthy volunteers and the

commencement of phase II clinical trials in respect of the DMD programme; and

* Fund the necessary capital expenditure associated with development

of a DMD lead drug candidate.

5. Sale of Ordinary Shares by the Selling Founder Shareholders

At the time of the Company's admission to AIM in October 2004, all of the

founding shareholders entered into undertakings not to dispose of Ordinary

Shares for periods of up to two years from the date of flotation. The Directors

believe that, in order to satisfy institutional demand, widen the Company's

Shareholder base and to improve the liquidity in the Company's Ordinary Shares

it is in the best interests of the Company to allow certain founder shareholders

(excluding the Directors, Professor Kay Davies and IP2IPO Group plc) to dispose

of a proportion of their shareholding now through the Placing. Accordingly,

conditional upon Admission, the Selling Founder Shareholders, have today agreed

to sell a total of 1,500,000 Ordinary Shares, which form part of the Placing.

Furthermore, the Directors, certain members of the SAB and IP2IPO Group plc, who

in aggregate currently hold approximately 48.8 per cent. of the existing issued

ordinary share capital of the Company, have given firm undertakings that they

will not (subject to certain limited exceptions) sell any Ordinary Shares prior

to the date on which the Company's preliminary results for the year ending 31

January 2007 are announced.

6. Current trading and prospects

Since 12 October 2005, being the date of the Group's interim results for the six

months ended 31 July 2005, the Group has announced that it has initiated a

fourth drug discovery programme focused on the bone morphogenetic protein (BMP)

signalling pathway and its role in osteoarthritis (November 2005) and also the

positive preclinical results in DMD (January 2006).

The Directors expect to announce the Group's preliminary results for the year

ending 31 January 2006 in May 2006. In these results, the Group expects to

announce that the service division has been profitable, recording revenues of

not less than #0.5 million for the year just ended (#0.1 million in the prior

year) and that the Group has good revenue visibility for the current financial

year. The Directors expect that the Group will report net cash levels as at 31

January 2006 of approximately #12.6 million.

The operational targets that the Directors have set for the current financial

year include recruiting a high calibre Chief Scientific Officer, whose primary

responsibility will be the development of the lead drug candidate for DMD, and

gaining orphan drug designation for the DMD programme. The Directors anticipate

being able to announce further positive progress on the other three R&D

programmes as well as initiating development of new programmes from the growing

pipeline of opportunities. Finally, the Directors expect to announce the signing

of larger service contracts from the services division during the year.

7. The Placing

The Placing is conditional upon, inter alia, the passing of the Resolutions and

Admission becoming effective. The Placing Shares are or will be in registered

form and, on Admission, will rank pari passu with the existing issued Ordinary

Shares.

On Admission, the Company will have 37,217,066 Ordinary Shares in issue (the "

Enlarged Issued Share Capital") and a market capitalisation of approximately

#65.9 million at the Placing Price. The New Ordinary Shares will represent 15.9

per cent. of the Enlarged Issued Share Capital. The Placing Price represents a

discount of 7.3 per cent. to the closing middle market price of 191 pence per

Ordinary Share at the close of business on 24 February 2006, being the last

business date prior to the date of this announcement.

Application will be made to the London Stock Exchange for the New Ordinary

Shares to be admitted to trading on AIM. It is expected that Admission will

occur on 23 March 2006.

8. Extraordinary General Meeting

The circular to be sent to Shareholders today contains a notice convening an EGM

to be held on 22 March 2006 at the Company's rRegistered office at 9.00 a.m., at

which the Resolutions will be proposed for the purposes of implementing the

Placing.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROIKGGZZNNLGVZG

Vox Valor Capital (LSE:VOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

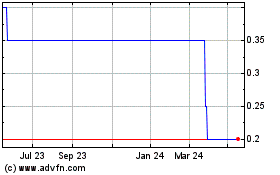

Vox Valor Capital (LSE:VOX)

Historical Stock Chart

From Jul 2023 to Jul 2024