TUI AG (TUI)

TUI AG: Admission of Subscription Rights settled in the form of Depositary

Interests ('DI Pre-Emptive Rights') and notice of intention to cancel

trading of DI Pre-Emptive Rights

11-Jan-2021 / 13:03 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION OR FORWARDING, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA OR JAPAN OR ANY

OTHER JURISDICTION IN WHICH SUCH PUBLICATION, DISTRIBUTION OR FORWARDING

WOULD BE UNLAWFUL. PLEASE READ THE IMPORTANT NOTICE AT THE OF THIS

ANNOUNCEMENT.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A PROSPECTUS

OR PROSPECTUS EQUIVALENT DOCUMENT. NOTHING HEREIN SHALL CONSTITUTE AN

OFFERING OF NEW SHARES OR OTHER SECURITIES. NEITHER THIS COMMUNICATION NOR

ANY PART OF IT SHALL FORM THE BASIS OF OR BE RELIED ON IN CONNECTION WITH OR

ACT AS AN INDUCEMENT TO ENTER INTO ANY CONTRACT OR COMMITMENT WHATSOEVER.

ANY DECISION TO PURCHASE, SUBSCRIBE FOR, OTHERWISE ACQUIRE, SELL OR

OTHERWISE DISPOSE OF ANY SECURITIES MUST BE MADE ONLY ON THE BASIS OF THE

INFORMATION CONTAINED IN THE PROSPECTUS OR THE INTERNATIONAL OFFERING

CIRCULAR.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE A RECOMMATION CONCERNING ANY

INVESTOR'S DECISION OR OPTIONS WITH RESPECT TO THE OFFERING (AS DEFINED

BELOW). THE PRICE AND VALUE OF SECURITIES OF THE COMPANY CAN GO DOWN AS WELL

AS UP. PAST PERFORMANCE IS NOT A GUIDE TO FUTURE PERFORMANCE. THE CONTENTS

OF THIS ANNOUNCEMENT ARE NOT TO BE CONSTRUED AS LEGAL, BUSINESS, FINANCIAL

OR TAX ADVICE. EACH SHAREHOLDER OR PROSPECTIVE INVESTOR SHOULD CONSULT HIS,

HER OR ITS OWN INDEPENT LEGAL ADVISER, BUSINESS ADVISER, FINANCIAL

ADVISER OR TAX ADVISER FOR LEGAL, FINANCIAL, BUSINESS OR TAX ADVICE.

TUI AG

Admission of Subscription Rights settled in the form of Depositary Interests

("DI Pre-Emptive Rights") and notice of intention to cancel trading of DI

Pre-Emptive Rights

11 January 2021

Further to the announcement on 7 January 2021, TUI AG (the Company)

announces that it has finalised its application to the London Stock Exchange

for the admission of 116,857,434 DI Pre-Emptive Rights to trading on a

multilateral trading facility of the London Stock Exchange. The Company

expects the admission to become effective tomorrow.

The Company intends to cancel the trading of the DI Pre-Emptive Rights on a

multilateral trading facility of the London Stock Exchange (the

Cancellation). It is expected that the Cancellation will take effect at

11:00 GMT on 22 January 2021.

All acceptances in respect of the DI Pre-Emptive Rights must be submitted so

as to settle by no later than 10:00 GMT on 26 January 2021, in accordance

with the instructions in the Prospectus (as defined below). The DI

Pre-Emptive Rights will settle on a T+2 basis.

Unexercised DI Pre-Emptive Rights will lapse and will not be sold. The New

Shares to which those unexercised DI Pre-Emptive Rights relate may be sold

in the Rump Placement or pursuant to the Commitment and Backstop Agreement

with Unifirm Limited, but shareholders or investors will not be entitled to

receive any proceeds from such sale, including any premium, as such payment

is restricted under the laws of Germany. Therefore, shareholders or

investors who take no action will not receive any compensation for any

unexercised Subscription Rights or DI Pre-Emptive Rights and will be

diluted.

A prospectus (the Prospectus) setting out the full details of the Offering,

including a full timetable of key dates, has been approved by the German

Federal Financial Supervisory Authority (BaFin) and passported into the

United Kingdom. The Prospectus is available on the Company's website

(https://www.tuigroup.com/en-en/investors/capital-increase) as well as on

the website of BaFin (www.bafin.de) and the website of the European

Securities and Markets Authority

(https://registers.esma.europa.eu/publication/). The information in this

announcement should be read in conjunction with the Prospectus.

All capitalised terms used but not otherwise defined in this announcement

including the important notices below have the meaning set out in the

Prospectus.

For further information, please contact:

Mathias Kiep, Group Director Investor Relations, Corporate Finance &

Controlling

Tel: +44 (0)1293 645 925/ +49 (0)511 566 1425

Nicola Gehrt, Director, Head of Group Investor Relations Tel: +49 (0)511 566

1435

Contacts for Analysts and Investors in UK, Ireland and Americas

Hazel Chung, Senior Investor Relations Manager Tel: +44 (0)1293 645 823

Contacts for Analysts and Investors in Continental Europe, Middle East and

Asia

Ina Klose, Senior Investor Relations Manager Tel: +49 (0)511 566 1318

Media

Kuzey Alexander Esener, Head of Media Relations Tel: +49 (0)511 566 6024

IMPORTANT NOTICES

This announcement may not be published, distributed or transmitted in the

United States, Australia, Canada, Hong Kong, Japan, New Zealand, Singapore,

South Africa, Switzerland or the United Arab Emirates, or in any other

jurisdiction in which the distribution, release or publication would be

restricted or prohibited. This announcement does not constitute an offer of

securities for sale or a solicitation of an offer to purchase securities of

the Company (the Securities) in the United States or any other jurisdiction.

The distribution of this announcement into jurisdictions may be restricted

by law, and, therefore, persons into whose possession this announcement

comes should inform themselves about and observe any such restrictions. Any

failure to comply with any such restrictions may constitute a violation of

the securities laws of such jurisdiction.

The Securities may not be offered or sold in the United States absent

registration or an exemption from registration under the Securities Act. The

Securities have not been, and will not be, registered under the Securities

Act. There will be no public offer of securities in the United States.

This announcement is an advertisement and not a prospectus for the purposes

of Prospectus Regulation (Regulation (EU) 2017/1129) (the Prospectus

Regulation) and the UK Prospectus Regulation (Regulation (EU) 2017/1129 as

it forms part of domestic law by virtue of the European Union (Withdrawal)

Act 2018) (the UK Prospectus Regulation). The public offering of certain

Securities in Germany and the United Kingdom will be made exclusively by

means of and on the basis of the published Prospectus of the Company which

has been approved by the BaFin and has been passported into the United

Kingdom, which approval and passporting should not be understood as an

endorsement of any Securities offered. Investors must not subscribe for or

purchase any Securities referred to in this announcement except on the basis

of information contained in the Prospectus published or the international

offering circular issued, by the Company in connection with the Offering, as

the case may be (together with any amendments or supplements thereto), and

should read the Prospectus or the international offering circular, as the

case may be (together with any amendments or supplements thereto) before

making an investment decision in order to fully understand the potential

risks and rewards associated with the decision to invest in the Securities.

The approved Prospectus is available on the website of the BaFin

(www.bafin.de [1]), the website of the Company

(https://www.tuigroup.com/en-en/investors/capital-increase [2]) and the

website of the European Securities and Markets Authority

(https://registers.esma.europa.eu/publication/).

This announcement has been issued by and is the sole responsibility of the

Company. The information contained in this announcement is for background

information purposes only and does not purport to be full or complete. No

reliance may be placed by any person for any purpose on the information

contained in this announcement or its accuracy, fairness or completeness.

This announcement does not constitute a recommendation concerning any

investor's decision or options with respect to the Offering. The price and

value of securities can go down as well as up. Past performance is not a

guide to future performance. The contents of this announcement are not to be

construed as legal, business, financial or tax advice. Each shareholder or

prospective investor should consult his, her or its own independent legal

adviser, business adviser, financial adviser or tax adviser for legal,

financial, business or tax advice.

Apart from the responsibilities and liabilities, if any, which may be

imposed on them by the Financial Services and Markets Act 2000, as amended

or the regulatory regime established thereunder, or under the regulatory

regime of any jurisdiction where exclusion of liability under the relevant

regulatory regime would be illegal, void or unenforceable, none of the Joint

Global Coordinators, the Sponsors nor any of their respective affiliates nor

any of its or their respective directors, officers, employees, advisers or

agents accepts any responsibility or liability whatsoever and makes no

representation or warranty, express or implied, for the contents of this

announcement, including its accuracy, fairness, sufficiency, completeness or

verification or for any other statement made or purported to be made by it,

or on its behalf, in connection with the Company or the Offering and nothing

in this announcement is, or shall be relied upon as, a promise or

representation in this respect, whether as to the past or future. Each of

the Joint Global Coordinators, the Sponsors and their respective affiliates

and its and their respective directors, officers, employees, advisers or

agents accordingly disclaims to the fullest extent permitted by law all and

any responsibility and liability whether direct or indirect, arising in

tort, contract or otherwise which it might otherwise have in respect of this

announcement or any such statement. Furthermore, each of the Joint Global

Coordinators, Sponsors and/or their affiliates provides various investment

banking, commercial banking and financial advisory services from time to

time to the Company.

Each of the Joint Global Coordinators and Sponsors is acting exclusively for

the Company in connection with the Offering and they are acting for no one

else. The Joint Global Coordinators and Sponsors will not regard any other

person as their respective clients in relation to the Offering or any other

matter in this announcement and will not be responsible to anyone other than

the Company for providing the protections afforded to their respective

clients, nor for providing advice in relation to the Offering, the contents

of this announcement or any transaction, arrangement or other matter

referred to herein.

In connection with the Offering, each of the Joint Global Coordinators and

any of their respective affiliates, may take up a portion of the Securities

as a principal position and in that capacity may retain, subscribe for,

purchase, sell, offer to sell or otherwise deal for their own accounts in

such Securities and other securities of the Company or related investments

in connection with the Offering or otherwise. Accordingly, references in

this announcement to the Securities being issued, offered, subscribed,

acquired, placed or otherwise dealt in should be read as including any

issue, offer, subscription, acquisition, placing or dealing by each of the

Joint Global Coordinators and any of their affiliates in such capacity. In

addition, certain of the Joint Global Coordinators or their affiliates may

enter into financing arrangements (including swaps, warrants or contracts

for difference) with investors in connection with which such Joint Global

Coordinators (or their affiliates) may from time to time acquire, hold or

dispose of Securities. None of the Joint Global Coordinators or any of their

affiliates intends to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or regulatory

obligation to do so.

No person has been authorised to give any information or to make any

representations other than those contained in this announcement and the

Prospectus published or the international offering circular issued, by the

Company in connection with the Offering, as the case may be (together with

any amendments or supplements thereto) and, if given or made, such

information or representations must not be relied on as having been

authorised by the Company, the Joint Global Coordinators, the Sponsors or

any of their respective affiliates.

Forward-Looking Statements

Certain statements included in this announcement are forward-looking. These

statements can be identified by the fact that they do not relate only to

historical or current facts. By their nature, they involve risk and

uncertainties because they relate to events and depend on circumstances that

will occur in the future. Actual results could differ materially from those

expressed or implied by such forward-looking statements. The potential

reasons for such differences include market fluctuations, the development of

world market fluctuations, the development of world market commodity prices,

the development of exchange rates or fundamental changes in the economic

environment. The Company does not intend or assume any obligation to update

any forward-looking statement to reflect events or circumstances after the

date of this announcement. The potential reasons for such differences

include market fluctuations, the development of world market fluctuations,

the development of world market commodity prices, the development of

exchange rates or fundamental changes in the economic environment. The

Company does not intend or assume any obligation to update any

forward-looking statement to reflect events or circumstances after the date

of this announcement.

Forward-looking statements often use words such as "expects", "may", "will",

"could", "should", "intends", "plans", "predicts", "envisages" or

"anticipates" or other words of similar meaning. They include, without

limitation, any and all projections relating to the results of operations

and financial conditions of the Company and its subsidiary undertakings from

time to time (the 'Group'), as well as plans and objectives for future

operations, expected future revenues, financing plans, expected expenditure

and divestments relating to the Group and discussions of the Group's

business plan. All forward-looking statements in this announcement are based

upon information known to the Group on the date of this announcement and

speak as of the date of this announcement. Other than in accordance with its

legal or regulatory obligations, the Group does not undertake to update or

revise any forward-looking statement to reflect any changes in events,

conditions or circumstances on which any such statement is based.

Actual results may differ from those expressed or implied in the

forward-looking statements in this announcement as a result of any number of

known and unknown risks, uncertainties and other factors, including, but not

limited to, the effects of the COVID-19 pandemic and uncertainties about its

impact and duration, many of which are difficult to predict and are

generally beyond the control of the Group, and it is not reasonably possible

to itemise each item. Accordingly, readers of this announcement are

cautioned against relying on forward-looking statements. All forward-looking

statements made on or after the date of this announcement and attributable

to the Company are expressly qualified in their entirety by the primary

risks set out in that section. Many of these risks are, and will be,

exacerbated by the COVID-19 pandemic and any further disruption to the

travel and leisure industry and economic environment as a result.

Information to Distributors

Solely for the purposes of the product governance requirements contained

within: (a) EU Directive 2014/65/EU on markets in financial instruments, as

amended (MiFID II); (b) Articles 9 and 10 of Commission Delegated Directive

(EU) 2017/593 supplementing MiFID II; and (c) local implementing measures

(together, the MiFID II Product Governance Requirements), and disclaiming

all and any liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance Requirements)

may otherwise have with respect thereto, the Securities the subject of the

Offering have been subject to a product approval process, which has

determined that such Securities are: (i) compatible with an end target

market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined in MiFID

II; and (ii) eligible for distribution through all distribution channels as

are permitted by MiFID II (the Target Market Assessment). Notwithstanding

the Target Market Assessment, distributors should note that: (i) the price

of the Securities may decline and investors could lose all or part of their

investment; (ii) the Securities offer no guaranteed income and no capital

protection; and (iii) an investment in the Securities is compatible only

with investors who do not need a guaranteed income or capital protection,

who (either alone or in conjunction with an appropriate financial or other

adviser) are capable of evaluating the merits and risks of such an

investment and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without prejudice

to the requirements of any contractual, legal or regulatory selling

restrictions in relation to the Offering. Furthermore, it is noted that,

notwithstanding the Target Market Assessment, the Joint Global Coordinators

will only procure investors who meet the criteria of professional clients

and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does not

constitute: (a) an assessment of suitability or appropriateness for the

purposes of MiFID II; or (b) a recommendation to any investor or group of

investors to invest in, or purchase, or take any other action whatsoever

with respect to the Securities. Each distributor is responsible for

undertaking its own Target Market Assessment in respect of the Securities

and determining appropriate distribution channels.

ISIN: DE000TUAG000

Category Code: ARI - TUI AG

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 3.1. Additional regulated information required to be

disclosed under the laws of a Member State

Sequence No.: 91199

EQS News ID: 1159703

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=3a585b492f8aaabc2f3b118cd6d3400e&application_id=1159703&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=5aefed76382229d4c4325f8619fe16f7&application_id=1159703&site_id=vwd&application_name=news

(END) Dow Jones Newswires

January 11, 2021 07:03 ET (12:03 GMT)

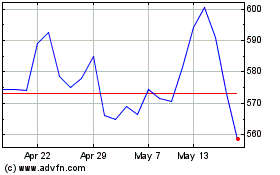

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

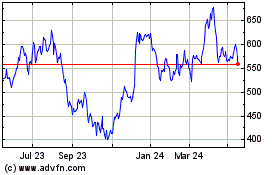

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024