TIDMTSCO

RNS Number : 5791F

Tesco PLC

29 October 2018

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE

MEANING OF ARTICLE 7(1) OF THE MARKET ABUSE REGULATION (EU)

596/2014.

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS

(INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN

SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF

THE UNITED STATES OR THE DISTRICT OF COLUMBIA (the United States)

OR IN OR INTO ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO

RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT.

Tesco Corporate Treasury Services PLC announces final results of

its Tender Offer for its EUR1,250,000,000 1.375 per cent. Notes due

2019 and guaranteed by Tesco PLC

and

Tesco PLC announces final results of its Tender Offers for its

GBP350,000,000 5.50 per cent. Notes due 2019, GBP900,000,000 6.125

per cent. Notes due 2022, GBP200,000,000 6 per cent. Notes due

2029, GBP200,000,000 5.50 per cent. Notes due 2033, GBP300,000,000

4.875 per cent. Notes due 2042 and GBP500,000,000 5.20 per cent.

Notes due 2057

29 October 2018.

On 15 October 2018, Tesco Corporate Treasury Services PLC (TCTS)

announced an invitation to holders of its outstanding

EUR1,250,000,000 1.375 per cent. Notes due 2019 and guaranteed by

Tesco (as defined below) (ISIN: XS1082970853) (the July 2019 Notes)

and Tesco PLC (Tesco and, together with TCTS, the Offerors)

announced separate invitations to holders of its outstanding (a)

GBP350,000,000 5.50 per cent. Notes due 2019 (ISIN: XS0159013068)

(the December 2019 Notes), (b) GBP900,000,000 6.125 per cent. Notes

due 2022 (ISIN: XS0414345974) (the 2022 Notes), (c) GBP200,000,000

6 per cent. Notes due 2029 (ISIN: XS0105244585) (the 2029 Notes),

(d) GBP200,000,000 5.50 per cent. Notes due 2033 (ISIN:

XS0159013142) (the 2033 Notes), (e) GBP300,000,000 4.875 per cent.

Notes due 2042 (ISIN: XS0248395245) (the 2042 Notes) and (f)

GBP500,000,000 5.20 per cent. Notes due 2057 (ISIN: XS0289810318)

(the 2057 Notes and, together with the July 2019 Notes, the

December 2019 Notes, the 2022 Notes, the 2029 Notes, the 2033 Notes

and the 2042 Notes, the Notes and each a Series) to tender their

Notes for purchase by TCTS or Tesco, as applicable, for cash (each

such invitation an Offer and, together, the Offers).

The Offers expired at 4.00 p.m. (London time) on 26 October 2018

(the Expiration Deadline) and TCTS and Tesco now announce the final

results of the Offers.

The Offers were made on the terms and subject to the conditions

contained in the tender offer memorandum dated 15 October 2018 (the

Tender Offer Memorandum) prepared by the Offerors. Capitalised

terms used in this announcement but not defined have the meanings

given to them in the Tender Offer Memorandum.

Satisfaction of New Financing Condition

TCTS and Tesco announced earlier today that, following the

successful completion of the issue by TCTS of its EUR750,000,000

1.375 per cent. Notes due 2023 guaranteed by Tesco (the New Notes)

on 24 October 2018, the New Financing Condition has been

satisfied.

Applicable Sterling/Euro Exchange Rate and Applicable USD/Euro

Exchange Rate

As at the Expiration Deadline, the Applicable Sterling/Euro

Exchange Rate was GBP1 = EUR1.1271 and the Applicable USD/Euro

Exchange Rate was US$1 = EUR0.8793.

Series Acceptance Amounts and Scaling Factors

TCTS (in the case of the July 2019 Notes) and Tesco (in the case

of each Series other than the July 2019 Notes) announce that they

have decided to accept valid tenders of July 2019 Notes, December

2019 Notes, 2022 Notes, 2029 Notes, 2033 Notes, 2042 Notes and 2057

Notes pursuant to the relevant Offers on the basis set out in the

table below, and each Series Acceptance Amount, and the applicable

Scaling Factors that will apply as a consequence, will be as set

out in the table below.

Pricing and Settlement

Pricing for the Offers took place at or around 2.00 p.m. (London

time) today.

A summary of the final pricing for, and results of, the Offers

appears below:

Aggregate Scaling Benchmark Purchase Purchase Purchase

Nominal Amount Factor Security Spread Yield Price

Accepted for Rate

Purchase

------------ ---------------- --------------- --------------- --------------- --------------- ---------------

July 2019 EUR205,479,000 39.859 per Not Applicable Not Applicable -0.15 per 100.996 per

Notes cent. cent. cent.

------------ ---------------- --------------- --------------- --------------- --------------- ---------------

December GBP83,863,000 Not Applicable 0.730 per 40 bps 1.133 per 104.762 per

2019 Notes cent. cent. cent.

------------ ---------------- --------------- --------------- --------------- --------------- ---------------

2022 Notes GBP0 0 per cent. Not Applicable Not Applicable Not Applicable Not Applicable

------------ ---------------- --------------- --------------- --------------- --------------- ---------------

2029 Notes GBP0 0 per cent. Not Applicable Not Applicable Not Applicable Not Applicable

------------ ---------------- --------------- --------------- --------------- --------------- ---------------

2033 Notes GBP0 0 per cent. Not Applicable Not Applicable Not Applicable Not Applicable

2042 Notes GBP32,025,000 80.61320 1.841 per 205 bps 3.929 per 114.279 per

per cent. cent. cent. cent.

2057 Notes GBP56,350,000 80.61320 1.824 per 215 bps 3.974 per 124.018 per

per cent. cent. cent. cent.

TCTS or Tesco, as applicable, will also pay an Accrued Interest

Payment in respect of Notes accepted for purchase pursuant to the

Offers.

The Settlement Date in respect of any Notes accepted for

purchase pursuant to the Offers is expected to be 5 November 2018.

Following settlement of the Offers, EUR725,750,000 in aggregate

nominal amount of the July 2019 Notes, GBP96,904,000 in aggregate

nominal amount of the December 2019 Notes, GBP530,554,000 in

aggregate nominal amount of the 2022 Notes, GBP97,657,000 in

aggregate nominal amount of the 2029 Notes, GBP149,855,000 in

aggregate nominal amount of the 2033 Notes, GBP31,574,000 in

aggregate nominal amount of the 2042 Notes and GBP72,750,000 in

aggregate nominal amount of the 2057 Notes will remain

outstanding.

BNP Paribas (Telephone: +44 20 7595 8668; Attention: Liability

Management Group; Email: liability.management@bnpparibas.com),

Citigroup Global Markets Limited (Telephone: +44 20 7986 8969;

Attention: Liability Management Group; Email:

liabilitymanagement.europe@citi.com), Goldman Sachs International

(Telephone: +44 20 7774 9862; Attention: Liability Management

Group; Email: liabilitymanagement.eu@gs.com) and MUFG Securities

EMEA plc (Tel: +44 207 577 4048/+44 207 577 4218; Attention:

Liability Management Group; Email: DCM-LM@int.sc.mufg.jp) are

acting as Dealer Managers for the Offers.

Lucid Issuer Services Limited (Telephone: + 44 20 7704 0880;

Attention: Arlind Bytyqi; Email: tesco@lucid-is.com) is acting as

Information and Tender Agent for the Offers.

This announcement is released by Tesco PLC and Tesco Corporate

Treasury Services PLC and contains information that qualified or

may have qualified as inside information for the purposes of

Article 7 of the Market Abuse Regulation (EU) 596/2014 (MAR),

encompassing information relating to the Offers described above.

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is made by Robert

Welch, Group Company Secretary at Tesco PLC.

LEI Number: 2138002P5RNKC5W2JZ46

DISCLAIMER This announcement must be read in conjunction with

the Tender Offer Memorandum. No offer or invitation to acquire any

securities is being made pursuant to this announcement. The

distribution of this announcement and the Tender Offer Memorandum

in certain jurisdictions may be restricted by law. Persons into

whose possession this announcement and/or the Tender Offer

Memorandum come(s) are required by each of the Offerors, the Dealer

Managers and the Information and Tender Agent to inform themselves

about, and to observe, any such restrictions.

Neither this announcement nor the Tender Offer Memorandum is an

offer of securities for sale in the United States or to U.S.

persons (as defined in Regulation S of the United States Securities

Act of 1933, as amended (the Securities Act)). Securities may not

be offered or sold in the United States absent registration under,

or an exemption from the registration requirements of, the

Securities Act. The New Notes have not been, and will not be,

registered under the Securities Act or the securities laws of any

state or other jurisdiction of the United States, and may not be

offered, sold or delivered, directly or indirectly, in the United

States or to, or for the account or benefit of, U.S. persons.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RTEPGGAUUUPRGQB

(END) Dow Jones Newswires

October 29, 2018 12:24 ET (16:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

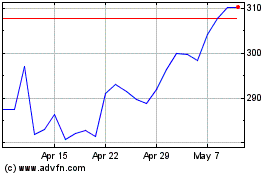

Tesco (LSE:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesco (LSE:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024