TIDMTHRU

RNS Number : 0747K

Thruvision Group PLC

19 December 2022

19 December 2022

Thruvision Group plc

(" Thruvision " or the " Group ")

Interim Results for the six months ended 30 September 2022

Thruvision Group plc (AIM: THRU), the specialist provider of

'safe distance' people-screening technology to the international

security market, announces unaudited results for the six months

ended 30 September 2022 (the first half of the Group's 2023

financial year - H1 2023) .

Key Highlights

-- Revenue was up 41% to GBP2.8 million (H1 2022: GBP2.0 million).

-- Two strategically important and larger than anticipated orders

received from US Customs and Border Protection (CBP) worth GBP8.7

million(1) ($9.7 million).

-- Despite challenging economic conditions for retailers, Profit

Protection product revenue for H1 was unchanged at GBP1.0 million

(H1 2022: GBP1.0 million) with good order intake since 1 October

from a combination of existing and new customers.

-- The Group's operating loss was GBP1.9 million (H1 2022: loss

of GBP2.0 million) and gross margin was 49% (H1 2022: 49%).

The Group's Adjusted EBITDA(2) loss was GBP1.6 million (H1 2022:

loss of GBP1.6 million).

-- The Group is currently on track to achieve its objective of

breaking even at Adjusted EBITDA this financial year for the

first time.

-- Cash balance as at 30 September 2022 was GBP1.1 million (31

March 2022: GBP5.4 million), with cash at 15 December 2022 of

GBP4.3 million.

(1) CBP US$ orders have been translated at the 30 September $:GBP

closing exchange rate of 1.12 throughout this announcement.

H1 2023 H1 2022

Continuing operations Unaudited Unaudited

GBPm GBPm Change

------------------------------ ----------- ----------- ---------

Statutory measures:

Revenue 2.8 2.0 +41%

Gross profit 1.4 1.0 +41%

Gross margin 49% 49% -

Operating loss (1.9) (2.0) +6%

Loss before tax (1.9) (2.0) +5%

Alternative measures:

Adjusted overheads (2) (3.2) (2.8) (13%)

Adjusted EBITDA (2) (1.6) (1.6) +1%

Adjusted loss before tax (2) (1.8) (1.9) +1%

------------------------------ ----------- ----------- ---------

(2) Alternative performance measures ('APMs') are used

consistently throughout this announcement and are referred to as

'adjusted'. These are defined in full and reconciled to the

reported statutory measures in the Appendix.

Commenting on the results, Colin Evans, Chief Executive of

Thruvision, said:

"With our unique offering and the traction we have gained in our

two core markets, Customs and Profit Protection, we expect to

deliver strong growth and achieve our objective of breaking even

this financial year. With over 100 of our highest-performance

cameras being deployed by US Customs and Border Protection (CBP)

over the coming months and with a multi-year purchasing framework

now in place, we expect further growth with this key customer over

the coming years as it starts a full rollout of our technology.

This significant opportunity, together with demand from other

customs agencies and our growing base of Profit Protection

customers should give us a profitable revenue base from which we

can now build the Group ."

For further information please contact:

Thruvision Group plc +44 (0)12 3542 5400

Tom Black, Chairman

Colin Evans, Chief Executive

Victoria Balchin, Chief Financial Officer

Investec Bank plc +44 (0)20 7597 5970

Patrick Robb / James Rudd / Sebastian Lawrence

FTI Consulting LLP +44 (0)20 3727 1000

Matt Dixon / Tom Blundell / Jemima Gurney

About Thruvision

Thruvision is the leading provider of safe distance, people

security screening technology. Using patented passive terahertz

technology, Thruvision is uniquely capable of detecting metallic

and non-metallic threats including weapons, explosives and

contraband items that are hidden under clothing, at distances

between 3m and 10m. Addressing the growing need for safe, fast and

effective security, Thruvision completely removes the need for

physical "pat-downs" and has been vetted and approved by the US

Transportation Security Administration for surface transportation.

Operationally deployed in 20 countries around the world, Thruvision

is used for aviation and transportation security, retail supply

chain loss prevention, facilities and public area protection and

customs and border control. The company has offices near Oxford and

Washington DC. www.thruvision.com

Important information

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Chairman's Statement

The Group saw trading momentum build through the period, despite

a worsening economic backdrop, culminating in the receipt of two

strategically important orders from US Customs and Border

Protection (CBP), via our US Government contracting partner,

totalling GBP8.7 million ($9.7 million). Revenue for the period was

GBP2.8 million, representing growth of 41% versus the comparable

period last year (H1 2022: GBP2.0 million), with our Customs and

Profit Protection markets accounting for almost the entirety of

this figure. In October, on receipt of the second order from CBP,

CBP order backlog stood at GBP7.4 million ($8.3 million), and

further non-CBP orders totalling GBP1.3 million have been received

since. We expect to deliver most, if not all, of this order backlog

during the second half of the financial year.

Customs

After successful pilot deployments in the summer of 2021, the

two CBP awards are an important milestone in the Group's strategic

development. Once delivered, CBP will have deployed over 100 of our

latest, high-performance cameras at land border crossings and

international airports where they will be used to check travellers

for contraband. One of the awards was made as the first purchase

under a framework purchasing agreement that CBP put in place during

the period. This agreement provides the mechanism through which CBP

can fulfil its publicly stated intention, as reported in our April

2022 update, to acquire significant further "passive body scanners"

in the period to September 2026.

Strategic adoption by CBP clearly assists our broader sales

efforts with other international Customs agencies. We received an

order for a sixth tranche of cameras from an existing Asian Customs

agency customer in November and we have several live opportunities

with other agencies where we expect to see progress in 2023.

Profit Protection

Almost all retail organisations we speak to report a rising

level of employee theft, potentially connected to the rapidly

increasing cost of living being felt in most global markets.

Therefore, while the economic situation has become increasingly

challenging for our Profit Protection customers, we have seen an

encouraging take-up of our new "WalkTHRU" screening lane solution

which we pioneered with Next and for which we recently won a retail

industry award . This solution comprises two cameras along with our

AI algorithm to significantly increase the throughput rate . This

allows 100% of employees to be screened quickly and effectively

thereby maximizing deterrence and delivering a strong return on

investment, with one major UK retailer calculating a payback within

six months of deploying Thruvision products.

Given employee theft is increasingly problematic and with a

growing list of flagship customers addressing the problem with our

solution, we remain confident that a combination of existing

customers buying more, and new retailers / third party logistics

(3PL) companies signing up will allow us to maintain our

performance in this market in the short term and return to growth

as economic conditions recover.

People

I am delighted to welcome Victoria Balchin, our new Chief

Financial Officer, who started with us in October 2022. Victoria

brings significant relevant experience to the Group. She qualified

as a chartered accountant with PwC and has held a number of finance

roles with British Sky Broadcasting Group plc, SABMiller plc,

Spectris plc and Brüel & Kjær Vibro, a Spectris business

headquartered in Germany. Victoria's appointment means that two of

the five members of the Board are now female.

After 12 years of service with the Group our Company Secretary,

John Woollhead, informed the board of his intention to retire at

the end of December. John has been a first-class and trusted

colleague for almost 20 years, and we will greatly miss his wise

counsel and good humour. John will be replaced by Hannah Platt, a

chartered accountant who qualified with EY and who has held a range

of commercial and company secretarial positions.

Outlook

The Group is entering a new phase in its development. With the

strategically significant purchasing framework with CBP now in

place and a material order backlog built for our second half, we

expect to deliver strong growth and achieve our objective of

breaking even this financial year.

Looking forward, the growing interest across our key markets

together with the enthusiasm with which our latest products have

been received by customers, gives us confidence that profitable

revenue growth will continue beyond the current period.

Strategic Update

Thruvision technology addresses the growing international need

to screen individuals for weapons, contraband or other illicit

items that might be concealed in their clothing. By operating at a

distance of around 3 metres from the person being screened,

Thruvision cameras are a very fast, flexible and effective way of

detecting non-metallic items in particular. Unlike airport body

scanners, Thruvision allows a security guard to see the concealed

item, meaning the need to physically touch the individual being

screened is removed.

These important competitive differentiators mean that Thruvision

has achieved critical mass in our two key markets - Customs and

Profit Protection, where we help reduce theft from retail

warehouses. In both markets, items being concealed are almost

always non-metallic - typically drugs and cash in Customs, and a

wide range of fashion, tobacco, alcohol, beauty and electronic

products in Retail. This means metal detectors (either walk-through

or handheld) do not work at all, and airport body scanners are

simply too slow and cumbersome to be effective in the very busy

border control and retail warehouse markets.

Given our growing, well-known "flagship" customer base in both

markets, we are now firmly established as a mainstream solution,

and we will continue to proactively invest in further sales

resource to drive growth. We remain engaged in the Aviation market

and in Entrance Screening but expect to see only modest revenue in

these markets in the short to medium term.

Business Review

Customs

As announced on 22 September and 5 October 2022, we received two

strategically important orders from US Customs and Border

Protection (CBP), via our US Government contracting partner,

totalling GBP8.7 million ($9.7 million) in September 2022. The

first of these orders, totalling GBP2.4 million ($2.7 million), was

to complete the process of upgrading CBP's existing fleet of 60

cameras to our latest high definition 16-channel variant. Half of

this first order was delivered in H1 with the balance to be

delivered in H2.

The second order, for GBP6.3 million ($7.0 million), was the

first to be received under a new framework purchasing agreement

which can, in principle, allow CBP to place additional orders for a

further four years up to the end of September 2026 . This order

further expands the CBP fleet of Thruvision equipment and is

expected to broaden operational deployments into major US

international airports for the first time. The order size is larger

than we had originally expected for FY23.

Our April 2022 trading update stated that CBP had made public

its intentions to acquire significant numbers of additional

"passive body scanners" during 2022 and beyond. The framework

purchasing agreement provides a mechanism through which CBP can

execute this intention. In this context, it is worth noting that in

total, Thruvision received orders worth

GBP12.5 million ($14.0 million) from CBP in the US Government's

last financial year (1 October 2021 to 30 September 2022).

Other orders received in this second half include an order from

an existing Asian Customs agency customer for a sixth tranche of

cameras to be delivered in the second half. We successfully beat

Chinese competition to this award. We continue to engage with

several other international Customs agencies (some existing

customers, others new) who are interested in acquiring Thruvision

products for contraband detection.

Profit Protection

The economic situation has become increasingly challenging for

retailers as the year has progressed and has resulted in our Profit

Protection product revenue for H1 being unchanged at GBP1.0 million

(H1 2022: GBP1.0 million). Encouragingly however, existing Profit

Protection customers have continued to expand and upgrade their

Thruvision fleets. This is because they now fully understand the

in-year return on investment that can be achieved by deploying our

technology. As discussed in the Chairman's Statement, we are seeing

strong interest in our latest "WalkTHRU" lane which we have now

sold to existing customers, Next and JD Sports in the UK, and a new

customer in the US, Saks Fifth Avenue.

Our focus on Third-Party Logistics providers (3PLs) which

operate significant numbers of distribution centres has also

delivered further success. In addition to CEVA, we have signed a

global supply framework agreement with a second major global 3PL,

which is headquartered in Germany. We have delivered a WalkTHRU

solution to one of this 3PL's high profile sites in the UK and are

discussing further deployments over the next few months with

them.

Aviation

While our solutions can be used for employee security screening

in airports in the US, passenger security screening is highly

regulated and requires accreditation. We started this process with

the US Transportation Security Administration (TSA) before the

pandemic and , after significant delays, testing has now

recommenced. Such accreditation would enable the use of our

solutions for passenger security screening in US airports. We are

seeing modest renewed demand from US airports for employee security

screening.

Entrance Security

Our key differentiator in this market is the ability to process

high visitor throughput rates and reliably detect mass casualty

threats such as military assault rifles and person-borne bomb

vests. We are seeing modest renewed interest, principally from the

Middle East although this is unlikely to become a reliable revenue

stream for the business.

Product Range

We are delighted with the uptake of our AI detection algorithm,

which is branded "Dynamic Detection". This has been included in the

latest cameras provided to CBP for Customs applications, and it is

enhancing the operational performance on our new WalkTHRU lane

described above. We continue to invest in further image processing

capabilities which we expect to add as software upgrades to our

camera range in calendar 2023, further weighting the value of our

solution towards software rather than purely hardware.

Supply chain

Despite well-documented global supply chain issues, we have

worked hard with our specialist Terahertz component suppliers to

maintain surety of supply of the very specific and even unique

components we require. Like others, we have been fully exposed to

global shortages of more mainstream electronics but have managed

this situation effectively by holding higher than normal levels of

inventory to mitigate delivery risk. Our ability to manufacture

using our US-based partner is now proven and is playing a

significant role in delivering the major CBP orders received in

September and October of this year.

People

Group headcount remained level at 47 during the period.

Financial review

Summary

Revenue for the six months ended 30 September 2022 was GBP2.8

million (H1 2022: GBP2.0 million; FY 2022: GBP8.4 million). H1 2023

contained a single large order from US Customs and Border

Protection (CBP) resulting in revenue of GBP1.3 million in the

period which did not occur in H1 2022. Gross margin remained level

with the prior period at 49% (H1 2022: 49%;

FY 2022: 47%).

Operating loss in the period was GBP1.9 million (H1 2022: loss

of GBP2.0 million; FY 2022: loss of GBP1.9 million).

Cash as of 30 September 2022 was GBP1.1 million (31 March 2022:

GBP5.4 million), with cash at 15 December 2022 of

GBP4.3 million. The majority of the reduction in cash during H1

relates to increases in our inventory balance to support delivery

of expected orders in H2 partly driven by targeted additional

inventory held for certain components where lead times were

becoming more uncertain.

Revenue

Revenue was GBP2.8 million in the six months to 30 September

2022 (H1 2022: GBP2.0 million, FY 2022: GBP8.4 million) and has

been split between our two principal activities (product revenue

and support and development revenue) as below:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- ----------

Product 2,364 1,622 7,667

Support and Development 407 340 694

------------------------- -------------- -------------- ----------

Total 2,771 1,962 8,361

------------------------- -------------- -------------- ----------

The principal growth driver for the business is product sales

and, while we expect to continue to be awarded customer funded

development contracts, we do not expect this to form a material

proportion of revenues in the future. Product revenue is split

further by sector below:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2022 2021 2022

Product revenue by sector GBP'000 GBP'000 GBP'000

--------------------------- -------------- -------------- ----------

Profit Protection 992 982 3,505

Customs 1,370 198 3,404

Aviation - 128 131

Entrance Security 2 314 627

Total 2,364 1,622 7,667

--------------------------- -------------- -------------- ----------

Gross Margin

Gross margin remained level with the comparable period at 49%

(H1 2022: 49%, FY 2022: 47%) and higher than the full year

results.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

---------------- -------------- -------------- ----------

Revenue 2,771 1,962 8,361

Gross Profit 1,356 961 3,902

---------------- -------------- -------------- ----------

Gross margin % 49% 49% 47%

---------------- -------------- -------------- ----------

Financial review (continued)

Administrative expenses

We continue to invest in sales and marketing activities relating

to Profit Protection in the US, whilst further investing in our

engineering, manufacturing capability and software development.

Administrative expenses increased by 9% to GBP3.2 million with

adjusted overheads up by 13% to GBP3.2 million compared to the

prior period. Administrative expenses include share-based payment

charges, but these are excluded from adjusted overheads. Adjusted

overheads as a proportion of sales were 115% (H1 2022: 144%; FY

2022: 74%) reflecting the growth and phasing of revenue and

continued tight control of overheads.

Sales and marketing expenditure increased by GBP82k with

additional headcount and travel to support growth in our European

and US Profit Protection markets.

Engineering costs, include Manufacturing and R&D costs,

increased by GBP146k as a result of increased headcount in our

software team as we look to scale up and increase our product

offerings going forward.

Management and PLC costs increased driven by one-off costs

relating to the CFO replacement, higher insurance costs and

professional fees.

Adjusted overheads are analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------------------------- -------------- -------------- ----------

Engineering 902 756 1,690

Sales and marketing 1,065 983 2,006

Property and administration 209 224 502

Management 597 338 708

PLC costs 354 240 693

Depreciation and amortisation 268 285 561

Foreign exchange (gains)

/ losses (203) 1 (6)

Adjusted overheads* 3,192 2,827 6,154

------------------------------- -------------- -------------- ----------

* Alternative performance measures ('APMs') are used

consistently throughout this report and are referred to as

'adjusted'. These are defined in full and reconciled to the

reported statutory measures in the Appendix.

Loss from continuing operations

The loss from continuing operations in the period was GBP1.9

million (H1 2022: loss of GBP1.9 million; FY 2022: loss of

GBP1.7 million). Adjusted loss before tax was GBP1.8 million (H1

2022: GBP1.9 million; FY 2022: loss of GBP2.3 million).

Balance sheet

Cash and cash equivalents at 30 September 2022 were GBP1.1

million (H1 2022: GBP4.1 million, FY 2022: GBP5.4 million), with

the principal impacts in the period being the loss recorded of

GBP1.8 million as well as the GBP2.7 million net working capital

outflow as set out in the cashflow statement on page 12.

Movements in working capital were as follows:

-- Trade and other receivables increased, driven by the timing

of sales, resulting in a GBP1.8 million outflow in the half

year. Included in trade and other receivables of GBP3.8m at

30 September 2022 was GBP2.4 million relating to CBP, the cash

for which was received during October and November.

-- Increased inventory to support expected orders in H2 FY 2023

as well as forward purchases of key electronic components resulted

in a GBP0.9 million outflow during in the period.

-- GBP0.3 million decrease in deferred revenue balances, as revenue

deferred as at 31 March 2022 was recognised as income during

the period.

-- An increase in trade and other payables resulted in an inflow

of GBP0.3 million. Trade creditors increased due to the timing

of stock purchases in the period.

Other

It is intended that a limited programme of share purchases by

the Thruvision plc EBT will be undertaken over the next 12 months

with the purpose of partly satisfying future employee exercises of

share options.

Consolidated income statement

6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March

2021 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

----------------------------------------- ------ ------------------ ------------- ----------------

Revenue 2 2,771 1,962 8,361

Cost of sales (1,415) (1,001) (4,459)

----------------------------------------- ------ ------------------ ------------- ----------------

Gross profit 1,356 961 3,902

Administrative expenses (3,243) (2,965) (5,788)

Operating loss (1,887) (2,004) (1,886)

Finance revenue 11 10 17

Finance costs (16) (7) (20)

----------------------------------------- ------ ------------------ ------------- ----------------

Loss before tax (1,892) (2,001) (1,889)

Income tax 89 87 231

----------------------------------------- ------ ------------------ ------------- ----------------

Loss for the period

from continuing operations (1,803) (1,914) (1,658)

----------------------------------------- ------ ------------------ ------------- ----------------

Discontinued operations

Loss from discontinued operation (net of tax) - (33) -

Loss for the period (1,803) (1,947) (1,658)

Basic and diluted loss

per share - continuing

operations 3 (1.23p) (1.31p) (1.14p)

----------------------------------------- ------ ------------------ ------------- ----------------

Consolidated statement of comprehensive income

6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March 2022

2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------- ------------------ ------------- --------------

Loss for the period from continuing operations (1,803) (1,914) (1,658)

Loss for the period from discontinued operations - (33) -

--------------------------------------------------------------- ------------------ ------------- --------------

Loss for the period

attributable to owners

of the parent (1,803) (1,947) (1,658)

Other comprehensive income/(expense) from continuing

operations

--------------------------------------------------------------- ------------------ ------------- --------------

Other comprehensive income that may be

subsequently reclassified to profit and loss:

Exchange differences

on retranslation

of foreign operations (45) 2 (6)

Total comprehensive loss attributable to owners of the parent (1,848) (1,945) (1,664)

--------------------------------------------------------------- ------------------ ------------- --------------

Consolidated statement of financial position

at 30 September 2022

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ------------- ------------- ----------

Assets

Non-current assets

Property, plant and

equipment 962 910 1,175

Other intangible assets 140 42 79

------------------------------ ----- ------------- ------------- ----------

1,102 952 1,254

Current assets

Inventories 4,772 5,257 3,868

Trade and other receivables 3,813 1,316 1,982

Current tax recoverable 302 270 210

Cash and cash equivalents 1,091 4,097 5,441

------------------------------ ----- ------------- ------------- ----------

9,978 10,940 11,501

------------------------------ ----- ------------- ------------- ----------

Total assets 11,080 11,892 12,755

Equity and liabilities

Attributable to owners

of the parent

Equity share capital 4 1,472 1,458 1,466

Share premium 308 47 201

Capital redemption

reserve 163 163 163

Translation reserve 16 69 61

Retained earnings 5,802 7,769 7,554

------------------------------ ----- ------------- ------------- ----------

Total equity 7,761 9,506 9,445

------------------------------ ----- ------------- ------------- ----------

Non-current liabilities

Other payables 518 259 600

Provisions 38 38 38

556 297 638

------------------------------ ----- ------------- ------------- ----------

Current liabilities

Trade and other payables 2,557 1,849 2,494

Provisions 206 240 178

2,763 2,089 2,672

------------------------------ ----- ------------- ------------- ----------

Total liabilities 3,319 2,386 3,310

------------------------------ ----- ------------- ------------- ----------

Total equity and liabilities 11,080 11,892 12,755

------------------------------ ----- ------------- ------------- ----------

Consolidated statement of changes in equity (unaudited)

Ordinary Share Capital Translation Retained Total

share premium redemption reserve earnings equity

capital GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

----------------------- --------- --------- ------------ --------------- ------------ -----------------

At 31 March 2021 1,458 47 163 67 9,578 11,313

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Share based payment

charge - - - - 138 138

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders - - - - 138 138

Loss for the period - - - - (1,947) (1,947)

Other comprehensive

income - - - 2 - 2

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

income/(loss) - - - 2 (1,947) (1,945)

----------------------- --------- --------- ------------ --------------- ------------ -----------------

At 30 September 2021 1,458 47 163 69 7,769 9,506

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Shares issued 8 154 - - - 162

Share based payment

credit - - - - (504) (504)

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders 8 154 - - (504) (342)

Profit for the period - - - - 289 289

Other comprehensive

expense - - - (8) - (8)

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

(loss)/income - - - (8) 289 281

----------------------- --------- --------- ------------ --------------- ------------ -----------------

At 31 March 2022 1,466 201 163 61 7,554 9,445

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Shares issued 6 107 - - - 113

Share based payment

charge - - - - 51 51

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders 6 107 - - 51 164

Loss for the period - - - - (1,803) (1,803)

Other comprehensive

loss - - - (45) - (45)

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

loss - - - (45) (1,803) (1,848)

----------------------- --------- --------- ------------ --------------- ------------ -----------------

At 30 September

2022 1,472 308 163 16 5,802 7,761

----------------------- --------- --------- ------------ --------------- ------------ -----------------

Consolidated statement of cash flows

6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March

2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------------------------------- ------------------ ------------- -----------

Operating activities

Loss for the period (1,803) (1,947) (1,658)

-------------------------------------------------------------------- ------------------ ------------- -----------

Adjustments:

Depreciation of property, plant and equipment 258 278 546

Amortisation of intangible assets 10 7 15

Share-based payment charge/(credit) 51 138 (366)

Profit on disposal of property, plant & equipment (10) - -

Finance income (10) (10) (17)

Finance costs 16 7 20

Taxation credit (89) (87) (231)

Working capital movements:

(Increase) / decrease in trade and other receivables (1,811) 126 (540)

(Increase) / decrease in inventories (904) (838) 551

Increase / (decrease) in trade and other payables 348 (487) 305

Increase in provisions 28 65 3

Decrease in deferred revenue (322) (460) (683)

Transfer from property, plant and equipment to inventory - 25 70

Cash utilised in operations (4,238) (3,183) (1,985)

Tax received - 197 399

-------------------------------------------------------------------- ------------------ ------------- -----------

Net cash outflow from operating activities (4,238) (2,986) (1,586)

-------------------------------------------------------------------- ------------------ ------------- -----------

Investing activities

Purchase of property, plant & equipment (26) (111) (187)

Purchase of intangible assets (70) - (46)

Proceeds from disposal of property, plant and equipment 11 - -

Interest received 10 10 17

Net cash outflow from investing activities (75) (101) (216)

-------------------------------------------------------------------- ------------------ ------------- -----------

Financing activities

Proceeds from issues of shares 93 - 162

Payments on principal portion of lease liabilities (81) (82) (168)

Interest paid on lease liabilities (4) (7) (13)

Net cash inflow / (outflow) from financing activities 8 (89) (19)

-------------------------------------------------------------------- ------------------ ------------- -----------

Net decrease in cash and cash equivalents (4,305) (3,176) (1,821)

Cash and cash equivalents at beginning of the period 5,441 7,268 7,268

Effect of foreign exchange rate changes on cash and cash

equivalents (45) 5 (6)

-------------------------------------------------------------------- ------------------ ------------- -----------

Cash and cash equivalents at end of the period 1,091 4,097 5,441

-------------------------------------------------------------------- ------------------ ------------- -----------

Notes to the financial statements

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of

Thruvision Group plc and all of its subsidiary undertakings

(together "the Group") drawn up at 30 September 2022 and have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting" ("IAS 34") as adopted for use in the

European Union ("EU"). The consolidated interim financial

statements have been prepared using accounting policies and methods

of computation consistent with those applied in the consolidated

financial statements for the period ended 31 March 2022.

The Group is a public limited company incorporated and domiciled

in England & Wales and whose shares are quoted on AIM, a market

operated by The London Stock Exchange.

All values are rounded to GBP'000 except where otherwise

stated.

Accounting policies

The annual consolidated financial statements of the Group are

prepared on the basis of International Financial Reporting

Standards ("IFRS"). The consolidated interim financial statements

are presented on a condensed basis as permitted by IAS 34 and

therefore do not include all the disclosures that would otherwise

be required in a full set of financial statements and should be

read in conjunction with the most recent Annual Report and Accounts

which were approved by the Board of Directors on 29 September 2022

and have been filed with Companies House. The condensed interim

financial statements do not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006 and are unaudited

for all periods presented. The financial information for the

12-month period ended 31 March 2022 is extracted from the financial

statements for that period. The auditors' report on those financial

statements was unqualified and did not contain an emphasis of

matter reference and did not contain a statement under section

498(2) or (3) of the Companies Act 2006 .

The half year results for the current period to 30 September

2022 have not been audited or reviewed by auditors pursuant to the

Auditing Practices Board guidance of Review of Interim Financial

Information.

Adoption of new and revised International Financial Reporting

Standards

The Group's accounting policies have been prepared in accordance

with IFRS effective as at its reporting date of

30 September 2022.

Standards Issued

The standards and interpretations that are issued up to the date

of issuance of the Group's interim financial statements are

disclosed below. The Group has adopted these standards, if

applicable, when these became effective. Further details are

disclosed in the 31 March 2022 Annual Report available on the

Group's website: www.thruvision.com.

Accounting developments - new standards, amendments and

interpretations issued and adopted

There were no new accounting standards or amendments requiring

disclosure in the period.

Going concern

The Group's loss before tax from continuing operations for the

period was GBP1.9 million (H1 2022: GBP2.0 million; FY 2022: GBP1.9

million). As at 30 September 2022 the Group had net current assets

of GBP7.2 million (30 September 2021: GBP8.9 million; 31 March

2022: GBP8.8 million) and net cash reserves of GBP1.1 million (30

September 2021: GBP4.1 million; 31 March 2022: GBP5.4 million).

Additionally cash and cash equivalents were GBP4.3 million as at 15

December 2022.

The Board has reviewed cash flow forecasts for the period up to

and including 31 December 2023. These forecasts and projections

take into account reasonably possible changes in trading

performance and show that the Group will be able to react as

required in order to operate within the level of current funding

resources, and no need for the Group to take on any debt. In order

to stress-test the adoption of the going concern basis, a cashflow

forecast was also produced which looked at the highly unlikely

scenario in which no further sales took place and certain

discretionary areas of cash expenditure were reduced. This showed

that even under this extreme condition, the Group would still have

positive cash reserves as at 31 December 2023 with no need to take

on external debt. The Directors therefore believe there is

sufficient cash available to the Group to manage through these

requirements.

As with all businesses, there are particular times of the year

where the Group's working capital requirements are at their peak.

However, the Group is well placed to manage business risk

effectively and the Board reviews the Group's performance against

budgets and forecasts on a regular basis to ensure action is taken

where needed.

The Directors therefore are satisfied that the Group has

adequate resources to continue operating for a period of at least

12 months from the approval of these accounts. For this reason,

they have adopted the going concern basis in preparing the

financial statements.

Notes to the financial statements (continued)

2. Segmental information

The Directors do not split the business into segments in order

to internally analyse the business performance. The Directors

believe that allocating overheads by department provides a suitable

level of business insight. The overhead department cost centres

comprise of Engineering (manufacturing and R&D), sales and

marketing, property and administration, Management and PLC costs,

with the split of costs as shown in the Half Year Report on page

7.

Analysis of revenue by customer

There have been two (H1 2022: three, FY 2022: two) individually

material customer(s) (each comprising in excess of 10% of revenue)

during the period. These customers individually represented

GBP1,335k and GBP415k of revenue (H1 2022: GBP359k, GBP206k and

GBP200k, FY 2022: GBP3,740k and GBP1,059k).

The Group's revenue by customer's geographical location is

detailed below:

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------- ------------- ------------- ------------

UK and Europe 990 1,033 3,508

Americas 1,759 693 4,445

Rest of World 22 236 408

2,771 1,962 8,361

--------------- ------------- ------------- ------------

The Group's revenue by type is detailed below:

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------- ------------- ------------- ------------

Revenue recognised at point in

time 2,398 1,662 7,718

Revenue recognised over time

- extended warranty and support

revenue 373 300 643

2,771 1,962 8,361

---------------------------------- ------------- ------------- ------------

The Group's non-current assets by geography are detailed

below:

As at As at As at

30 September 30 September 31 March

2022 2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------- -------------- -------------- -------------

UK 1,037 828 1,157

Americas 65 124 97

1,102 952 1,254

---------- -------------- -------------- -------------

Notes to the financial statements (continued)

3. Loss per share

The following reflects the loss and share data used in the basic

and diluted loss per share calculations:

Loss per share 6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March

2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------------------------- ------------------ ------------- ----------------

Loss from continuing operations attributable to ordinary

shareholders (1,803) (1,914) (1,658)

----------------------------------------------------------------- ------------------ ------------- ----------------

Loss from continuing and discontinued operations attributable to

ordinary shareholders (1,803) (1,947) (1,658)

Weighted average number of shares 147,097,721 145,779,118 145,853,091

----------------------------------------------------------------- ------------------ ------------- ----------------

Basic and diluted loss per share - continuing operations (1.23p) (1.31p) (1.14p)

----------------------------------------------------------------- ------------------ ------------- ----------------

Basic and diluted loss per share - continuing and discontinued

operations (1.23p) (1.34p) (1.14p)

----------------------------------------------------------------- ------------------ ------------- ----------------

The inclusion of potential Ordinary Shares arising from Share

based payments (LTIP awards and EMI Options) would be

anti-dilutive. Basic and diluted loss per share has therefore been

calculated using the same weighted number of shares.

4. Issued share capital

As at 30 September 2022, there were 147,165,718 Ordinary Shares

in issue (30 September 2021: 145,779,118;

31 March 2022: 146,589,118).

APPIX - ALTERNATIVE PERFORMANCE MEASURES

Policy

Thruvision uses adjusted figures as key performance measures in

addition to those reported under IFRS, as management believe these

measures enable management and stakeholders to assess the

underlying trading performance of the businesses as they exclude

certain items that are considered to be significant in nature

and/or quantum.

The alternative performance measures ('APMs') are consistent

with how the businesses' performance is planned and reported within

the internal management reporting to the Board. Some of these

measures are used for the purpose of setting remuneration

targets.

The key APMs that the Group uses include adjusted measures for

the income statement together with adjusted cash flow measures.

Explanations of how they are calculated and how they are reconciled

to an IFRS statutory measure are set out below.

Adjusted measures

The Group's policy is to exclude items that are considered to be

significant in nature and/or quantum and where treatment as an

adjusted item provides stakeholders with additional useful

information to better assess the period-on-period trading

performance of the Group. The Group excludes certain items, which

management have defined for 2023 and 2022 as:

- Share based payments charge or income

Based on the above policy, the adjusted performance measures are

derived from the statutory figures as follows

a) Adjusted overheads

6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March 2022

2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------ ------------- ---------------

Administrative expenses (3,243) (2,965) (5,788)

------------------------------------- ------------------ ------------- ---------------

Add back:

Share-based payment charge/(credit) 51 138 (366)

------------------------------------- ------------------ ------------- ---------------

Adjusted overheads (3,192) (2,827) (6,154)

------------------------------------- ------------------ ------------- ---------------

b) Adjusted EBITDA

6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March 2022

2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------ ------------- -----------------

Statutory operating loss (1,887) (2,004) (1,886)

------------------------------------- ------------------ ------------- -----------------

Add back:

Depreciation and amortisation 268 285 561

Share-based payment charge/(credit) 51 138 (366)

------------------------------------- ------------------ ------------- -----------------

Adjusted EBITDA (1,568) (1,581) (1,691)

------------------------------------- ------------------ ------------- -----------------

c) Adjusted loss before tax

6 months ended 6 months Year ended

ended

30 September 2022 30 September 31 March

2021 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------ ------------- -----------

Statutory loss before tax (1,892) (2,001) (1,889)

------------------------------------- ------------------ ------------- -----------

Add back:

Share-based payment charge/(credit) 51 138 (366)

------------------------------------- ------------------ ------------- -----------

Adjusted loss before tax (1,841) (1,863) (2,255)

------------------------------------- ------------------ ------------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FVLFFLLLBFBQ

(END) Dow Jones Newswires

December 19, 2022 02:00 ET (07:00 GMT)

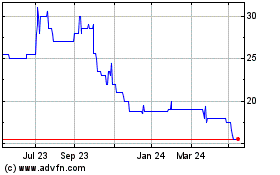

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

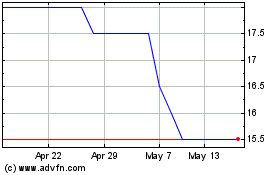

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024