TIDMTHRU

RNS Number : 1862P

Thruvision Group PLC

08 June 2020

8 June 2020

Thruvision Group plc

(" Thruvision " or the " Group ")

Results for the Year ended 31 March 2020

Thruvision (AIM: THRU), the specialist provider of

people-screening technology to the international security market,

announces results for the financial year ended 31 March 2020.

Highlights

-- Good revenue growth to GBP8.0 million (2019: GBP6.0 million)

with operating loss before tax reduced to GBP1.7 million (2019:

GBP2.1 million);

-- Adjusted loss before tax* of GBP1.2 million (2019: GBP1.7 million);

-- Ten new customers in the year accounting for 55% of units

sold and including US Customs, British Government and Morrisons,

along with repeat orders from four existing customers;

-- Notable uptake of new product variants which has led to

increased average revenue per unit and gross profit margins;

-- COVID-19 pandemic is changing the security industry landscape

by prioritising the need for 'safe distance' security screening

technology like Thruvision;

-- Cash at 31 March 2020 of GBP8.4 million (31 March 2019: GBP9.4 million).

* Adjusted loss before tax is defined as loss before tax from

continuing operations, adding back share-based payments and share

buyback costs.

On 19 March 2020 Thruvision Group Plc entered into a trade with

Investec to sell $4.4m USD at the available spot rate. IFRS 9

requires the gain to be recorded within Current Assets and as such

the difference in value between the prevailing year end USD/GBP

exchange rate and the value of the contract is not recorded with

the Group's cash and cash equivalents. The gain was GBP0.2m

realised and reported in April 2020 as a result.

Commenting on the results, Colin Evans, Chief Executive,

said:

"We have had a positive year, albeit affected in the latter

stages by the COVID-19 pandemic. Our three key markets of Profit

Protection, Customs and, most recently, Aviation have all performed

well, validating our decision to place our focus in these areas.

Looking forward, each of these markets is strongly driven by the

requirement for 'safe distance' security measures and the need to

remove physical "patdowns" . I have been encouraged by the

increased interest in our technology and resulting new sales

opportunities in recent weeks.

Our broadening product range, robust balance sheet and the

strength of our sales pipeline mean we are well positioned to

continue to trade through this difficult period and we remain

confident about our medium-term prospects."

For further information please contact:

Thruvision Group plc +44 (0)1235 425 400

Tom Black, Executive Chairman

Colin Evans, Chief Executive

Investec Bank PLC (NOMAD & Broker) +44 (0)20 7597 5970

Patrick Robb / James Rudd / Sebastian Lawrence

FTI Consulting LLP

+44 (0)20 3727 1000

Matt Dixon / Shamma Kelly

About Thruvision

Thruvision is the leading provider of safe distance, people

security screening technology. Using patented passive terahertz

technology, Thruvision is uniquely capable of detecting metallic

and non-metallic threats including weapons, explosives and

contraband items that are hidden under clothing, at distances

between 3m and 10m. Addressing the growing need for safe, fast and

effective security, Thruvision completely removes the need for

physical "pat-downs" and has been vetted and approved by the US

Transportation Security Administration for surface transportation.

Operationally deployed in 20 countries around the world, Thruvision

is used for aviation and transportation security, retail supply

chain loss prevention, facilities and public area protection and

customs and border control. The company has offices near Oxford,

and Washington DC.

www.thruvision.com

Chairman's statement

The Group achieved good growth in the year with revenues up by

34% to GBP8.0m. This was achieved by ten new customers taking

delivery of their first units combined with existing customers

expanding their Thruvision unit count. Although entirely new

customers are vital to any growth business, the latter group is

particularly pleasing as it provides solid evidence of our

technology's effectiveness. While revenue growth was marginally

behind our initial expectations, due to the start of the COVID-19

impact in March, good progress was made in the eleven months prior

to that. This, together with the quality of our current sales

pipeline, suggests that we remain well on track to become a

mainstream supplier of people screening security technology to the

international market.

Trading, Markets and COVID-19

Before the COVID-19 crisis struck, it was already becoming

evident that our greatest opportunities lie in the Customs, Profit

Protection and most recently Aviation markets, where regulatory

demands and return-on-investment underpin the business case to

purchase Thruvision's products. In the Customs market, we added US

Customs and Border Protection (CBP) and Macau Customs as new

customers, and saw follow on awards from US State Department's

Bureau of International Narcotics and Law Enforcement (INL), and

Hong Kong Customs. In Profit Protection, Morrisons selected

Thruvision to underpin its distribution centre security upgrade

programme across the UK, and we secured orders from two further new

customers, including our first in North America. On the strength of

this progress, we are investing in launching our Profit Protection

offering into certain countries in mainland Europe.

In Aviation, we continued to make good progress with the US

Transportation Security Administration's (TSA's) testing and trials

programme to obtain the necessary approvals to operate in the

highly regulated passenger screening market. Our newly developed

AI-based detection algorithm, developed to meet US legal

requirements, is performing well and, since period end, La Guardia

Airport has purchased Thruvision units using this new capability

for screening employees in its flagship new terminal.

The COVID-19 crisis caused inevitable delays in order flow in

the last month of the period but, more significantly, it has had a

profound impact on our industry landscape, which is likely to drive

long-term positive effects for the Group. Legacy security

solutions, such as walk-through metal detectors and traditional

airport body scanners, often require close-proximity physical

searches to resolve alarms. It is now clear that the security

industry cannot continue with such searches, and many organisations

are therefore reviewing how they can safely maintain security in

the future. Since Thruvision operates at a physically distant range

of several metres and obviates the need for physical searches, our

'safe distance' security technology is attracting considerable new

interest.

We previously reported that we were developing several new

product variants. We have been very pleased with the uptake which

increased our average revenue per unit and gross margins. Although

this interest has been across our whole customer base, we were

particularly pleased to receive our first development order for the

Group's new higher performance 16-channel sensor from a global

technology firm seeking to improve data centre security, a new and

developing market segment for us.

Through the COVID-19 lockdown period in both the UK and US, we

have been able to maintain both sales and manufacturing operations,

albeit at reduced levels, while prioritising the health and

wellbeing of our staff . Based on the most recent UK Government

guidance, we are now increasing activity levels again and I would

like to thank our staff for their dedication and commitment through

this difficult period. Our headcount has now reached 37 and we are

continuing to invest further in sales staff in North America, the

UK and Europe.

The Board is acutely aware that, as I cannot be regarded as

independent due to my long association with Thruvision, we have

only one Independent Director and the Board has started discussing

the timing of adding another Independent Director. In the meantime,

we have a full-time Company Secretary and continue to operate to

very high levels of governance for a business of our size .

Outlook

Although the COVID-19 crisis caused a slowdown in sales in

March, we have maintained good levels of engagement with customers

throughout. In fact, our 'safe distance' people screening

capability, which removes the need for physical searches, has given

additional impetus to a number of sales opportunities where we were

already well placed. We successfully maintained operations through

the lockdown, and our supply chain remains solidly intact. Given

the evolving nature of COVID-19, it remains too early to provide

guidance on the Group's prospects for the financial year ending 31

March 2021. However, given our healthy cash balance, zero debt and

strengthening sales pipeline based on an increased need for 'safe

distance' security post COVID-19, we remain confident about our

strategic prospects.

Update on strategy

Thruvision addresses the growing international need to safely,

quickly and comprehensively security screen individuals for

weapons, contraband or other illicit non-metallic items that might

be concealed in their clothing. The two most widely deployed

existing technologies, walk-through metal detectors and airport

body scanners do not meet this need. Critically, both these

technologies require close proximity, physical search to resolve

alarms, and the COVID-19 pandemic is forcing security users

globally to re-evaluate the safety implications of this.

Thruvision comprehensively solves this problem. By allowing a

security guard to see concealed items of any material, as small as

3cm by 3cm, and from a safe distance of 3 metres, Thruvision

completely removes the need for physical search. This combination

of safe distance, contactless operation with reliable,

comprehensive detection is unique to Thruvision.

With a growing list of internationally recognised 'flagship'

government and commercial customers now in place, we have

transitioned our technology from an early stage niche into the

mainstream international security market. With this transition, we

have refined our focus onto the three key markets where purchasing

of people security screening technology is either driven by

regulation or commercial return on investment. These are:

-- Customs - now a well-established market for Thruvision where

we are screening for predominantly non-metallic, prohibited items

such as cash and drugs, at all types of border checkpoints

including airports, land crossings, seaports, cruise-liner

terminals, bridges and railway stations. Customers are national

government agencies resulting in total order quantities that could

be substantial although sales cycles are extended by government

procurement procedures. Key customers here now include US Customs

and Border Protection (CBP), Hong Kong Customs, Macau Customs and

the US State Department's Bureau of International Narcotics and Law

Enforcement (INL).

-- Profit Protection - another well-established market

(previously referred to as Loss Prevention) where we are screening

again for largely non-metallic items being stolen by employees from

retail distribution centres. The market consists of a potentially

very large number of retailers covering a number of sub-sectors

including grocery, fashion, electronics, healthcare, and supporting

third-party logistics. With a clear financial return on investment

driving purchasing, relatively short sales cycles have been

demonstrated. Flagship customers include Morrisons, Next, JD

Sports, Matalan, Sony and Hermes.

-- Aviation - this has become a new key market in the last year

where we are screening people for prohibited items in the regulated

environment at airport security checkpoints. Today we have TSA

approval for screening employees at airports in the US, with Los

Angeles, Seattle and LaGuardia Airports all now customers. We are

also steadily working through the necessary TSA approvals for

Thruvision to be also used for passenger screening in the US which

should then also open the international aviation security market to

us. The COVID-19 crisis has injected urgency into identifying and

deploying 'contactless' security technology into airports globally

which is helping us make more rapid progress in this area than

would otherwise be the case.

With this refinement of focus we are now optimising our product

range to meet the specific needs of each of these markets, and we

are investing in strengthening our sales and marketing teams in

these areas.

We continue to operate in and receive interest from two further

markets, characterised by weapons detection and counter-terrorism,

where the nature and likelihood of the threat generally leads to

longer new customer purchasing cycles. These markets are:

-- Surface Transport - this is where we are screening for

suicide vests and automatic weapons at railways, subways and

airport concourses. Customers in this segment include governments

and a combination of city or regional public sector organisations.

We have TSA approval for this kind of high-throughput 'detection at

range' requirement and key customers include Los Angeles Metro and

the Philippines Government.

-- Entrance Protection - this is where we are screening for

weapons at entrances to high profile or high security buildings,

sports and entertainment venues and other public areas. Covering

both public and private sector sites, the aim here is to ensure

sites are protected from non-metallic threat items and to speed up

the process of screening visitors. A key customer here is the

British Government's Brexit Negotiation Headquarters in central

London.

We have ensured our product range continues to meet the needs of

both these markets, but we have adopted a more reactive stance

given the weaker market demand in these areas. We are seeing some

pick up in interest due to COVID-19 and will re-evaluate this

stance over the coming months as the fuller implications of living

in a post-pandemic world become clearer.

Business Review

Sales

Although curtailed by the impact of the COVID-19 crisis in

March, we still recorded good sales performance for the year, with

a total of 114 units shipped (2019: 109). Importantly, this

included ten new customers including 'flagship' organisations CBP,

Morrisons and Los Angeles World Airports. These new customer sales

accounted for 55% of units sold with the balance being purchased by

existing customers. Customs was our strongest segment accounting

for half of units sold and with Profit Protection and Surface

Transport accounting for almost a quarter each.

Regional updates

-- Americas : We continued to focus heavily on the Customs and

Aviation segments and saw 54% of revenue in the period come from

customers in the US. We secured headline orders from the State

Department's Bureau of International Narcotics and Law Enforcement

(INL) and CBP, and since the year-end, LaGuardia Airport for

employee screening. As a result of the COVID-19 crisis, we have

seen added impetus in the aviation market where 'safe distance'

security is clearly needed and where we expect to build on the good

progress so far by obtaining the TSA approvals needed for passenger

screening in airports. Separately, we received our first order from

our Profit Protection sales partner and secured a contract from a

global technology firm to develop a solution capable of reliably

detecting data sticks to enhance data centre security.

-- UK and Europe : Our primary regional focus has been building

our Profit Protection business, and we continued to make good

progress. We secured two new customers during the year, Sports

Direct and Morrisons which rolled Thruvision out across all its

distribution centres as part of a significant security upgrade

programme. Separately, the British Government selected our

technology to form the basis of new visitor-friending security for

the Brexit Trade Negotiations Headquarters in central London.

-- Asia Pacific : Here, we focused on the Customs and Surface

Transport segments. We deployed a fifth batch of units with our

Hong Kong customer and won a competitive tender to supply units to

Macau Customs. We received a fourth order from our

Philippines-based partner for Transportation security. Given the

COVID-19 crisis, we decided to reduce our direct investment in

expanding our footprint in the region. This resulted in the closure

of our Sydney office and we will focus on managing our existing

partner network from the UK for the foreseeable future.

-- Middle East and Africa : Our dedicated sales investment in

this region enjoyed a good year of pipeline building in all the

major GCC states. With an emphasis on Customs and entrance

security, we expect to see sales starting to come through as

regional economies recover from the COVID-19 crisis.

Routes to market

Our routes to market vary depending on region and market sector.

We operate directly with end customers in the US where we have

built strong relationships across TSA, CBP, State Department and

the Defense Department. We currently install and support Thruvision

deployments in the US directly but are building out our partner set

to provide a country-wide support infrastructure as our units are

deployed operationally across the country.

For Profit Protection in the UK and Europe, we mostly sell

directly to end-customers, although we are starting to appoint

Profit Protection-specific partners in mainland Europe where we

believe interest levels are increasing. Similarly, we work through

local partners in Asia Pacific and the Middle East, where we engage

with end customers directly alongside our local partners. With

international travel now severely restricted for the foreseeable

future, we have further developed our video conference-based

product demonstration and training capability to maintain

momentum.

Manufacturing and support

Our manufacturing capability is now mature and, including our

outsourced US facility, capable of producing the near- to

medium-term volumes we are expecting. We have the infrastructure in

place to take production levels higher than this if demand dictates

and we remain confident of our ability to scale production as

needed.

We have rolled out a more comprehensive support offering to key

customers that offers a complete maintenance programme for an

annual charge. This is proving to be especially important for US

Government buyers and is allowing us to build up recurring revenue.

We are also starting to see a number of customers moving into an

equipment refresh cycle for our older units, and we have also been

able to offer a trade-in or upgrade path for these.

New product development

We have seen rapid market adoption of our Thruvision TAC8

product which we launched in the summer of 2018, after its approval

by the TSA. As well as driving our average revenue per unit higher,

it has also formed the basis our new product range including our

LPC8, designed specifically for the profit protection market and

our new aviation checkpoint camera, the CPC8 purchased by LaGuardia

Airport.

As well as making significant improvements to our hardware, we

completed our AI-based image processing software during the year.

This forms the basis of our new automatic threat detection

capability which is an important element of our CPC8 product.

Looking forward, we expect to further expand our product range

in FY21 to include a new very high-throughput, multi-person

entrance screening product.

Competition

As we move into the broader mainstream market, we are starting

to compete more directly with airport body scanners in a number of

areas with the aim of expanding our market share here in due

course. We continue to see a handful of smaller, early stage

technology companies in the market, focused principally on the

entrance security market. None of these have yet entered any form

of formal TSA testing and we do not believe any have yet reached a

significant level of sales. We maintain a watching brief.

IP protection

We continue to invest in the research and development of the

Thruvision product range and, where appropriate, suitable patent

protection is put in place. During the year, applications for two

additional patents were submitted to the Patent Office and they are

currently being assessed in accordance with the normal patent

application process.

Staff

We increased headcount from 34 to 37 staff through the year.

This increase was predominantly in Sales and Sales Support. Due to

the significant global slowdown caused by the COVID-19 pandemic, we

closed our Sydney operation at the end of the year but we expect to

further strengthen our aviation and profit protection sales and

marketing teams in FY21. Voluntary staff attrition was nil.

As a manufacturing business with recently upgraded production

facilities, we have been able to implement, with minimal

operational impact, new working practices that fully comply with

the UK Government's latest guidelines on social distancing and

related health and safety at work. We will continue to monitor this

guidance, both in the UK and the US, to ensure that we continue to

comply fully with best practice in this regard as it develops.

Financial Review

Summary

For the year ended 31 March 2020, Thruvision revenues grew by

34% to GBP8.0 million (2019: GBP6.0 million) which resulted in a

reduced operating loss of GBP1.7 million (2019 loss: GBP2.1

million).

The Directors believe that adjusted loss before tax is currently

an important measure of the performance of the business. The Group

recorded an adjusted loss of GBP1.2 million (2019: GBP1.7 million).

This was arrived at as follows:

Adjusted loss:

2020 2019

GBP'000 GBP'000

------------------------------------------- -------- --------

Loss before tax from continuing operations (1,502) (2,060)

Share-based payment 297 207

Share buyback costs - 119

------------------------------------------- -------- --------

Adjusted loss before tax for the year from

continuing operations (1,205) (1,734)

------------------------------------------- -------- --------

Further details on the above are provided in note 4.

New product sales of Thruvision units resulted in 114 units

delivered in 2020 (2019: 109) at a unit gross margin of 48% (2019:

40%). This included ten new customers and repeat business with four

others. The introduction of the higher priced new TSA-approved

Thruvision TAC8 unit helped increase overall Gross Margin to 47%

(2019: 39%). Unit sales increased by over 400% in our main target

market of the US and the remainder were spread evenly across all

regions, showing balanced growth. Average revenue per unit

increased to GBP68k (2019: GBP54k) year-on-year as a result of

being able to achieve higher pricing on existing models as the

business became more established and starting to sell the new

higher priced TAC8 models in the US.

A focus on the reduction of non-productive overheads, which

continued to reduce as a percentage of revenue, generated savings

that were used to partially offset our investment in the Sales and

Marketing resource required to drive growth, and to expand our

manufacturing capacity to deal with expected short to medium-term

demand. Three employees joined the company during the year to

increase our sales and marketing capacity.

The cash balance at the year-end was GBP8.4 million (2019:

GBP9.4 million) as a result of good control over cash collections

from customers. We also completed a further major order to the

Philippines in Q4 again this year, resulting in a debtor over the

period-end of GBP1.75 million. It is expected that this cash will

be received by December 2020.

Key Performance Indicators ('KPIs')

We consider the following to be our KPIs which track the trading

performance and position of the business.

KPIs

2020 2019

GBP'000 GBP'000

-------------------------- -------- --------

Revenue 8,002 5,981

Number of units shipped 114 109

Average revenue per unit 68 54

Gross Profit 3,760 2,327

Gross Margin 47% 39%

Overheads (5,280) (4,277)

Operating loss (1,729) (2,108)

Number of employees at 31

March 2020 37 34

-------------------------- -------- --------

Revenue

Thruvision revenues grew by 34% to GBP8.0 million (2019: GBP6.0

million). Revenues from unit sales contributed GBP7.8 million

(2019: GBP5.9 million), and development revenue was GBP0.2 million

(2019: GBP0.1 million).

The growth in revenues over the prior year was based on an

increase in the number of units delivered (noting March order flow

was reduced by COVID-19 lockdown) and an increase in average

revenue per unit. The strategic progress made with various US

Federal Government agencies is reflected in the strong revenue

growth here, and we expect to see the US remain the primary focus

moving forwards.

2020 2019

Revenue GBP'000 GBP'000

--------------------- -------- --------

Units 7,765 5,901

Development 237 80

--------------------- -------- --------

Total 8,002 5,981

--------------------- -------- --------

2020 2019

Revenue by Geography GBP'000 GBP'000

--------------------- -------- --------

UK & Europe 1,234 1,338

Americas 4,311 975

Asia-Pacific 2,430 3,640

Middle East & Africa 27 28

--------------------- -------- --------

Total 8,002 5,981

--------------------- -------- --------

Gross Profit

Gross Profit increased to GBP3.8 million in the period (2019:

GBP2.3 million) with Gross Margin increasing to 47% (2019: 39%).

The Gross Margin increase was due to a higher mix of the new

TSA-approved TAC8 product sales, the consequent improvement in

Average Revenue Per Unit, and by further manufacturing-cost

reductions compared to the prior year. Product Gross Margin

increased to 48% (2019: 40%) and was offset, in a minor way, by

delivering the one customer-funded development project in the year

at broadly break-even.

2020 2019

Gross Margin GBP'000 GBP'000

------------------------- -------- --------

Unit Revenue 7,765 5,901

Unit Gross Profit 3,755 2,337

------------------------- -------- --------

Gross Margin % 48% 40%

Development Revenue 237 80

Development Gross Profit 6 (10)

------------------------- -------- --------

Gross Margin % 2% (13)%

Overall Revenue 8,002 5,981

Overall Gross Profit 3,761 2,327

------------------------- -------- --------

Gross Margin % 47% 39%

------------------------- -------- --------

Overheads

Overheads increased by 23% to GBP5.3 million (2019: GBP4.3

million) primarily due to a focus on sales and marketing investment

. Overall however, they reduced as a % of revenue and we continue

to focus on closely managing our overhead base whilst growing the

business.

Sales & Marketing expenditure was increased by GBP0.5

million to invest in our strategically important US and Profit

Protection markets. This additional investment was made to

capitalise on our 'flagship' customer deployments in these regions

and was used to increase direct marketing and provide enhanced

pre-sales capability.

Manufacturing and R&D engineering costs increased by GBP0.3

million where we focused on increasing production capacity and

strengthening our software capability, particularly to enable the

development of new AI-based threat-detection algorithms.

Property and administration costs increased due to the full year

effect of recruitment in late FY19, while depreciation increased

principally due to the effect of operating lease costs now being

recognised as depreciation under IFRS 16 (amounting to GBP158k and

not being comparable to last year) and manufacturing facility

investments made late in FY19.

PLC costs decreased due to lower levels of legal and

professional costs incurred in year.

2020 2019

Overheads GBP'000 GBP'000

------------------------------ -------- --------

Engineering 1,510 1,268

Sales and Marketing 1,557 1,100

Property and administration 492 432

Management 738 701

PLC costs 533 595

Depreciation and amortisation 450 181

------------------------------ -------- --------

Total Overheads 5,280 4,277

------------------------------ -------- --------

LTIP 297 207

------------------------------ -------- --------

Share buyback costs - 119

------------------------------ -------- --------

FX (gains) (88) (163)

------------------------------ -------- --------

Total Administration

costs 5,489 4,440

------------------------------ -------- --------

Looking forward, we expect to see further investment,

principally in Sales & Marketing, but at a rate below the

headline growth rate of the business. We do not expect to

materially increase management and administration or PLC costs in

the near-term.

Operating loss

Operating Loss from operations before tax including

depreciation, share-based payments, FX and interest improved to

GBP1.7 million (2019 loss: GBP2.1 million).

Discontinued profit/loss

Additional deferred consideration, in excess of expectations

last year, were received in the year totalling GBP265k. Other

discontinued costs relate to the closure of our Australian office

as well as further minor professional advisor costs in relation to

the discontinued part of the business.

Taxation

As a result of brought-forward tax losses we do not expect to

pay the full rate of UK corporation tax in the next financial year.

The Income Statement tax credit for the year of GBP223k (2019:

GBP23k) relates to the expected R&D tax credit reclaim, with

the increase this year primarily due to a prudent assessment last

year on the expected R&D credit receivable.

At 31 March 2020, the Group had unutilised tax losses carried

forward of approximately GBP11.5 million (2019: GBP10.5 million).

Given the varying degrees of uncertainty as to the timescale of

utilisation of these losses, the Group has not recognised GBP11.5

million (2019: GBP10.8 million) of potential deferred tax assets

associated with these losses. At 31 March 2020, the Group's net

deferred tax liability stood at GBPnil (2019: GBPnil).

Cash

The Group cash and cash equivalents at 31 March 2020 were GBP8.4

million (2019: GBP9.4 million).

On 19 March 2020 Thruvision Group Plc entered into a trade with

Investec to sell $4.4m USD at the available spot rate on the day of

1.1735. As the company was not able to transact the swap on the day

due to the cash being in a 31-day savings account a forward

contract was taken out. This meant the company was able to fix the

overall $4.4m balance at a favourable fixed rate in GBP cash, which

was completed on 22 April 2020.

IFRS 9 requires this balance to be recorded as a Derivative

financial instrument and as such the difference in value between

the prevailing year end USD/GBP exchange rate of 1.24 and the value

of the contract is not recorded with the Group's cash and cash

equivalents. The company had initially recorded this deal as a cash

equivalent of GBP0.2m and included as cash in the Group's RNS of 4

April 2020. Subsequently this was presented separately as a

Derivative financial instrument.

On 22 April 2020 the contract with Investec was completed and

Thruvision Group Plc recorded a GBP0.2m increase in its cash

balances on that date.

The overall cash outflow of GBP1.0 million for the year ended 31

March 2020 was in line with the operating loss of the business, as

good working capital management ensured that the growth in revenue

had minimal impact on cash reserves being tied up in working

capital. Stock value at 31 March 2020 was GBP3.7 million (2019:

GBP3.3 million) which was somewhat higher than planned and in part

due to a delay in several orders closing in March as a result of

the COVID-19 pandemic.

Currency Impact

The Group generated foreign currency exchange gains during the

period of GBP0.3 million (2019: GBP0.2 million), principally due to

the above FX forward transaction converting excess USD into GBP

shortly before the year end generating a gain of GBP0.2 million.

These gains are split within the Income Statement between

Administration costs and Finance Income.

Consolidated income statement

for the year ended 31 March 2020

Year ended Year ended

31 March 31 March

2020 2019

Notes GBP'000 GBP'000

Continuing operations

Revenue 2 8,002 5,981

Cost of sales (4,242) (3,654)

------------------------------------------------------ ----- ---------- ----------

Gross profit 3,760 2,327

Administration costs (5,489) (4,440)

Other income - 5

------------------------------------------------------ ----- ---------- ----------

Operating loss 3 (1,729) (2,108)

Finance income 5 253 78

Finance costs (26) (30)

------------------------------------------------------ ----- ---------- ----------

Loss before tax (1,502) (2,060)

Income tax 223 23

------------------------------------------------------ ----- ---------- ----------

Loss for the period / year from continuing operations (1,279) (2,037)

------------------------------------------------------ ----- ---------- ----------

Discontinued operations

Profit/(loss) from discontinued operations after

tax 12 189 (233)

------------------------------------------------------ ----- ---------- ----------

Loss for the year (1,090) (2,270)

------------------------------------------------------ ----- ---------- ----------

Adjusted loss: 4

Loss before tax from continuing operations (1,502) (2,060)

Share-based payment 4 297 207

Share buyback costs 4 - 119

------------------------------------------------------ ----- ---------- ----------

Adjusted loss before tax for the year from continuing

operations (1,205) (1,734)

------------------------------------------------------ ----- ---------- ----------

Loss per share - continuing operations

Loss per share - basic 6 (0.88p) (1.33p)

Loss per share - diluted 6 (0.88p) (1.33p)

Loss per share - continuing and discontinued

operations

Loss per share - basic 6 (0.75p) (1.49p)

Loss per share - diluted 6 (0.75p) (1.49p)

------------------------------------------------------ ----- ---------- ----------

Consolidated statement of comprehensive income

for the year ended 31 March 2020

Year ended Year ended

31 March 31 March

2020 2019

GBP'000 GBP'000

-------------------------------------------------------- ---------- ----------

Loss for the year from continuing operations (1,279) (2,037)

-------------------------------------------------------- ---------- ----------

Profit/(loss) for the year from discontinued operations 189 (233)

-------------------------------------------------------- ---------- ----------

Loss for the year attributable to owners of the parent (1,090) (2,270)

-------------------------------------------------------- ---------- ----------

Other comprehensive income/(loss) from continuing

operations

-------------------------------------------------------- ---------- ----------

Exchange differences on retranslation of foreign

operations - continuing 101 6

-------------------------------------------------------- ---------- ----------

Net other comprehensive income to be reclassified

to profit or loss in subsequent periods 101 6

-------------------------------------------------------- ---------- ----------

Total comprehensive loss attributable to owners of

the parent (989) (2,264)

-------------------------------------------------------- ---------- ----------

Consolidated statement of financial position

at 31 March 2020

31 March 31 March

2020 2019

Notes GBP'000 GBP'000

Assets

Non current assets

Property, plant and equipment 1,238 760

Intangible assets 62 7

------------------------------------- ----- -------- --------

1,300 767

------------------------------------- ----- -------- --------

Current assets

Inventories 3,671 3,349

Trade and other receivables 7 2,221 2,690

Derivative financial instrument 203 -

Current tax recoverable 296 114

Cash and cash equivalents 8,431 9,375

------------------------------------- ----- -------- --------

14,822 15,528

------------------------------------- ----- -------- --------

Total assets 16,122 16,295

------------------------------------- ----- -------- --------

Equity and liabilities

Attributable to owners of the parent

Equity share capital 9 1,455 1,618

Share premium - -

Capital redemption reserve 163 -

Translation reserve 115 14

Retained earnings 11,652 12,445

------------------------------------- ----- -------- --------

Total equity 13,385 14,077

------------------------------------- ----- -------- --------

Non current liabilities

Other payables 305 -

Provisions 38 38

343 38

------------------------------------- ----- -------- --------

Current liabilities

------------------------------------- ----- -------- --------

Trade and other payables 8 2,394 2,180

Total liabilities 2,737 2,218

------------------------------------- ----- -------- --------

Total equity and liabilities 16,122 16,295

------------------------------------- ----- -------- --------

Consolidated statement of changes in equity

for the year ended 31 March 2020

Ordinary Share Capital

share premium redemption Translation Retained Total

capital account reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- --------- ----------- ----------- --------- --------

At 31 March 2018 1,814 109,078 4,786 8 (96,207) 19,479

------------------------- -------- --------- ----------- ----------- --------- --------

Capital redemption - (109,078) (4,786) - 113,864 -

Share buyback (196) - - - (3,149) (3,345)

Share-based payment

credit - - - - 207 207

------------------------- -------- --------- ----------- ----------- --------- --------

Transactions with

shareholders (196) (109,078) (4,786) - 110,922 (3,138)

------------------------- -------- --------- ----------- ----------- --------- --------

Gain/(loss) for the

year - - - - (2,270) (2,270)

Other comprehensive

gain/(loss) - - - 6 - 6

------------------------- -------- --------- ----------- ----------- --------- --------

Total comprehensive

gain/(loss) - - - 6 (2,270) (2,264)

------------------------- -------- --------- ----------- ----------- --------- --------

At 31 March 2019 1,618 - - 14 12,445 14,077

------------------------- -------- --------- ----------- ----------- --------- --------

Cancellation of deferred

shares (163) - 163 - - -

Share-based payment

credit - - - - 297 297

------------------------- -------- --------- ----------- ----------- --------- --------

Transactions with

shareholders (163) - 163 - 297 297

------------------------- -------- --------- ----------- ----------- --------- --------

Gain/(loss) for the

year - - - - (1,090) (1,090)

Other comprehensive

gain/(loss) - - - 101 - 101

------------------------- -------- --------- ----------- ----------- --------- --------

Total comprehensive

gain/(loss) - - - 101 (1,090) (989)

------------------------- -------- --------- ----------- ----------- --------- --------

At 31 March 2020 1,455 - 163 115 11,652 13,385

------------------------- -------- --------- ----------- ----------- --------- --------

Consolidated statement of cash flows

for the year ended 31 March 2020

Year ended Year ended

31 March 31 March

2020 2019

GBP'000 GBP'000

------------------------------------------------------ ---------- ----------

Operating activities

Loss before tax from continuing operations (1,502) (2,060)

Profit/(loss) before tax from discontinued operations 189 (233)

------------------------------------------------------- ---------- ----------

Loss before tax (1,313) (2,293)

------------------------------------------------------- ---------- ----------

Non-cash adjustment to reconcile loss before

tax to net cash flows

Depreciation of property, plant and equipment 444 179

Amortisation of intangible assets 7 2

Leasing obligation repayments (previously in

administration costs) (186) -

Share-based payment transaction expense 297 207

Unrealised gains on foreign exchange 48 (25)

Disposal of fixed assets 42 28

Finance income (50) (78)

Finance costs 26 30

Working capital adjustments:

Increase in trade and other receivables (21) (1,724)

Increase in inventories (322) (1,536)

Increase in trade and other payables (123) 545

Increase in deferred revenue 185 156

Decrease in provisions - (27)

------------------------------------------------------- ---------- ----------

Cash utilised in operations (966) (4,536)

Net tax receipts 56 -

------------------------------------------------------- ---------- ----------

Net cash flow from operating activities (910) (4,536)

------------------------------------------------------- ---------- ----------

Investing activities

Purchase of property, plant & equipment (340) (579)

Expenditure on intangible assets (62) (7)

Interest received 50 78

Deferred consideration from disposal of Video

Business 265 182

------------------------------------------------------- ---------- ----------

Net cash flow from investing activities (87) (326)

------------------------------------------------------- ---------- ----------

Financing activities

Share buyback - reduction in share capital - (3,345)

Net cash flow from financing activities - (3,345)

------------------------------------------------------- ---------- ----------

Net (decrease)/increase in cash and cash equivalents (997) (8,207)

Cash and cash equivalents at the beginning of

the year 9,375 17,587

Effect of foreign exchange rate changes on cash

and cash equivalents 53 (5)

Cash and cash equivalents at end of year 8,431 9,375

------------------------------------------------------- ---------- ----------

Notes to the financial information

1. Accounting policies

Basis of preparation

The principle financial policies of the Group are set out in the

Group's 2019 annual report and financial statements. One new

standard became effective from 1 April 2019:

-- IFRS 16 Leases, which replaced IAS 17.

As permitted by the standard the group applied IFRS 16 on a

modified retrospective basis without restating prior years.

The impact of adopting IFRS 16 on 1 April 2019 resulted in an

increase in right of use assets of GBP623k, and an increase in

lease liabilities of GBP623k. As at 31 March 2020 the NBV value of

right of use assets within Fixed assets was GBP461k with a

corresponding liability of GBP457k.

The adoption of IFRS 16 has also had a timing effect on how we

have recognised the cost of leases in our income statement which

has resulted in FY20 costs not being directly comparable to

FY19.

Full disclosure of the transition will be included in the 2020

Financial Statements, but the Company has not identified any

changes to its accounting policies that require retrospective

adjustment.

All values are rounded to GBP'000 except where otherwise

stated.

The Company is a public limited company incorporated and

domiciled in England and Wales and whose shares are quoted on AIM,

a market operated by the London Stock Exchange.

Going Concern

The Group's loss before tax from continuing operations for the

period was GBP1.5 million (2019: GBP2.1 million). As at 31 March

2020 the Group had net current assets of GBP12.3 million (31 March

2019: GBP13.3 million) and net cash reserves of GBP8.4 million (31

March 2019: GBP9.4 million).

The Board has reviewed various cash flow forecast scenario for

the period up to and including 30 June 2021 all of which show a

positive cash position and no need for the Group to take on any

debt. In addition to this the Board reviewed cash forecasts in

March assuming the worst-case scenarios where no sales were made

for twelve months, with stock purchases dramatically reduced to

only committed orders, and other worst-case scenarios including

trade receivables recoverability. These forecasts, updated for

events occurring since the year end, showed that the Group would

still have cGBP3m cash at 30 June 2021. Following from this

forecast, further sales as well as cash has been received, meaning

that this worst-case scenario is no longer plausible. These

forecasts and projections take into account the potential impact

that the Covid-19 pandemic may have for at least the next six to

twelve months of trading performance and show that the Group will

be able to operate within the level of current funding resources.

The Directors therefore believe there is sufficient cash available

to the Group to manage through these requirements.

As with all businesses, there are particular times of the year

where the Group's working capital requirements are at their peak.

The Group is well placed to manage business risk effectively and

the Board reviews the Group's performance against budgets and

forecasts on a regular basis to ensure action is taken where

needed.

The Directors therefore are satisfied that the Group has

adequate resources to continue operating for a period of at least

12 months from the approval of these accounts. For this reason,

they have adopted the going concern basis in preparing the

financial statements.

2. Segmental information

The directors do not split the business into segments in order

to internally analyse the business performance and as a result the

results of the business are only presented below as continuing and

discontinued. The directors believe that allocating overheads by

department provides a suitable level of business insight. The

overhead department cost centers comprise of:

-- engineering (manufacturing and R&D)

-- sales and marketing,

-- property and administration,

-- management

-- plc costs

Following its disposal on 31 October 2017 the Video Business has

been reported as a discontinued operation. The profit disclosed

this year within discontinued operations includes further amounts

due on deferred consideration as part of the Share Purchase

Agreement on the sale of the Video Business. Further details are

provided in note 12.

In accordance with IFRS 8, the Group has derived the information

for its operating segments using the information used by the Chief

Operating Decision Maker and supplemented this with additional

analysis to assist readers of the Annual Report to better

understand the impact of the Group's current trading performance.

The Group has identified the Board of Directors as the Chief

Operating Decision Maker as it is responsible for the allocation of

resources to operating segments and assessing their

performance.

Video Business Thruvision

Discontinued Continuing Total

Year ended 31 March 2020 GBP'000 GBP'000 GBP'000

------------------------------------------- -------------- ----------- --------

Revenue - 8,002 8,002

------------------------------------------- -------------- ----------- --------

Depreciation and amortisation - 444 444

------------------------------------------- -------------- ----------- --------

Segment adjusted operating profit/(loss) 189 (1,432) (1,243)

------------------------------------------- -------------- ----------- --------

Share based payment charge - (297) (297)

------------------------------------------- -------------- ----------- --------

Segment operating profit/(loss) 189 (1,729) (1,540)

------------------------------------------- -------------- ----------- --------

Finance income - 253 50

Finance costs - (26) (26)

------------------------------------------- -------------- ----------- --------

Segment profit/(loss) before tax 189 (1,502) (1,313)

------------------------------------------- -------------- ----------- --------

Income tax (charge)/credit - 223 223

------------------------------------------- -------------- ----------- --------

Profit/(loss) for the year from continuing

operations 189 (1,279) (1,090)

------------------------------------------- -------------- ----------- --------

2. Segmental information (continued)

Video Business Thruvision

Discontinued Continuing Total

Year ended 31 March 2019 GBP'000 GBP'000 GBP'000

--------------------------------------------- -------------- ----------- --------

Revenue - 5,981 5,981

--------------------------------------------- -------------- ----------- --------

Depreciation and amortisation - 181 181

--------------------------------------------- -------------- ----------- --------

Segment adjusted operating (loss) (233) (1,901) (2,134)

--------------------------------------------- -------------- ----------- --------

Share based payment charge - (207) (207)

--------------------------------------------- -------------- ----------- --------

Segment operating (loss) (233) (2,108) (2,341)

--------------------------------------------- -------------- ----------- --------

Finance income - 78 78

Finance costs - (30) (30)

--------------------------------------------- -------------- ----------- --------

Segment (loss) before tax (233) (2,060) (2,293)

--------------------------------------------- -------------- ----------- --------

Income tax (charge)/credit - 23 23

--------------------------------------------- -------------- ----------- --------

Loss for the year from continuing operations (233) (2,037) (2,270)

--------------------------------------------- -------------- ----------- --------

Analysis of revenue by customer

There have been five (2019: two) individually material customers

(comprising over 10% of total revenue) in the year. These customers

individually represented GBP2,227,000, GBP1,397,000, GBP1,359,000,

GBP965,000 and GBP897,000 of revenue for the year (2019:

GBP2,310,000 and GBP808,000).

Other segment information

The following tables provides disclosure of the Group's

continuing and discontinued revenue analysed by geographical market

based on the location of the customer.

The Group's Revenue by geographical area are detailed below:

2020 2019

GBP'000 GBP'000

----------------------- -------- --------

UK and Europe 1,234 1,338

Americas 4,311 975

Asia-Pacific 2,430 3,640

Middle East and Africa 27 28

8,002 5,981

----------------------- -------- --------

The Group's non-current assets by geography are detailed

below:

2020 2019

GBP'000 GBP'000

------------------------- -------- --------

United Kingdom 1,127 737

United States of America 173 30

------------------------- -------- --------

1,300 767

------------------------- -------- --------

3. Group operating loss

The Group operating loss attributable to continuing operations

is stated after charging/(crediting):

2020 2019

GBP'000 GBP'000

------------------------------------------------------- -------- --------

Operating lease rentals - land and buildings * - 152

Research and development costs 549 429

Bad debt expense - 12

Depreciation of property, plant and equipment 437 179

Amortisation of intangible assets initially recognised

on acquisition 7 2

Exchange gains (88) (163)

------------------------------------------------------- -------- --------

* Due to a change in accounting policy effective 1 April 2019,

property and motor vehicle long term leases are accounted for under

IFRS 16 Leases.

Auditors' remuneration

The following table shows an analysis of all fees payable to

Grant Thornton UK LLP, the Group's auditors:

2020 2019

GBP'000 GBP'000

Audit services

Fees payable to the Company's auditor for the

audit of the financial statements 37 42

The audit of the Company's subsidiaries 20 17

---------------------------------------------- -------- --------

57 59

---------------------------------------------- -------- --------

Non-audit services

Tax advisory services 19 61

Other non-audit services 7 9

---------------------------------------------- -------- --------

26 70

---------------------------------------------- -------- --------

Fees relate to all activities undertaken by Grant Thornton UK

LLP (2019: Grant Thornton UK LLP) in the period, covering

continuing and discontinued operations.

4. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a better measure of the Group's

underlying performance. Adjusted loss is not defined under IFRS and

has been shown as the Directors consider this to be helpful for a

better understanding of the performance of the Group's underlying

business. It may not be comparable with similarly titled

measurements reported by other companies and is not intended to be

a substitute for, or superior to, IFRS measures of profit. The net

adjustments to loss before tax from continuing operations are

summarised below:

2020 2019

GBP'000 GBP'000

Share based payment (i) 297 207

Share buyback costs (ii) - 119

------------------------- -------- --------

Total adjustments 297 326

------------------------- -------- --------

(i) The performance condition associated with LTIP awards made

in January 2019 are subject to a non-market based performance

measure. Accordingly, should these LTIP awards fail to vest, the

share-based payment charge will be added back to the income

statement. To date the majority of historic LTIP awards have failed

to vest. The inclusion provides consistency over time allowing a

better understanding of the financial position of the Group.

(ii) Share buyback costs incurred represent additional legal and

professional fees incurred as a result of the share buyback carried

out in August 2018.

5. Finance income

2020 2019

GBP'000 GBP'000

------------------------------------------------ -------- --------

Gain on forward contract measured at fair value

through income statement 203 -

Bank interest receivable 50 78

------------------------------------------------ -------- --------

253 78

------------------------------------------------ -------- --------

6. Loss per share

Unadjusted loss per share

Year ended Year ended

31 March 31 March

2020 2019

GBP'000 GBP'000

------------------------------------------------- ----------- -----------

Loss from continuing operations attributable to

ordinary shareholders (1,279) (2,037)

------------------------------------------------- ----------- -----------

Loss from continuing and discontinued operations

attributable to ordinary shareholders (1,090) (2,270)

------------------------------------------------- ----------- -----------

Weighted average number of shares 145,454,118 152,839,321

------------------------------------------------- ----------- -----------

Basic and diluted loss per share - continuing

operations (0.88p) (1.33p)

------------------------------------------------- ----------- -----------

Basic and diluted loss per share - continuing

and discontinued operations (0.75p) (1.49p)

------------------------------------------------- ----------- -----------

Adjusted loss per share

Year ended Year ended

31 March 31 March

2020 2019

GBP'000 GBP'000

--------------------------------------------------- ----------- -----------

Loss from continuing operations attributable to

ordinary shareholders (1,279) (2,037)

--------------------------------------------------- ----------- -----------

Share-based payment 297 207

--------------------------------------------------- ----------- -----------

Financing set up fees - 119

--------------------------------------------------- ----------- -----------

Adjusted (loss)/profit after tax (982) (1,711)

--------------------------------------------------- ----------- -----------

Weighted average number of shares 145,454,118 152,839,321

--------------------------------------------------- ----------- -----------

Basic and diluted loss per share (0.88p) (1.33p)

--------------------------------------------------- ----------- -----------

Basic and diluted adjusted (loss)/profit per share (0.68p) (1.12p)

--------------------------------------------------- ----------- -----------

7. Trade and other receivables

Gross carrying Provision Net carrying Gross carrying Provision Net carrying

amounts for impairment amounts amounts for impairment amounts

2020 2020 2020 2019 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------------- --------------- ------------ -------------- --------------- ------------

Trade receivables 2,102 - 2,102 2,262 - 2,262

Prepayments 93 - 93 158 - 158

Accrued income - - - 1 - 1

VAT recoverable - - - 87 - 87

Deferred consideration - - - 123 - 123

Other receivables 26 - 26 59 - 59

----------------------- -------------- --------------- ------------ -------------- --------------- ------------

2,221 - 2,221 2,690 - 2,690

----------------------- -------------- --------------- ------------ -------------- --------------- ------------

Trade receivables

The Group's credit risk on trade and other receivables is

primarily attributable to one receivable. One customer represents

GBP1,754,000 of the Group's trade receivables at 31 March 2020

(2019: one customer GBP1,608,000). There is no other significant

concentration of credit risk.

The Group believes that the carrying amounts of the Group's

trade receivables by the type of customer gives a fair presentation

of the credit quality of the assets:

2020 2019

GBP'000 GBP'000

--------------------- -------- --------

Government customers 27 200

Commercial customers 2,075 2,062

--------------------- -------- --------

2,102 2,262

--------------------- -------- --------

Trade receivables, net of an allowance of GBPnil (2019: GBPnil)

for doubtful debts, are aged as follows:

2020 2019

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Within credit terms 1,907 2,081

Not more than three months past due 6 32

More than three months but not more than six months

past due 21 147

More than six months past due 168 2

---------------------------------------------------- -------- --------

2,102 2,262

---------------------------------------------------- -------- --------

8. Trade and other payables

2020 2019

GBP'000 GBP'000

-------------------------------- -------- --------

Current

Trade payables 877 1,240

Accruals 789 586

Deferred income 447 262

Social security and other taxes 75 72

VAT payable 39 -

Right of use lease liabilities 152 -

Other payables 15 20

-------------------------------- -------- --------

2,394 2,180

-------------------------------- -------- --------

At 31 March 2020 the amount owing on secured creditors was

GBPnil (31 March 2019: GBPnil).

9. Share capital

Number GBP'000

----------------------------------------------- ------------ -------

Authorised, allotted, called-up and fully paid

Ordinary Shares of 1 pence each

At 31 March 2018 165,130,024 1,651

----------------------------------------------- ------------ -------

Share buyback (1) (19,675,906) (196)

----------------------------------------------- ------------ -------

At 31 March 2019 and 31 March 2020 145,454,118 1,455

----------------------------------------------- ------------ -------

Number GBP'000

----------------------------------------------- --------- -------

Authorised, allotted, called-up and fully paid

Deferred Shares of GBP1 each

----------------------------------------------- --------- -------

At 31 March 2018 and 31 March 2019 163,124 163

----------------------------------------------- --------- -------

Cancellation of deferred shares (2) (163,124) (163)

----------------------------------------------- --------- -------

At 31 March 2020 - -

----------------------------------------------- --------- -------

GBP'000

-------------------- -------

Total share capital

-------------------- -------

At 31 March 2019 1,618

-------------------- -------

At 31 March 2020 1,455

-------------------- -------

(1) The Board announced on 12 March 2018 to return up to GBP8.0

million to shareholders. GBP3,345k was subsequently returned to

shareholders in August 2018 at 17p per share, with 19,675,906

shares being cancelled.

(2) On 22 February 2010, 217,500 Incentive shares were issued to

three directors. Of these shares 163,124 failed to vest and were

converted to deferred shares with nominal value. Following

shareholder approval at the 2019 AGM, 163,124 deferred shares were

bought back by the Company for total consideration of GBP3 and

subsequently cancelled on 25 September 2019.

10. Related party transactions

Remuneration

The remuneration of Directors and other members of key

management, recognised in the income statement, is set out below in

aggregate. Key management are defined as the Board of Thruvision

Group plc and other persons classified as 'persons discharging

managerial responsibility' under the rules of the Financial Conduct

Authority. Currently no employees outside of the Directors are

classified as 'persons discharging managerial responsibility'.

2020 2019

GBP'000 GBP'000

------------------------ -------- --------

Directors' remuneration 481 480

Pension contributions 5 3

------------------------ -------- --------

486 483

------------------------ -------- --------

The highest paid Director received GBP235,000 (2019: GBP235,000)

in the year, with GBPnil in pensions contributions (2019: GBPnil).

Key management compensation comprises short -- term employee

benefits (including national insurance) of GBP591,000 (2019:

GBP545,000), pension contributions of GBP5,000 (2019: GBP3,000) and

share-based payments of GBP120,000 (2019: GBP84,000).

The Directors share-holding at the year-end are as detailed

below (based on the year end share price of GBP0.145 per share

(2019: GBP0.2865 per share):

2020 2019 2020 2019

No of shares No of shares GBP'000 GBP'000

------------ -------------- ------------- --------- --------

Tom Black 11,349,444 11,349,444 1,645 3,252

Colin Evans 2,423,900 2,423,900 351 694

Paul Taylor 272,489 272,489 40 78

------------ -------------- ------------- --------- --------

11. Post balance sheet event

The Group has no post balance sheet events.

12. Profit/(loss) from discontinued operations

Video Business

On 7 October 2017 the Board signed an agreement for the disposal

of the Video Business segment to Volpi Capital LLP for a maximum

consideration payable of GBP27.5 million in cash of which GBP25.5

million was payable on completion (on a cash free/debt free basis)

and the remaining GBP2.0 million payable subject to the Video

Business securing a specific trading contract within 12 months

following completion. Further amounts have become payable in the

year ended 31 March 2019 as a result of sales of a specific

category of inventory. As more than twelve months have passed since

the deferred consideration balance was reduced to GBPnil, further

assessments are no longer considered necessary.

Costs included in 2019 included an amount due under warranties

as part of the Video Business sale which was not known at the point

of signing the FY18 accounts, as well as a reassessment of the

likely amount due in deferred consideration.

The sale completed on 31 October 2017, with the following being

attributable to the disposal group:

12. Profit/(loss) from discontinued operations (continued)

Discontinued Operations - Income statement

2020 2019

GBP'000 GBP'000

------------------------------------------------------ -------- --------

Contingent consideration received (sale of inventory) 265 -

Loss on disposal and exit costs (31) (233)

Profit/(loss) before tax attributable to Digital

Barriers discontinued operation 234 (233)

------------------------------------------------------ -------- --------

Income tax credit/(expense) - -

------------------------------------------------------ -------- --------

Loss after tax attributable to Digital Barriers

discontinued operation 234 (233)

------------------------------------------------------ -------- --------

Closure of Australasia Office (45) -

------------------------------------------------------- ---- -----

Loss after tax attributable to discontinued operations 189 (233)

------------------------------------------------------- ---- -----

No tax arises on disposal income or expenditure.

Cash flows

Cash flows attributable to the disposal group include:

2020 2019

GBP'000 GBP'000

---------------------------------------------------- -------- --------

Net cash flows attributable to operating activities (31) (138)

Net cash flows attributable to investing activities 265 182

Net cash flows attributable to financing activities - -

---------------------------------------------------- -------- --------

Cash flows from discontinued operations 234 (44)

---------------------------------------------------- -------- --------

13. Publication of non-statutory accounts

The above does not constitute statutory accounts within the

meaning of the Companies Act 2006. It is an extract from the full

accounts for the year ended 31 March 2020 on which the auditor has

expressed an unmodified opinion and does not include any statement

under section 498 of the Companies Act 2006. The accounts will be

posted to shareholders on or before 30 June 2020 and subsequently

filed at Companies House.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FRMMTMTJMTFM

(END) Dow Jones Newswires

June 08, 2020 02:00 ET (06:00 GMT)

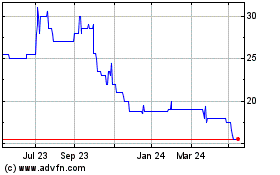

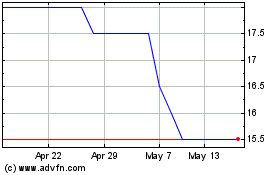

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024