TIDMSPE

RNS Number : 8095U

Sopheon PLC

28 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION (IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY) IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE 2.4 OF THE CITY CODE

ON TAKEOVERS AND MERGERS (THE "CODE") AND DOES NOT CONSTITUTE AN

ANNOUNCEMENT OF A FIRM INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF

THE CODE. THERE CAN BE NO CERTAINTY THAT ANY OFFER WILL BE

MADE.

FOR IMMEDIATE RELEASE

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

SOPHEON PLC

("Sopheon", the "Company" or the "Group")

Offer update - extension to PUSU Deadline

On 31 October 2023, Sopheon announced that it had reached

agreement in principle on the key terms of a possible cash offer by

IOps Buyer Inc. ("Bidco"), for the entire issued and to be issued

share capital of the Company at a price of GBP10.00 per Sopheon

share (the "Possible Offer", the "2.4 Announcement").

IOps Buyer Inc. ("Bidco") is a wholly-owned subsidiary of

Wellspring Worldwide Inc. ("Wellspring", and together with its

affiliates, the "Wellspring Group") and Wellspring is backed and

controlled by Resurgens Technology Partners ("Resurgens"), a

technology-focused private equity firm headquartered in Atlanta,

Georgia, USA.

The 2.4 Announcement stated that, in accordance with Rule 2.6(a)

of the Code, Bidco was required, by not later than 5.00 p.m.

(London time) on 28 November 2023, to do one of the following: (i)

announce a firm intention to make an offer for Sopheon in

accordance with Rule 2.7 of the Code; or (ii) announce that it does

not intend to make an offer for Sopheon, in which case the

announcement will be treated as a statement to which Rule 2.8 of

the Code applies.

As previously disclosed in the 2.4 Announcement, discussions

relating to the Possible Offer are well advanced and Bidco's due

diligence has been completed to Bidco's satisfaction. The board of

Sopheon has also confirmed to Bidco that it intends to unanimously

recommend the Possible Offer to Sopheon's shareholders, should a

firm offer be made on these terms. The announcement of a firm

intention to make an offer pursuant to Rule 2.7 of the Code is

subject to the receipt of a regulatory clearance by the Wellspring

Group, for which a relevant application has been submitted and

which is expected to be received in or before late December 2023,

as well as customary clerical finalisation of documentation.

Wellspring Group and Resurgens are working hard to expedite this

regulatory clearance process and will proceed to make an

announcement of a firm intention of an offer as soon as

practicable. In order to allow further time to receive such

clearances, the Board of Sopheon has requested that the Panel

extend the PUSU Deadline in accordance with Rule 2.6(c) of the

Code.

In the light of this request, an extension has been granted by

the Panel and, in accordance with Rule 2.6(a) of the Code, Bidco is

required, by not later than 5.00pm on 26 December 2023, either to

announce a firm intention to make an offer in accordance with Rule

2.7 of the Code or to announce that it does not intend to make an

offer, in which case the announcement will be treated as a

statement to which Rule 2.8 of the Code applies. This deadline may

be further extended with the consent of the Panel, at Sopheon's

request, in accordance with Rule 2.6(c) of the Code.

Important Takeover Code notes

As detailed in the 2.4 Announcement and in accordance with Rule

2.5 of the Code, Bidco reserves the right to offer an alternative

form of consideration, in addition to the cash consideration

contemplated by the Possible Offer. Bidco also reserves the right

to make an offer on less favourable terms than the Possible Offer

(i) with the agreement or consent of the board of Sopheon; (ii) if

a third party announces a firm intention to make an offer for

Sopheon which, at that date, is of a value less than the value of

the Possible Offer; or (iii) following the announcement by Sopheon

of a Rule 9 waiver transaction pursuant to Appendix 1 of the Code

or a reverse takeover (as defined in the Code).

There can be no certainty either that any offer will ultimately

be made for the Company.

A further announcement will be made when appropriate. This

announcement has been made with the consent of Bido.

Enquiries:

Sopheon via Cavendish

Andy Michuda , Executive Chairman

Greg Coticchia, Chief Executive Officer

Arif Karimjee , Chief Financial Officer

Cavendish Capital Markets Ltd (Nominated +44 (0) 20 7220

Adviser and Broker to the Company) 0500

Henrik Persson

Carl Holmes

Abigail Kelly

George Dollemore

Resurgens, Wellspring and Bidco via Raymond James

Adi Filipovic

Fred Sturgis

Danny Carpenter

Raymond James (Financial Adviser to Resurgens, +44 (0) 20 3798

Wellspring and Bidco) 5700

Junya Iwamoto

Felix Beck

This Announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No 596/2014 (as it

forms part of U.K. domestic law by virtue of the European Union

(Withdrawal) Act 2018). Upon publication of this Announcement, this

inside information will be considered to be in the public domain.

The person responsible for arranging the release of this

Announcement on behalf of the Company is Arif Karimjee, Chief

Financial Officer.

Cavendish Capital Markets Limited ("Cavendish"), which is

authorised and regulated in the United Kingdom by the FCA, is

acting as financial adviser to Sopheon and no one else in

connection with the matters described in this Announcement and will

not be responsible to anyone other than Sopheon for providing the

protections offered to clients of Cavendish or for providing advice

in connection with any matter referred to in this Announcement.

Neither Cavendish nor any of its affiliates (nor their respective

directors, officers, employees or agents) owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Cavendish in connection with this

Announcement, any statement contained herein, a scheme of

arrangement or otherwise. No representation or warranty, express or

implied, is made by Cavendish as to the contents of this

Announcement.

Publication on website

A copy of this Announcement will be made available (subject to

certain restrictions relating to persons resident in restricted

jurisdictions) at www.sopheon.com and

https://offer.wellspring.com/news by no later than 12 noon (London

time) on the business day following the release of this

Announcement in accordance with Rule 26.1 of the Code. The content

of the website referred to in this Announcement is not incorporated

into and does not form part of this Announcement.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Note

References to "Code" are to the rules of the City Code on

Takeovers and Mergers. The terms "offeror", "offeree company",

"offer period", "interested" (and related variations), "relevant

securities", "deals" (and related variations) and "acting in

concert" all bear the same meanings given to them in the City Code

on Takeovers and Mergers.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPNKOBBABDDODB

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

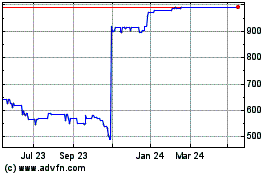

Sopheon (LSE:SPE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sopheon (LSE:SPE)

Historical Stock Chart

From Jan 2024 to Jan 2025