Sanderson Group PLC Trading Update (9268K)

April 22 2015 - 2:01AM

UK Regulatory

TIDMSND

RNS Number : 9268K

Sanderson Group PLC

22 April 2015

FOR IMMEDIATE RELEASE 22 APRIL 2015

SANDERSON GROUP PLC

Pre-close Trading Update

"Continued progress: solid growth backed by a good intake of

sales orders"

Sanderson Group plc ('Sanderson' or 'the Group'), the software

and IT services business specialising in multi-channel retail and

manufacturing markets in the UK and Ireland, announces the

following trading update ahead of the announcement of its interim

results for the six months ended 31 March 2015, scheduled to be

released on Tuesday 9 June 2015.

The Group's trading results for the six month period ending 31

March 2015 ('the period') will show revenue and profit growing by

just over 10% compared to the six month period ending 31 March 2014

('prior year period'). Revenue will show growth to GBP9 million,

compared with just under GBP8 million in the prior year period.

Sales order intake was GBP4.9 million, compared with GBP4.3 million

in the prior year period, with the existing customer base being

particularly active. The order book at 31 March 2015 was very

strong at GBP2.8 million (31 March 2014: GBP2.5 million) and

pre-contracted recurring revenues continue to represent over 50% of

total revenue. The net cash balance was approximately GBP4 million

at the period end on 31 March 2015.

The Sanderson businesses which address customers in the

multi-channel retail markets, enjoyed continued growth very much

driven by the expansion of mobile commerce and ecommerce. Proteus,

which was acquired on 5 December 2014, has made a steady start as

part of Sanderson and has made a positive contribution. The

Sanderson businesses in the Manufacturing division, which are

focused on supplying the manufacturing market sector with software

and service solutions, delivered a flat trading performance as

compared with the prior year period. The Manufacturing division's

order intake improved in the period and there is a strong order

book, with good sales prospects going into the second half

year.

The general economic environment continues to show signs of

improvement, though sales cycles continue to be protracted. The

Group continues to seek complementary acquisitions, but during the

current year, the priority of the management is to remain focused

on delivering 'on target' results.

The Board remains cautious in its approach but a strong order

book and healthy balance sheet together with a long list of sales

prospects, provides the Board with a good level of confidence that

the Group will continue to make further progress and deliver

trading results in line with market expectations for the current

year ending 30 September 2015.

Sanderson Group plc 0333 123 1400

Christopher Winn, Chairman

Adrian Frost, Finance Director

Ian Newcombe, Managing Director, Sanderson Multi-Channel

Solutions Limited

Charles Stanley Securities - Nominated Advisor

and Broker 020 7149 6000

Mark Taylor/Kevin Ashton

Walbrook PR 0117 985 8989

Paul Vann or 07768 807631

paul.vann@walbrookpr.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEAEEFFISELL

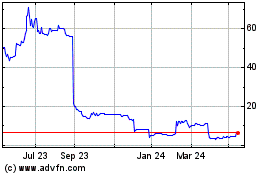

Sondrel (holdings) (LSE:SND)

Historical Stock Chart

From Jun 2024 to Jul 2024

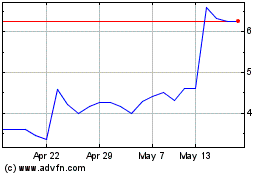

Sondrel (holdings) (LSE:SND)

Historical Stock Chart

From Jul 2023 to Jul 2024