TIDMRGL

RNS Number : 4731Z

Regional REIT Limited

27 May 2016

27 May 2016

Regional REIT Limited

May 2016 Trading Update, Dividend Declaration and AGM Outlook

Statement

Regional REIT Limited (LSE: RGL) ("Regional REIT", "the Group"

or "the Company") today announces its Trading Update as at 27 May

2016 and its dividend declaration for the first quarter of 2016. In

addition, the Company will hold its Annual General Meeting at which

the Chairman will provide a statement on the outlook for 2016.

May 2016 Trading Update

The Group has pursued its strategy of providing investors with

an attractive return on a sustained and consistent basis from

investing in, predominantly, offices and light industrial property

in the main regional centres of the UK outside of the M25

motorway.

-- As at 31 March 2016:

o c. 130 properties, around 970 units and approximately 700

tenants, amounting to some GBP507m of gross property assets; a

contracted rent roll run-rate c. GBP43.5m pa.

o Offices (by value) were 59.1% of the portfolio (IPO 58.4%) and

industrial sites 29.0% (IPO 25.3%); England & Wales represented

c. 67% (IPO 64.6%) of the portfolio.

o Occupancy (by area) 80.9%; 31 March 2016 like-for-like (versus

31 December 2015) occupancy was 82.0%, broadly in line with the

year end (82.8%).

o Average lot size increased to c. GBP3.8m (IPO GBP3.0m).

o Gross borrowings GBP225.9m; net loan-to-value ratio c. 40%;

cost of debt reduced to c. 3.7% pa. Cash and cash equivalent

balances GBP24.7m.

-- Summary of the First Quarter to 31 March 2016 :

In the period the Group completed a number of acquisitions,

o Rosalind House, Basingstoke, for GBP3m in January.

o Wing portfolio for GBP37.5m in March, comprising four

multi--let office buildings - in Basingstoke, Leeds, Leicester and

Manchester - and a multi-let industrial estate - in Beverley. The

portfolio totals c. 703,000 sq. ft., provides a net income of

GBP3.38 million pa and a net initial yield of 8.5%.

o Rainbow portfolio for GBP80.0m, also in March. The portfolio

comprised 12 assets - five offices and seven industrial sites -

totalling 1.15m sq. ft., geographically spread throughout the UK's

major regional urban areas, including Bristol, Manchester, Cardiff,

Sheffield and the West Midlands. A net yield of 8.2% at a capital

rate of GBP70 per sq. ft.

There were a number of disposals by the Group,

o Churchill Plaza, Basingstoke, for GBP12m, a 9% increase on the

December 2015 valuation.

o Five retail assets for a total consideration of GBP4.8m,

marginally ahead of the December 2015 valuation.

o 21 Blythswood Square, Glasgow, an office building, for

GBP1.5m, in line with valuation.

The Group completed several asset management projects,

generating additional income through new lettings and maintaining

and improving income through lease renewals and re-gears,

o Tay House, Glasgow - Barclays Bank plc re-geared as the major

tenant of the Grade A office building, occupying 78,044 sq. ft.

This will provide a contractually guaranteed income until October

2021. Separately, refurbishment commenced on the first and second

floors amounting to 48,533 sq. ft.

o Chancellor Court, The Calls, Leeds - a five-year lease

extension, from September 2016, was negotiated with the current

tenant St James Place Wealth Management Limited. The lease consists

of 17,896 sq. ft. of office space over two floors, providing a rent

of GBP268,440 pa.

o Other asset management initiatives were completed at St James

Court, Bristol, at St James Court, Bath, and at Sherwood Park,

Nottingham.

o The Group undertook additional bank borrowing to support the

two major portfolio acquisitions and extended and refinanced

several of its existing facilities.

-- Since 31 March 2016:

o On 6 April the Group announced the sale of its student

accommodation, Blythswood House, Glasgow, for GBP17.4m, in line

with the valuation at 31 December 2015. Also, Unit A, Spectrum

Business Park, Wrexham, was sold for GBP4.1m, 22% higher than the

valuation at 30 June 2015. A new 10-year management agreement was

secured with Regus for 30,000 sq. ft. at Tay House, Glasgow.

o In late May the Group completed the purchases of a multi-let

office building in Nottingham city centre for GBP4.3m and an office

building In Sheffield city centre for GBP6.3m.

o Acquisitions of GBP131.1m since Listing, including two

regional office and industrial portfolios.

o Non-core property disposals since Listing total GBP45.6m,

generating profits of GBP5.1m.

o In the period the office and industrial share of the portfolio

has increased further to approximately 91.5% of the gross property

asset value, whilst the share of England & Wales has risen to

around 73%.

First Quarter 2016 Dividend Announcement

The Company will pay a dividend of 1.75 pence per share ("pps")

for the period 1 January 2016 to 31 March 2016. The dividend

payment will be made on 8 July 2016 to shareholders on the register

as at 10 June 2016. The ex-dividend date will be 9 June 2016.

It is the Company's current intention to pay three quarterly

dividends at approximately this level in relation to the financial

year 2016 and then a fourth quarter dividend to manage compliance

with the 90% minimum REIT distribution requirement.

The payment of dividends will remain subject to market

conditions, the Company's performance, its financial position and

the business outlook.

Annual General Meeting Outlook Statement

At the Annual General Meeting of the Company that will take

place today, the Chairman, Kevin McGrath, will make the following

statement on the Group's outlook for 2016.

"Into 2016 we have delivered on our strategy and the commitments

we made at the time of the Listing, of significant acquisitions,

asset management initiatives including disposals and reducing the

cost of our debt financing."

"We remain positive on the prospects for the Group in 2016, with

a sustained growth in rental income and tight control of costs,

accompanied by some further growth in assets and an active

management of the portfolio mix. We see a strong underpinning for

longer term NAV growth and returns to our Shareholders."

Top-15 Investments as at 31 March 2016 (market values as at 31

December 2015)

Property Sector Market % of Lettable Let Annualised WAULT

value (GBPm) portfolio area by area gross to

(sq. (%) rent (GBPm) expiry

ft.) (years)

Tay House,

Glasgow Office 30.5 6.1% 156,933 69.1% 2.2 9.0

Buildings 2/3,

Walton St,

Aylesbury Office 21.1 4.2% 146,936 100.0% 2.3 5.6

Juniper Park,

Southfield

Industrial

Estate, Fenton

Way, Basildon Industrial 20.1 4.0% 296,100 70.0% 1.5 2.2

Wardpark

Industrial

Estate,

Cumbernauld Industrial 19.1 3.8% 709,816 88.9% 2.3 3.9

Blythswood House, Student

Glasgow* Accomm. 17.4 3.5% 32,000 100.0% 0.9 24.5

Hampshire

Corporate Park,

Chandler's

Ford, Eastleigh Office 14.8 3.0% 85,422 100.0% 1.4 2.9

One and Two

Newstead Court,

Nottingham Office 14.7 2.9% 146,063 100.0% 1.5 6.0

Columbus House,

Coventry Office 14.7 2.9% 53,253 100.0% 1.1 7.8

Winsford

Industrial

Estate,

Winsford Industrial 13.1 2.6% 246,209 100.0% 0.9 18.5

1-4 Llansamlet

Retail Park,

Swansea Retail 12.5 2.5% 71,615 85.7% 1.0 9.6

Tower North,

Leeds Office/Retail 10.8 2.2% 98,856 82.0% 0.8 4.9

The Point, Mixed

Glasgow use 10.5 2.1% 193,861 89.0% 0.8 11.1

Oaklands House,

Manchester Office 10.2 2.0% 152,404 78.7% 1.1 14.6

Templeton on the

Green, Glasgow Office 10.2 2.0% 138,123 86.9% 1.0 10.2

CGU House, Leeds Office 9.9 2.0% 50,763 100.0% 1.0 1.5

229.6 45.8% 2,578,354 19.8

*Blythswood House, Glasgow, sold in April 2016.

Debt Profile as at 31 March 2016

Lender Original Outstanding Maturity Gross Annual Amortisation Hedging

Facility Debt Date LTV Interest and Swaps:

GBP'000 GBP'000* Rate Notional

Amounts/

Rates**

------------- ----------- ------------ --------- ------ -------------- ------------- ----------------

Mandatory

Santander 2.0% over Prepayment

UK GBP48,673 GBP45,669 Dec-18 42.2% 3mth LIBOR basis GBP25.15m/1.35%

Mandatory

Santander 2.0% over Prepayment

UK GBP25,343 GBP25,343 Dec-18 46.7% 3mth LIBOR basis GBP12.9m/1.43%

Royal Bank 2.15% over

of Scotland GBP25,000 GBP24,450 Jun-19 39.5% 3mth LIBOR None GBP14.0m/1.79%

ICG Longbow 5.0% pa for

Ltd GBP65,000 GBP65,000 Aug-19 43.0% term None n/a

Santander 2.0 % over GBP50,000

UK GBP7,000 GBP6,800 Feb-18 45.8% 3mth LIBOR per qtr GBP5.44m/1.444%

Mandatory

Royal Bank 2.40 % over Prepayment

of Scotland GBP40,000 GBP39,848 Mar-21 50.0% 3mth LIBOR basis In progress***

Mandatory

Santander 2.0 % over Prepayment

UK GBP18,750 GBP18,750 Jan-19 50.0% 3mth LIBOR basis GBP9.375m/1.09%

----------- ------------ ---------

GBP229,766 GBP225,859

------------- ----------- ------------ --------- ------ -------------- ------------- ----------------

* Including unamortised debt issue costs

** Hedging arrangements: As at 31 March 2016, the swap notional

amount was GBP66.9m. Under the swap agreements, the notional amount

reduces on a quarterly basis.

*** Since 31 March 2016 swap hedging arrangements with a

notional amount of GBP19.9m have been executed at 1.395% in respect

of this facility.

Table may not cast due to rounding.

- ENDS -

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

Enquiries:

Regional REIT Limited

Press enquiries through Headland

London & Scottish Investments Tel: +44 (0) 141 248 4155

Asset Manager to the Group

Stephen Inglis

Derek McDonald

Toscafund Asset Management Tel: +44 (0) 20 7845 6100

Investment Manager to the Group

James S Johnson

Nigel Gliksten

Headland Tel: +44 (0)20 7367 5222

Financial PR

Francesca Tuckett

About Regional REIT

Regional REIT Limited (LSE: RGL) is a London Stock Exchange Main

Market listed specialist real estate investment trust focused on

office and industrial property interests in the principal regional

locations of the United Kingdom outside of the M25 motorway.

Regional REIT is managed by London & Scottish Investments,

the Asset Manager, and Toscafund Asset Management, the Investment

Manager, and was formed by the combination of two existing funds

previously created by the Managers as a differentiated play on the

expected recovery in UK regional property, to deliver an attractive

total return to shareholders and with a strong focus on income.

The Group's investment portfolio, as at 31 December 2015, was

spread across more than 120 regional properties, in excess of 710

units and over 530 tenants. As at 31 December 2015, the investment

portfolio had a value of GBP403.7m and a net initial yield of 7.6%.

The weighted average unexpired lease term was approximately six

years.

The Company's shares joined the Official List of the UK's

Financial Conduct Authority and were admitted to trading on the

London Stock Exchange on 6 November 2015. For more information,

please visit the Group's website at www.regionalreit.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBRGDUGBDBGLL

(END) Dow Jones Newswires

May 27, 2016 02:00 ET (06:00 GMT)

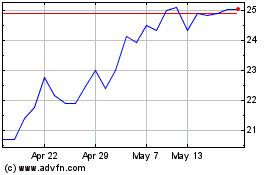

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

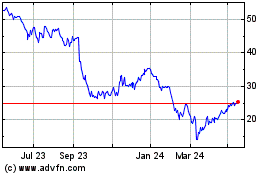

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024