PureTech Health PLC Director/PDMR Shareholding (9204Y)

May 20 2016 - 11:12AM

UK Regulatory

TIDMPRTC

RNS Number : 9204Y

PureTech Health PLC

20 May 2016

PureTech Health plc

Performance Share Plan

PureTech Health plc ("PureTech") announces that awards of

restricted share units ("RSUs") were granted by PureTech to certain

directors and other persons discharging managerial responsibilities

("PDMRs") pursuant to its Performance Share Plan ("PSP") on 20 May

2016. Each RSU entitles the holder to one ordinary share of par

value one pence each in PureTech ("Ordinary Share") on vesting. The

RSUs were granted for nil consideration. Following vesting, each

recipient will be required to make a payment of one pence per

Ordinary Share on settlement of the RSUs.

The RSUs have been made to the directors and PDMRs in respect of

a total of 2,592,863 Ordinary Shares (representing approximately

1.09 per cent. of the issued ordinary share capital of PureTech) as

follows:

Director/PDMR Number of Percentage Total maximum Percentage

Ordinary of issued number of of issued

Shares in ordinary Ordinary ordinary

respect of share capital Shares subject share capital

RSUs granted to outstanding

on 20 May awards under

2016 the PSP following

the awards

notified

in this announcement

Daphne Zohar 1,109,959 0.47 1,109,959 0.47

Stephen

Muniz 370,726 0.16 370,726 0.16

Michael

MacLean(1) 370,726 0.16 370,726 0.16

David Steinberg 370,726 0.16 370,726 0.16

Eric Elenko 370,726 0.16 370,726 0.16

Vesting of the RSUs is subject to the satisfaction of

performance conditions. The number of Ordinary Shares stated in the

table above is the maximum number that could be issued to each

director or PDMR upon full satisfaction of the performance

conditions attaching to the RSUs.

The performance conditions attaching to the RSUs are based on

the achievement of Total Shareholder Return targets (50 per cent.

of the awards), Net Asset Value growth targets (25 per cent. of the

awards) and targets based on strategic measures (25 per cent. of

the awards), measured over the three year period to 31 December

2018 ("Performance Period"), as further described in the Directors'

Remuneration Report of PureTech's 2015 Annual Report and Accounts.

PureTech's Remuneration Policy and Annual Remuneration Report were

recently approved by PureTech's shareholders at its Annual General

Meeting held on 9 May 2016.

The awards will generally vest following the end of the

Performance Period on determination of the extent to which the

performance conditions have been satisfied. No award can vest

before 1 January 2019. Any awards made will be subject to recovery

and withholding provisions.

As of the date of this announcement, awards over a total of

3,504,353 Ordinary Shares (representing 1.47 per cent. of the

issued ordinary share capital of PureTech) have been awarded and

are outstanding to directors, PDMRs, and employees of and other

service providers to PureTech pursuant to the PSP. PureTech

currently has 237,387,951 Ordinary Shares in issue.

This announcement is made in accordance with Rule 3.1.4(1)(a) R

of the Disclosure and Transparency Rules.

1. Mr. MacLean also holds an option to purchase 159,344 Ordinary

Shares pursuant to the PSP which was granted to him on 29 September

2015.

About PureTech Health

PureTech Health (PureTech Health plc, PRTC.L) is a

cross-disciplinary healthcare company developing innovative

products that could improve the lives of billions of patients.

PureTech is focused on areas of growing scientific and technical

insights that it believes are at an important inflection point,

including the central nervous, gastro-intestinal and immune

systems, and the interactions and signaling between them. PureTech

has a pipeline of more than 30 programs and has approximately 20

clinical studies across its pipeline, targeting multi-billion

dollar market opportunities. PureTech's advanced programs include

five with human proof-of-concept and multiple with pivotal or

registration study readouts in the next two years. PureTech has

over 220 patents and patent applications. PureTech's leading team

and board, along with an advisory network of more than 60 expert

founder-scientists and advisors across multiple disciplines, gives

PureTech access to potentially ground-breaking science and

technological innovation. With healthcare undergoing major

transformation, PureTech believes it is well positioned to develop

and launch medicines for the 21st century. For more information,

visit www.puretechhealth.com and connect with us on Twitter.

For more information, please contact:

PureTech

Allison Mead, Associate Director,

Communications and Investor Relations +1 617 651 3156

FTI Consulting (Communications

adviser to PureTech) +44 (0)20 3727

Ben Atwell / Matthew Cole 1000

This information is provided by RNS

The company news service from the London Stock Exchange

END

DSHEBLFLQEFFBBB

(END) Dow Jones Newswires

May 20, 2016 11:12 ET (15:12 GMT)

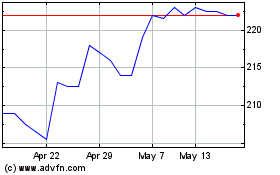

Puretech Health (LSE:PRTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Puretech Health (LSE:PRTC)

Historical Stock Chart

From Jul 2023 to Jul 2024