RNS Number:6136M

PC Medics Group PLC

5 November 2001

CHIEF EXECUTIVE OFFICER STATEMENT

I am pleased to announce the Interim Results for the half year to 30 September

2001. These are the first results following our admission to the AIM market on

8 May 2001.

Our company has made strides towards fulfilling the promise of nationwide

coverage and placing the emphasis on remote access help. We believe that the

future lies in being able to effect instant repairs over a telephone or

Internet link, and our Smart Helpdesk is now providing solutions for over 80%

of all problems posed using remote access software via modem or via the Web.

We have begun to establish a network of affiliates and service partners. This

has started well with our association with the Birmingham-based Qcom, which

provides our on-site service on the M5/M6 axis from Bristol to Manchester and

across the East and West Midlands. Qcom is a service company of 23 years

standing and has over 600 customers and 2,000 prospects at which we are also

aiming our membership to the Smart Helpdesk service.

In addition, we have also formed an association with TIPS (Technology and

Internet Property Services PLC), the providers of serviced office

accommodation as Your Space in London, and, in time, throughout the rest of

the UK. We look forward to a long-term and deeper association as we start to

provide our services to the individual tenants of the Your Space buildings.

We are also pleased to announce a number of other important affiliations since

30 September 2001:-

1. A joint marketing agreement with ADVFN, the AIM-listed Web company that

provides information and dealing services to over 158,000 member traders of

stocks, bonds and commodities. It is intended that our Smart Helpdesk service

could be an essential insurance against downtime; and

2. A reseller agreement with Cable & Wireless. Your Space clients will be

interested in increased network security and faster network and Web access

provided by high-speed and leased line telephony. Many of our other clients

with multi-local and distributed offices, and growing companies with increased

IT needs are asking us to assist in this area. We believe this reseller

agreement is likely to provide our company with a significant and regular

income based on our clients' installation and ongoing use of the facility.

The unaudited interim results for the period ended 30 September 2001 have seen

a continued growth of sales of memberships, many of these for larger

configurations of servers and PCs. Turnover and gross profit have increased

from #145,897 and #29,278 for the six months to 30 September 2000 to #463,732

and #155,128 for the current period respectively. We are continuously

reviewing the level of our administration expenses and are pleased to advise

that the cut backs we have put in place coupled with the increased gross

profit have reduced the loss before taxation to #443,298 (30 September 2000 :

#479,492). We now look after nearly 4,000 PCs for 550 members and a further

300 ad hoc non-member customers. We have had a number of challenges to address

in raising the efficiency of our on-site technical support team and I am glad

to state that our monthly number of hours sold has more than doubled in the

period from some 275 to nearly 600 without an increase in headcount.

On September 1 2001 we increased both our subscription rates for new members

and our hourly charges for call-outs. We have also removed the #1-per-minute

premium telephone charge for members, preferring to offer this service for

free within the subscription.

We have raised our hardware sales considerably, and with growing memberships

at a higher rate, and increased technician charges at an enhanced rate too, we

are benefiting from a better cashflow. The profit and loss account has been

improved by charging a #30 administration fee in the first month of each

membership.

Our company is still in the early stages of its development and it is

paramount that we achieve our performance targets, be these sales of

memberships, hardware and other services or technician efficiencies. Every

endeavour is being invested in achieving these, and I thank my fellow

directors and the employees for their sterling efforts throughout this period

of maintaining the accelerated growth, when considerable commitment has been

demanded of them and rewards have been kept to a minimum.

We believe that the need for our services is universal and that there is a

great opportunity to establish a global brand. We are making great headway in

establishing the brand as the IT support company of choice here in the UK,

with London being our home territory. Now that we can confidently service

customers in the Midlands and north-west we are in the early stages of

delivering our plan to roll out the service to the rest of the UK. Already we

are able to sell memberships to nearly half of all the UK's SMEs. Our

affiliate programme should accelerate this expansion. The results for the past

six months demonstrate the management's successful adherence to its business

plans, its continued endeavours to delivering shareholder value by controlling

costs while maintaining an ambitious expansion programme, and its commitment

to realising the potential of its employees and the market opportunities.

Finally, I would like to thank all shareholders for your considerable support

during the early development of the company and the establishment of our

brand. We look forward to the next half-year with optimism for our company as

we improve our techniques and increasing numbers of customers discover the

benefits that subscribing to PC Medics confers.

.......................................

Robin Parker

Chief Executive Officer

05 November 2001

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2001

Note 6 months ended 30 6 months ended 30 Year ended 31

September 2001 September 2000 March 2001

# # #

Turnover 463,732 145,897 711,827

Cost of sales (308,604) (116,619) (522,989)

Gross profit/(loss) 155,128 29,278 188,838

Administration (596,654) (519,186) (1,212,795)

expenses

Operating loss (441,526) (489,908) (1,023,957)

Interest receivable

and similar income 3,457 12,220 19,984

Interest payable and (5,229) (1,804) (3,544)

similar charges

Loss on ordinary

activities

before taxation (443,298) (479,492) (1,007,517)

Taxation on loss on

ordinary activities 2 - - -

Loss for the (443,298) (479,492) (1,007,517)

financial period

Basic loss per share

As previously 3 - (3.0p) (6.30p)

published

As restated 3 (0.4p) (0.75p) (1.57p)

Fully diluted loss 3 (0.4p) (0.75p) (1.57p)

per share

CONSOLIDATED BALANCE SHEETS

30 SEPTEMBER 2001

30 September 30 September 31 March

2001 2000 2001

Unaudited Unaudited Audited

# # #

Fixed assets

Intangible 44,964 86,865 78,085

Tangible 130,528 145,229 142,717

175,492 232,094 220,802

Current assets

Stocks 4,721 5,128 4,825

Debtors 250,289 239,726 159,110

Cash at bank and in hand 165,525 318,047 101,532

420,535 562,901 265,467

Creditors: Amounts falling

due within one year (364,747) (316,428) (604,843)

Net current assets/ 55,788 246,473 (339,376)

(liabilities)

Total assets less current

Liabilities 231,280 478,567 (118,574)

Creditors: Amounts falling

due after more than one (1,800) (11,253) (3,262)

year

229,480 467,314 (121,836)

Capital and reserves

Called up share capital 297,679 160,000 160,000

Share premium account 1,575,515 979,705 918,580

Profit and loss account (1,643,714) (672,391) (1,200,416)

Equity shareholders' funds 229,480 467,314 (121,836)

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2001

Note 30 September 2001 30 September 2000 31 March 2001

Unaudited Unaudited Audited

# # #

Net cash

ouflow from

operating 4 (704,961) (372,360) (615,768)

activities

Return on

investments

and servicing

of finance

Interest 3,457 12,220 19,984

received

Interest (3,818) - (1,509)

paid

Interest

element of

finance

lease (1,411) (1,834) (2,035)

payments

Net cash

(outflow)/

inflow

from

returns on

investment

and

servicing of

finance (1,772) 10,386 16,440

Taxation - - 6,033

Capital

expenditure

and

financial

investment

Purchase of

intangible

fixed

assets - - (15,000)

Purchase of

tangible

fixed

assets, (20,768) (148,905) (158,839)

net

Sale of - - 4,910

tangible

fixed assets

Net cash

inflow for

capital

expenditure

and

financial

investment (20,768) (148,905) (168,929)

Acquisitions

and

disposals

Purchase of

subsidiary - - (1)

undertaking

Net cash/

(overdrafts)

acquired

with - - 39,127

subsidiary

Net cash

inflow for - - 39,126

acquisition

and

disposals

Cash outflow

before use

of liquid

resources

and

financing (727,501) (510,879) (723,098)

Financing

Issue of 794,614 - -

equity share

capital

capital

element of

finance

lease (3,120) (1,194) (5,490)

rental

payments

Net cash

inflow from

financing 791,494 (1,194) (5,490)

Increase/ 63,993 (512,073) (728,588)

(decrease)

in cash

CONSOLIDATED CASH FLOW STATEMENTS (continued)

FOR THE SIX MONTHS ENDED 30 SETPEMBER 2001

Note 30 September 30 September 31 March

2001 2000 2001

# # #

Reconciliation of net cash

flow to movement in net funds

Increase/(decrease) in cash

in the period 63,993 (512,073) (728,588)

Cash outflow from increase in 3,120 1,194 5,490

debt

Change in net funds resulting

from

cash flows 67,113 (510,879) (723,098)

New finance leases and hire

purchase

contracts - (9,000) (9,000)

Movements in funds in the 67,113 (519,879) (732,098)

period

Opening net funds 93,571 825,669 825,669

Closing net funds 5 160,684 305,790 93,571

NOTE TO THE FINANCIAL INFORMATION

30 SEPTEMBER 2001

1 Basis of preparation

The interim financial information has been prepared on the basis of the

accounting policies adopted for the audited accounts for the year ended 31

March 2001.

The financial information has been drawn up on the going concern basis.

2 Taxation

There is no taxation charge for the period.

3 Loss per share

The basic loss per share for the half year is based on the loss after taxation

of #443,298 and the weighted average number of ordinary shares of 0.25p each

on issue of 109,893,460 (30/9/00 and 31/3/01 as restated: 64,000,000).

The previous periods' loss per share have been restated to take account of the

conversion of the nominal value of ordinary shares from shares of 1p each to

shares of 0.25p each in May 2001.

In calculating the diluted loss per share, share options and warrants have

been considered to be non-dilutive because their exercise prices are above

the current share price

4 Reconciliation of operating loss to net cash outflow from operating

activities

30 September 30 September 31 March

2001 2000 2001

# # #

Operating loss (441,526) (489,908) (1,023,957)

Depreciation of tangible fixed 32,957 22,077 52,060

assets

Amortisation of intangible fixed 33,121 29,076 65,884

assets

Decrease/(increase) in stock 104 (4,000) (2,196)

Increase in debtors (91,179) (142,620) 71,884

(Decrease)/increase in creditors (238,438) 213,015 224,412

Profit on disposal of tangible - - (3,855)

fixed assets

Net cash outflow from operating (704,961) (372,360) (615,768)

activities

5 Analysis of net debt

At 31 At 30

March Cash flow # September

2001 2001

#

Cash at bank and in hand 101,532 63,993 165,525

Finance leases (7,961) 3,120 (4,841)

Total 93,571 67,113 160,684

6 There are no recognised gains or losses other than those recorded in the

profit and loss account.

7 The interim financial information is unaudited and was approved by the

directors on 3 November 2001. The interim financial information has been

reviewed by the Group's auditors and their report is attached. The interim

financial information does not comprise full financial statements within the

meaning of Section 240 of the Companies Act 1985.

8 The figures in respect of the period ended 31 March 2001 have been taken

from the full accounts for the period ended on that date on which the auditors

reported without qualification and which contained no statement under Section

237(2) or (3) of the Companies Act 1985 (as amended) and which have been

delivered to the Registrar of Companies.

9 The Directors do not recommend the payment of a dividend.

10. A copy of this statement is being posted to all shareholders and will be

available from the Company's registered office at Lion House, Red Lion Street,

London WC1R 4GB for a period of 14 days from today.

INDEPENDENT REVIEW REPORT TO PC MEDICS GROUP PLC

Introduction

We have been instructed by the company to review the financial information for

the six months ended 30 September 2001 which comprises the profit and loss

account, the balance sheet, the cash flow statement and the related notes. We

have read the other information contained in the interim report and considered

whether it contains any apparent misstatements or material inconsistencies

with the financial information.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the directors. The directors

are responsible for preparing the interim report in accordance with the AIM

Rules which require that the accounting policies and presentation applied to

the interim figures should be consistent with those applied in preparing the

preceding annual accounts except where any changes, and the reasons for them,

are disclosed.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin 1999

/4 issued by the Auditing Practices Board for use in the United Kingdom. A

review consists principally of making enquiries of group management and

applying analytical procedures to the financial information and underlying

financial data and, based thereon, assessing whether the accounting policies

and presentation have been consistently applied unless otherwise disclosed. A

review excludes audit procedures such as tests of controls and verification of

assets, liabilities and transactions. It is substantially less in scope than

an audit performed in accordance with United Kingdom Auditing Standards and

therefore provides a lower level of assurance than an audit. Accordingly we

do not express an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 30 September 2001.

Saffery Champness ........................................

Chartered Accountants

London

5 November 2001

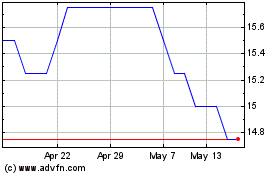

Parkmead (LSE:PMG)

Historical Stock Chart

From Jun 2024 to Jul 2024

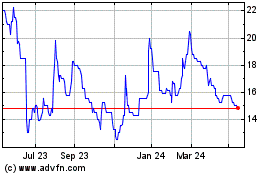

Parkmead (LSE:PMG)

Historical Stock Chart

From Jul 2023 to Jul 2024