Petra Diamonds Sales results for Tender 4 FY 2023

March 15 2023 - 3:00AM

UK Regulatory

TIDMPDL

FOR IMMEDIATE RELEASE

15 March 2023 LSE: PDL

Sales results for Tender 4 FY 2023

Petra achieves US$72.1 million in sales in its fourth tender cycle for FY 2023

Richard Duffy, Chief Executive Officer of Petra Diamonds (Petra), said:

"Petra's fourth tender for FY 2023 saw a 12.5% increase in like-for-like[1]

prices on Tender 3 FY 2023, confirming the improving trend observed in the

previous tender. We ascribe the positive pricing trends to a recovery in demand

from China as COVID-19 restrictions continue to dissipate, coupled with a more

buoyant outlook from the recent Hong Kong International Jewellery Show.

Stronger demand from major jewellery brands has also supported prices for

smaller goods. Solid demand for coloured stones across all size ranges was

evident in this cycle leading to improved pricing.

We continue to expect a supportive diamond market in the medium to longer-term

as a result of the structural supply deficit. Current levels of demand remain

robust, though we are cognisant of possible near-term volatility owing to

recent geopolitical and macroeconomic uncertainty."

Petra announces the results of Tender 4 of FY 2023, at which 505,398 carats

were sold for a total of US$72.1 million from Petra's South African operations.

This cycle includes a US$7 million Exceptional Stone2 from our Cullinan Mine

and US$4.3 million of Finsch diamonds sold during H1 FY 2023, both of which

were reported in our Interim Results announcement during February 2023. No

sales for Williamson were recorded in this cycle given the operations at the

mine are still suspended.

Rough diamond sales results for the respective periods are set out below:

Tender 4 Tender 3 Variance Tender 4 YTD FY 2023 YTD FY 2022

FY23 FY23 T3 FY23 FY22 after after

Mar-23 Dec-22 vs Feb-22 Tenders Tenders

T4 FY23 1-4 1-4

Diamonds sold 505,398 305,366 +66% 735,222 1,778,051 2,331,070

(carats)

Sales (US$ 72.1 42.3 +71% 140.6 278.5 405.3

million)

Average price 143 138 +3% 191 157 174

(US$/ct)

Revenue from 7.0 - 100% 5.5 7.0 83.4

Exceptional

Stones[2] (US$

million)

[1] Like-for-like refers to the change in realised prices between tenders and

excludes revenue from all single stones and Exceptional Stones, while

normalising for the product mix impact

[2] Petra classifies "Exceptional Stones" as rough diamonds which sell for US$5

million or more each

Sales

The results of Tender 4 bring FY 2023 YTD revenue from rough diamond sales to

US$278.5 million, including US$7 million from Exceptional Stone sales, compared

to US$405.3 million in the first four tenders of FY 2022, which included a

US$83.4 million contribution from Exceptional Stones. The comparative fourth

tender in FY 2022 closed around the Russian invasion of Ukraine which saw

prices temporarily spike at that specific tender. The lower volume sold in

Tender 4 FY 2023 relative to the equivalent tender last year was driven by

lower production from the South African operations, and no production from the

Tanzanian operation, with Williamson currently suspended pending the restart

planned for Q1 FY 2024.

Mine by mine average prices for the respective periods are set out in the table

below:

US$/carat Tender 4 Tender 3 Tender 4 YTD FY 2023 YTD FY FY 2022

FY23 FY23 FY22 after 2022 12 months

Mar-23 Dec-22 Feb-22 Tenders 1-4 after to

Tenders 30 June

1-4 2022

Cullinan Mine 1541 116 1801 1541 1881 1691

Finsch 121 107 151 121 112 118

Williamson n/a 266 369 280 4881 3841

Koffiefontein 461 371 856 452 612 581

Note 1: Prices for both Cullinan Mine and Williamson include proceeds from the

sale of Exceptional Stones.

Like-for-like prices

Like-for-like rough diamond prices improved by 12.5% on Tender 3 FY 2023 driven

by double-digit increases in all categories, except for the 2 to 5ct size

ranges which increased by some 3.5%. Prices decreased by 11.9% compared to

Tender 4 of FY 2022 reflecting the significant, but temporary, upward price

movements seen at the commencement of the Russian/Ukraine conflict.

Notwithstanding this spike, YTD prices are marginally up by 0.2% compared to

the equivalent four tenders of FY 2022.

Product mix

The balance of price movements are attributable to product mix, resulting in

an increase at Cullinan Mine, supported by the Exceptional Stone, but downward

price pressure at Finsch in this cycle. Koffiefontein sales comprised the final

1,927 carats of diamonds recovered prior to steps being taken to place the mine

on care and maintenance.

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494

8203

Patrick Pittaway

investorrelations@petradiamonds.com

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground mines in South Africa (Finsch,

Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

which supports the potential for long-life operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's loan notes due in 2026 are

listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

March 15, 2023 03:00 ET (07:00 GMT)

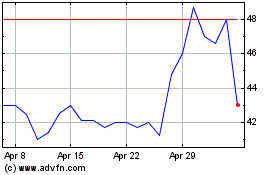

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

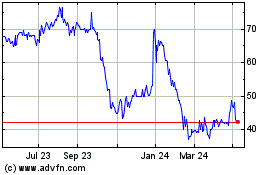

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024