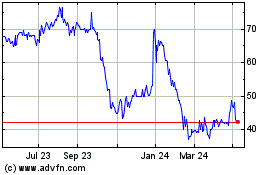

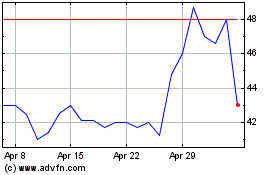

TIDMPDL

Correction to the Key operational guidance metrics' table in respect of Cash

on-mine costs and G&A for H1 FY23A and H2 FY23E

21 February 2023 LSE: PDL

Petra Diamonds Limited

Interim results for the six months ended 31 December 2022

H1 in line with expectations; annual production on track to increase by c.1 Mct

in FY 2025

Petra Diamonds Limited ("Petra" or the "Company" or the "Group") announces its

unaudited interim results for the six months ended 31 December 2022 (the

"Period", "H1 FY 2023", or "H1").

Richard Duffy, Chief Executive Officer at Petra Diamonds commented:

"Petra's new culture and ongoing focus on continuous improvement through our

operating model has enabled the Company to respond swiftly and efficiently to

the operational challenges experienced in H1 FY 2023.

We are optimistic that the fundamentals of the diamond market will continue to

support prices, with demand for luxury goods remaining robust in the USA,

notwithstanding recent economic volatility. We also expect that the ending of

lock-down restrictions in China will benefit diamond pricing in the near to

medium term.

We remain on track to meet recent production guidance, while our cost guidance

remains largely unchanged despite inflationary pressures as a result of our

ongoing focus on costs, supported by a weaker Rand. Both the Finsch & Cullinan

Mines have a significant resource base giving them potential for long lives,

and our projects at both mines continue to progress in line with expectations.

As a result, our guidance shows annual production increasing by c.1 million

carats from 2.8 million carats in FY 2023 to 3.6 - 3.9 million carats in FY

2025. Production will be further boosted from the recently approved C-Cut

extension at the Cullinan Mine, set to deliver a total of 2.3 million

additional carats from FY 2025 through to FY 2033.

At Williamson, we have made considerable progress in addressing the social and

environmental impact of the tailings storage facility wall breach. The

necessary permits are being put in place, with production anticipated to resume

during Q1 FY 2024. Ahead of this resumption, maintenance is being accelerated

and waste stripping is being carried out to construct the interim tailings

storage facility and to enable an efficient ramp-up in production.

Koffiefontein has been loss making for a number of years and incurred an

operating loss of US$8.7 million in H1. We are taking important steps towards

responsible closure in discussion with all relevant stakeholders.

Revenue for the half year decreased from US$264.7 million in H1 FY 2022 to

US$212.1 million, with the strength of our product mix and an increase in

like-for-like diamond prices of 12.6% helping to offset lower production and no

contribution from Exceptional Stones[1] (H1 FY 2022: US$77.9 million).

Post period-end, two blue diamonds recovered from the Cullinan Mine, including

an Exceptional Stone, were sold into partnership. The 17.4 and 10.4 carat gem

quality blue diamonds were sold for US$7 million and US$2 million respectively.

We will share equally in any upside on the sale of the stones once cut and

polished, extending our partnership approach on selected diamonds."

[1] Petra classifies "Exceptional Stones" as rough diamonds which sell for US$5

million or more each

Summary of financial results

US$m unless stated otherwise H1 FY 2023 H1 FY 2022 FY 2022

Revenue 212.1 264.7 585.2

Revenue from rough diamond sales 210.7 264.7 584.1

Average realised price per carat 160 166 165

Adjusted mining and processing costs 130.4 109.8 307.1

Adjusted EBITDA1 77.4 150.9 264.9

Adjusted EBITDA margin1 36% 57% 45%

Adjusted profit before tax1 18.9 91.1 141.9

Adjusted net profit after tax1 4.5 66.4 102.0

Net (loss) / profit after tax (17.6) 49.1 88.1

Adjusted basic (loss) / earnings per (0.91) 29.01 42.93

share1 (USc)

Basic (loss) / earnings per share (USc) (12.23) 22.29 35.53

Capital expenditure 51.9 16.7 52.2

Operational free cash flow1 11.7 122.4 230.0

Consolidated net debt1 90.2 152.3 40.6

Unrestricted cash 130.4 256.7 271.9

Consolidated net debt : Adjusted EBITDA1 0.47x 1.0x 0.15x

Note 1: For all non-GAAP measures refer to the Summary of Results table within

the Financial Results section below.

* Revenue amounted to US$212.1 million (H1 FY 2022: US$264.7 million),

including US$1.4 million from Petra's realised profit share from

partnership stones

* The average realised price per carat in H1 FY 2023 was US$160/ct down 3% to

US$166 in H1 FY 2022 and US$165/ct for FY 2022

* Adjusted mining and processing costs remained within expectations despite

inflationary pressures. The increase was largely attributable to diamond

inventory movement while cash on mine cost remained largely flat

* Adjusted EBITDA 49% lower YoY, due to the lack of contribution from

Exceptional Stones (US$64 million at Cullinan Mine and US$13.9 million at

Williamson Mine in the prior period), together with lower sales volumes

* Basic loss per share from continuing operations of USc12.23 per share and

USc0.91 on an adjusted basis after accounting for non-controlling interests

* Capex increased to US$51.9 million (H1 FY 2022: US$ 16.7 million) largely

due to the planned capital expenditure relating to expansion projects at

the Cullinan and Finsch Mines, coupled with accelerated equipment

replacement at Finsch

* Operational free cash flow down to US$11.7 million on the back of reduced

sales and the planned increase in capital expenditure relating to expansion

projects

* Further strengthening of the Balance Sheet:

+ Unrestricted cash decreased by US$141.5 million to US$130.4 million

following the successful repurchase of Loan Notes totaling US$146.1

million

+ Consolidated net debt increased to US$90.2 million from US$40.6 million

as at 30 June 2022, with Consolidated net debt : Adjusted EBITDA at

0.47x compared with 0.15x at 30 June 2022

Safety and operational performance

Unit H1 FY 2023 H1 FY 2022 Variance FY 2022

Lost time injury frequency rate 0.19 0.18 6% 0.23

(LTIFR)

Lost time injuries (LTIs) 7 7 0% 15

Gross ore processed Mt 5.4 5.6 -4% 11.7

Gross diamonds recovered Carats 1,399,749 1,777,424 -21% 3,353,670

Gross diamonds sold Carats 1,312,900 1,595,581 -18% 3,536,316

Updates on Williamson

Tailings storage facility (TSF) wall breach

* Financial: As a result of the TSF wall breach, a US$5.9 million remediation

charge is reflected in the profit and loss statement (after Adjusted NPAT).

Approximately US$1.5 million of this amount was incurred up to 31 December

2022, with the balance accrued for at period-end and is expected to be

incurred during H2 FY 2023.

* Environment, Local Community, Technical and Production: We continue to make

good progress with regards to the environmental, social and economic impact

evaluation and remediation process, with humanitarian relief remaining in

place for those affected. The geotechnical evaluation to establish the root

cause of the subsidence that caused the breach is underway, with operations

anticipated to restart using an interim TSF in Q1 FY 2024. More detailed

information regarding these processes and assessments is available on our

website: https://www.petradiamonds.com/our-operations/our-mines/williamson/

tailings-storage-facility-breach/

Blocked diamond parcel

* Under the Framework Agreement entered into by the Government of Tanzania

("GoT"), the Company and Williamson Diamonds Limited ("WDL") in December

2021, the GoT agreed to allocate the proceeds of the confiscated diamond

parcel of 71,654.45 carats ("Blocked Parcel") to WDL. It has come to our

attention that a portion of the Blocked Parcel has recently been sold. We

are engaging with GoT to confirm the application of the proceeds. More

information on the history of the Blocked Parcel can be found on our

website: Petra Diamonds | Blocked Diamond Parcel - Petra Diamonds

Independent Grievance Mechanism and community projects at Williamson

* The Independent Grievance Mechanism (IGM), a non-judicial process to

address the historical allegations of human rights abuses at Williamson

became operational in November 2022 and is now in its pilot phase. The

pilot phase will involve the award of remedy to those determined to have

suffered severe human rights impacts whilst allowing for the IGM's systems

and procedures to be further developed to take into account the learnings

of the pilot phase. More detailed information on the IGM and the

Restorative Justice Projects being put in place to provide sustainable

benefits to the communities located around the mine can be found on our

website: https://www.petradiamonds.com/our-operations/our-mines/williamson/

allegations-of-humanrights-abuses-at-the-williamson-mine/

Outlook

Actions taken to strengthen our business and improve cash flow generation,

together with our capital discipline, means that Petra is well placed to take

advantage of the supportive diamond market fundamentals. Our projects remain on

track to deliver a c.1Mct annual increase in FY 2025, with work commencing on

the C-cut extension to unlock a further 2.3Mct from FY 2025 through to FY 2033,

as we continue to develop the long term potential of our resource base. We

remain confident that we will continue to generate sufficient cash to fund

capex and allow further deleveraging. The Company will consider the payment of

a FY 2023 dividend when finalising its year end results.

Key operational guidance metrics1,2

Unit H1 FY23A H2 FY23E FY23E FY24E FY25E

Total carats Mcts 1.4 1.35 - 1.45 2.75 - 2.85 3.0 - 3.3 3.6 - 3.9

recovered

Cash on-mine costs US$m 140.93 140 - 160 280 - 300 280 - 300 280 - 300

and G&A2

Expansion capex2 US$m 38.2 59 - 62 92 - 104 117 - 129 110 - 125

Sustaining capex2 US$m 13.7 26 - 28 35 - 39 31 - 36 25 - 28

Note 1: Production guidance revised in January 2023 to reflect the revised

grade outlook at Cullinan Mine, a challenging H1 2023 at Finsch and temporary

closure at Williamson

Note 2: Real amounts stated in FY 2023 money terms using 6% CPI. US$ amounts

converted at exchange rate of USD1:ZAR17 apart from H1-FY23 converted at

exchange rate of USD1:ZAR17.32.

Note 3: Cash on-mine costs and G&A (H1 FY 23a) comprises Cash on-mine costs

US$128.4m, Group technical, support and marketing costs US$7.1m and Adjusted

corporate overhead US$5.4m

More detailed guidance is available on Petra's website at: https://

www.petradiamonds.com/investors/analysts/analyst-guidance/

PRESENTATION DETAILS

Richard Duffy, CEO, Jacques Breytenbach, CFO, will present the results to

investors and analysts.

Online and in person at 9.30am GMT

In-person: Storey Club, 100 Liverpool St, Broadgate, London EC2M 2AU

Webcast: To join https://stream.brrmedia.co.uk/broadcast/

63ece9ed46729d09e3663d62

Dial in details:

· Johannesburg, toll/tollfree: +27 (0) 0800 980 512

· UK: +44 (0)33 0551 0200

· USA local: +1 786 697 3501

Password: Quote "Petra Diamonds Interim Results" when prompted by the operator

Recording of presentation

A recording of the webcast will be available later today on Petra's website at

https://www.petradiamonds.com/investors/presentations

Investor Meet Company presentation at 2pm GMT

Petra will present the results on the Investor Meet company platform,

predominantly aimed at retail investors. To join: https://

www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Petra Diamonds, London +44 207 494

8203

Patrick Pittaway

investorrelations@petradiamonds.com

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Group's portfolio

incorporates interests in three underground mines in South Africa (Finsch,

Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

which supports the potential for long-life operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Group aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Group's loan notes due in 2026 are listed

on the Irish Stock Exchange and admitted to trading on the Global Exchange

Market. For more information, visit www.petradiamonds.com.

FINANCIAL RESULTS

SUMMARY RESULTS (unaudited)

6 months to 31 6 months to 31 Year ended 30

December 2022 December 2021 June 2022

("H1 FY 2023") ("H1 FY 2022") ("FY 2022")

US$ million US$ million US$ million

Revenue 212.1 264.7 585.2

Adjusted mining and processing costs1 (130.4) (109.8) (307.1)

Other direct income 0.6 0.3 (0.8)

Adjusted profit from mining activity2 82.3 155.2 277.3

Other corporate income 0.5 0.6 0.6

Adjusted corporate overhead3 (5.4) (4.9) (13.0)

Adjusted EBITDA4 77.4 150.9 264.9

Depreciation and Amortisation (37.2) (43.5) (85.3)

Share-based expense (0.9) (0.1) (1.1)

Net finance expense8 (20.4) (16.2) (36.6)

Adjusted profit before tax 18.9 91.1 141.9

Tax expense (excluding taxation credit (14.4) (24.7) (39.9)

on unrealised foreign exchange gain /

(loss))5

Adjusted net profit after tax6 4.5 66.4 102.0

Impairment (charge) / reversal - (3.8) 0.1 19.6

operations and other receivables7

Transaction costs and acceleration of (9.0) - -

unamortised costs on partial redemption

of Notes8

Williamson tailings facility - (5.9) - -

remediation costs

Williamson tailings facility - (5.2) - -

accelerated depreciation

Recovery of fees relating to - 0.2 0.8

investigation and settlement of human

rights abuse claims

Net unrealised foreign exchange gain / 1.6 (28.7) (36.5)

(loss)

Taxation credit on unrealised foreign 0.2 11.1 2.2

exchange gain / (loss)4

Net (loss) / profit after tax (17.6) 49.1 88.1

Earnings per share attributable to

equity holders of the Company -

US cents

Basic (loss) / profit per share (12.23) 22.29 35.53

Adjusted (loss) / profit per share9 (0.91) 29.01 42.93

As at 31 As at 31

December 2022 December 2021 As at

30 June 2022

(US$ million) (US$ million)

Unit (US$

million)

Cash at bank - (including US$m 146.6 272.3 288.2

restricted amounts)

Diamond debtors US$m 4.9 0.4 37.4

Diamond inventories14 US$m 59.9 79.6 52.7

/Cts 540,153 819,252 453,380

Loan notes (issued March 2021) US$m 241.7 346.4 366.2

10

Bank loans and borrowings11 US$m - 78.6 -

Consolidated net debt12 US$m 90.2 152.3 40.6

Bank facilities undrawn and US$m 58.8 0.6 61.5

available11

Consolidated net debt : 0.47x 1.0x 0.15x

Adjusted EBITDA (rolling twelve

months)

The following exchange rates have been used for this announcement: average for

H1 FY 2023 US$1:ZAR17.32 (H1 FY 2022: US$1: ZAR15.03, FY 2022: US$1:ZAR15.22);

closing rate as at 31 December 2022 US$1:ZAR17.00 (31 December 2021 US$1:

ZAR15.99, 30 June 2022: US$1:ZAR16.27).

Notes:

The Group uses several non-GAAP measures above and throughout this report to

focus on actual trading activity by removing certain non-cash or non-recurring

items. These measures include adjusted mining and processing costs, profit from

mining activities, adjusted EBITDA, adjusted net profit after tax, adjusted

earnings per share, adjusted US$ loan note, and consolidated net debt for

covenant measurement purposes. As these are non-GAAP measures, they should not

be considered as replacements for IFRS measures. The Group's definition of

these non-GAAP measures may not be comparable to other similarly titled

measures reported by other companies. The Board believes that such alternative

measures are useful as they exclude one-off items such as the impairment

charges and non-cash items to provide a clearer understanding of the underlying

trading performance of the Group.

1. Adjusted mining and processing costs are mining and processing costs

stated before depreciation.

2. Adjusted profit from mining activities is revenue less adjusted mining

and processing costs plus other direct income.

3. Adjusted corporate overhead is corporate overhead expenditure less

corporate depreciation, tender offer transaction costs and share-based expense.

4. Adjusted EBITDA is stated before depreciation, amortisation of

right-of-use asset, share-based expense, net finance expense, tax expense,

impairment reversal/(charges), expected credit loss release/ (charge), recovery

of fees relating to investigation and settlement of human rights abuse claims,

Williamson tailings facility remediation costs and accelerated depreciation and

unrealised foreign exchange gains and (losses).

5. Tax expense is the tax expense for the Period excluding taxation credit

on unrealised foreign exchange gain/(loss) generated during the Period; such

exclusion more accurately reflects resultant adjusted net profit.

6. Adjusted net profit after tax is net profit after tax stated before

impairment (charge)/reversal, Williamson tailings facility remediation costs

and accelerated depreciation, recovery of fees relating to investigation and

settlement of human rights abuse claims net unrealised foreign exchange gains

and losses, and excluding taxation credit on net unrealised foreign exchange

gains and losses and excluding taxation credit on impairment charge.

7. Impairment charge of US$3.8 million (30 June 2022: US$19.6 million

reversal and 31 December 2021: US$0.1 million reversal) was due to the Group's

impairment review of its operations and other receivables. Refer to note 15 for

further details.

8. Transaction costs and acceleration of unamortised costs on partial

redemption of Notes comprise transaction costs of US$0.8 million included

within Corporate expenditure (refer to note 5) and US$8.2 million in respect of

the redemption premium and acceleration of unamortised costs included within

Finance expense (refer to note 6).

9. Adjusted EPS is stated before impairment charge, gain on extinguishment

of Notes net of unamortised costs, acceleration of unamortised costs on Notes,

Williamson tailings facility remediation costs and accelerated depreciation,

recovery of fees relating to investigation and settlement of human rights abuse

claims, and net unrealised foreign exchange gains and losses, and excluding

taxation credit on net unrealised foreign exchange gains and losses.

10. The 2026 US$336.7 million loan notes, originally issued following the

capital restructuring (the "Restructuring") completed during March 2021, have a

carrying value of US$241.7 million (30 June 2022: US$366.2 million) which

represents the outstanding principal amount of US$210.2 million (after the

early participation phase of the debt tender offers as announced in September

and October 2022) plus US$43.0 million of accrued interest and net of

unamortised transaction costs capitalised of US$11.5 million. Refer to Note 8

for further detail.

11. Bank loans and borrowings represent the Group's ZAR1 billion (US$58.8

million) revolving credit facility which remains undrawn and available.

During the FY2022, the South African banking facilities held with the Group's

previous consortium of South African lenders were settled and cancelled,

comprising of the revolving credit facility of ZAR404.6 million (US$24.9

million) (capital plus interest) and the term loan of ZAR893.2 million (US$54.9

million) (capital plus interest).

12. Consolidated Net Debt is bank loans and borrowings plus loan notes, less

cash and less diamond debtors.

13. Operational free cashflow is defined as cash generated from operations

less cash outflows on the acquisition of property, plant and equipment.

14. Diamond inventory includes the 71,654.45 carat parcel of diamonds

blocked for export during August 2017, with a carrying value of US$12.5

million. In terms of the framework agreement reached with the Government of

Tanzania, as announced on 13 December 2021, the proceeds from the sale of this

parcel will be allocated to Williamson. During February 2023, it has come to

our attention that a portion of the Blocked Parcel has been sold. We are

engaging with GoT to confirm the application of the proceeds.

Revenue

H1 FY 2023 amounted to US$212.1 million (H1 FY 2022: US$264.7 million),

comprising revenue from rough diamond sales of US$210.7 million (H1 FY 2022:

US$264.7 million) and additional revenue from profit share agreements of US$1.4

million (H1 FY 2022: US$nil).

H1 FY 2023 revenue from rough diamond sales decreased 20% to US$210.7 million

(H1 FY 2022: US$264.7 million) as result of no sales of Exceptional Stones

during the Period (H1 FY 2022 US$77.9 million), lower volumes sold largely

owing to reduced tonnages at Finsch and lower grades at the Cullinan Mine,

which was partially offset by improved product mix, largely at the Cullinan

Mine, and a 12.6% increase in like-for-like diamond prices.

Mining and processing costs

The mining and processing costs for H1 FY 2023 comprised on-mine cash costs as

well as other operational expenses. A breakdown of the total mining and

processing costs for the Period is set out below.

On-mine Diamond Diamond Group Adjusted Depreciation Total

cash royalties inventory technical, mining and Williamson and mining and

costs1 and support processing tailings amortisation4 processing

US$m stockpile and costs facility - costs

US$m movement marketing remediation US$m (IFRS)

costs2 US$m costs3

US$m US$m

US$m US$m

H1 FY 2023 128.4 3.7 (8.8) 7.1 130.4 5.9 42.1 178.4

H1 FY 2022 129.8 3.4 (29.5) 6.1 109.8 - 43.1 152.9

FY 2022 272.3 14.6 0.5 19.7 307.1 - 84.4 391.5

Notes:

1. Includes all direct cash operating expenditure at operational level,

i.e. labour, contractors, consumables, utilities and on-mine overheads.

2. Certain technical, support and marketing activities are conducted on a

centralised basis.

3. Remediation costs comprise costs involved in establishing the root cause

of the failure, humanitarian relief to the affected community, livelihood- and

environmental restoration and costs to repair.

4. Includes US$5.2 million of accelerated depreciation at Williamson

relating to assets damaged in the TSF failure and amortisation of right-of-use

assets under IFRS 16 of US$1.7 million (H1 FY2022: US$0.6 million and FY 2022:

US$2.3 million) and excludes corporate / administration.

On-mine cash costs reduced by US$1.4 million (1.1%) compared to H1 FY 2022 and

in line with expectations, due to:

* The effect of translating ZAR denominated costs at the South African

operations at a weaker ZAR/USD average exchange rate (12.4% decrease)

* Lower production volumes at South African operations (5.0% decrease)

* Other cost savings, including reduction in on-mine costs due to

centralisation (3.4% decrease)

Offset by:

* Increase in Williamson cash costs compared to a lower prior year base,

following restart post-care and maintenance in H1 FY22 (12.0% increase)

* Inflationary increases (6.9% increase)

* Above-inflation increases associated with electricity costs (0.8% increase)

Royalties increased to US$3.7 million (H1 FY 2022: US$3.4 million) driven by

increased revenues from Williamson compared to the prior period.

Adjusted profit from mining activities

Adjusted profit from mining activities decreased 47% to US$82.3 million (H1 FY

2022: US$155.2 million), mainly due to no sales of Exceptional Stones during

the Period, the impact of lower volumes at the Cullinan and Finsch Mines, and

increased costs at Williamson being in production for a period of almost five

months (prior to the tailings storage facility failure when operations at the

mine ceased) compared to three months in the comparative period.

Adjusted corporate overhead - general and administration

Corporate overhead (before depreciation and share based payments) increased to

US$5.4 million for the Period (H1 FY 2022: US$4.9 million) mainly attributable

to the increase in corporate governance structures and costs associated with

the Williamson IGM process during the Period.

Adjusted EBITDA

Adjusted EBITDA, being profit from mining activities less adjusted corporate

overhead, decreased 49% to US$77.4 million (H1 FY 2022 US$150.9 million),

representing an adjusted EBITDA margin of 36% (H1 FY 2022: 57%) driven by the

lower production, increased mining costs and zero contribution from Exceptional

Stones.

Depreciation and amortisation

Depreciation and amortisation for the Period of US$42.4 million (H1 FY 2022:

US$43.1 million), decreased due to lower production and a weaking ZAR/USD,

offset by the inclusion of accelerated depreciation of US$5.2 million

attributable to the assets written down at Williamson as a result of the

tailings storage facility failure.

Impairment reversal / charge

As a result of the impairment reviews carried out at the Group's operating

assets and other receivables during the Period, an overall net impairment

charge of US$3.8 million (H1 FY 2022: US$0.1 million impairment reversal) was

recognised, comprising:

US$ million H1 FY H1 FY 2022

2023

Asset class

Impairment charge - property, plant & equipment (Refer (0.3) (0.3)

note 15)

Impairment (charge)/reversal - other current receivables (3.5) 0.4

(refer note 15)

Total (3.8) 0.1

Impairment reviews carried out at the Cullinan, Finsch and Williamson Mines did

not result in an impairment charge or reversal for operational assets during

the Period (H1 FY 2022: US$nil). Asset level impairment at Koffiefontein

amounted to US$0.3 million (H1 FY 2022: US$0.3 million), compared to the

Group's carrying value of property, plant and equipment of US$615.3 million (H1

FY 2022: US$624.0 million) pre-impairment.

During the Period, an impairment charge of US$3.5 million (H1 FY 2022: US$0.4

million) relating to VAT receivable at Williamson was recognised in the

Consolidated Income Statement.

Net financial expense

Net financial expense of US$27.0 million (H1 FY 2022: US$44.9 million)

comprises:

US$ million H1 FY 2023 H1 FY 2022

Net realised foreign exchange gain on settlement of - 8.8

forward exchange contracts and foreign loans

Interest received on bank deposits 1.7 0.5

Net interest receivable on the BEE partner loans and 0.8 1.3

amortisation of lease liabilities in accordance with

IFRS 16

Offset by:

Net realised foreign exchange loss on settlement of (7.7) -

forward exchange contracts and foreign loans

Interest on the Group's debt and working capital (13.6) (23.8)

facilities

Unwinding of the present value adjustment for Group (1.6) (3.0)

rehabilitation costs

Acceleration of unamortised bank facility and Notes (8.2) -

transaction costs

Net unrealised foreign exchange gains / (losses) 1.6 (28.7)

Net financial expense (27.0) (44.9)

Tax credit / charge

The tax charge of US$14.2 million (H1 FY 2022: US$13.6 million) comprised a

deferred tax charge of US$14.0 million (H1 FY 2022: US$24.3 million) and a net

current tax charge of US$0.2 million (H1 FY 2022: US$nil). The tax charge of

US$14.2 million (H1 FY 2022: US$13.6 million) comprised a deferred tax charge

of US$14.2 million (H1 FY 2022: US$24.3 million) in respect of the utilisation

of capital allowances at the Cullinan Mine, Finsch and Williamson Mines and

US$0.2 million deferred tax credit (H1 FY2022: US$11.1 million) relating to

unrealised foreign exchange losses during the Period, which reduced existing

deferred tax liabilities, with an income tax charge of US$0.2 million at

Williamson for the Period (H1 FY 2021: US$0.4 million at Finsch).

The current period effective tax rate is higher than the South African tax rate

of 27% (the Group's primary tax paying jurisdiction) primarily due to foreign

exchange losses and permanent differences as a result of the Koffiefontein

impairment and loss making companies (within the Group) where deferred tax

assets on operating losses are not recognised, which when consolidated reduces

the Group's overall profit before tax resulting in an increased effective tax

rate.

Williamson Tailings Storage Facility (TSF)

On 7 November 2022, the TSF wall at the Williamson mine was breached, resulting

in flooding away from the pit which has extended into certain areas outside of

the mine lease area. As a result, remediation costs relating to the incident

have been incurred during the Period and additional costs will be incurred

going forward. The remediation costs comprise establishing the root cause of

the failure, humanitarian relief to the affected community, livelihood and

environmental restoration and costs to repair.

In H1 FY 2023, US$1.5 million of costs have been incurred and a further US$4.4

million of costs, comprising management's best estimate based on the current

information available, has been provided for ongoing remediation costs.

In addition, US$5.2 million of accelerated depreciation was recognised in the

Period to fully write down assets damaged in the TSF breach.

Earnings per share

Basic loss per share from continuing operations of USc12.23 was recorded (H1 FY

2022: USc22.29 profit).

Adjusted loss per share from continuing operations (adjusted for impairment

charges, transaction costs and accelerated unamortised costs, taxation credit

on net unrealised foreign exchange losses and net unrealised foreign exchange

gains and losses) of USc0.91 was recorded (H1 FY 2022: USc29.01 profit

(adjusted for impairment charges, taxation charge on net unrealised foreign

exchange gains and net unrealised foreign exchange gains and losses)).

Operational free cash flow

During the Period, operational free cash flow of US$11.7 million (H1 FY 2022:

US$122.4 million) reflects the impact from an increase in capital expenditure

of US$32.4 million and a decrease in revenue from Exceptional Stones of US$89.1

million. This cash flow performance was further impacted by:

* US$6.4 million outflow (H1 FY 2022: US$4.8 million inflow) of net realised

foreign exchange gains/(losses) and cash finance expenses net of finance

income;

* US$2.7 million dividend paid to BEE partners (H1 FY 2022: US$3.5 million).

Cash and Diamond Debtors

As at 31 December 2022, Petra had cash at bank of US$146.6 million (H1 FY 2022:

US$272.3 million). Of these cash balances, US$130.4 million was held as

unrestricted cash (H1 FY 2022: US$256.7 million), US$15.4 million was held by

Petra's reinsurers as security deposits on the Group's cell captive insurance

structure (with regards to the Group's environmental guarantees) (H1 FY 2022:

US$14.8 million) and US$0.8 million was held by Petra's bankers as security for

other environmental rehabilitation bonds lodged with the Department of Mineral

Resources and Energy in South Africa (H1 FY 2022: US$0.8 million).

The decrease in cash balances is attributable to the repayment to Noteholders,

through a debt tender offer during the Period, of US$144.6 million comprising

the principal amount of US$126.4 million and PIK interest of US$18.2 million.

The principal amount of Notes outstanding after the repayments to Noteholders

is US$210,190,662. Cash costs of US$1.4 million attributable to the debt tender

offer have been expensed in the Consolidated Income Statement under finance

expense (refer to Note 6).

Diamond debtors as at 31 December 2022 were US$4.9 million (H1 FY 2022: US$0.4

million).

Loans and Borrowings

The Group had loans and borrowings (measured under IFRS) at Period end of

US$241.7 million (H1 FY 2022: US$425.3 million) comprised of US$210.2 million

of Second Lien Notes (including US$43.0 million of accrued interest and

unamortised transaction costs of US$11.5 million) and bank loans and borrowings

of US$nil (H1 FY 2022: US$78.6 million). Bank debt facilities undrawn and

available to the Group as at 31 December 2022 were US$58.8 million (H1 FY 2022:

US$0.6 million). Refer to note 8 for further details relating to the movement

in loans and borrowings during the Period.

Consolidated net debt as at 31 December 2022 was US$90.2 million (H1 FY2022:

US$152.3 million).

Covenant Measurements attached to banking facilities

The Company's EBITDA-related covenants associated with its banking facilities

are as outlined below:

· To maintain a Consolidated Net Debt : Adjusted EBITDA ratio tested

semi-annually on a rolling 12-month basis

· To maintain an Interest Cover Ratio (ICR) tested semi-annually on a rolling

12-month basis

· To maintain minimum 12 month forward looking liquidity requirement that

consolidated cash and cash equivalents (excluding diamond debtors) shall not

fall below US$20.0 million

The Company's covenant levels, which have not been breached during the Period

under review, for the respective measurement periods are outlined below:

FY22 H2 FY23 H1 FY23 H2 FY24 H1 FY24 H2 FY25 H1 FY25 H2 FY26 H1

Consolidated Net Debt :

EBITDA Leverage ratio 4.00 4.00 3.50 3.50 3.25 3.25 3.00 3.00

(maximum)

Interest Cover Ratio (ICR) 1.85 1.85 2.50 2.50 2.75 2.75 3.00 3.00

(minimum)

For further detail on the SA Lender facilities refer to Note 8 below.

Going concern considerations

The Board has reviewed the Group's forecasts with various sensitivities

applied, for the 18 months to June 2024, including both forecast liquidity and

covenant measurements. As per the First Lien agreements, the liquidity and

covenant measurements exclude contributions from Williamson's trading results

and only recognise cash distributions payable to Petra upon forecasted receipt,

or Petra's funding obligations towards Williamson upon payment.

The Board has given careful consideration to potential risks identified in

meeting the forecasts under the review period. The following sensitivities have

been performed in assessing the Group's ability to operate as a going concern

(in addition to the Base Case) as at the date of this report:

* A 10% decrease in forecast rough diamond prices from January 2023 to June

2024

* A 10% strengthening in the forecast South African Rand (ZAR) exchange rate

against the US Dollar from January 2023 to June 2024

* A 5% increase in operating costs from January 2023 to June 2024

* A US$15 million reduction in revenue contribution from the effects of

product mix and/or Exceptional Stones

* Combined sensitivity: prices down 10% and ZAR stronger by 10%, reduced

contribution from Exceptional Stones and operating costs up 5%

Under all the cases, the forecasts indicate that the Group's liquidity outlook

over the 18-month period to December 2024 remains strong, even when applying

the above sensitivities to the base case forecast.

The forward-looking covenant measurements associated with the new First Lien

(1L) facility do not indicate any breaches during the 18-month review period

for the base case as well as all the above sensitivities when considered on a

stand-alone basis. The combined sensitivity shows a covenant breach for the

required ICR in the June 2024 measurement period. While the ICR is projected to

be breached in this combined sensitivity, neither the Consolidated Net Debt :

EBITDA covenant nor the liquidity covenant is projected to be breached, while

the revolving credit facility (RCF) remains undrawn. It is therefore assumed

that the RCF remains available on the expectation that the 1L lender will agree

to an ICR covenant waiver given that the Group does not expect to utilise the

RCF for servicing of its Second Lien (2L) interest obligations. Furthermore,

this potential ICR breach may be cured by means of cost savings and revenue

enhancing opportunities through, for example, entering into partnership

agreements on the sale of high-value or Exceptional stones.

As a result, the Board concluded that there are no material uncertainties that

would cast doubt on the Company continuing as a going concern. See 'Basis of

preparation including going concern' in the Financial Statements for further

information.

Capex and Production

Total Group capex for the Period increased to US$51.9 million (H1 FY 2022:

US$16.7 million), comprising:

* US$38.2 million expansion capex (H1 FY 2022: US$11.7 million)

* US$13.7 million sustaining capex (H1 FY 2022: US$5.0 million)

Capex (US$m) H1 FY 2023 H1 FY 2022

Cullinan 23.3 12.5

Finsch 23.1 2.5

Williamson 3.2 0.8

Koffiefontein 0.3 0.3

Subtotal - capex incurred by operations 49.9 16.1

Corporate 2.0 0.6

Total Group capex 51.9 16.7

Group Production Summary

Below is a summary of the Group production for the Period, further detail can

be obtained from the H1 FY2023 Operating update released on 16 January 2023.

Production H1 FY 2023 H1 FY 2022

ROM tonnes Tonnes 5,240,992 5,401,532

Tailings and other tonnes Tonnes 198,090 238,292

Total tonnes treated Tonnes 5,439,082 5,639,824

ROM diamonds Carats 1,337,931 1,649,989

Tailings and other diamonds Carats 61,818 127,435

Total diamonds Carats 1,399,749 1,777,424

PRINCIPAL BUSINESS RISKS

The Group is exposed to a number of risks and uncertainties which could have a

material impact on its long-term development, and performance and management of

these risks is an integral part of the management of the Group.

A summary of the risks identified as the Group's principal external, operating

and strategic risks (in no order of priority), which may impact the Group over

the next twelve months, is listed below.

Risk Risk Risk Nature Change in FY 2023: H1

appetite rating of risk

External Risks

1. Rough High Medium Long No Change - The third tender for FY 2023 saw

diamond price term a 2.2% increase in like-for-like prices

compared to the second tender, reversing the

trend of the previous two tenders. An upward

movement of prices in the 2ct to 10ct size

ranges, as a likely result of the festive

season and easing of lockdown restrictions in

China, more than offset softer pricing in the

0.75ct to 2ct ranges. While some volatility

is expected in pricing in the short-term

given the ongoing macroeconomic situation, we

remain encouraged by the supportive diamond

market resulting from the projected supply

deficit in the medium to longer term.

2. Currency High Medium Long No change - The ZAR/USD rate weakened during

term H1 FY 2023, opening at R16.44 and ending the

six-month period at R17.00 and this provided

some support for Petra. The IMF's recent

positive sentiments on global growth (as

China eases its zero-COVID policies and

greater resilience is shown to impact higher

inflation/interest rates despite the ongoing

war in Ukraine) may drive the strength of

emerging market currencies, though this

remains to be seen for South Africa's Rand.

3. Country High Medium Long No change - The risk of political instability

and political term remains in South Africa. In addition,

rolling blackouts as a result of

load-shedding (electricity outages), continue

due to the inability of South Africa's

electricity provider to service the

population and businesses.

It has come to our attention that a portion

of the c.71kct parcel seized by the

Government of Tanzania ("GoT") in 2017 has

recently been sold. The proceeds of this

parcel are required to be allocated to WDL

under the Framework Agreement with the GoT.

We are engaging with the GoT to confirm the

application of the Blocked Parcel proceeds.

4. COVID-19 Medium Low Short to No change - Despite the emergence of a new,

pandemic medium more transmissible sub-variant, COVID-19

(operational term levels at Petra's operations have remained

impact) low during H1 FY 2023. The impact of COVID

19 infections continues to have no

significant effect on our operations or sales

processes at this time.

Strategic

Risks

5. Group Medium Medium Short to Higher - Whilst the Group's balance sheet was

Liquidity long strengthened through the repurchase of the

term Company's loan notes totalling US$145m,

resulting in annual interest savings of c.

US$14 million, the Group has experienced

operational challenges, including lower

grades experienced at the Cullinan Mine which

are now expected to continue through FY 2024

and lower tonnes mined at Finsch in H1 FY

2023, which impact Petra's liquidity

position.

A number of ongoing mitigating actions are

being taken to address these challenges.

Halting operations at Koffiefontein and

placing the mine on care and maintenance will

have a positive impact on liquidity for the

Group.

6. Licence to Medium High Long Higher - In light of operations at

operate: term Koffiefontein having ceased and consultations

regulatory and taking place regarding placing the mine on

social impact care and maintenance, increasing community

& community tensions have led to disagreements on the

relations viability and delivery of certain projects

that are required to be implemented under

Social and Labour Plans. Management has

conducted extensive engagements between local

communities, the DMRE and the local

municipality to resolve these issues.

At Williamson, the IGM became operational at

the end of November 2022 with the

commencement of the pilot scheme.

Whilst no fatalities or serious injuries were

reported after the TSF breach at Williamson,

the livelihoods of a number of community

members were affected. An assessment of the

impact on the surrounding communities and

potential remediation is currently nearing

completion. The TSF breach has resulted in

WDL providing immediate humanitarian relief

to those affected and work is underway to

develop an Entitlement Framework that will

enable community members who have been

impacted by the TSF breach to be

appropriately compensated.

Operating

Risks

7. Mining; Medium High Long Higher - Lower grades at the Cullinan Mine

production term are now expected to continue through FY

(including ROM 2024. This is attributable to the C-Cut cave

grade and maturity as the cave progresses from SW to

product mix NE and the earlier than anticipated waste

volatility) ingress from the overlying depleted mining

blocks. Several mitigating actions are

underway to address these grade issues,

including:

. Tailings treatment has been optimised

but is not in isolation sufficient to

address the grade reduction.

. The re-opening of Tunnels 36 (which

has already commenced) and 41 and the

establishment of Tunnels 46 and 50 (the

development of which have recently been

approved by the Board) will provide

additional volume from FY 2025 and more than

offset the impact of lower grades in FY 2023

/24.

. Production from the CC1E project will

contribute meaningfully from FY 2025 and is

expected to see grades move back towards

40cpht.

Finsch's production target fell short of

guidance largely attributable to low machine

availability owing to an ageing underground

fleet, challenges with the centralised

blasting system and emulsion quality and an

extended rock-winder breakdown.

As noted above, production at Williamson has

been suspended for the remainder of FY 2023

due to the TSF breach and a restart is

reliant on the implementation of an interim

TSF, with operations anticipated to restart

in Q1 FY 2024.

Operations at Koffiefontein have ceased in

light of consultations to place the mine on

care and maintenance.

As a result of the above events, Group

production guidance has been lowered to c.

2.8 Mcts for FY 2023 and 3.0 to 3.3 Mcts for

FY 2024.

8. Labour Medium Medium Short to No Change - Stable labour relations were

relations medium experienced at all operations throughout H1

term FY23. For FY 2023, the Group has introduced

a quarterly production bonus scheme for

lower band employees to ensure alignment

with other incentive structures across the

Group.

A Collective Bargaining Agreement with

TAMICO, the majority union at Williamson,

was signed in November 2022.

A statutory consultation process is underway

with employees regarding placing

Koffiefontein in care and maintenance which

would result in the retrenchment of the

mine's workforce.

9. Safety Medium Medium Short to Higher - LTIFR and LTIs marginally increased

medium to 0.19 and 7 respectively in comparison to

term H1 FY 2022. FY 2023 YTD safety indicators

show a declining trend. Remedial actions and

behaviour intervention programmes with

various focus areas have been launched to

address this trend.

10. Medium Medium Long Higher - Following the TSF breach at

Environment term Williamson on 7 November 2022, significant

work has been undertaken to contain the

breach, determine the extent of the

environmental impact and commence

environmental remediation. An investigation

is being conducted to determine the root

cause of the TSF breach. WDL continues to

engage with Tanzania's environmental

regulator (National Environment Management

Council) regarding the breach.

No significant changes in terms of

environmental impacts were observed for the

SA operations in H1 FY2023.

11. Climate High Medium Long No Change - Management continues to monitor

Change term progress against annual climate change

targets set for on-mine water and electricity

consumption and efficiency.

Petra is looking to formulate and implement a

renewables strategy that will be key in

enabling Petra to reach its 2030 interim

target of a 35-40% reduction in Scope 1 & 2

emissions (against Petra's 2019 baseline).

12. Supply Medium High Short to Higher - Progress was made in the Supply

Chain medium Chain function to address various gaps which

Governance term included: (1) reviewing the Group's Supply

Chain policy to improve compliance,

governance and risk management, (2) improving

procurement, tender and supplier registration

procedures and (3) filling critical roles in

the function. An online due diligence

platform, administered by an external third

party, went live in December 2022 to improve

the vetting and screening of suppliers.

An independent external expert was engaged to

conduct a gap analysis of existing Supply

Chain processes and systems and this has

resulted in management formulating action

plans to address areas that require

improvement.

13. Capital Medium High Short to Higher - For the CC1E Project at the Cullinan

Projects medium Mine and the Lower Block 5 3 Levels SLC at

term Finsch, management have initiated various

mitigating actions led by intensive safety

inventions and expediting Trackless Mining

Machinery and drill rig availability to

address the risk of both projects falling

behind project plans. Alternate labour

sourcing strategies are also being

considered.

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE 6 MONTH PERIODED 31 DECEMBER 2022

US$ million Notes (Unaudited) (Unaudited) (Audited)

1 July 1 July Year ended

2022- 2021- 30 June

31 December 31 December 2022

2022 2021

Revenue 212.1 264.7 585.2

Mining and processing costs (178.4) (152.9) (391.5)

Other direct income / expense 0.6 0.3 (0.8)

Corporate expenditure including 5 (7.4) (5.2) (14.1)

settlement costs

Other corporate income 0.5 0.6 0.6

Impairment (charge) / reversal of 15 (0.3) (0.3) 21.1

non-financial assets

Impairment (charge) / reversal of other 15 (3.5) 0.4 (1.5)

receivables

Total operating costs (188.5) (157.1) (386.2)

Financial income 6 25.8 11.4 19.0

Financial expense 6 (52.8) (56.3) (92.1)

(Loss) / profit before tax (3.4) 62.7 125.9

Income tax charge (14.2) (13.6) (37.8)

(Loss) / profit for the Period (17.6) 49.1 88.1

Attributable to:

Equity holders of the parent company (23.7) 43.2 69.0

Non-controlling interest 6.1 5.9 19.1

(17.6) 49.1 88.1

Profit per share attributable to the

equity holders of the parent during the

Period:

Continuing operations:

Basic (loss) / earnings per share - US 13 (12.23) 22.29 35.53

cents

Diluted (loss) / earnings per share - 13 (12.23) 22.29 35.53

US cents

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTH PERIODED 31 DECEMBER 2022

US$ million (Unaudited) (Unaudited) (Audited)

1 July 1 July Year ended

2022- 2021- 30 June

31 December 31 December 2022

2022 2021

(Loss) / profit for the Period (17.6) 49.1 88.1

Exchange differences on translation of the - - (0.3)

share-based payment reserve

Exchange differences on other reserves - - -

Exchange differences on translation of foreign (18.1) (44.6) (46.8)

operations1

Exchange differences on non-controlling (0.5) 0.3 (0.4)

interest1

Total comprehensive (loss) / income for the (36.2) 4.8 40.6

Period

Total comprehensive income and expense

attributable to:

Equity holders of the parent company (41.8) (1.4) 21.9

Non-controlling interest 5.6 6.2 18.7

(36.2) 4.8 40.6

¹ These items will be reclassified to the consolidated income statement if

specific future conditions are met.

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

US$ million Notes (Unaudited) (Unaudited) (Audited)

31 31 December 30 June

December 2021 2022

2022

ASSETS

Non-current assets

Property, plant and equipment 7 620.2 626.6 633.2

Right-of-use assets 20.0 26.8 21.9

BEE loans and receivables 11 38.2 43.1 44.6

Other receivables 2 5.1 1.8 2.6

Total non-current assets 683.5 698.3 702.3

Current assets

Trade and other receivables 24.7 26.2 49.8

Inventories 81.7 97.5 70.6

Cash and cash equivalents (including 146.6 272.3 288.2

restricted amounts)

Total current assets 253.0 396.0 408.6

Total assets 936.5 1,094.3 1,110.9

EQUITY AND LIABILITIES

Equity

Share capital 12 145.7 145.7 145.7

Share premium account 12 609.5 959.5 959.5

Foreign currency translation reserve (467.0) (446.7) (448.9)

Share-based payment reserve 2.8 1.9 1.9

Other reserves (0.8) (0.8) (0.8)

Accumulated reserves / (losses) 12 142.7 (210.1) (183.6)

Attributable to equity holders of the 432.9 449.5 473.8

parent company

Non-controlling interest 0.5 (7.8) 4.7

Total equity 433.4 441.7 478.5

Liabilities

Non-current liabilities

Loans and borrowings 8 221.1 398.0 353.9

Provisions 97.3 96.0 97.7

Lease liabilities 17.8 23.6 19.2

Deferred tax liabilities 82.4 55.3 71.3

Total non-current liabilities 418.6 572.9 542.1

Current liabilities

Loans and borrowings 8 20.6 27.3 12.3

Lease liabilities 3.0 3.2 3.2

Trade and other payables 56.5 49.2 74.8

Provisions 2 4.4 - -

Total current liabilities 84.5 79.7 90.3

Total liabilities 503.1 652.6 632.4

Total equity and liabilities 936.5 1,094.3 1,110.9

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 31 DECEMBER 2022

US$ million Notes (Unaudited) (Unaudited) (Audited)

1 July 1 July Year ended

2022- 2021- 30 June

31 December 31 December 2022

2022 2021

(Loss) / profit before taxation for the (3.4) 62.7 125.9

Period

Depreciation of property plant and 40.5 42.9 82.8

equipment

Amortisation of right-of-use asset 1.9 0.6 2.5

Impairment charge - non financial assets 15 0.3 0.3 (21.1)

Impairment charge / (reversal) - other 15 3.5 (0.4) 1.5

receivables

Movement in provisions 4.3 (3.3) 1.6

Dividend received from BEE partner (0.5) (0.6) (0.6)

Financial income 6 (25.8) (11.4) (19.0)

Financial expense 6 52.8 56.3 92.1

Profit on disposal of property, plant and - 0.1 1.5

equipment

Share based payment provision 0.9 0.1 1.1

Operating profit before working capital 74.5 147.3 268.3

changes

Decrease / (increase) in trade and other 15.7 25.3 (7.1)

receivables

(Decrease) / increase in trade and other (15.0) (2.2) 24.5

payables

Increase in inventories (12.6) (29.5) (1.7)

Cash generated from operations 62.6 140.9 284.0

Net realised gains on foreign exchange 4.1 8.7 12.6

contracts

Finance expense (0.4) (4.4) (6.3)

Income tax received / (paid) 0.3 (0.4) (7.8)

Net cash generated from operating 66.6 144.8 282.5

activities

Cash flows from investing activities

Acquisition of property, plant and (50.9) (18.5) (54.0)

equipment

Proceeds from sale of property, plant and - 0.1 -

equipment

Loan repayment from BEE partners - 0.4 0.2

Dividend paid to BEE partners (2.7) (3.5) (3.5)

Dividend received from BEE partners 0.5 0.6 0.6

Repayment from KEMJV 0.3 1.9 2.5

Finance income 1.7 0.5 1.3

Net cash utilised in investing activities (51.1) (18.5) (52.9)

Cash flows from financing activities

Cash paid on lease liabilities (2.4) (0.8) (3.2)

Net realised foreign exchange loss on

settlement of foreign currency loans (11.8) - -

Repayment of borrowings (including Notes 8

redemption premium of US$1.4 million; 31

December 2021: US$nil; 30 June 2022: (146.1) (14.4) (98.2)

US$nil)

Net cash utilised by financing activities

(160.3) (15.2) (101.4)

Net (decrease) / increase in cash and (144.8) 111.1 128.2

cash equivalents

Cash and cash equivalents at beginning of 271.9 156.9 156.9

the Period

Effect of exchange rate fluctuations on 3.3 (11.3) (13.2)

cash held

Cash and cash equivalents at end of the 130.4 256.7 271.9

Period1

1. Cash and cash equivalents in the Consolidated Statement of Financial

Position includes restricted cash of US$16.2 million (30 June 2022: US$16.3

million and 31 December 2021: US$15.6 million) and unrestricted cash of

US$130.4 million (30 June 2022: US$271.9 million and 31 December 2021: US$256.7

million).

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 31 DECEMBER 2022

(Unaudited) Share Share Foreign Share-based Other Accumulated Attributable Non-controlling Total

capital premium currency payment reserves reserves / to the interest equity

account translation reserve (losses) parent

US$ million reserve

Six month Period

ending 31 December

2022:

At 1 July 2022 145.7 959.5 (448.9) 1.9 (0.8) (183.6) 473.8 4.7 478.5

(Loss) / profit for - - - - - (23.7) (23.7) 6.1 (17.6)

the Period

Other comprehensive - - (18.1) - - - (18.1) (0.5) (18.6)

(expense) / income

Conversion of share - (350.0) - - - 350.0 - - -

premium (refer note

12)

Dividend paid to - - - - - - - (9.8) (9.8)

Non-controlling

interest

shareholders

Equity settled share - - - 0.9 - - 0.9 - 0.9

based payments

At 31 December 2022 145.7 609.5 (467.0) 2.8 (0.8) 142.7 432.9 0.5 433.4

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 31 DECEMBER 2022

(Unaudited) Share Share Foreign Share-based Other Accumulated Attributable Non-controlling Total

capital premium currency payment reserves losses to the interest equity

account translation reserve parent

US$ million reserve

Six month Period

ending 31 December

2021:

At 1 July 2021 145.7 959.5 (402.1) 1.8 (0.8) (253.3) 450.8 (10.5) 440.3

Profit for the Period - - - - - 43.2 43.2 5.9 49.1

Other comprehensive - - (44.6) - - - (44.6) 0.3 (44.3)

(expense) / income

Dividend paid to - - - - - - - (3.5) (3.5)

Non-controlling

interest shareholders

Equity settled share - - - 0.1 - - 0.1 - 0.1

based payments

At 31 December 2021 145.7 959.5 (446.7) 1.9 (0.8) (210.1) 449.5 (7.8) 441.7

PETRA DIAMONDS LIMITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 31 DECEMBER 2022

(Unaudited) Share Share Foreign Share-based Other Accumulated Attributable Non-controlling Total

capital premium currency payment reserves losses to the interest equity

account translation reserve parent

US$ million reserve

Year ended 30 June

2022:

At 1 July 2021 145.7 959.5 (402.1) 1.8 (0.8) (253.3) 450.8 (10.5) 440.3

Profit for the Year - - - - - 69.0 69.0 19.1 88.1

Other comprehensive - - (46.8) (0.3) - - (47.1) (0.4) (47.5)

expense

Dividend paid to - - - - - - - (3.5) (3.5)

Non-controlling

interest shareholders

Equity settled share - - - 1.1 - - 1.1 - 1.1

based payments

Transfer between - - - (0.7) - 0.7 - - -

reserves:

At 30 June 2022 145.7 959.5 (448.9) 1.9 (0.8) (183.6) 473.8 4.7 478.5

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTH PERIODED 31 DECEMBER 2022

1. GENERAL INFORMATION

Petra Diamonds Limited (the "Company"), a limited liability company listed on

the Main Market of the London Stock Exchange, is registered in Bermuda with its

Group management office domiciled in the United Kingdom. The Consolidated

Interim Financial Statements of the Company for the six month period ended 31

December 2022 comprise the Company and its subsidiaries, joint operations and

associates (together referred to as the "Group").

2. ACCOUNTING POLICIES

The interim results, which are unaudited, have been prepared in accordance with

the requirements of International Accounting Standard 34. This condensed

interim report does not include all the notes of the type normally included in

an annual financial report. This condensed report is to be read in conjunction

with the Annual Report for the year ended 30 June 2022, and any public

announcements made by the Group during the interim reporting period. The annual

financial report for the year ended 30 June 2022 was prepared in accordance

with International Financial Reporting Standards adopted by the European Union

("IFRS's") and the accounting policies applied in this condensed interim report

are consistent with the polices applied in the annual financial report for the

year ended 30 June 2022 unless otherwise noted.

Basis of preparation including going concern

Going concern

The six-month period to 31 December 2022 delivered US$77.4 million in adjusted

EBITDA and US$11.7 million in operational free cash flow for the Group, while

Consolidated Net Debt reduced from $40.6 million as at 30 June 2022 to US$90.2

million at 31 December 2022.

Production

The first half of FY23 saw all of the Petra operations deal with operational

challenges. The Cullinan Mine experienced lower grades in the block cave on

account of accelerated waste ingress, resulting in lower ROM carats being

recovered, while also lowering the ROM carats production for the remainder of

FY23 and FY24. Several mitigation steps are currently being investigated to

minimise the impact of the lower grade. These include re-opening of T36 & T41,

while also evaluating the addition of two more tunnels (T46&T50) adjacent to

the current C-Cut centre.

Finsch experienced production challenges as a result of machine availability

owing to an aging underground fleet, challenges with the centralised blasting

system and emulsion quality and an extended rock-winder breakdown. Several

mitigation steps were implemented at Finsch, such as new underground equipment

being delivered and commissioned, coupled with positive changes to the blasting

process, the introduction of new long hole drill rigs and Load Haul Dump (LHDs)

loaders as well as the appointment of individuals to a number of key positions.

Furthermore, the 3-Level SLC project scope was amended to 90L, which adds

additional production tonnes to the Life of Mine plan. The mitigation steps

undertaken are expected to limit the lower production to FY23, with FY24

expected to deliver as per previous guidance, while the new project is expected

to add value beyond this Going Concern assessment period.

Williamson performed well throughout FY2023 until the Tailings Storage Facility

incident in the first week of November 2022. Production has been suspended

until the new tailings storage facility is completed. It is assumed that

production will only commence in July 2023. Progress is also being made in

closing out the Framework Agreement with the Government of Tanzania and the MoU

with Caspian).

Following the unsuccessful sales process during the Period, production at

Koffiefontein was stopped in November 2022 and the operation has subsequently

been placed on care and maintenance.

Diamond prices and diamonds market

Diamond prices continued their upward trend, with a 12.7% increase on a

like-for-like basis compared H1 FY22. While the Cullinan Mine did not

contribute revenue from exceptional stones (>US$5.0 million), it has generated

a robust $/ct price on account of a strong product mix, including several high

value single stones that did not individually breach the US$5.0 million

threshold.

Diamond prices are now the highest since the peaks experienced in 2011/2012. In

general, the market continues to be supported by a fundamental supply deficit,

with robust demand recovery experienced post COVID-19. From a demand

perspective, the Chinese lockdown had potentially moderated demand for certain

categories of polished goods, while the rising inflation and interest rate

cycles may impact disposable income and therefore further moderate/reduce

short-term demand for diamonds. This may lead to some short-term price

volatility, but the medium-long term supply/demand fundamentals are expected to

support the diamond price outlook.

Williamson framework agreement and MoU

The Group announced that it had entered into a framework agreement with the

Government of Tanzania in December 2021, which sets out key principles on the

economic benefit sharing amongst WDL shareholders, treatment of outstanding VAT

balances, the allocation of proceeds of the blocked parcel of diamonds and

settlement of historic disputes, amongst others. This agreement should provide

important fiscal stability for the mine and its investors and will become

effective upon completion of certain suspensive conditions. At the same time,

Petra also announced entering into a non-binding Memorandum of Understanding

(MoU) with Caspian Ltd to sell 50% (less 1 share) of Petra's indirect stake in

WDL for a purchase consideration of US$15 million.

Bond tender offer and South African banking facilities

During the Period, the Group carried out a successful tender offer to its

Noteholders, repaying the Noteholders US$144.6 million (principal plus

interest), utilising existing cash reserves at the time, resulting in the

deleveraging of the gross debt balances within the Group.

The Group's ZAR 1 billion senior Revolving Credit Facility (RCF) facility

remains undrawn at 31 December 2022, with the Group having access to the full

ZAR 1 billion (US$58.8 million).

The factors above, coupled with the further significant progress towards

stabilising the Group's balance sheet positions the Group well for this Going

Concern period.

Forecast liquidity and covenants

The Board has reviewed the Group's forecasts with various sensitivities applied

for the 18 months to June 2024, including both forecast liquidity and covenant

measurements. As per the First Lien agreements, the liquidity and covenant

measurements exclude contributions from Williamson's trading results and only

recognises cash distributions payable to Petra upon forecasted receipt, or

Petra's funding obligations towards Williamson upon payment.

The Board has given careful consideration to potential risks identified in

meeting the forecasts under the review period. The following sensitivities have

been performed in assessing the Group's ability to operate as a going concern

(in addition to the Base Case) at the date of this report:

* a 10% decrease in forecast rough diamond prices from January 2023 to June

2024

* a 10% strengthening in the forecast South African Rand (ZAR) exchange rate

from January 2023 to June 2024

* a 5% increase in Operating Costs from July 2022 to Dec 2023

* a US$15 million reduction in revenue contribution from the effects of

product mix and/or from Exceptional Stones

* Combined sensitivity: Prices down 10% and ZAR stronger by 10% and

Exceptional Stones contributions reduced by US$15 million and Operating

Costs up 5%

Under all the cases, the forecasts indicate the Group's liquidity outlook over

the 18-month period to June 2024 remains strong, even when applying the above

sensitivities to the base case forecast.

The forward-looking covenant measurements associated with the new First Lien

facility do not indicate any breaches during the 18-month review period for the

base case as well as all the above sensitivities, except for the worse case

combined sensitivity, which shows a covenant breach for the required interest

cover ratio in the June 2024. While the ICR is projected to be breached in this

combined sensitivity, both the Net Debt : EBITDA covenant and the liquidity

covenant remain healthy, while the RCF remains undrawn. It is therefore assumed

that the RCF remains available, with the 1L lender assumed to agree to an ICR

covenant waiver, given that the Group does not expect to utilise the RCF for

servicing of its 2L interest obligations. Furthermore, this potential ICR

breach may be cured by means of cost savings and revenue enhancing

opportunities through entering into partnership agreements on the sale of

Exceptional stones.

Conclusion

The Board is of the view that the longer-term fundamentals of the diamond

market remain sound and that the Group will continue to benefit from an

improving operating model throughout the review period and beyond.

Based on its assessment of the forecasts, principal risks and uncertainties and

mitigating actions considered available to the Group in the event of downside

scenarios, the Board confirms that it is satisfied the Group will be able to

continue to operate and meet its liabilities as they fall due over the review

period. Accordingly, the Board have concluded that the going concern basis in

the preparation of the financial statements is appropriate and that there are

no material uncertainties that would cast doubt on that basis of preparation.

New standards and interpretations applied

The IASB has issued new standards, amendments and interpretations to existing

standards with an effective date on or after 1 July 2022 which are not

considered to have a material impact on the Group during the Period under

review.

New standards and interpretations not yet effective

Certain new standards, amendments and interpretations to existing standards

have been published that are mandatory for the Group's accounting periods

beginning after 1 July 2022 or later periods. The only standard which is

anticipated to be significant or relevant to the Group is:

Amendments to IAS 1: Classification of Liabilities as Current or Non-current

Amendments to IAS 1, which are intended to clarify the requirements that an

entity applies in determining whether a liability is classified as current or

non-current. The amendments are intended to be narrow scope in nature and are

meant to clarify the requirements in IAS 1 rather than modify the underlying

principles. The amendments include clarifications relating to:

* how events after the end of the reporting period affect liability

classification;

* what the rights of an entity must be in order to classify a liability as

non-current;

* how an entity assesses compliance with conditions of a liability (e.g. bank

covenants); and

* how conversion features in liabilities affect their classification.

The amendments were originally effective for periods beginning on or after 1

January 2022 which was deferred to 1 January 2023 by the IASB in July 2020.

Earlier application is permitted but Amendments to IAS 1 has not yet been

endorsed for application by the European Union.

Significant assumptions and judgements:

The preparation of the condensed consolidated interim financial statements

requires management to make estimates and judgements and form assumptions that

affect the reported amounts of the assets and liabilities, reported revenue and

costs during the periods presented therein, and the disclosure of contingent

liabilities at the date of the interim financial statements. Estimates and

judgements are continually evaluated and based on management's historical

experience and other factors, including future expectations and events that are

believed to be reasonable. The estimates and assumptions that have a

significant risk of causing a material adjustment to the financial results of

the Group in future reporting periods are discussed below.

Key estimates and judgements:

Impairment reviews

The Group prepares impairment models and assesses mining assets for impairment

or reversals of previous impairments. While conducting an impairment test of

its assets using recoverable values using the current life of mine plans, the

Group exercised judgement in making assumptions about future rough diamond

prices, foreign exchange rates, volumes of production, ore reserves and

resources included in the current life of mine plans, future development and

production costs and factors such as inflation and discount rates. Changes in

estimates used can result in significant changes to the 'Consolidated Income

Statement' and 'Statement of Financial Position'.

Cullinan, Finsch, Koffiefontein and Williamson Mines

The impairment tests for the Cullinan, Finsch and Williamson Mines indicated no

further impairment charges or reversals to be recognised. The impairment test

for Koffiefontein indicated an impairment of US$0.3 million on a carrying value

of the Group's property, plant and equipment of US$615.3 million

(pre-impairment). This follows US$21.1 million impairment reversal recognised

at 30 June 2022 (comprising Koffiefontein impairment charge of US$0.3 million

and a Group level impairment reversal relating to Williamson, previously

recognised under IFRS 5, of US$21.4 million as Williamson was no longer

considered an asset held for sale.) on a carrying value of the Group's

property, plant and equipment of US$608.2 million (pre-impairment) at the time

of recognition. For further details of the inputs, assumptions and

sensitivities in the impairment model, refer to note 15.

Recoverability and ownership of diamond parcel in Tanzania

The Group holds diamond inventory valued at US$12.5 million (30 June 2022:

US$12.5 million and 31 December 2021: US$10.6 million) in the Statement of

Financial Position in respect of the Williamson mine's confiscated diamond

parcel. The diamond inventory parcel was written up from the net realisable

value of prior periods to historical cost during FY2022. The recommencing of

operations and the sales tenders at Williamson during the FY 2022 provided

additional information for management to assess the value of the diamond parcel

and was the basis used to revalue the diamond parcel to the lower of cost or

net realisable value. During FY 2018, an investigation into the Tanzanian

diamond sector by a parliamentary committee in Tanzania was undertaken to

determine if diamond royalty payments were being understated. In connection

with this, Petra announced on 11 September 2017 that a parcel of diamonds

(71,654.45 carats) from the Williamson mine in Tanzania (owned 75% by Petra and

25% by the Government of the United Republic of Tanzania ("GoT")) had been

blocked for export to Petra's marketing office in Antwerp.

The assessment of the recoverability of the diamond parcel required significant

judgement. In making such a judgement, the Group considered the Framework

Agreement that was signed with the GoT on 13 December 2021, confirmation

received from the GoT in FY 2018 that they held the diamond parcel of 71,654.45

carats, ongoing discussions held with the GoT, an assessment of the internal

process used for the sale and export of diamonds confirming such process is in

full compliance with legislation in Tanzania and the Kimberley Process and

legal advice received from the Group's in-country attorneys which supports the

Group's position.

The Framework Agreement which refers to the diamond parcel as the "Government

Diamond Parcel" sets out that the GoT agrees to allocate proceeds from the sale

of the Parcel to Williamson Diamonds Limited ("WDL"). Post period end, the

Company was informed that a portion of the Parcel was sold and the Company is

engaging with the GoT to confirm the application of the proceeds. For further

details refer to note 18.

While these engagements between the Company and the GoT are ongoing, based on

the above judgements and assessment thereof, management remain confident that

based on the signed Framework Agreement, and the legal advice received from the

Group's in-country attorneys, WDL will derive future economic benefit from the

sale proceeds of the parcel (both the portion already sold and any portion that

is yet to be sold).

Recoverability of VAT in Tanzania

The Group has VAT receivable of US$5.1 million (30 June 2022: US$2.6 million