TIDMPDL

CORRECTION TO GUIDANCE TABLE WHICH NOW SHOWS ROW HEADINGS AND TO FORMATTING ON

THE FOLLOWING BULLET:

. Gross debt decreased to US$241.7 million (30 June 2022: US$366.2 million)

reflecting the successful tender offer to repurchase second lien notes

16 January 2023 LSE: PDL

Petra Diamonds Limited

H1 FY 2023 Operating Update

Petra reports its operating results for the first half of FY 2023

Richard Duffy, Chief Executive Officer of Petra, commented:

"Despite some challenges in the first half of FY 2023, Petra continues to

benefit from the operational improvements we have made across the business

which provide for greater stability and resilience. As a result, we are seeing

improvements to equipment and tunnel availability at Finsch, resulting in an

increase in ROM grades from December 2022. At the Cullinan Mine, we have

continued to mine and recover targeted tonnes as we continue to seek to

mitigate the impact of the recent grade challenges experienced.

Although lower grades at the Cullinan Mine are now expected to continue through

FY 2024, mitigating factors around the re-opening of Tunnels 36 and 41 and the

completion of development of two new tunnels, Tunnels 46 and 50, are expected

to start contributing to production in FY 2025 and more than offset the impact

of lower grades this financial year and next. The CC1E project currently under

development is further expected to contribute higher grade tonnes from the end

of FY 2024 and return average grades towards the 40cpht level. At Finsch, the

acquisition of new drill rigs and LHD loaders supports improved production in

the second half of FY 2023.

Strong relationships at both government and local level, as well as a robust

governance framework, provided for a swift response to the regrettable tailings

storage facility (TSF) breach that occurred at Williamson on 7 November 2022.

With this continued cooperation and focused team on the ground, I am confident

production will resume safely from the beginning of FY 2024 and that the

actions taken to date by Williamson Diamonds Limited will enable the

environmental and social impacts to be fully remediated.

After having commenced mining in the early 1880s and being a renowned source of

gem-quality white and coloured diamonds, the Board, in ongoing consultation

with its stakeholders, has taken the difficult decision to cease operations and

place Koffiefontein on care and maintenance. Engagement with our key

stakeholders remains constructive as we seek to ensure an inclusive and

responsible process towards mine closure.

Following on from the above, we have reduced our diamond production guidance

for this financial year to circa 2.8 Mcts and 3.0 to 3.3 Mcts for FY 2024,

which includes the impact of lost production at Williamson and Koffiefontein.

Guidance in FY 2025 remains unchanged.

With a stronger product mix offsetting the recent softness in rough diamond

prices, we remain confident that we will continue to generate cash to fund

capex, allow further deleveraging and pay dividends."

Highlights vs H1 FY 2022

* LTIFR and LTIs marginally increased to 0.19 and 7 respectively

* Ore processed decreased 4% to 5.4Mt, largely due to the suspension of

production at Williamson and lower tonnes mined at Finsch

* Total diamond production decreased 21% to 1.4 million carats due to lower

grades at the Cullinan Mine, lower tonnes mined at Finsch and production

suspensions at Williamson and Koffiefontein

* Support from a weaker Rand and more stable diamond pricing

* Revenue amounted to US$212.1 million (H1 FY 2022: US$264.7 million)

+ Post the Tender 3 sales results announcement released on 13 December

2022, additional off-tender sales of some US$4.3 million (40,246

carats) to local South African cutting & polishing clients were

effected, bringing total rough diamond sales for the period to US$210.7

million

+ Revenue includes US$1.4 million from Petra's 50% share in the profit

from the sale of polished stones cut from the 342.92 carat rough white

diamond sold into a partnership for US$10 million in August 2021

* Gross debt decreased to US$241.7 million (30 June 2022: US$366.2 million)

reflecting the successful tender offer to repurchase second lien notes

Safety, sales H1 FY 2023 H1 FY 2022

and production Unit

Q2 Q1 Total Q2 Q1 Total

Safety

LTIFR - 0.22 0.16 0.19 0.06 0.31 0.18

LTIs Number 4 3 7 1 5 6

Sales

Diamonds sold Carats 792,889 520,011 1,312,900 1,017,665 578,186 1,595,851

Revenue1 US$m 107.8 102.9 210.7 149.9 114.9 264.7

Contribution US$m 0.0 0.0 0.0 27.7 50.2 77.9

from Exceptional

Stones

Production

ROM tonnes Tonnes 2,198,975 3,042,017 5,240,992 2,935,488 2,466,044 5,401,532

Tailings and Tonnes 92,375 105,715 198,090 122,699 115,593 238,292

other tonnes

Total tonnes Tonnes 2,291,350 3,147,732 5,439,082 3,058,187 2,581,637 5,639,824

treated

ROM diamonds Carats 604,917 733,014 1,337,931 839,643 810,346 1,649,989

Tailings and Carats 31,612 30,206 61,818 61,370 66,065 127,435

other diamonds

Total diamonds Carats 636,529 763,220 1,399,749 901,013 876,411 1,777,424

1 Revenue reflects proceeds from the sale of rough diamonds and excludes

revenue from profit share arrangements (as noted in the text above)

2 Petra classifies "Exceptional Stones" as rough diamonds which sell for US$5

million or more each

* Production guidance for FY 2023 & FY 2024 revised downwards from 3.3 to 3.6

Mcts for each of these years to circa 2.8 Mcts for FY 2023, increasing to

3.0 to 3.3 Mcts for FY 2024. The adjustment incorporates the impact of

production curtailment at Williamson on FY 2023 of c. 200 kcts, cessation

of production at Koffiefontein during H1 FY 2023 of c. 40 kcts p.a. for

both FY 2023 and FY 2024, lower H1 FY 2023 production at Finsch compared to

earlier guidance of c. 85 kcts and a restated grade forecast for the

Cullinan Mine for FY 2023 and FY 2024 given accelerated waste ingress of c.

200 kcts per year for each of the two years

Production and guidance

* LTI and LTIFR increased marginally in H1 FY 2023 due to an increase in the

number of LTIs, with the LTIFR impacted by a smaller number of hours worked

at Koffiefontein. Petra continues to strive for a zero harm environment and

has increased its focus on identifying and mitigating safety risks through

behaviour-based intervention programmes.

* Cullinan Mine ROM grade reduced to 31.2cpht and is expected to be between

30cpht and 32cpht for the full year. As announced previously, this is

attributable to the C-Cut cave maturity as the cave progresses from SW to

NE. From March 2022, the C-Cut experienced early ingress of waste from the

overlying depleted mining blocks. The change in ore makeup (lower grade and

higher density) as a result of the cave progression also resulted in

processing challenges due to the high process yields, causing a reduction

in plant capacity to process tailings treatment.

Ingress of overlying waste into the extraction draw points is a natural process

in block cave mining. However, the onset and rate of the observed waste ingress

occurred earlier and much more rapidly than predicted by the depletion model

provided by an independent external expert. The C-Cut depletion model has been

recalibrated by the independent external expert and model parameters adjusted

to obtain alignment between the modelled and observed waste ingress. Once the

ingress of waste commences, dilution of the ore is unavoidable and will

increase as the cave maturity progresses. The impact of the change in the ore

makeup on treatment capacity has, however, been largely negated with changes

made in the dense media separation plant.

Several mitigating action plans to reduce the loss in carats are being

considered and evaluated. Tailings treatment has been optimised but, in

isolation, is not sufficient to address the extent of the carat loss associated

with waste ingress in the C-Cut. Other mitigation action plans include the

re-opening of Tunnels 36 and 41, which have already commenced, and the

establishment of two new tunnels, Tunnels 46 and 50 (C-Cut extension), which

are being evaluated. The re-opening of Tunnels 36 and 41 and the establishment

of Tunnels 46 and 50 are expected to provide additional volume from FY 2025

onwards. Early development spend has been approved for Tunnels 46 and 50 and

the additional production from these two tunnels is expected to more than

offset the impact of lower grades in FY 2023 and FY 2024. Production from the

CC1E capital expansion project will contribute meaningfully from FY 2025

onwards and is expected to see grades move back towards 40cpht.

As a consequence of the continued lower grades being experienced, production

guidance for the full year and for FY 2024, which was expected to be towards

the lower end of guidance, is now expected to fall below previously guided

ranges with an annual negative impact of around 200 to 250 kcts for both FY

2023 and FY 2024, with FY 2025 guidance remaining unchanged at 1.7 to 1.9 Mct.

* Finsch mined and treated 1.1Mt in H1 FY 2023. Finsch experienced further

production challenges in Q2 FY 2023, resulting in tonnes hoisted and

treated being significantly below target in the first half. These

challenges included low machine availability owing to an aging underground

fleet, challenges with the centralised blasting system and emulsion quality

and an extended rock-winder breakdown. In December 2022, production

improved on the back of new underground equipment being delivered and

commissioned following the previously announced increased lead-times,

coupled with positive changes to the blasting process. These blasting

process changes, together with the introduction of new long hole drill rigs

and Load Haul Dump (LHDs) loaders as well as the appointment of individuals

to a number of key positions, supports the expected improvement in

production in the second half.

The lower production in the first half is expected to result in full year

production falling short of earlier guidance by some 75kcts. Guidance for FY

2024 onwards remains unchanged.

* Production at Williamson was trending positively against guidance until the

TSF breach in November 2022. Following the incident, all production

activities were suspended, with no further production expected for FY 2023.

On-mine activities are focused on remedial steps and critical maintenance

to allow for a smooth start-up once the TSF has been recommissioned. A

separate announcement will be released shortly by the Company to provide an

update on activities at Williamson since the incident.

On 28 November 2022, the Independent Grievance Mechanism (IGM) at Williamson

became operational with the commencement of the IGM's pilot phase. A detailed

update, dated 30 November 2022, of the IGM work undertaken since July 2022, the

Restorative Justice Projects that are being put in place to provide sustainable

benefits to the communities located close to the mine and illegal incursions

onto the Williamson mine lease area during Q1 FY 2023 is set out here:

Williamson-IGM-and-RJPs-November-Update-for-website-29-November-22.pdf

(petradiamonds.com)

* As previously announced, Petra has been exploring options for a responsible

exit at Koffiefontein as the mine approaches the end of its mine plan and

with the sales process announced in April 2022 having not resulted in a

potential buyer for the mine. The asset has been loss-making for several

years and low morale remains a risk to the mine's safety performance. A

Section 189(3) notice was issued to all KDM employees during November 2022

informing them of the economic realities of the mine and inviting them to

join a collaborative process to determine the optimal way forward towards

achieving the mine being placed on care and maintenance. Operations were

halted to ensure all assessed risks were adequately mitigated for. Our

consultations with the mine's key stakeholders remain constructive and we

are optimistic that an inclusive and responsible process towards mine

closure will be achieved. As a result, further production from

Koffiefontein has been removed from our updated guidance.

* Guidance - the following items are amended, with items not shown being

unchanged with reference to earlier guidance. Updated cost and capital

guidance, including actual results to December 2022, will be provided with

the Company's interim results on 21 February 2023.

Original Guidance Restated Guidance

Group Carats recovered

- FY 2023 3.3 - 3.6 Mcts 2.8 Mcts

- FY 2024 3.3 - 3.6 Mcts 3.0 - 3.3 Mcts

Cullinan Mine Carats recovered

- FY 2023 1.61 - 1.79 Mcts 1.4 - 1.5 Mcts

- FY 2024 1.66 - 1.85 Mcts 1.45 - 1.55 Mcts

ROM grade

- FY 2023 36.5 - 38.5 cpht 30.8 cpht

- FY 2024 36.7 - 38.8 cpht 30.7 cpht

Finsch Carats recovered

- FY 2023 1.28 - 1.39 Mcts 1.15 - 1.25 Mcts

Williamson Carats recovered

- FY 2023 319 - 358 kcts 141 kcts

Koffiefontein Carats Recovered

- FY 2023 47 - 52 kcts 6 kcts

- FY 2024 45 - 49 kcts

- FY 2024 29 - 32 kcts

More detailed guidance is available on Petra's website at https://

www.petradiamonds.com/investors/analysts/analyst-guidance/

Balance sheet further strengthened through successful debt tender offer

* Balance Sheet as at 31 December 2022:

* Gross debt decreased to US$241.7 million (30 June 2022: US$366.2 million)

reflecting the successful tender offer in September/October 2022 to

repurchase second lien notes.

+ Gross cash of US$146.6 million (30 June 2022: US$288.2 million) and

unrestricted cash of US$130.4 million (30 June 2022: US$271.9 million)

reflecting the repurchase of the Company's loan notes totalling

US$145.0 million during the period.

+ Consolidated net debt of US$90.8 million (30 June 2022: US$40.6

million) increased due partly to timing of the Company's tender cycles

and resultant inventory build during the period together with the

previously announced increase in capital expenditure for the expansion

projects at the Cullinan Mine and Finsch.

Outlook

Although the recent grade and dilution issues at the Cullinan Mine are expected

to impact production for the remainder of FY 2023 and FY 2024, the impact of

this on the business is expected to be more than offset from FY 2025.

Production from Tunnels 46 and 50 are not included in Cullinan Mine's current

LOM plan and therefore provide incremental tonnes and carats. At Finsch, the

successful commissioning of a new underground fleet and appointment of

individuals to a number of key positions are expected to lead to improved

production in H2 FY 2023. At Williamson, remedial steps and critical

maintenance are ongoing to allow for a smooth and safe start-up once the TSF

has been recommissioned, which is expected from the beginning of FY 2024.

Production at Koffiefontein will remain halted while we continue to engage with

our key stakeholders to determine the optimal way forward in moving towards

placing the mine on care and maintenance as part of finalising a responsible

process towards mine closure.

The backdrop of structural changes to the supply and demand fundamentals in the

diamond market remains unchanged and we anticipate it to remain supportive

going forward. We are cautiously optimistic that the resilience seen in the

luxury goods market, together with the easing of lockdown restrictions in

China, will lead to a stabilisation of prices in the early part of CY 2023.

This announcement includes inside information as defined in Article 7 of the UK

Market Abuse Regulation No. 596/2014 and is being released on behalf of Petra

by the Company Secretary.

INVESTOR WEBCASTS

Webcast presentation for institutional investors and analysts

09:30am GMT tomorrow, 17 January 2023

Petra's CEO, Richard Duffy, and CFO, Jacques Breytenbach, will host a webcast

for institutional investors and analysts tomorrow to discuss this trading

update at 09:30 GMT.

Please register at:

https://www.investis-live.com/petra-diamonds/63c12fedaba36a0c0021ee6a/hyaie

Dial in details:

United Kingdom 0800 640 6441

South Africa 087 550 8441

United States (Local) 1 646 664 1960

All other locations +44 20 3936 2999

09:30: Access code: 723364

Press *1 to ask a question, *2 to withdraw your question, or *0 for operator

assistance.

Link for recording (available later in the day):

https://www.petradiamonds.com/investors/results-reports/

Investor Meet webcast at 14.30 GMT on 17 January 2023

Petra will also present the results on the Investor Meet Company platform,

predominantly aimed at retail investors. To join: https://

www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Please contact

Petra Diamonds, London

Telephone: +44 207494 8203

Patrick Pittaway

investorrelations@petradiamonds.com

Julia Stone

Notes:

1. The following definitions have been used in this announcement:

a. Exceptional Stones: diamonds with a valuation and selling price of US$5m or

more per stone

b. cpht: carats per hundred tonnes

c. LTIs: lost time injuries

d. LTIFR: lost time injury frequency rate, calculated as the number of LTIs

multiplied by 200,000 and divided by the number of hours worked

e. FY: financial year ending 30 June

f. CY: calendar year ending 31 December

g. H: half of the financial year

h. ROM: run-of-mine (i.e. production from the primary orebody)

i. m: million

j. Mt: million tonnes

k. LHD: Load Haul Dump loaders

ABOUT PETRA DIAMONDS

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground mines in South Africa (Finsch, the

Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

which supports the potential for long-life operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's loan notes due in 2026 are

listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

Corporate and financial summary 31 December 2022

Unit As at 31 December As at 30 September As at 30 June

2022 2022 2022

Cash at bank - US$m 146.6 154.0 288.2

(including

restricted

amounts)¹

Diamond debtors US$m 4.3 4.2 37.4

Diamond US$m 59.9 76.3 52.7

inventories2,3 Carats 540,153 692,219 453,380

2026 US$336.7m US$m 241.7 235.8 366.2

loan notes4

Bank loans and US$m - - -

borrowings5

Consolidated Net US$m 90.8 77.6 40.6

Debt6

Bank facilities US$m 58.8 55.1 61.5

undrawn and

available5

Note: The following exchange rates have been used for this announcement:

average for H1 FY 2023 US$1: ZAR17.32 (FY 2022: US$1: ZAR15.22); closing rate

as at 31 December 2022 US$1: ZAR17.00 (30 June 2022: US$1: ZAR16.27).

Notes:

1. The Group's cash balances comprise unrestricted balances of US$130.4

million, and restricted balances of US$16.2 million.

2. Recorded at the lower of cost and net realisable value.

3. Diamond inventories includes the Williamson 71,654.45 carat parcel of

diamonds blocked for export during August 2017, with a carrying value of

US$12.5 million. Under the framework agreement reached with the Government

of Tanzania, as announced on 13 December 2021, the proceeds from the sale

of this parcel are required to be allocated to Williamson.

4. The 2026 US$336.7 million loan notes, originally issued following the

capital restructuring (the "Restructuring") completed during March 2021,

have a carrying value of US$241.7 million which represents the outstanding

principal amount of US$210.2 million (after the early participation phase

of the debt tender offers as announced in September and October 2022) plus

US$45.5 million of accrued interest and net of unamortised transaction

costs capitalised of US$14.0 million.

5. Bank loans and borrowings represent the Group's ZAR1 billion revolving

credit facility which remains undrawn and available.

6. Consolidated Net Debt is bank loans and borrowings plus loan notes, less

cash and diamond debtors.

Mine-by-mine tables:

Cullinan Mine - South Africa

H1 FY 2023 H1 FY 2022

Unit

Q2 Q1 Total Q2 Q1 Total

Sales

Revenue US$m 45.8 56.9 102.7 74.9 92.8 167.7

Diamonds sold Carats 400,999 267,728 668,727 500,008 372,296 872,304

Average price per US$ 114 212 154 150 249 192

carat

ROM Production

Tonnes treated Tonnes 1,120,282 1,110,912 2,231,194 1,099,643 1,207,343 2,306,986

Diamonds produced Carats 328,137 368,796 696,933 411,235 431,967 843,202

Grade1 Cpht 29.3 33.2 31.2 37.4 35.8 36.5

Tailings Production

Tonnes treated Tonnes 62,178 77,572 139,750 122,700 115,593 238,293

Diamonds produced Carats 28,211 26,790 55,001 61,370 66,065 127,435

Grade1 Cpht 45.4 34.5 39.4 50.0 57.2 53.5

Total Production

Tonnes treated Tonnes 1,182,460 1,188,484 2,370,944 1 222,343 1,322,936 2,545,279

Diamonds produced Carats 356,348 395,586 751,934 472,605 498,032 970,637

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

Finsch - South Africa

H1 FY 2023 H1 FY 2022

Unit

Q2 Q1 Total Q2 Q1 Total

Sales

Revenue US$m 32.0 23.4 55.4 46.4 19.3 65.7

Diamonds sold Carats 283,833 177,285 461,118 474,643 201,652 676,295

Average price per US$ 113 132 120 98 96 97

carat

ROM Production

Tonnes treated Tonnes 522,578 572,976 1,095,554 721,741 701,378 1,423,119

Diamonds produced Carats 234,150 260,217 494,367 351,175 350,368 701,543

Grade1 Cpht 44.8 45.4 45.1 48.7 50.0 49.3

Tailings Production

Tonnes treated Tonnes 30,197 17,305 47,502 - - -

Diamonds produced Carats 3,402 3,160 6,562 - - -

Grade1 Cpht 11.3 18.3 13.8 - - -

Total Production

Tonnes treated Tonnes 552,775 590,281 1,143,056 721,741 701,378 1,423,119

Diamonds produced Carats 237,552 263,377 500,929 351,175 350,368 701,543

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

Williamson - Tanzania

H1 FY 2023 H1 FY 2022

Unit

Q2 Q1 Total Q2 Q1 Total

Sales

Revenue US$m 27.9 21.2 49.1 20.2 - 20.2

Diamonds sold Carats 103,829 71,295 175,124 26,611 - 26,611

Average price per US$ 269 297 280 760 - 760

carat

ROM Production

Tonnes treated Tonnes 520,017 1,309,359 1,829,376 988,978 365,138 1,354,116

Diamonds produced Carats 39,766 100,750 140,516 68,453 14,420 82,873

Grade1 Cpht 7.6 7.7 7.7 6.9 3.9 6.1

Total Production

Tonnes treated Tonnes 520,017 1,309,359 1,829,376 988,978 365,138 1,354,116

Diamonds produced Carats 39,766 100,750 140,516 68,453 14,420 82,873

Koffiefontein - South Africa

H1 FY 2023 H1 FY 2023

Unit

Q2 Q1 Total Q2 Q1 Total

Sales

Revenue US$m 2.2 1.4 3.6 8.3 2.8 11.1

Diamonds sold Carats 4,228 3,703 7,931 16,400 4,238 20,638

Average price per US$ 508 383 450 505 664 538

carat

ROM Production

Tonnes treated Tonnes 36,099 48,770 84,869 125,126 192,184 317,310

Diamonds produced Carats 2,862 3,253 6,115 8,779 13,592 22,371

Grade1 Cpht 7.9 6.7 7.2 7.0 7.1 7.1

Tailings Production

Tonnes treated Tonnes - 10,837 10,837 - - -

Diamonds produced Carats - 255 255 - - -

Grade1 Cpht - 2.4 2.4 - - -

Total Production

Tonnes treated Tonnes 36,099 59,607 95,706 125,126 192,184 317,310

Diamonds produced Carats 2,862 3,508 6,370 8,779 13,592 22,371

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

END

(END) Dow Jones Newswires

January 16, 2023 05:15 ET (10:15 GMT)

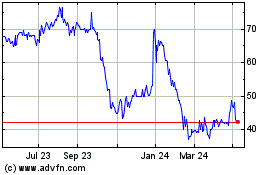

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

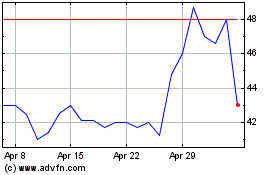

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024