Petra Diamonds Sales Results for Tender 2 FY2023

November 24 2022 - 8:44AM

UK Regulatory

TIDMPDL

24 November 2022 LSE: PDL

PETRA DIAMONDS LIMITED

Sales results for Tender 2 FY 2023

Petra achieves US$61.3 million in sales in its second tender for FY 2023

Richard Duffy, Chief Executive Officer of Petra Diamonds (Petra), said:

"This is a creditable result in the current somewhat muted market, with

like-for-like[1] prices 12.6% higher compared to Tender 2 of FY 2022 and 5.1%

lower than Tender 1 of FY 2023. Demand for fancy coloured and large white

stones continued to be evident despite this being a seasonally weaker period.

Subdued demand in China continued to impact pricing in the gem quality 0.75ct

up to 5ct size ranges, with some pricing pressure also evident in the 5ct -

10ct range. Pricing across smaller size ranges was largely flat on the previous

tender.

Although we continue to expect a supportive diamond market in the medium to

longer term as a result of the structural supply deficit, we see current levels

of demand continuing into the New Year, albeit with the potential upside of

festive season sales and any easing of lockdown restrictions in China."

Petra announces the results of Tender 2 of FY 2023, at which 447,276 carats

were sold for a total of US$61.3 million across Petra's mining operations.

Rough diamond sales results for the respective periods are set out below:

Tender 2 Tender 1 Variance Tender 2 YTD FY 2023 YTD FY 2022

FY23 FY23 T1 FY23 FY22 after after

Oct / Sep-22 vs Oct-21 Tenders Tenders

Nov-22 T2 FY23 1&2 1&2

Diamonds sold 447,276 520,011 -14% 132,525 967,287 710,712

(carats)

Sales (US$ 61.3 102.9 -40% 21.5 164.1 136.4

million)

Average price 137 198 -31% 162 170 192

(US$/ct)

Revenue from - - - - - 50.2

Exceptional

Stones[2] (US$

million)

Sales

Volumes for the second tender cycle are typically lower than the first tender

cycle given the respective cut-off dates for these cycles. As previously

announced, the final closure for Tender 2 FY 2023, originally planned towards

the second half of October, was extended as a result of unusual market

conditions with some build up in inventory pre-Diwali. This extension resulted

in an overall price increase of around 6.4% on the affected parcels. Our third

sales tender for FY 2023 is currently planned to close early December 2022

although we will continue to be flexible in our approach.

[1] Like-for-like refers to the change in realised prices between tenders and

excludes revenue from all single stones and Exceptional Stones, while

normalising for the product mix impact

[2] Petra classifies "Exceptional Stones" as rough diamonds which sell for US$5

million or more each

The results of Tender 2 bring FY 2023 revenue from rough diamond sales to

US$164.1 million, with no Exceptional Stone sales YTD, compared to US$136.4

million in the first two tenders of FY 2022, which included a US$50.2 million

contribution from Exceptional Stones.

Mine by mine average prices for the respective periods are set out in the table

below:

US$/carat Tender 2 Tender 1 Tender 2 YTD FY 2023 YTD FY FY 2022

FY23 FY23 FY22 after 2022 12 months

Oct / Nov-22 Sep-22 Oct-21 Tenders 1&2 after to

Tenders 1& 30 June

2 2022

Cullinan Mine 113 212 2141 165 2451 1691

Finsch 118 132 109 126 99 77

Williamson 272 297 n/a 286 n/a 3841

Koffiefontein 639 383 461 477 562 581

Note 1: Prices for both Cullinan Mine and Williamson include proceeds from the

sale of a number of Exceptional Stones.

Like-for like prices

Whilst like-for-like rough diamond prices declined by 5.1% on Tender 1 FY 2023,

they increased 12.6% compared to Tender 2 of FY 2022, with YTD prices up 19.0%

on a like-for-like basis compared to the first two tenders of FY 2022.

Product mix

The balance of price movements are attributable to product mix, particularly

for the Cullinan Mine, where the previous tender cycle benefited from an

increased number of high value stones, which largely normalised in Tender 2

resulting in a lower overall price per carat.

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494

8203

Patrick Pittaway

investorrelations@petradiamonds.com

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of 226.6 million carats, which supports the potential for long-life operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's loan notes due in 2026 are

listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

November 24, 2022 08:44 ET (13:44 GMT)

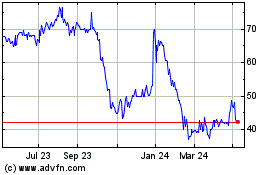

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

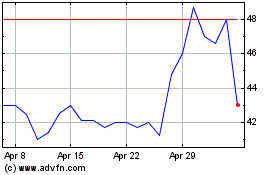

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024