TIDMPDL

27 September 2022 LSE: PDL

Petra Diamonds Limited

("Petra", the "Company", the "Group")

Petra's wholly owned subsidiary, Petra Diamonds US$ Treasury Plc, has today

made the following announcement on the Irish Stock Exchange:

FOR IMMEDIATE RELEASE

This announcement and any materials relating to the Offer do not constitute,

and may not be used in connection with, any form of offer or solicitation in

any place where such offers or solicitations are not permitted by law.

The distribution of this announcement in certain jurisdictions may be

restricted by law. Persons into whose possession this announcement comes are

required to inform themselves about, and to observe, any such restrictions.

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN

DOUBT ABOUT THE ACTION YOU SHOULD TAKE, YOU SHOULD CONSULT IMMEDIATELY YOUR

STOCKBROKER, BANK MANAGER, SOLICITOR, ACCOUNTANT OR APPROPRIATELY AUTHORISED

INDEPENT FINANCIAL ADVISER.

Petra Diamonds US$ Treasury Plc

Company Number: 09518557

(the "Offeror")

Announcement of Early Tender Results and Amendment of Offer Terms

$336,656,000 in aggregate notional principal amount of Senior Secured Second

Lien Notes due 2026

(ISIN No. XS2289899242, Common Code 228989924 (Private Placement))

(ISIN No. XS2289895927, Common Code 228989592 (Regulation S))

27 September 2022

On September 13, 2022, Petra Diamonds US$ Treasury Plc (the "Offeror")

announced its invitation to offer (the "Offer") to holders (the "Noteholders")

to submit tenders to sell to the Offeror for cash the $336,656,000 in aggregate

notional principal amount of the Senior Secured Second Lien Notes due 2026 (the

"Notes") up to a maximum consideration of $150,000,000 (the "Acceptance

Consideration"), subject to the offer and distribution restrictions, upon the

terms and subject to the conditions set forth in a tender offer memorandum

dated September 13, 2022 (as it may be amended or supplemented from time to

time, the "Tender Offer Memorandum") in accordance with a modified Dutch

auction procedure (the "Tender Offer Announcement").

Capitalised terms used in this announcement but not otherwise defined have the

meanings given to them in the Tender Offer Memorandum and the Tender Offer

Announcement.

Following the Early Participation Deadline of the Offer at 5.00 p.m. London

time on September 26, 2022, the Offeror hereby announces that:

a. all conditions to the Offer as of the Early Participation Deadline,

including, without limitation, the Transaction Conditions, have been

satisfied or waived by the Offeror;

b. it will accept for purchase valid tenders of Notes pursuant to the Offer

prior to the Early Participation Deadline;

c. the notional principal amount of Notes that have been validly tendered by

Noteholders prior to the Early Participation Deadline and are accepted for

payment by the Offeror is $125,590,338 (corresponding to an actual

principal amount after application of the Pool Factor of $143,627,622.34);

d. the Acceptance Consideration will be increased to $175,000,000, as noted

below with respect to amendments to the terms of the Offer. Therefore, no

Scaling Factor will be applied to valid tenders of Notes prior to the Early

Participation Deadline;

e. the Total Consideration for Notes tendered prior to the Early Participation

Deadline will be $1,010 per $1,000 in principal amount of Notes; and

f. the total cash purchase price to be paid by the Offeror on the Early

Settlement Date (that is, the Total Consideration for all Notes validly

tendered multiplied by the Pool Factor) is $145,063,898.63.

Further, the Offeror hereby notifies the Noteholders as follows:

a. Pursuant to the Tender Offer Memorandum, subject to applicable law and as

provided in the Tender Offer Memorandum, the Offeror may, in its sole and

absolute discretion, extend, re-open, withdraw or terminate the Offer and

amend or waive any of the terms and conditions of the Offer at any time

before any acceptance by the Offeror of Notes tendered in the Offer.

b. The Offeror has amended the terms of the Offer as follows:

+ The Acceptance Consideration will be increased to $175,000,000; and

+ All Noteholders who validly tender their Notes after the Early

Participation Deadline but prior to the Expiration Deadline will be

eligible to receive the Total Consideration of $1,010 per $1,000

principal amount of Notes validly tendered (to be multiplied by the

Pool Factor of 1.14362). Tenders made after the Early Participation

Deadline but prior to the Expiration deadline may be subject to

scaling, as detailed in the Tender Offer Memorandum, in the event that

the total cash consideration amount for tenders received after the

Early Participation Deadline but prior to the Expiration Deadline

exceeds the difference between the Acceptance Consideration and the

total cash consideration amount for Notes tendered prior to the Early

Participation Deadline.

c. The amendments to the terms of the Offer as set out in this Announcement

become effective from the date of this Announcement (inclusive). Any

references:

+ to the Acceptance Consideration in the Tender Offer Memorandum should

be read as references to $175,000,000, and to Tender Consideration in

the Tender Offer Memorandum should be read as references to Total

Consideration, each as amended by this Announcement; and

+ any references to the Tender Offer Memorandum or terms and conditions

of the Offer shall be read as references to the Tender Offer Memorandum

or terms and conditions of the Offer, in each case, as amended by this

Announcement.

d. All other terms of the Offer and the provisions of the Tender Offer

Memorandum remain in full force, subject to the right of the Offeror at its

option and in its sole and absolute discretion, at any time, before any

acceptance by the Offeror of Notes tendered in the Offer, to extend,

re-open or amend such Offer in any respect (including, but not limited to,

any further amendment to any of the Acceptance Consideration or the Tender

Consideration).

e. The provisions in the "Governing Law" and "Terms and Conditions of the

Offer" sections of the Tender Offer Memorandum shall apply to this

Announcement with necessary modifications.

The following table summarizes the early tender results as of the Early

Participation Deadline and the aggregate principal amount of Notes that the

Offeror has accepted for purchase.

Description ISIN/Common Outstanding Principal Early Tender Total

of Code Notional Amount Premium(2) Consideration(2)

the Notes Principal Validly (3) (3)

Amount(1) Tendered on

or Prior to

the Early

Participation

Deadline and

Accepted For

Purchase

Private $336,656,000 $125,590,338 $50 $1,010

$336,656,000 Placement:

in aggregate ISIN:

notional XS2289899242

principal Common code:

amount of 228989924

Senior

Secured Regulation S:

Second Lien ISIN:

Notes due XS2289895927

2026 (the " Common code:

Notes") 228989592

(1) Represents the notional outstanding principal amount. The actual principal

amount after application of a pool factor of 1.14362 is $385,006,534.72. Unless

stated otherwise, all references to outstanding principal in this announcement

are to the notional outstanding principal amount prior to the application of

the pool factor.

(2) Per $1,000 of principal amount of Notes.

(3) Total Consideration per $1,000 of principal amount of Notes includes the

Early Tender Premium and will be multiplied by the pool factor of 1.14362.

Total Consideration has been determined pursuant to a modified Dutch auction

procedure.

The expected Settlement Date in respect of the tenders received prior to the

Early Participation Deadline is September 28, 2022. Full details concerning the

Offer are set out in the Tender Offer Memorandum. No accrued interest will be

payable in addition to the Total Consideration.

Noteholders who have tendered their Notes for purchase pursuant to the Offer

are advised to check with the bank, securities broker, custodian, trust

company, direct participant or other intermediary through which they hold their

Notes to determine whether their tendered Notes have been accepted for purchase

by the Offeror.

Any Notes purchased pursuant to the Offer will be cancelled by the Offeror in

accordance with the Indenture. Notes that have been tendered but not accepted

by the Offeror for purchase pursuant to the Offers shall be unblocked in the

relevant Noteholder's account in the relevant Clearing System. Notes that are

not tendered and accepted for purchase pursuant to the Offer will remain

outstanding.

Absa Bank Limited and Merrill Lynch International are acting as Dealer Managers

for the Offer (the "Dealer Managers") and Kroll Issuer Services Limited is

acting as the Information and Tender Agent for the Offers (the "Information and

Tender Agent").

Any questions and requests for assistance concerning the terms of the Offer may

be directed to the Dealer Managers and the Information and Tender Agent at the

telephone numbers and locations listed below:

Absa Bank Limited

15 Alice Lane

Sandton

Johannesburg 2196

South Africa

Telephone: +44 203 961 6067, +44 738 411 8926

Attention: Simon Rankin

Email: Simon.Rankin@absa.africa

Merrill Lynch International

2 King Edward Street

London EC1A 1HQ

United Kingdom

United Kingdom Telephone (Europe): +44 207 996 5420

Telephone (U.S. Toll Free): +1 (888) 292-0070

Telephone (U.S.): +1 (980) 388-3646

Attention: Liability Management Group

Email: DG.LM-EMEA@bofa.com

Kroll Issuer Services Limited

The Shard

32 London Bridge Street

London SE1 9SG

United Kingdom

Telephone: +44 20 7704 0880

Attention: Thomas Choquet

Email: petradiamonds@is.kroll.com

Offer Website: https://deals.is.kroll.com/petradiamonds

DISCLAIMER

This announcement must be read in conjunction with the Tender Offer Memorandum

and the Tender Offer Announcement. This announcement and the Tender Offer

Memorandum contain important information which should be read carefully. If any

Noteholder is in any doubt as to the action it should take, it is recommended

to seek its own financial and legal advice, including as to any tax

consequences, from its stockbroker, bank manager, solicitor, accountant or

other independent financial or legal adviser. None of the Offeror, the

Information and Tender Agent or the Trustee is providing Noteholders with any

legal, business, tax, investment or other advice in the Tender Offer

Memorandum.

Subject to applicable law, the Offeror reserves the right, in its sole

discretion, to extend, re-open, withdraw or terminate the Offer and to amend or

waive any of the terms and conditions of the Offer at any time after the

announcement of the Offer as described under "Amendment and Termination" in the

Tender Offer Memorandum, including with respect to any Tender Instructions

already submitted as of the time of any such extension, re-opening, withdrawal,

termination, amendment or waiver.

Forward-Looking Statements

This announcement contains certain forward-looking statements, which are based

on current intentions, beliefs, assumptions and estimates by the management of

the Offeror concerning, among other things, results of operations, financial

condition, liquidity, prospects, growth, strategies of Petra Diamonds Limited

("PDL") and its subsidiaries (the "Group") and the industries in which the

Group operates. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Readers are cautioned that forward-looking

statements are not guarantees of future performance and that the Group's actual

results of operations, financial condition and liquidity, and the development

of the industries in which it operates, may differ materially from those made

in or suggested by the forward-looking statements contained in this

announcement. In addition, even if the Group's or its affiliates' results of

operations, financial condition and liquidity and the development of the

industries in which it operates are consistent with the forward-looking

statements contained in this announcement, those results or developments may

not be indicative of results or developments in subsequent periods. The Offeror

undertakes no obligation to update these forward-looking statements and will

not publicly release any revisions that may be made to these forward-looking

statements which may result from events or circumstances arising after the date

of this announcement.

Ends

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494 8203

Patrick Pittaway

investorrelations@petradiamonds.com

Jill Sherratt

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Group's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 226.6 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Group aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Group's US$336.7 million notes due in 2026

are listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

September 27, 2022 02:00 ET (06:00 GMT)

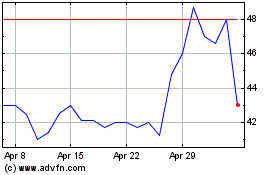

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

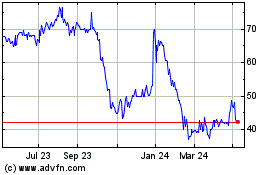

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024