TIDMOSB

LEI: 213800WTQKOQI8ELD692

7 May 2020

OneSavings Bank plc

(the 'Company')

Results of Annual General Meeting (AGM)

Results of AGM

Results of the proxy voting for the 2020 AGM held on Thursday, 7 May

2020.

All resolutions were passed by the requisite majority on a poll;

resolutions 1 to 3 and 6 to 11 as ordinary resolutions, resolutions 4

and 12 to 16 as special resolutions. Resolution 5 was withdrawn due to

the unprecedented circumstances relating to COVID-19.

The following proxy votes were cast in respect of the AGM resolutions:

Total votes Total votes Total votes % of issued Votes

Ordinary Resolutions For % Against % cast share capital withheld

-------------------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To receive the Accounts

1 and the Reports 384,135,615 99.99% 41,772 0.01% 384,177,387 86.10% 1,236,514

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To approve the Remuneration

2 Report 346,107,741 89.80% 39,302,760 10.20% 385,410,501 86.38% 3,400

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To approve the Remuneration

3 Policy 362,457,659 94.37% 21,608,346 5.63% 384,066,005 86.07% 927,854

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To authorise the higher

variable

4 remuneration cap 381,448,385 99.99% 35,035 0.01% 381,483,420 85.50% 3,151,289

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To declare a dividend

5 (WITHDRAWN) n/a n/a n/a n/a n/a n/a n/a

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(a) To elect Noël Harwerth 384,888,777 99.86% 524,847 0.14% 385,413,624 86.38% 278

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(b) To elect Rajan Kapoor 384,881,845 99.86% 522,809 0.14% 385,404,654 86.37% 9,248

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(c) To re-elect David Weymouth 383,905,330 99.84% 619,909 0.16% 384,525,239 86.18% 888,663

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To re-elect John Graham

6(d) Allatt 384,760,360 99.83% 653,264 0.17% 385,413,624 86.38% 278

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(e) To re-elect Sarah Hedger 384,890,609 99.86% 523,015 0.14% 385,413,624 86.38% 278

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(f) To re-elect Mary McNamara 373,777,991 96.98% 11,635,632 3.02% 385,413,623 86.38% 278

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(g) To re-elect Andrew Golding 384,889,138 99.86% 524,486 0.14% 385,413,624 86.38% 278

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

6(h) To re-elect April Talintyre 384,454,176 99.75% 959,448 0.25% 385,413,624 86.38% 278

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To re-appoint Deloitte

7 LLP as Auditor 385,386,642 99.99% 26,400 0.01% 385,413,042 86.38% 860

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

the Group Audit Committee

to agree the Auditor's

8 remuneration 385,408,687 100.00% 3,355 0.00% 385,412,042 86.38% 1,860

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

9 make political donations 372,983,610 96.78% 12,428,792 3.22% 385,412,402 86.38% 1,500

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

allot shares (general

10 authority) 381,519,810 98.99% 3,891,237 1.01% 385,411,047 86.38% 2,855

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

allot shares (in relation

to Regulatory Capital

11 Convertible Instruments) 383,406,983 99.48% 2,004,064 0.52% 385,411,047 86.38% 2,855

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

Special Resolutions

-------------------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

disapply pre-emption

12 rights (general authority) 380,244,752 98.66% 5,166,195 1.34% 385,410,947 86.38% 2,955

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

disapply pre-emption

rights (acquisitions

and specified capital

13 investments) 382,219,507 99.17% 3,191,440 0.83% 385,410,947 86.38% 2,955

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

disapply pre-emption

rights (in relation to

Regulatory Capital Convertible

14 Instruments) 381,265,556 98.92% 4,145,390 1.08% 385,410,946 86.38% 2,955

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To give authority to

15 purchase own shares 384,400,216 99.76% 934,008 0.24% 385,334,224 86.36% 79,677

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

To authorise the convening

of a general meeting

other than an AGM on

not less than 14 clear

16 days' notice 379,597,153 98.49% 5,816,749 1.51% 385,413,902 86.38% 0

----------- ------------------------------- ----------- ------- ----------- ------ ----------- -------------- ---------

NOTES:

1. 'Total Votes For' include votes recorded as at the discretion of the

appointed proxy.

2. The 'vote withheld' option was provided to enable shareholders to

refrain from voting on any particular resolution. A vote withheld is not

a vote in law and has not been counted in the calculation of the

proportion of the vote 'For' and 'Against' a resolution.

3. At the date of the AGM the issued share capital of the Company was

446,201,467 ordinary shares.

4. The full text of the resolutions is detailed in the Notice of Meeting

to be found on the Company website

https://www.globenewswire.com/Tracker?data=zZSNQQvKPgJyk_gS3CIWBcSF8NJdnlTl_HfumnYj1T9lMAHWEyYt-Awwi0YsUPlNj6Eda5kOCrP_6W3_s9LoY_t8nDfIcKl8t7hEJKIoB_0cMfw0uHUTEpsnFY025JCCKUN-pZ2Y3TVpfF_o57UOsPqm7pNwk6jk0n7AuZjyf-kpYf5rtEijjMoLYvzkiXuO-FfBDJSi1Z6zE96GgA8g9I7VeqMdXjx43jtXhNLg2qA=

https://www.osb.co.uk/investors/shareholder-services/agm-information/

Copies of the special business resolutions passed at the AGM have been

submitted to the UK Listing Authority, and will shortly be available for

inspection at the UK Listing Authority's National Storage Mechanism

which is located at

https://www.globenewswire.com/Tracker?data=zZSNQQvKPgJyk_gS3CIWBQRHPk3trwQOmDB-Cc2IwjXVqHpFxxKfCk_pvcBW55LQuLqB0qSiqH9BJmmR9UwA7x-rE_q2d1UU0Esl9GzRJ7f-_gYNFiYUsXEXuNreYeogRFs14X9Cg3Ecvo-GB_QupYnfKt5BAgxdv26RSKLd-vX1PEZ8DsQb2r14Xk44OYvK

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Board Changes

Tim Brooke, Margaret Hassall and Ian Ward left the Board at the

conclusion of the AGM.

Enquiries:

OneSavings Bank plc

Nickesha Graham-Burrell

Head of Company Secretariat

t: 01634 835 796

Brunswick Group

Robin Wrench/Simone Selzer

t: 020 7404 5959

Notes to Editors

About OneSavings Bank plc

OneSavings Bank plc (OSB) began trading as a bank on 1 February 2011 and

was admitted to the main market of the London Stock Exchange in June

2014 (OSB.L). OSB joined the FTSE 250 index in June 2015. On 4 October

2019, OSB acquired Charter Court Financial Services Group plc (CCFS) and

its subsidiary businesses. OSB is a specialist lending and retail

savings Group authorised by the Prudential Regulation Authority, part of

the Bank of England, and regulated by the Financial Conduct Authority

and Prudential Regulation Authority.

OneSavings Bank

OSB primarily targets market sub-sectors that offer high growth

potential and attractive risk-adjusted returns in which it can take a

leading position and where it has established expertise, platforms and

capabilities. These include private rented sector Buy-to-Let, commercial

and semi-commercial mortgages, residential development finance, bespoke

and specialist residential lending, secured funding lines and asset

finance.

OSB originates mortgages organically via specialist brokers and

independent financial advisers through its specialist brands including

Kent Reliance for Intermediaries, InterBay Commercial and Prestige

Finance. It is differentiated through its use of highly skilled, bespoke

underwriting and efficient operating model.

OSB is predominantly funded by retail savings originated through the

long-established Kent Reliance name, which includes online and postal

channels as well as a network of branches in the South East of England.

Diversification of funding is currently provided by securitisation

programmes, the Term Funding Scheme and the Bank of England Indexed

Long-Term Repo operation.

Charter Court Financial Services Group

CCFS focuses on providing Buy-to-Let and specialist residential

mortgages, mortgage servicing, administration and credit consultancy and

retail savings products. It operates through its three brands -- Precise

Mortgages, Exact Mortgage Experts and Charter Savings Bank.

It is differentiated through risk management expertise and best-of-breed

automated technology and systems, ensuring efficient processing, strong

credit and collateral risk control and speed of product development and

innovation. These factors have enabled strong balance sheet growth

whilst maintaining high credit quality mortgage assets.

CCFS is predominantly funded by retail savings originated through its

Charter Savings Bank brand. Diversification of funding is currently

provided by securitisation programmes, the Term Funding Scheme and the

Bank of England Indexed Long-Term Repo operation.

(END) Dow Jones Newswires

May 07, 2020 07:08 ET (11:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

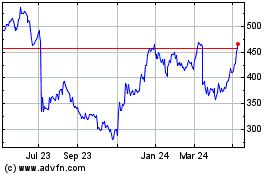

Osb (LSE:OSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

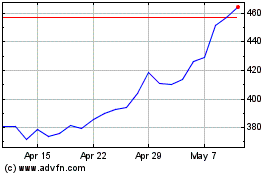

Osb (LSE:OSB)

Historical Stock Chart

From Jul 2023 to Jul 2024