Old Mutual Swung to 1st Half Net Loss; Suspends Dividend

September 01 2020 - 2:01AM

Dow Jones News

By Ian Walker

Old Mutual Ltd. on Tuesday reported a swing to net loss for the

first half of the year and suspended its dividend payout due to the

coronavirus pandemic, but said its liquidity levels remain positive

and solvency ratio within its targeted range.

The South Africa-based, financial-services company added that it

has withdrawn its previous guidance targets and replaced them with

new ones to reflect the pressure on revenues from the pandemic. The

group expects to deliver 750 million South African Rand ($44.3

million) of pretax run rate savings by the end of 2022, it

said.

Net loss for the half year was ZAR5.62 billion compared with a

profit of ZAR5.82 billion. Headline earnings--one of the company's

preferred metrics which strips out exceptional and other one-off

items--was ZAR4.22 billion compared with ZAR5.85 billion for the

first half of 2019.

The group's solvency ratio--a measure of financial

stability--was 182% compared with 189%.

Old Mutual said it will review its full-year dividend payout

when there's "more clarity on the shape of possible economic

recovery scenarios."

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

September 01, 2020 01:46 ET (05:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

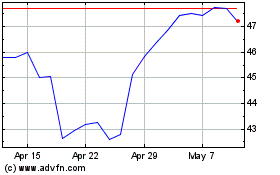

Old Mutual (LSE:OMU)

Historical Stock Chart

From Mar 2024 to Apr 2024

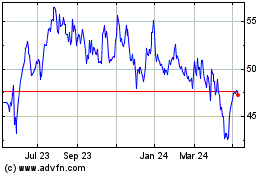

Old Mutual (LSE:OMU)

Historical Stock Chart

From Apr 2023 to Apr 2024