TIDMNWG

RNS Number : 0650R

NatWest Group plc

27 February 2023

FILING OF ANNUAL REPORT ON FORM 20-F WITH THE US SECURITIES AND

EXCHANGE COMMISSION

NatWest Group plc (the "Company") announces that, on 24 February

2023, it filed its Annual Report on Form 20-F with the US

Securities and Exchange Commission (SEC). The document is available

for viewing on the SEC website at www.sec.gov and also on the

Company's website at www.natwestgroup.com . The Company will send

any holder of the Company's securities, upon request, a hard copy

of the Company's complete audited financial statements free of

charge. Requests may be made by writing to the Chief Governance

Officer and Company Secretary, NatWest Group plc, Gogarburn, PO Box

1000, Edinburgh EH12 1HQ.

Jan Cargill

Chief Governance Officer and Company Secretary

27 February 2023

Legal Entity Identifier

NatWest Group plc 2138005O9XJIJN4JPN90

Forward-looking statements

Cautionary statement regarding forward-looking statements

Certain sections in this document contain 'forward-looking

statements' as that term is defined in the United States Private

Securities Litigation Reform Act of 1995, such as statements that

include the words 'expect', 'estimate', 'project', 'anticipate',

'commit', 'believe', 'should', 'intend', 'will', 'plan', 'could',

'probability', 'risk', 'Value-at-Risk (VaR)', 'target', 'goal',

'objective', 'may', 'endeavour', 'outlook', 'optimistic',

'prospects' and similar expressions or variations on these

expressions. In particular, this document includes forward-looking

targets and guidance relating to financial performance measures,

such as income growth, operating expense, RoTE, ROE, discretionary

capital distribution targets, impairment loss rates, balance sheet

reduction, including the reduction of RWAs, CET1 ratio (and key

drivers of the CET1 ratio including timing, impact and details),

Pillar 2 and other regulatory buffer requirements and MREL and

non-financial performance measures, such as NatWest Group's initial

area of focus, climate and ESG-related performance ambitions,

targets and metrics, including in relation to initiatives to

transition to a net zero economy, Climate and Sustainable Funding

and Financing (CSFF) and financed emissions. In addition, this

document includes forward-looking statements relating, but not

limited to: implementation of NatWest Group's purpose-led strategy

and other strategic priorities (including in relation to: phased

withdrawal from ROI, cost-controlling measures, the NatWest Markets

refocusing, the creation of the C&I franchise and the

progression towards working as One Bank across NatWest Group to

serve customers); the timing and outcome of litigation and

government and regulatory investigations; direct and on-market

buy-backs; funding plans and credit risk profile; managing its

capital position; liquidity ratio; portfolios; net interest margin

and drivers related thereto; lending and income growth, product

share and growth in target segments; impairments and write-downs;

restructuring and remediation costs and charges; NatWest Group's

exposure to political risk, economic assumptions and risk, climate,

environmental and sustainability risk, operational risk, conduct

risk, financial crime risk, cyber, data and IT risk and credit

rating risk and to various types of market risk, including interest

rate risk, foreign exchange rate risk and commodity and equity

price risk; customer experience, including our Net Promotor Score

(NPS); employee engagement and gender balance in leadership

positions.

Limitations inherent to forward-looking statements

These statements are based on current plans, expectations,

estimates, targets and projections, and are subject to significant

inherent risks, uncertainties and other factors, both external and

relating to NatWest Group's strategy or operations, which may

result in NatWest Group being unable to achieve the current plans,

expectations, estimates, targets, projections and other anticipated

outcomes expressed or implied by such forward-looking statements.

In addition, certain of these disclosures are dependent on choices

relying on key model characteristics and assumptions and are

subject to various limitations, including assumptions and estimates

made by management. By their nature, certain of these disclosures

are only estimates and, as a result, actual future results, gains

or losses could differ materially from those that have been

estimated. Accordingly, undue reliance should not be placed on

these statements. The forward-looking statements contained in this

document speak only as of the date we make them and we expressly

disclaim any obligation or undertaking to update or revise any

forward-looking statements contained herein, whether to reflect any

change in our expectations with regard thereto, any change in

events, conditions or circumstances on which any such statement is

based, or otherwise, except to the extent legally required.

Important factors that could affect the actual outcome of the

forward-looking statements

We caution you that a large number of important factors could

adversely affect our results or our ability to implement our

strategy, cause us to fail to meet our targets, predictions,

expectations and other anticipated outcomes or affect the accuracy

of forward-looking statements described in this document. These

factors include, but are not limited to, those set forth in the

risk factors and the other uncertainties described in NatWest Group

plc's Annual Report on Form 20-F and its other filings with the US

Securities and Exchange Commission. The principal risks and

uncertainties that could adversely NatWest Group's future results,

its financial condition and/or prospects and cause them to be

materially different from what is forecast or expected, include,

but are not limited to: economic and political risk (including in

respect of: political and economic risks and uncertainty in the UK

and global markets, including due to high inflation, supply chain

disruption and the Russian invasion of Ukraine); uncertainty

regarding the effects of Brexit; changes in interest rates and

foreign currency exchange rates; and HM Treasury's ownership as the

largest shareholder of NatWest Group plc); strategic risk

(including in respect of the implementation of NatWest Group's

purpose-led Strategy; future acquisitions and divestments; phased

withdrawal from ROI and the transfer of its Western European

corporate portfolio); financial resilience risk (including in

respect of: NatWest Group's ability to meet targets and to make

discretionary capital distributions; the competitive environment;

counterparty and borrower risk; prudential regulatory requirements

for capital and MREL; liquidity and funding risks; changes in the

credit ratings; the requirements of regulatory stress tests; model

risk; sensitivity to accounting policies, judgments, assumptions

and estimates; changes in applicable accounting standards; the

value or effectiveness of credit protection; the adequacy of

NatWest Group's future assessments by the Prudential Regulation

Authority and the Bank of England; and the application of UK

statutory stabilisation or resolution powers); climate and

sustainability risk (including in respect of: risks relating to

climate change and the transitioning to a net zero economy; the

implementation of NatWest Group's climate change strategy,

including publication of an initial climate transition plan in 2023

and climate change resilient systems, controls and procedures;

climate-related data and model risk; the failure to adapt to

emerging climate, environmental and sustainability risks and

opportunities; changes in ESG ratings; increasing levels of

climate, environmental and sustainability related regulation and

oversight; and climate, environmental and sustainability-related

litigation, enforcement proceedings and investigations);

operational and IT resilience risk (including in respect of:

operational risks (including reliance on third party suppliers);

cyberattacks; the accuracy and effective use of data; complex IT

systems; attracting, retaining and developing senior management and

skilled personnel; NatWest Group's risk management framework; and

reputational risk); and legal, regulatory and conduct risk

(including in respect of: the impact of substantial regulation and

oversight; compliance with regulatory requirements; the outcome of

legal, regulatory and governmental actions and investigations; the

transition of LIBOR other IBOR rates to replacement risk-free

rates; and changes in tax legislation or failure to generate future

taxable profits).

Climate and ESG disclosures

Climate and ESG disclosures in this document are not measures

within the scope of International Financial Reporting Standards

('IFRS'), use a greater number and level of judgements, assumptions

and estimates, including with respect to the classification of

climate and sustainable funding and financing activities, than our

reporting of historical financial information in accordance with

IFRS. These judgements, assumptions and estimates are highly likely

to change over time, and, when coupled with the longer time frames

used in these disclosures, make any assessment of materiality

inherently uncertain. In addition, our climate risk analysis, net

zero strategy, including the implementation of our climate

transition plan remain under development, and the data underlying

our analysis and strategy remain subject to evolution over time.

The process we have adopted to define, gather and report data on

our performance on climate and ESG measures is not subject to the

formal processes adopted for financial reporting in accordance with

IFRS and there are currently limited industry standards or globally

recognised established practices for measuring and defining climate

and ESG related metrics. As a result, we expect that certain

climate and ESG disclosures made in this document are likely to be

amended, updated, recalculated or restated in the future. Please

also refer to the cautionary statement in the section entitled

'Climate-related and other

forward-looking statements and metrics' of the NatWest Group

2022 Climate-related Disclosures Report.

Cautionary statement regarding Non-IFRS financial measures and

APMs

NatWest Group prepares its financial statements in accordance

with generally accepted accounting principles (GAAP). This document

may contain financial measures and ratios not specifically defined

under GAAP or IFRS ('Non-IFRS') and/or alternative performance

measures ('APMs') as defined in European Securities and Markets

Authority ('ESMA') guidelines. APMs are adjusted for notable and

other defined items which management believes are not

representative of the underlying performance of the business and

which distort period-on-period comparison. Non-IFRS measures

provide users of the financial statements with a consistent basis

for comparing business performance between financial periods and

information on elements of performance that are one-off in nature.

Any Non-IFRS measures and/or APMs included in this document, are

not measures within the scope of IFRS, are based on a number of

assumptions that are subject to uncertainties and change, and are

not a substitute for IFRS measures.

The information, statements and opinions contained in this

document do not constitute a public offer under any applicable

legislation or an offer to sell or a solicitation of an offer to

buy any securities or financial instruments or any advice or

recommendation with respect to such securities or other financial

instruments.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFQLLLXLLXBBF

(END) Dow Jones Newswires

February 27, 2023 02:00 ET (07:00 GMT)

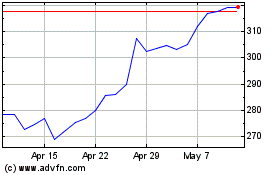

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024