Marston's PLC Preliminary Results -5-

November 27 2014 - 2:00AM

UK Regulatory

Equity share capital 44.4 44.4

Share premium account 334.0 333.8

Revaluation reserve 545.9 575.3

Capital redemption reserve 6.8 6.8

Hedging reserve (92.9) (95.0)

Own shares (126.8) (130.9)

Retained earnings 47.6 107.5

----------------------------------------------- ----------- -----------

Total equity 759.0 841.9

----------------------------------------------- ----------- -----------

* During the current period the provider of the securitisation's

liquidity facility, the Royal Bank of Scotland Group plc, had its

short-term credit rating downgraded below the minimum prescribed in

the facility agreement and as such the Group exercised its

entitlement to draw the full amount of the facility and hold it in

a designated bank account. The amount drawn down of GBP120.0

million is included within cash and cash equivalents and the

corresponding liability is included within borrowings.

GROUP STATEMENT OF CHANGES IN EQUITY

For the 52 weeks ended 4 October 2014

Equity Share Capital

share premium Revaluation redemption Hedging Own Retained Total

capital account reserve reserve reserve shares earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

At 6 October 2013 44.4 333.8 575.3 6.8 (95.0) (130.9) 107.5 841.9

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Loss for the period .- .- .- .- .- .- (50.7) (50.7)

Remeasurement of

retirement benefits .- .- .- .- .- .- (12.5) (12.5)

Tax on remeasurement

of retirement benefits .- .- .- .- .- .- 2.8 2.8

Losses on cash flow

hedges .- .- .- .- (36.4) .- .- (36.4)

Transfers to the

income statement

on cash flow hedges .- .- .- .- 39.0 .- .- 39.0

Tax on hedging reserve

movements .- .- .- .- (0.5) .- .- (0.5)

Property revaluation .- .- 16.4 .- .- .- .- 16.4

Property impairment .- .- (3.4) .- .- .- .- (3.4)

Deferred tax on

properties .- .- (2.0) .- .- .- .- (2.0)

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Total comprehensive

income/(expense) .- .- 11.0 .- 2.1 .- (60.4) (47.3)

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Share-based payments .- .- .- .- .- .- 0.7 0.7

Tax on share-based

payments .- .- .- .- .- .- 0.1 0.1

Issue of shares .- 0.2 .- .- .- .- .- 0.2

Sale of own shares .- .- .- .- .- 4.1 (3.6) 0.5

Disposal of properties .- .- (44.6) .- .- .- 44.6 .-

Tax on disposal

of properties .- .- 4.7 .- .- .- (4.7) .-

Transfer to retained

earnings .- .- (0.5) .- .- .- 0.5 .-

Dividends paid .- .- .- .- .- .- (37.1) (37.1)

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Total transactions

with owners .- 0.2 (40.4) .- .- 4.1 0.5 (35.6)

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

At 4 October 2014 44.4 334.0 545.9 6.8 (92.9) (126.8) 47.6 759.0

------------------------- --------- --------- ------------ ------------ --------- -------- ---------- --------

Equity Share Capital Retained Total

share premium Revaluation redemption Hedging Own earnings equity

capital account reserve reserve reserve shares (Restated) (Restated)

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

At 30 September

2012 44.3 332.8 560.4 6.8 (129.6) (130.9) 78.2 762.0

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

Profit for the

period .- .- .- .- .- .- 56.9 56.9

Remeasurement of

retirement

benefits .- .- .- .- .- .- 5.9 5.9

Tax on

remeasurement

of retirement

benefits .- .- .- .- .- .- (1.5) (1.5)

Gains on cash flow

hedges .- .- .- .- 24.9 .- .- 24.9

Transfers to the

income statement

on cash flow

hedges .- .- .- .- 24.7 .- .- 24.7

Tax on hedging

reserve

movements .- .- .- .- (15.0) .- .- (15.0)

Property

revaluation .- .- 2.1 .- .- .- .- 2.1

Deferred tax on

properties .- .- 15.6 .- .- .- .- 15.6

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

Total

comprehensive

income .- .- 17.7 .- 34.6 .- 61.3 113.6

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

Share-based

payments .- .- .- .- .- .- 0.2 0.2

Tax on share-based

payments .- .- .- .- .- .- 0.3 0.3

Issue of shares 0.1 1.0 .- .- .- .- .- 1.1

Disposal of

properties .- .- (2.1) .- .- .- 2.1 .-

Transfer to

retained

earnings .- .- (0.7) .- .- .- 0.7 .-

Dividends paid .- .- .- .- .- .- (35.3) (35.3)

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

Total transactions

with owners 0.1 1.0 (2.8) .- .- .- (32.0) (33.7)

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

At 5 October 2013 44.4 333.8 575.3 6.8 (95.0) (130.9) 107.5 841.9

------------------- --------- --------- ------------ ------------ --------- -------- ------------ ------------

NOTES

1 Accounting policies

Basis of preparation

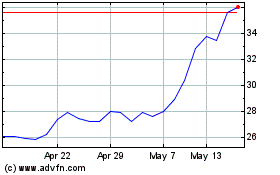

Marston's (LSE:MARS)

Historical Stock Chart

From Aug 2024 to Sep 2024

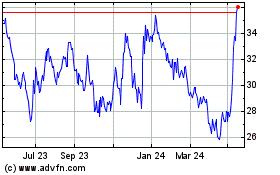

Marston's (LSE:MARS)

Historical Stock Chart

From Sep 2023 to Sep 2024