TIDMLWDB

RNS Number : 1663U

Law Debenture Corp PLC

29 July 2022

The Law Debenture Corporation p.l.c. today published its results

for the half-year ended 30 June 2022

Resilience, continued outperformance and dividend growth against

the backdrop of turbulent global markets

Group Highlights:

-- NAV total return with debt and Independent Professional

Services (IPS) at FV for H1 2022 of -4.0%

-- Another period of strong performance from IPS with profit

before tax up by 5.9% and valuation up 4.9% to GBP178.4m

-- The Group has issued 3.8 (1) million new ordinary shares at a

premium to NAV, to existing and new investors, with net proceeds of

GBP30.4m to support ongoing investment

-- Continued low ongoing charges of 0.48 (2) %, compared to the industry average of 1.09 (3) %

-- Winner of Investment Week's UK Income Sector Investment Trust of the year for 2021

Dividend Highlights

-- Declared a first interim dividend of 7.25 pence per ordinary

share, paid in July 2022, representing an increase of 5.5% over the

prior year's first interim dividend

-- It is the Board's intention for each of the first three

interim dividends for 2022 to be equivalent to a quarter of Law

Debenture's total 2021 dividend of 29.0 pence per ordinary share.

Performance and growth in Independent Professional Services

business (IPS) continues to support the Board's intention to

maintain or increase the total dividend in 2022

-- Dividend yield of 3.8%(4)

-- 13.8% CAGR in dividends over the last four years(5)

Investment Portfolio Highlights:

-- Material outperformance of the benchmark over three, five and ten years

-- Strong long term record with Share price total return over 10

years of 180.8% (FTSE All-Share: 94.6%) and of 808.9% over 25 years

(FTSE All-Share: 312.5%)

-- Revenue return from the portfolio of GBP16.9m (June 2021:

GBP10.2m), representing growth of 65.6%

YTD 1 year 3 years 5 years 10 years

% % % % %

NAV total return (with debt at par) (6*) -8.4 -3.5 23.1 34.8 155.7

NAV total return (with debt at fair value) (6*) -4.0 0.4 28.5 40.6 157.5

FTSE Actuaries All-Share Index Total Return (7) -4.6 1.6 7.4 17.8 94.6

Share price total return (7*) -3.8 3.4 43.8 58.2 180.8

Change in Retail Price Index (8) 7.0 11.8 17.4 24.9 40.6

IPS Highlights:

-- Wholly-owned independent provider of professional services.

Accounts for 19% of H1 2022 NAV but has funded 36.4% of dividends

in the last 10 years (9)

-- IPS enters its fifth consecutive year of growth with net

revenues of GBP21.7m (June 2021: GBP19.5m) up 11.3%

Longer Term Record:

-- 133 years of value creation for shareholders

-- 114.8%(9) increase in the dividend over the last 10 years

-- Over 40 years of increasing or maintaining dividends to shareholders

Robert Hingley, Chairman, said:

"Law Debenture aims to provide a steadily increasing income for

our shareholders whilst achieving long-term capital growth in real

terms. The Group has an excellent long-term record for

outperformance, and we are encouraged by the relative capital

preservation and continued good performance from IPS in this

turbulent and challenging period of political and economic

uncertainty.

We are confident that, in the long term, the combination of a

robust and well-positioned equity portfolio and continued growth in

our IPS business will deliver attractive returns for our

shareholders. IPS benefits from strong recurring revenues, and the

team is investing to ensure the consistent growth delivered in the

last four years can be sustained over the longer term."

Denis Jackson, Chief Executive Officer, commented:

"Against a very challenging and uncertain political and economic

backdrop, with rising global inflation and interest rates, Law

Debenture has delivered another resilient performance. The Group

has maintained its consistent long-term benchmark outperformance.

The strong, consistent income from the IPS business offers our

portfolio managers greater flexibility in their investment

selection, helping set Law Debenture apart from other UK equity

income Trusts and underpinning our confidence in our ability to

continue to outperform in the long-term."

The Law Debenture Corporation +44 (0)20 7606 5451

Denis Jackson, Chief Executive denis.jackson@lawdeb.com

Officer

+44 (0) 777 193 7173

Tulchan Communications (Financial l awdebenture@tulchangroup.com

PR)

David Allchurch

Guy Bates

Company History:

From its origins in 1889, Law Debenture has diversified to

become a group with a unique range of activities in the financial

and professional services sectors. The group has two distinct areas

of business.

Investment Portfolio:

Our portfolio of investments is managed by James Henderson and

Laura Foll of Janus Henderson Investors.

Our objective is to achieve long-term capital growth in real

terms and steadily increasing income. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index

Total Return through investing in a diversified portfolio of

stocks.

Independent Professional Services:

We are a leading provider of independent professional services,

built on three foundations: our Pensions, Corporate Trust and

Corporate Services businesses. We operate globally, with offices in

the UK, New York, Ireland, Hong Kong, Delaware and the Channel

Islands.

Companies, agencies, organisations and individuals throughout

the world rely upon Law Debenture to carry out our duties with the

independence and professionalism upon which our reputation is

built.

(1) For the period from 1 January 2022 to 30 June 2022

(2) Calculated based on data held by Law Debenture for the period

ended 30 June 2022

(3) Source: Association of Investment Companies (AIC) industry

average as at 30 June 2022

(4) Calculated based on share price of 772p as at 27 July 2022,

using the total 2021 dividend paid of 29.0p per share

(5) Calculated for the 4 years ended 31 December 2021

(6) NAV is calculated in accordance with the Association of

Investment Companies (AIC) methodology, based on performance

data held by Law Debenture including the fair value of the

IPS business and long-term borrowings

(7) Source: Refinitiv

(8) Source: Office for National Statistics

(9) Calculated for the 10 years ended 31 December 2021

(*) Items marked "*" are considered to be alternative performance

measures and calculated using the published daily NAV

THE LAW DEBENTURE CORPORATION P.L.C. AND ITS SUBSIDIARIES

HALF YEARLY REPORT FOR THE SIX MONTHS TO 30 JUNE 2022

(UNAUDITED)

Financial summary

Six months Six months Twelve months

30 June 30 June 2021 31 December

2022 2021

GBP000 GBP000 GBP000

------------------------------------ ----------- -------------- --------------

Net Asset Value (NAV) - including

debt and IPS at fair value(1) 917,365 936,448 964,493

------------------------------------ ----------- -------------- --------------

Pence Pence Pence

NAV per share at fair value(1,2,*) 726.74 766.89 787.83

Revenue return per share:

Investment portfolio 13.66 8.48 18.09

Independent professional services 4.55(3) 4.39 10.00

Group revenue return per share 18.21 12.87 28.09

Capital (loss)/return per share (100.61) 79.92 94.60

Dividends per share(4) 7.25 6.875 29.00

Share price 760 750 799

------------------------------------ ----------- -------------- --------------

% % %

Ongoing charges(5*) 0.48 0.50 0.50

Gearing(*) 11 11 13

Premium/(discount)(*) 4.58 (2.20) 1.42

------------------------------------ ----------- -------------- --------------

* Items marked "*" are considered to be alternative performance

measures. For a description of these measures, see page 134 of the

annual report and financial statements for the year ended 31

December 2021.

(1) Please see below for calculation of NAV.

(2) NAV is calculated in accordance with the AIC methodology,

based on performance data held by Law Debenture including the fair

value of the IPS business and long-term borrowings.

(3) This figure takes into account the new shares issued since

30 June 2021. Using the weighted average shares on issue at 30 June

2021, IPS revenue return per share would be 4.67 pence.

(4) The second interim dividend is not due to be announced until

September 2022 and has not been factored in the calculation

presented. The Board have indicated their intention to pay three

interim dividends of 7.25p in respect to 2022, each representing a

quarter of the total 2021 dividend declared of 29.0p. The final

dividend will be declared in February 2023.

(5) Ongoing charges are calculated based on AIC guidance, using

the administrative costs of the investment trust and include the

Janus Henderson investment management fee, charged at an annual

rate of 0.30% of the NAV of the investment portfolio. There is no

performance related element to the fee.

Half yearly management report

Introduction

There is a huge amount of uncertainty in financial markets

around the world as a result of the invasion of Ukraine and its

geopolitical fallout, the continued impact of inflationary

pressures not seen for 40 years and a potential severe global

economic slowdown. We are mindful of the challenges that all our

stakeholders face and continue to provide assistance where we can.

Despite these significant uncertainties, our diversified business

model has held up well.

It never feels good to report a reduced Net Asset Value for any

reporting period but we have preserved 96%(1) of shareholders'

capital and increased group earnings per share by 41.5%(2) in the

first half of the year. We believe that achieving these results in

the face of the material challenges highlighted above is an

acceptable result.

Our Investment Managers have continued to add to their

successful long-term record of outperformance against our

benchmark, the FTSE Actuaries All Share Index, and drivers of their

performance are covered in detail in their report. Our Independent

Professional Services business is now well into its fifth year of

growth, with net revenue up 11.3% and profit before tax up

5.9%.

Our Independent Professional Services business accounts for 19%

of Law Debenture's NAV but has funded 36% of dividends over the

past decade. As a result, our Investment Managers have increased

flexibility in selecting strong business models and attractive

valuation opportunities, which will continue to position the equity

portfolio for future longer-term growth.

(1) Calculated based on -4% YTD to 30 June 2022 NAV performance

with debt and IPS at fair value, resulting in 96% of preserved

shareholders' capital.

(2) Calculated based on increased group earnings per share of

12.87p at 30 June 2021 to 18.21p at 30 June 2022.

Dividend

We are pleased to continue building on our 43-year record of

maintaining or increasing dividends. We recently declared a first

interim dividend of 7.25 pence per ordinary share, representing an

increase of 5.5% over the prior year's first interim dividend. This

highlights the benefits of the IPS' stable and diversified income

streams, as well as our substantial revenue reserves.

This dividend was paid on 7 July 2022 to shareholders on the

register at close of business on 6 June 2022. Based on the current

share price, the dividend yield per Law Debenture share is 3.8%(3)

. Since the publication of our Annual Report at the end of February

2022, we have issued 3.8 million new ordinary shares to existing

and new investors, raising a total of GBP30.4 million.

It is the Board's current intention to recommend that the total

dividend in relation to 2022 is to maintain or increase on the

total 2021 dividend of 29.0p. Our shareholders will be asked to

vote on the final dividend at our AGM in March 2023.

(3) Calculated based on share price of 772p as at 27 July 2022,

using the total 2021 dividend paid of 29.0p per share.

IPS performance

We are pleased to report that all of our business lines grew

their revenues in the first half of 2022 and we have seen growth in

our profit before tax of 5.9%. Yet again, the diversification and

repeatable nature of many of our income streams served us well.

Nonetheless, in line with many other operating businesses, we have

suffered some margin compression.

Approximately a third of our administration costs are related to

our people. As the 'Great Resignation' and unwind of lockdowns have

played through, the demand for skilled employees in our sectors has

been the most intense for many years. We must compete to retain our

people who underpin the quality of service we deliver to our

clients. This was reflected in the uplift to our staff's

remuneration this year. These pay increases have an immediate

impact on our cost base and, while we have been able to pass on

some of these, as we highlight later in the report, there are

elements of our revenue streams where contracted inflation-linked

increases only feed through to our invoices over time.

We are active in the management of our cost base and are working

hard to ensure our profit margins are sustainable.

Independent Professional Services

DIVISION Revenue(1) Revenue(1) Growth

30 June 2022 30 June 2021 2021/2022

GBP000 GBP000 %

-------------------- ------------- ------------- ----------

Pensions 6,973 6,462 7.9%

Corporate Trust 5,185 4,937 5.0%

Corporate Services 9,515 8,069 17.9%

-------------------- ------------- ------------- ----------

Total 21,673 19,468 11.3%

-------------------- ------------- ------------- ----------

(1) Revenue shown is net of cost of sales

Pensions

The first half of 2022 has illustrated the value that can be

created from a well-planned investment strategy. Many asset classes

saw material adjustments and the large upward move in bond yields

fed through to significant revisions in scheme liabilities over the

reporting period. Schemes with appropriate levels of

asset/liability hedging have been well positioned to navigate these

movements.

Our Pensions business executed well on behalf of our clients and

achieved further growth. Revenues in the first half were up 7.9%.

Our compound revenue growth over the past four years has been

12.1%*. As I highlighted in our Annual Report, this growth is

underpinned by a drive by the regulator to improve Pension Scheme

governance. Given that most UK schemes still do not have

professional trustees, we believe that there continues to be a

growing market for our services.

We continue to win new clients. Notable wins in the first half

of this year for our Trustee business included Coca-Cola. Having

won our first mandate late last year in Ireland, we have added a

further three in the first half of the year. We will need to

continue to invest in our people in Ireland to service this

expanding book of business. We have also made additional hires in

Manchester to strengthen our regional footprint. Pegasus, our

Executive Pensions offering, expanded its client base with

companies including EY and the ICAEW.

The growth in our revenues from Master Trusts, Investment

Governance Committees, and Corporate Sole Trustee appointments is

particularly pleasing. We are increasingly involved in project

work, such as GMP equalisation and risk settlement, as an

increasing number of schemes execute partial or full buy outs.

To support our growth in this market, we have hired dedicated

business development and bid support resource. We continue to

invest in the people and skills necessary to ensure that we provide

a first-class service to our expanding book of clients.

* For the four years ended 31 December 2021.

Corporate Trust

Following a challenging 2021, our deep relationships and broad

referral networks enabled us to grow our revenues by 5.0% in the

first half of 2022. This encouraging result was achieved in the

face of extremely challenging issuance conditions in Debt Capital

Markets. Half year European Debt Capital Market issuance levels

were down by 27% (source: Dealogic) with European High Yield Debt

issuance levels down by 69% (source: Dealogic). Such volatility in

new debt issuance is not uncommon and market conditions can change

rapidly.

While primary markets were weak in the first half of 2022, the

majority of the capital markets transactions that sit on our books,

built up over many decades, have contractual inflation-linked fee

increases for our services. These fee increases are applied on the

transaction anniversary. The longer that inflation remains at

elevated levels, the more these inflation-linked increases will

feed through to our book of business. It is likely that this will

be increasingly helpful as the year progresses.

Key to our success in this market is our ability to move fast

and use our domain expertise to consider non-standard transactions

as our clients' needs evolve. As lockdown took hold in 2020, we

used our Escrow Product to support NHS trusts sourcing PPE at short

notice, from around the world. More recently, in late April 2022,

our escrow product was even used to support the Tyson Fury vs.

Dillon White world title boxing event at Wembley Stadium.

An escrow arrangement is often used when two parties wish to

move or transfer an asset, subject to certain conditions being met.

The most widely understood example of this service is the role

played by the lawyer on completion of a house purchase. The lawyer

receives the monies and the deeds from each party. When the lawyer

is satisfied that all the conditions have been met and the

documentation is in order, the monies and legal title are

transferred between the buyer and the seller. Our longevity, large

capital base and strong reputation for independence make us well

placed to grow this business. We are increasingly involved in

escrows to support M&A, Corporate Disposals, Litigation, Global

Trading and Commercial Property transactions.

Post-issue work, when a bond issuer runs into financial

difficulty, can lead to incremental revenues for this business. As

the massive central bank and government support put into place

during the pandemic is removed and businesses adapt to an

inflationary environment, it would not be surprising to see

corporate bankruptcies increase from their recent modest levels

when compared with historical averages.

We are now in our 134(th) year of the provision of Corporate

Trust services to our clients. This long history tells us that it

produces good returns to our shareholders over time. We are pleased

to have grown our business in the first half of 2022 despite

challenging primary market conditions.

Corporate Services

Company Secretarial Services

We acquired the majority of our current Company Secretarial

Services business from Eversheds Sutherland (International) LLP on

29 January 2021. We remain confident that we have bought a business

which both complements our existing offerings and is able to grow

its market share in a growing market. The business is also

producing high-quality, repeatable revenue and we have been

investing heavily in the people, skills, training, technology and

infrastructure necessary to ensure our offering delivers the high

standards of client service expected from Law Debenture.

Half year revenues grew by 41.6%, although this is not

like-for-like, as the prior year period was only five months, given

the timing of the acquisition.

In our previous Annual Reports, I highlighted an acceleration in

outsourcing trends, partly brought about as a result of the

lockdowns, and this remains the case. Examples of new business wins

in the first half of 2022 include appointments by several Schroders

Investment Trusts and Rentokil Initial. We have a strong pipeline

of new business and we look forward to expanding our client base

further in the second half of the year.

Service of Process

This is our business which is most dependent on global

macro-economic factors. Major economies, such as the UK and US,

allow overseas businesses to sign legal documents subject to their

laws, provided that they have either a registered address or

appointed agent for service of process in the governing

jurisdiction. We act as the agent for service of process to

thousands of clients from all over the world each year. The greater

the amount of global trade and capital markets activity, the

greater the demand for our product. Given the current elevated

levels of economic uncertainty, we are particularly pleased that

Service of Process grew its revenues by 5.2% in the first half of

2022.

We have created significant capacity and enhanced operational

control with the roll-out last year of a new technology platform to

support this business. We have continued to invest in our business

development activities with a focused effort on our referral

partner networks. Our long history in this market tells us that

predicting revenues in the short term is difficult, but, over the

economic cycle, this business provides a critical service to our

clients and good returns to our shareholders.

Structured Finance

A small but important part of our product mix, this business

provides accounting and administrative services to special purpose

vehicles (SPVs). Typical buyers of our services are boutique asset

managers, hedge funds and challenger banks. They use SPV structures

to warehouse and provide long-term funding for real assets.

Examples include credit card receivables, mortgages, real estate or

aircraft leases.

In the first half of the year, we are delighted to have

supported new vehicles that have been structured by the likes of

LendInvest, Pepper and Avenue. We are proud too that Reinsurance

Group of America's structure, which we supported, won "Overall Deal

of the Year" at GlobalCapital's first Annual Securitization Awards

in London in March. The growth in our Loan Agency book of business

is also pleasing.

Revenues grew by 21.0% in the first half of the year and have

grown by 11.6% compound over the past four years.

Safecall

With oversight from Jo Lewis, who joined us in late August last

year, the new leadership team at Safecall have made an excellent

start to the year. They have been busy refreshing and

reinvigorating our whistleblowing business. In the first half of

the year, we signed up a record number of new clients, measured by

revenue. We are also pleased with the growth in the amount of

training that we are providing to our clients to support

whistleblowing issues. Examples of new clients signed up in the

first half of the year included Beazley Insurance, First Central

Group, The Royal Institute of British Architects and the RSPB. Our

recorded revenues for the reporting period were up 16.1%. After 23

years in the original offices, during June we have moved to larger

offices in Sunderland.

Like our other businesses, our whistleblowing business is based

on independence and trust. The quality of our product is its

differentiating factor. All whistleblowing issues are handled by

our highly trained team of former police officers. During the first

half of the year, we handled a record number of cases from our

existing client base. Given the growing demand for our services, it

is critical we invest to evolve our product offering and the first

phase of our new client portal is on track for delivery in the

second half of this year.

Central overview

The focus in the first half of the year has been on fully

embedding the investments we made during 2021. We are pleased to

report that our Manchester-based Shared Service Centre is now fully

operational. We also made significant investment in our people

function and launched our first 'Future Leaders of Law Debenture'

programme.

Environmental, Social and Governance (ESG)

This is the first year of the FTSE Women Leaders Review, which

is the third and successor phase to the Hampton-Alexander and

Davies Reviews. It is an independent, voluntary and business-led

initiative supported by the Government, aimed at increasing the

representation of women. We are delighted that LawDeb ranked 1st in

Financial Services (2nd overall) amongst the FTSE 250 in the

inaugural FTSE Women Leaders Review.

We continue to give consideration to ESG factors across both the

investment portfolio and the IPS business. We will be enhancing our

reporting on ESG in the 2022 Annual Report.

Outlook

The recent surge in geopolitical risk has the potential to upend

decades of relative international stability and increasing

globalisation. It is also putting significant upward pressure on

energy costs, at least in the short term. The economic outlook is

uncertain, with gilt yields having risen to the highest level in

six years and UK inflation at its highest level in almost 40 years.

Whilst we are alive to the risks this creates, we remain confident

in our ability to deliver for our shareholders over the longer

term. The competitive advantage of Law Debenture's unique offering

has proved itself many times through challenging periods.

We understand the importance shareholders place on us to deliver

regular and reliable income. We remain focused on continuing our

unbroken 43-year record of maintaining or raising the dividend. Our

confidence is underpinned by the diversified and recurring nature

of the revenues of our IPS business. The cash flows from IPS allow

James and Laura increased flexibility in portfolio construction to

continue to outperform the benchmark over the longer term. We

continue to look for opportunities to grow our business through

organic investment and disciplined acquisitions where

appropriate.

We are encouraged by the new senior hires and the good new

business momentum and continue to invest in talent and technology

to ensure we continue to gain market share and maintain our

longer-term growth. With the expertise we have within the business

and the momentum building, I am confident that we are on the right

path and will be able to navigate the wider macro uncertainties

facing the economy today.

The Board has great confidence in your Company's longer-term

future and appreciates the ongoing trust you place in us.

Denis Jackson

Chief Executive

28 July 2022

Investment managers' report

Overview

The economic backdrop is highly unusual. Interest rates are

going up to combat inflation, while recession is widely predicted

for later this year. The economy had, in 2021, staged a partial

recovery from the pandemic but it was uneven. Shortages of labour

and supply bottlenecks were evident in many areas but recessionary

conditions continued in others. Then the first quarter of this year

saw war break out in Europe, with Russia invading Ukraine. Whilst

we are witnessing the impact now, with the expansion of NATO,

Germany substantially increasing military spend and food shortages

stoking inflation, the consequences will be experienced for years.

The current uncertainties have dominated investor thinking, leading

to steep valuation declines that were largely concentrated in the

most cyclical areas of the market.

Despite the challenging backdrop, the performance of the

investment portfolio has generally been satisfactory during a time

when the median share in the UK has fallen substantially. As a

demonstration of this, while the FTSE All-Share fell 4.6% in the

six months, outperformance in the benchmark was highly concentrated

at the top end of the FTSE 100 (which is dominated by natural

resource companies as well as defensive sectors such as

pharmaceuticals), while the median share in the FTSE 350 fell

19.7%. This compares to Law Debenture's NAV fall (with debt at fair

value) of 4.0%. As can be seen more clearly in the portfolio

performance section below, the Trust's NAV decline was (to an

extent) mitigated by portfolio holdings in natural resources, which

were held partly for diversification reasons in case the current

backdrop of high commodity prices were to arise. While these

positions helped from a mitigation perspective, they were not

enough to fully offset the substantial share price declines seen

elsewhere in sectors such as retail.

Dividend growth has been coming through at the upper end of our

expectations, corporate balance sheets are conservatively

positioned to weather an economic slowdown and company outlook

statements, while acknowledging the uncertainties ahead, are

broadly positive. The substantial de-rating we have seen in much of

the UK equity market in the first half of this year may, to a large

extent, already reflect the current economic uncertainties. For

these reasons we have been net buyers of UK equities in the first

half of the year, concentrating purchases in the areas that have

seen the steepest valuation falls.

Portfolio performance and activity

At the portfolio level, the de-rating was the most severe among

consumer discretionary holdings (such as Marks & Spencer) and

early-stage companies (such as Accsys Technologies). There is more

detail of the individual drivers of performance in the tables

below.

Top five absolute detractors

The following five stocks produced the largest negative impact

on portfolio valuation in the first half of 2022:

Share price

Stock movement (%) Contribution (GBPm)

------------------------- -------------- --------------------

Accsys Technologies -38.3% -6.0

Marks & Spencer -41.8% -5.9

Ceres Power -45.1% -5.9

Herald Investment Trust -36.1% -5.4

IP Group -45.5% -4.9

Source: Performance data held by Law Debenture based on market

prices.

In the case of consumer discretionary companies, our holdings

are largely in those that have undergone significant 'self-help' in

recent years and where we do not think this improvement is

reflected in the current valuation. Marks & Spencer, for

example, has begun to address its legacy store estate and re-set

prices to the extent that both the food and clothing businesses are

gaining market share. While recent UK consumer confidence figures

are notably weak, there are pockets of consumers that have built up

substantial savings during the pandemic and this could mean

spending in some areas is relatively insulated. This appears to be

the case with, for example, repair, maintenance and improvement

('RMI') spend, which is holding up well. We do not think these

nuances in consumer spending are being fully reflected in company

valuations, where the sell-off in shares year-to-date has been

material and indiscriminate. As a result, we have, in a number of

cases, added to the holdings in this area during the last six

months.

In the case of early-stage companies, these are businesses that,

in our view, have the potential to be substantially bigger in time.

However, within the portfolio they present the greatest degree of

'binary' risk, as some of their technologies may not reach full

commercialisation or sales prospects may be smaller than hoped. At

a time when market sentiment is poor, and there is a retreat to the

relative safety of more defensive industries such as utilities and

healthcare, this area performed poorly, particularly in the absence

of meaningful company-specific news. Over the long term, this area

has been a good contributor to the investment portfolio's

performance and has acted as a diversifier in previous years, such

as 2020, as the prospects for these businesses are largely

independent of the economic cycle. Similar to the consumer

discretionary holdings, we have made some additions to early-stage

companies on share price weakness.

Top five absolute contributors

The following five stocks produced the largest absolute

contribution to performance in the first half of 2022:

Share price

Stock movement (%) Contribution (GBPm)

------------- -------------- --------------------

Shell 31.5% 6.4

BAE Systems 51.0% 5.0

HSBC 19.4% 3.8

i3 Energy 94.3% 3.5

BP 17.5% 3.3

Source: Performance data held by Law Debenture based on market

prices.

The best performers during the six months tended to be companies

with earnings either positively exposed to rising commodity prices

(natural resource companies such as Shell, i3 Energy and BP), the

potential for higher defence spending (BAE Systems), or rising

interest rates (HSBC). We took profits in some of these areas

following good performance. The positions in mining companies BHP

and Glencore, for example, were sold, as was the position in US oil

services company Schlumberger.

During the period we were modest net sellers, divesting GBP12m

(net) and, within this, investing GBP30m (net) in the UK while

divesting from Europe and the US. This meant the UK weighting

within the portfolio rose to 85% at the end of June (compared to

83% at the end of 2021). It continues to be our view that the UK

market offers the most attractive valuation opportunities. Within

the UK market, the starkest de-rating in recent years has been

among domestically exposed businesses, where we added to several

positions during the first half, such as building materials

companies Marshalls and Ibstock, retailers Kingfisher, Halfords and

Vertu Motors and a new position in free-to-air broadcaster ITV.

These additions were partially funded by sales of positions that

were trading on high valuations versus their own history, such as

logistics property owner Urban Logistics and information services

provider Relx.

Income

Dividends during the period came in at the upper end of our

expectations, with investment income rising materially to GBP18.4m

(compared to GBP11.8m in the same period in 2021). This increase in

income is partially a result of us being net investors within the

UK, which continues to pay a higher dividend yield on average than

elsewhere.

At the stock level we have seen some holdings, such as Irish

Continental, return to dividend payments for the first time since

the pandemic, and have seen healthy dividend increases from sectors

such as banks (the three UK domestic banks held all more than

doubled their final dividends year-on-year). We have also seen a

notable trend of UK companies announcing share buybacks this year,

where Boards see their share prices as undervalued.

ESG

We continue to think that interaction and engagement with

companies, both at the board and executive levels, provides the

most accurate insights into whether companies are aiming to be (for

example) best in class with regards to their environmental

footprint. During the first half, we have challenged a number of

company management teams about the ambitiousness of their net zero

targets. In most cases, the answers are nuanced; some industrial

processes, for example, rely on very high temperatures that cannot

yet be replicated outside of using fossil fuels. We need to

continue to ask questions and challenge where we think companies

could move faster, but we also need to recognise that the ability

to achieve environmental goals varies hugely by industry.

Outlook

Inflation and interest rates will rise further in the short term

but there are signs that the supply bottlenecks are easing. In a

year's time, as the large jump in energy costs work their way out,

inflation will likely retreat. Once this is clearly seen, the

upward trend in interest rates will cease. Company operating

performances may come to be seen as surprisingly robust given the

backdrop. Portfolio valuations are low on any historic perspective.

These are the ingredients for a share price recovery and is the

reason we are a net buyer of UK equities for the portfolio. We

continue to see opportunities across a wide range of companies,

buying stocks on weak days in a diversified list of well-run

companies that have strong management and low valuations.

James Henderson and Laura Foll

Investment Managers

28 July 2022

Sector distribution of portfolio by value

30 June 2022 31 December 2021

-------------------- ------------- -----------------

Oil and gas 11.1% 10.1%

Basic materials 7.0% 9.7%

Industrials 20.3% 20.7%

Consumer goods 7.9% 7.4%

Health care 10.7% 7.2%

Consumer services 7.6% 8.8%

Telecommunications 3.3% 2.6%

Utilities 4.5% 4.4%

Financials 27.0% 27.5%

Technology 0.6% 1.6%

Geographical distribution of portfolio by value

30 June 2022 31 December 2021

------------------------ -----------------------

United Kingdom 84.7% United Kingdom 82.6%

North America 5.4% North America 5.4%

Europe 8.7% Europe 10.0%

Japan 1.2% Japan 1.1%

Other Pacific 0.7%

Other 0.2%

Fifteen largest holdings: investment rationale

at 30 June 2022

Approx Valuation Appreciation/ Valuation

Rank % of Market 2021 Purchases Sales (Depreciation) 2022

2022 Company portfolio Cap. GBP000 GBP000 GBP000 GBP000 GBP000

------ ------------------- ----------- ----------- ---------- ---------- -------- ---------------- ----------

1 GlaxoSmithKline 3.47 GBP89.8bn 26,911 - - 2,659 29,570

2 Shell 3.13 GBP157bn 20,280 - - 6,395 26,675

3 HSBC 2.72 GBP107.4bn 19,454 - - 3,769 23,223

4 BP 2.59 GBP74.4bn 18,839 - - 3,294 22,133

5 Barclays 2.21 GBP25.3bn 20,196 2,355 - (3,717) 18,834

6 Rio Tinto 2.16 GBP83.3bn 18,345 - - 92 18,437

7 NatWest 1.79 GBP22.8bn 14,100 1,724 - (543) 15,281

8 BAE Systems 1.75 GBP26.2bn 9,896 - - 5,048 14,944

Direct Line

9 Insurance 1.74 GBP3.3bn 13,950 2,220 - (1,320) 14,850

10 National Grid 1.61 GBP38.4bn 14,934 - 1,218 50 13,766

11 Tesco 1.59 GBP19.2bn 13,488 1,697 - (1,642) 13,543

12 Anglo American 1.55 GBP39.3bn 13,572 - - (355) 13,217

Lloyds Banking

13 Group 1.49 GBP29.2bn 14,340 - - (1,647) 12,693

14 Vodafone 1.41 GBP35.5bn 10,657 - - 1,374 12,031

15 Standard Chartered 1.37 GBP18.4bn 8,456 - - 3,205 11,661

Calculation of net asset value (NAV) per share

Valuation of our IPS business

Accounting standards require us to consolidate the income, costs

and taxation of our IPS business into the Group income statement

below. The assets and liabilities of the business are also

consolidated into the Group column of the statement of financial

position below. A segmental analysis is provided of these accounts,

which shows a detailed breakdown of the split between the

investment portfolio, IPS business and Group charges.

Consolidating the value of the IPS business in this way fails to

recognise the value created for shareholders by the IPS business.

To address this, since December 2015, the NAV we have published for

the Group has included a fair value for the standalone IPS

business.

The current fair value of the IPS business is calculated based

on historical earnings before interest, taxation, depreciation and

amortisation (EBITDA) for the second half of 2021, and the EBITDA

for the half year to 30 June 2022, with an appropriate multiple

applied.

The calculation of the IPS valuation and methodology used to

derive it are included in the previous annual report at note 14. In

determining a calculation basis for the fair valuation of the IPS

business, the Directors have taken external professional advice,

from PwC LLP. The multiple applied in valuing IPS is from

comparable companies sourced from market data, with appropriate

adjustments to reflect the difference between the comparable

companies and IPS in respect of size, liquidity, margin and growth.

A range of multiples is then provided by PwC, from which the Board

selects an appropriate multiple to apply. The make-up of our IPS

business is unique meaning we do not have a like for like

comparator group to benchmark ourselves against. We believe our

core comparators remain as Sanne Group, Intertrust, Link

Administration Holdings and JTC. However, each of these companies

have specific factors which limit their usability for a market

multiples-based valuation approach. Sanne Group and Intertrust are

under offer and experiencing no share price movement, Link is in

ongoing mergers and acquisitions discussions and JTC is a highly

acquisitive group.

These company-specific factors restrict their usability when

monitoring market movements, but the transaction multiples

themselves do provide benchmark data points for consideration.

However, given these limitations, PwC have also considered the

wider, less comparable companies listed below, but only to broadly

assess market movements in the relevant and complimentary service

sectors.

The table below shows a summary of performance of our

comparators:

Revenue

Revenue CAGR FY18 EBITDA

LTM* LTM EV/EBITDA - margin

Company (GBPM) 30 June 2022 LTM 2022 LTM

------------------------------ -------- -------------- ----------- --------

Law Deb IPS 46 10.5x 12% 33%

SEI Investments 1,555 10.1x 5% 33%

SS&C Technologies Holdings

Inc. 3,889 10.4x 10% 37%

EQT Holdings 58 12.0x 4% 38%

Perpetual 403 7.8x 8% 25%

JTC 148 18.2x 25% 17%

Sanne Group 204 22.6x 16% 29%

Link Administration Holdings 621 11.6x -2% 10%

Begbies Traynor Group 99 12.6x 17% 10%

Christie Group 61 N/A -5% 5%

Intertrust N.V. 489 12.5x 2% 28%

*LTM refers to the trailing 12 months 'results' which are

publicly available. Source: Capital IQ.

The multiple selected for the current period is 10.5x, which

represents a discount of 19.8% on the mean multiple of the

comparator group. The multiple selected is marginally down on the

full year multiple of 10.8x to reflect the current market

conditions.

It is hoped that our initiatives to inject growth into the IPS

business will result in a corresponding increase in valuation over

time. As stated above, management is aiming to achieve mid to high

single digit growth in 2022. The valuation of the IPS business has

increased by GBP88m/97% since the first valuation of the business

as at 31 December 2015.

Valuation guidelines require the fair value of the IPS business

be established on a stand-alone basis. The valuation does not

therefore reflect the value of Group tax relief from the investment

portfolio to the IPS business.

In order to assist investors, the Company restated its

historical NAV in 2015 to include the fair value of the IPS

business for the last ten years. This information is provided in

the annual report within the 10-year record.

Long-term borrowing

The methodology of fair valuing all long-term borrowings is to

benchmark the Group debt against A rated UK corporate bond

yields.

Calculation of NAV per share

The table below shows how the NAV at fair value is calculated.

The value of assets already included within the NAV per the Group

statement of financial position that relates to IPS is removed

(GBP44.4m) and substituted with the calculation of the fair value

and surplus net assets of the business (GBP133.9m). The fair value

of the IPS business has increased by 4.9% due to higher surplus net

assets being available. An adjustment of GBP4.5m is then made to

show the Group's debt at fair value, rather than the book cost that

is included in the NAV per the Group statement of financial

position. This calculation shows NAV fair value for the Group as at

30 June 2022 of GBP917.4m or 726.74 pence per share:

30 June 2022 31 December 2021

Pence per Pence per

GBP000 share GBP000 share

------------------------------------ --------- ---------- --------- ----------

Net asset value (NAV) per Group

statement of financial position 787,932 624.20 878,837 717.86

Fair valuation of IPS: EBITDA

at a multiple of 10.5x (June

2021: 10.1x) 163,317 129.38 165,985 135.58

Surplus net assets 15,067 11.94 4,041 3.31

Fair value of IPS business 178,384 141.32 170,026 138.89

Removal of assets already included

in NAV per financial statements (44,420) (35.19) (34,141) (27.89)

Fair value uplift for IPS business 133,964 106.13 135,885 111.00

Debt fair value adjustment (4,531) (3.59) (50,229) (41.03)

NAV at fair value 917,365 726.74 964,493 787.83

------------------------------------ --------- ---------- --------- ----------

Group income statement

for the six months ended 30 June 2022 (unaudited)

30 June 2022 30 June 2021

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

UK dividends 15,921 - 15,921 10,050 - 10,050

UK special dividends - 3,442 3,442 - - -

Overseas dividends 2,487 - 2,487 1,789 - 1,789

Overseas special dividends - - - - - -

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Total dividend income 18,408 3,442 21,850 11,839 - 11,839

Interest income 14 - 14 - - -

Independent professional services fees 25,691 - 25,691 23,047 - 23,047

Other income 216 - 216 302 - 302

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Total income 44,329 3,442 47,771 35,188 - 35,188

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Net (loss)/gain on investments held

at fair value through profit or loss - (124,238) (124,238) - 99,170 99,170

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Total income and capital (losses)/gains 44,329 (120,796) (76,467) 35,188 99,170 134,358

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Cost of sales (4,061) - (4,061) (3,579) - (3,579)

Administrative expenses (16,288) (996) (17,284) (14,826) (1,105) (15,931)

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Operating (loss)/profit 23,980 (121,792) (97,812) 16,783 98,065 114,848

Finance costs

Interest payable (818) (2,454) (3,272) (660) (1,979) (2,639)

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

(Loss)/profit before taxation 23,162 (124,246) (101,084) 16,123 96,086 112,209

Taxation (669) - (669) (650) - (650)

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

(Loss)/profit for the period 22,493 (124,246) (101,753) 15,473 96,086 111,559

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Return per ordinary share (pence) 18.21 (100.61) (82.40) 12.87 79.92 92.79

Diluted return per ordinary share (pence) 18.21 (100.58) (82.37) 12.87 79.92 92.79

------------------------------------------- --------- ---------- ---------- --------- --------- ---------

Group statement of comprehensive income

for the six months ended 30 June 2022 (unaudited)

30 June 2022 30 June 2021

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------------------------ -------- ---------- ---------- -------- -------- --------

(Loss)/profit for the period 22,493 (124,246) (101,753) 15,473 96,086 111,559

------------------------------------------------------ -------- ---------- ---------- -------- -------- --------

Foreign exchange on translation of foreign operations - (112) (112) - (20) (20)

------------------------------------------------------ -------- ---------- ---------- -------- -------- --------

Total comprehensive (loss)/income for the period 22,493 (124,358) (101,865) 15,473 96,066 111,539

------------------------------------------------------ -------- ---------- ---------- -------- -------- --------

Group statement of financial position

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December 2021

GBP000 GBP000 GBP000

------------------------------------------------------- ------------- ------------- -----------------

Non-current assets

Goodwill 18,973* 20,122 18,973

Property, plant and equipment 1,901 2,202 1,974

Right-of-use asset 5,253 5,591 5,542

Other intangible assets 3,177 620 3,516

Investments held at fair value through profit or loss 853,231 945,471 992,478

Retirement benefit asset 7,085 - 6,577

Deferred tax assets - 771 -

------------------------------------------------------- ------------- ------------- -----------------

Total non-current assets 889,620 974,777 1,029,060

------------------------------------------------------- ------------- ------------- -----------------

Current assets

Trade and other receivables 24,213 12,979 20,466

Contract assets 8,720 9,759 6,611

Cash and cash equivalents 71,979 9,885 35,880

------------------------------------------------------- ------------- ------------- -----------------

Total current assets 104,912 32,623 62,957

------------------------------------------------------- ------------- ------------- -----------------

Total assets 994,532 1,007,400 1,092,017

------------------------------------------------------- ------------- ------------- -----------------

Current liabilities

Trade and other payables 19,854 25,490 29,329

Lease liability 356 250 287

Corporation tax payable 1,387 763 925

Deferred tax liability 1,060 - 1,060

Other taxation including social security 2,561 670 1,543

Contract liabilities 7,504 5,305 5,620

------------------------------------------------------- ------------- ------------- -----------------

Total current liabilities 32,722 32,478 38,764

------------------------------------------------------- ------------- ------------- -----------------

Non-current liabilities and deferred income

------------------------------------------------------- ------------- ------------- -----------------

Long-term borrowings 164,267 114,214 164,245

Contract liabilities 3,463 3,234 4,054

Lease liability 6,148 5,881 6,117

Retirement benefit liability - 2,354 -

------------------------------------------------------- ------------- ------------- -----------------

Total non-current liabilities 173,878 125,683 174,416

------------------------------------------------------- ------------- ------------- -----------------

Total net assets 787,932 849,239 878,837

------------------------------------------------------- ------------- ------------- -----------------

Equity

Called up share capital 6,371 6,123 6,145

Share premium 72,042 38,346 41,865

Own shares (3,128) (2,003) (3,215)

Capital redemption 8 8 8

Translation reserve 2,544 1,982 2,656

Capital reserves 665,177 770,677 789,423

Retained earnings 44,918 34,106 41,955

------------------------------------------------------- ------------- ------------- -----------------

Total equity 787,932 849,239 878,837

------------------------------------------------------- ------------- ------------- -----------------

Total equity pence per share(+) 624.20 695.47 717.86

------------------------------------------------------- ------------- ------------- -----------------

* Note the decrease in goodwill is due to part of this balance

being re-classified as 'other intangible assets' in the 2021 annual

accounts.

(+) Please see above for calculation of total equity pence per

share.

Group statement of cash flows

Unaudited Unaudited Audited

30 June 2022 30 June 2021 31 December 2021

GBP000 GBP000 GBP000

-------------------------------------------------------------- ------------- ------------- -----------------

Operating activities

Operating (loss)/profit before interest payable and taxation (97,812) 114,848 155,320

Losses/(gains) on investments 124,238 (98,066) (121,170)

Depreciation of property, plant and equipment 152 181 220

Depreciation of right-of-use assets 349 354 858

Interest on lease liability 339 257 -

Amortisation of intangible assets 340 - 490

(Increase)/decrease in receivables (5,856) (80) (4,419)

(Decrease)/increase in payables (8,183) (1,931) 1,920

Transfer from capital reserves - (800) -

Normal pension contributions in excess of cost (509) (486) (940)

-------------------------------------------------------------- ------------- ------------- -----------------

Cash generated from operating activities 13,058 14,277 32,279

-------------------------------------------------------------- ------------- ------------- -----------------

Taxation 811 (125) (307)

-------------------------------------------------------------- ------------- ------------- -----------------

Operating cash flow 13,869 14,152 31,972

-------------------------------------------------------------- ------------- ------------- -----------------

Investing activities

Acquisition of property, plant and equipment (79) (1,295) (1,075)

Expenditure on intangible assets (60) (1) -

Cash consideration transferred in relation to acquisition - (18,208) (18,214)

Purchase of investments (77,296) (112,370) (200,096)

Sale of investments 92,327 77,980 140,440

-------------------------------------------------------------- ------------- ------------- -----------------

Cash flow from investing activities 14,892 (53,894) (78,945)

-------------------------------------------------------------- ------------- ------------- -----------------

Financing activities

Interest paid (3,272) (2,639) (5,277)

Dividends paid (19,530) (18,021) (34,923)

Payment of lease liability (239) (212) (371)

Proceeds of increase in share capital 30,403 29,269 32,810

Proceeds of issuance of long-term borrowings - - 50,000

Purchase of own shares 87 (542) (1,754)

-------------------------------------------------------------- ------------- ------------- -----------------

Net cash flow from financing activities 7,449 7,855 40,485

-------------------------------------------------------------- ------------- ------------- -----------------

Net increase/(decrease) in cash and cash equivalents 36,210 (31,887) (6,488)

-------------------------------------------------------------- ------------- ------------- -----------------

Cash and cash equivalents at beginning of period 35,880 41,762 41,762

Foreign exchange (losses)/gains on cash and cash equivalents (111) 10 606

-------------------------------------------------------------- ------------- ------------- -----------------

Cash and cash equivalents at end of period 71,979 9,885 35,880

-------------------------------------------------------------- ------------- ------------- -----------------

Group statement of changes in equity

Share Share Own shares Capital Translation Capital Retained Total

capital premium redemption reserve reserves earnings

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ---------- ----------

Balance at 1

January 2022 6,145 41,865 (3,215) 8 2,656 789,423 41,955 878,837

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ---------- ----------

Net

gain/(loss)

for the

period - - - - - (124,246) 22,493 (101,753)

Foreign

exchange - - - - (112) - - (112)

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ---------- ----------

Total

comprehensive

loss for the

period - - - - (112) (124,246) 22,493 (101,865)

Issue of

shares 226 30,177 - - - - - 30,403

Movement in

own shares - - 87 - - - - 87

Dividend

relating to

2021 - - - - - - (10,396) (10,396)

Dividend

relating to

2022 - - - - - - (9,134) (9,134)

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ---------- ----------

Total equity

at 30 June

2022 6,371 72,042 (3,128) 8 2,544 665,177 44,918 787,932

--------------- ----------- ----------- ----------- ----------- ------------ ----------- ---------- ----------

Group segmental analysis

Independent Professional

Investment Portfolio Services Group charges Total

---------------------------------- ------------------------------- ------------------------- -----------------------------------

30 June 30 June 31 30 June 30 June 31 30 30 31 Dec 30 June 30 June 31

2022 2021 Dec 2021 2022 2021 Dec June June 2021 2022 2021 Dec 2021

2021 2022 2021

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ---------- ---------- ---------- --------- --------- --------- ------- ------- ------- ---------- ----------- ----------

Revenue

Segment income 18,408 11,839 26,259 25,691 23,047 49,513 - - - 44,099 34,886 75,772

Other income 216 299 551 - 3 - - - - 216 302 551

Cost of sales (43) - (110) (4,018) (3,579) (7,927) - - - (4,061) (3,579) (8,037)

Administration

costs (898) (1,289) (3,434) (15,390) (13,537) (28,246) - - - (16,288) (14,826) (31,680)

17,683 10,849 23,266 6,283 5,934 13,340 - - - 23,966 16,783 36,606

Interest

payable

(net) (804) (660) (1,319) - - - - - - (804) (660) (1,319)

Return,

including

profit on

ordinary

activities

before

taxation 16,879 10,189 21,947 6,283 5,934 13,340 - - - 23,162 16,123 35,287

Taxation - - - (669) (650) (1,210) - - - (669) (650) (1,210)

Return,

including

profit

attributable

to

shareholders 16,879 10,189 21,947 5,614 5,284 12,130 - - - 22,493 15,473 34,077

Return per

ordinary

share (pence) 13.66 8.48 18.09 4.55 4.39 10.00 - - - 18.21 12.87 28.09

Assets 910,116 952,257 1,020,114 84,416 55,122 71,903 - 21 - 994,532 1,007,400 1,092,017

Liabilities (166,604) (123,977) (175,418) (39,996) (34,184) (37,762) - - - (206,600) (158,161) (213,901)

Total net

assets 743,512 828,280 844,696 44,420 20,938 34,141 - 21 - 787,932 849,239 878,837

The capital element of the income statement is wholly

attributable to the investment portfolio.

Principal risks and uncertainties

The principal Group risks include investment performance and

market risk, financial reporting, and cyber and technology risks.

The principal risks specific to the IPS business include meeting

its strategic and financial objectives, change management, and

financial crime. Emerging risks include ESG factors, and the

prominence of an increasingly digital IPS competitor landscape.

These top risks are explained along with mitigating actions in

the Risk Management section of the Annual Report for the year ended

31 December 2021. In the view of the Board these risks and

uncertainties are as applicable to the remaining six months of the

financial year as they were to the period under review. As part of

ongoing risk management to identify new risks and developments, the

Board continues to review and assess risks, uncertainties and

impacts during the course of the year.

Related party transactions

There have been no related party transactions during the period

which have materially affected the financial position or

performance of the Group. During the period, transactions between

the Corporation and its subsidiaries have been eliminated on

consolidation. Details of related party transactions are given in

the notes to the annual accounts for the year ended 31 December

2021.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted

by the UK and gives a true and fair view of the assets, liabilities,

financial position and profit of the Group as required by

DTR 4.2.4R;

-- the half yearly report includes a fair review of the information

required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred

during the first six months of the current financial year and

their impact on the condensed set of financial statements;

and a description of the principal risks and uncertainties

for the remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the

first six months of the current financial year and that have

materially affected the financial position or performance of

the entity during that period.

On behalf of the Board

Robert Hingley

Chairman

28 July 2022

Notes to the condensed consolidated financial statements

1. Basis of preparation

The condensed set of financial statements included in this

half yearly financial report has been prepared in accordance

with International Accounting Standard (IAS) 34 Interim Financial

Reporting, as adopted for use in the UK.

The financial resources available are expected to meet the

needs of the Group for the foreseeable future. The financial

statements have therefore been prepared on a going concern

basis.

The Group's accounting policies during the period are the same

as in its 2021 annual financial statements, except for those

that relate to new standards effective for the first time for

periods beginning on (or after) 1 January 2022, and will be

adopted in the 2022 annual financial statements.

2. Presentation of financial information

The financial information presented herein does not amount

to full statutory accounts within the meaning of section 435

of the Companies Act 2006 and has neither been audited nor

reviewed pursuant to guidance issued by the Auditing Practices

Board. The annual report and financial statements for 2021

have been filed with the Registrar of Companies. The independent

auditor's report on the annual report and financial statements

for 2021 was unqualified, did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying the report, and did not contain a statement

under section 498(2) or (3) of the Companies Act 2006.

3. Calculations of NAV and earnings per share

The calculations of NAV and earnings per share are based on:

NAV: shares at end of the period 126,230,289 (30 June 2021:

122,109,313; 31 December 2021: 122,424,129) being the total

number of shares on issue less shares acquired by the ESOT

in the open market.

Income: average shares during the period 123,497,103 (30 June

2021: 120,226,033; 31 December 2021: 121,308,792) being the

weighted average number of shares on issue after adjusting

for shares held by the ESOT.

4. Listed investments

Listed investments are all traded on active markets and as

defined by IFRS 13 are Level 1 financial instruments. As such

they are valued at unadjusted quoted bid prices. Unlisted investments

are Level 3 financial instruments. They are valued by the Directors

using unobservable inputs including the underlying net assets

of the instruments.

5. Portfolio investments

A full list of investments is included on the website each

month.

6. Half yearly report 2022

The half yearly report 2022 will be available on the website

in early August via the following link:

https://www.lawdebenture.com/investment-trust/shareholder-information/annual-reports-and-half-yearly-reports

Registered office:

8th Floor, 100 Bishopsgate, London, EC2N 4AG Telephone: 020 7606

5451

(Registered in England - No. 00030397)

LEI number - 2138006E39QX7XV6PP21

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVDDRITFIF

(END) Dow Jones Newswires

July 29, 2022 02:00 ET (06:00 GMT)

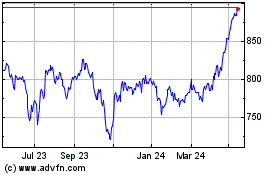

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

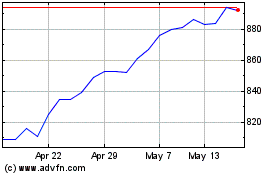

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024