TIDMLWDB

RNS Number : 7481U

Law Debenture Corp PLC

31 July 2020

The following amendment has been made to the Half Year Report

announcement under RNS number 6825U: Footnote 3 relating to the

Financial Summary has been corrected in relation to the intention

to pay a full year dividend of not less than 26.0 pence per share.

All other details remain unchanged. The full amended text is shown

below.

The Law Debenture Corporation p.l.c. today published its results

for the half-year ended 30 June 2020.

Group Highlights:

-- 2020 dividend to be at least equal to 2019 level of 26.0 pence per share

-- Dividend yield of 5%(1)

-- Solid performance from the Independent Professional Services

business continues to support dividend growth

-- Transitioned to quarterly dividends, creating greater

regularity and predictability around dividend payments

-- On-going charges remain low at 0.48% compared to the industry average of 1.04%(2)

Investment Portfolio Highlights:

-- NAV total return (with debt at par) for the six months

declined 16.5%(3) compared to a 17.5%(4) decline in the benchmark

FTSE Actuaries All-Share Total Return Index

-- Sizeable net investor during period, investing GBP33m to take

advantage of attractive valuations

-- Outperformance of the benchmark in all performance periods.

Strong long term out performance of 57.6% over 10 years and 58.6%

over 5 years(4)

-- Moving to daily NAV publication from the start of August to increase transparency

YTD 1 year 3 years 5 years 10 years

Performance % % % % %

-------------------------------- ------ ------ ------- ------- --------

NAV total return (with debt

at par)(3*) (16.5) (10.6) (2.0) 24.1 144.7

NAV total return (with debt

at fair value)(3*) (18.6) (13.0) (4.8) 18.1 129.7

FTSE Actuaries All-Share

Index Total Return(5) (17.5) (13.0) (4.6) 15.2 91.8

Share price total return(5*) (16.5) (7.3) 2.0 21.9 163.9

Change in Retail Price Index(5) 0.3 1.1 7.5 13.0 30.6

Independent Professional Services (IPS) Highlights:

-- Leading wholly owned independent provider of professional

services, a key differentiator to other investment trusts

-- Revenues grew by 6.5% and earnings per share by 6.6%

Longer Term Track Record:

-- 131 years of value creation

-- 113%(6) increase in dividend over the last ten years

-- 41 years of increasing or maintaining dividends to shareholders

-- Diversified and highly repeatable nature of IPS revenues

funded 35%(7) of dividends for the trust over the preceding 10

years

Commenting, Robert Hingley, Chairman, said:

" The spread of Covid-19 has resulted in some very challenging

months for the global economy. Your Company has shared in some of

that pain, with a decline in NAV total return never comfortable to

report. However, our investment portfolio's long-term performance

remains well ahead of its benchmark. Our IPS business has continued

to build on two years of strong high single digit growth, despite

some significant macroeconomic headwinds.

The pandemic has highlighted how advantageous Law Debenture's

unique structure is for regular income seekers. The Board

recognises the importance of our dividend to shareholders, at a

time of pervasive dividend cuts across the market. We informed

shareholders in June of our intention to at least maintain calendar

2020 dividends at 26.0 pence per share, implying an attractive 5%

dividend yield. We have moved to a quarterly dividend cycle, with

our first quarterly payment made to shareholders on 28 July. This

differentiates Law Debenture and illustrates our continued

resilience and strong revenue reserves."

Commenting, Denis Jackson, Chief Executive Officer, said:

"I am grateful to our talented team for their incredible work

and best in class client service through the pandemic. Despite the

difficult macroeconomic backdrop, our IPS business grew revenues by

6.5% and earnings per share by an impressive 6.6%.

As we look ahead, we remain focused on execution within our IPS

business where we continue to see significant opportunities to grow

our market share. We have an excellent investment management team,

who the Board is confident are well placed to continue to position

the equity portfolio for future longer-term growth and

outperformance."

Company History:

From its origins in 1889, Law Debenture has diversified to

become a group with a unique range of activities in the financial

and professional services sectors. The group has two distinct areas

of business.

Investment Portfolio:

Our portfolio of investments is managed by James Henderson and

Laura Foll of Janus Henderson Investors.

Our objective is to achieve long term capital growth in real

terms and steadily increasing income. The aim is to achieve a

higher rate of total return than the FTSE Actuaries All-Share Index

Total Return through investing in a diversified portfolio of

stocks.

Independent Professional Services:

We are a leading provider of independent professional services,

built on three excellent foundations: our Pensions, Corporate Trust

and Corporate Services businesses. We operate globally, with

offices in the UK, New York, Ireland, Hong Kong, Delaware and the

Channel Islands.

Companies, agencies, organisations and individuals throughout

the world rely upon Law Debenture to carry out our duties with the

independence and professionalism upon which our reputation is

built.

The Law Debenture Corporation +44 (0)20 7606 5451

Denis Jackson, Chief Executive Officer denis.jackson@lawdeb.com

Katie Thorpe, Chief Financial Officer katie.thorpe@lawdeb.com

Tulchan Communications (Financial +44 (0)20 7353 4200

PR) Lawdebenture@tulchangroup.com

David Allchurch

Deborah Roney

* Items marked "*" are considered to be alternative performance

measures. For a description of these measures, see page 115 of the

annual report and financial statements for the year ended 31

December 2019.

1 Based on a closing share price of 522 pence as at 29 July

2020.

2 Law Debenture ongoing charges have been calculated based on

data held by Law Debenture as at 31 December 2019. Industry average

data was sourced from The Association of Investment Companies

(excluding 3i) as at 31 December 2019.

3 NAV is calculated in accordance with the Association of

Investment Companies methodology, based on performance data held by

Law Debenture including the fair value of the IPS business and

long-term borrowings. NAV is shown with debt measured at par and

with debt measured at fair value.

4 Outperformance compares NAV total return with debt at par to

the FTSE Actuaries All-Share Index Total Return.

5 Source: Bloomberg

6 Calculation based on the increase in annual dividend per share

between 1 January 2010 and 31 December 2019.

7 Dividends paid to shareholders between 1 July 2010 and 30 June

2020.

The Law Debenture Corporation p.l.c. and its subsidiaries

Half yearly report for the six months to 30 June 2020

(unaudited)

Financial summary 30 June 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

--------------------------- -------- -------- -----------

Net assets(1) 642,705 784,213 830,139

Pence Pence Pence

Net Asset Value (NAV) per

share at fair value(1,2*) 543.93 663.67 702.17

Revenue return per share

- Investment portfolio 6.33 11.76 22.18

- Independent professional

services 4.18 3.92 8.54

- Group charges -- (0.04)

Group revenue return per

share 10.51 15.68 30.68

Capital (loss)/return per

share (131.86) 50.42 79.27

Dividends per share(3) 13.0 6.60 26.00

Share price 517.00 592.00 650.00

--------------------------- -------- -------- -----------

%% %

Ongoing charges(4*) 0.48 0.43 0.48

Gearing(4) 197 9

Discount(*) (5.0) (10.8) (7.4)

* Items marked "*" are considered to be alternative performance

measures. For a description of these measures, see page 115 of the

annual report and financial statements for the year ended 31

December 2019.

1 Please refer to later in this statement for calculation of net

asset value.

2 NAV is calculated in accordance with the Association of

Investment Companies (AIC) methodology, based on performance data

held by Law Debenture including fair value of IPS business and

long-term borrowings. NAV is shown with debt measured at par and

with debt measured at fair value.

3 Whilst the second interim dividend is not due to be announced

until September 2020, the Board have already indicated their

intention to pay a full year dividend of not less than 26.0 pence

for 2020. This number includes an expected second interim dividend

of 6.5 pence for comparability.

4 Source: AIC. Ongoing charges are based on the costs of the

investment trust and include the Janus Henderson Investors

management fee of 0.30% of NAV of the investment trust. There is no

performance related element to the fee.

Half yearly management report

Introduction

The Covid-19 pandemic has had a profound impact on the

investment trust industry. The impact has not just been felt in the

well documented volatility in markets and wide spread dividend

cuts, but also by our growing global workforce of 154 people.

During the first three weeks of March, all of our employees

transitioned to remote working as Covid-19 took a firm grip on the

world's economy.

Since that time, all of our employees have had to adapt their

working practices significantly and have made huge sacrifices in

both their personal and professional lives. My enduring memory of

the last six months will be the way that all of our staff,

unselfishly, and with no prompting from me, brought the very best

of our collective experience to bear to solve the rapidly evolving

needs of our clients. I am proud of the kindness that our staff

showed to one another and the calm, measured and thoroughly

professional way in which they applied themselves. We are lucky to

have them and must continue to invest in them and in their

wellbeing.

Dividend

In April, our AGM was held virtually for the first time in your

Company's 131 year history. The Corporation declared, and our

shareholders overwhelmingly approved, a 50% increase in our final

dividend payment for 2019.

With significant turmoil in global markets as a result of the

Covid-19 pandemic, a large number of quoted companies cut their

dividends in response to the collapse of global revenues. We

recognised that this was happening at a time when the recipients of

those dividends may themselves be increasingly reliant on that

income.

A great advantage of the investment trust structure is the

ability to retain a portion of income received each year in order

to smooth dividends in times of market stress. With that backdrop,

the unique advantage of the Law Debenture structure has never been

more evident. We approached 2020 with an Independent Professional

Services business that had funded more than a third of dividends

for the Group over the preceding 10 years and Group retained

earnings of GBP62.5m(1) . Indeed, Investec produced some

independent research in March highlighting that our reserves

position was the strongest of all investments trusts in the AIC's

UK income and growth sector.

We were able to use these qualities to our shareholders'

advantage. Our first quarterly dividend payment of 6.5 pence per

ordinary share was made earlier this week to shareholders on the

register at the close of business on 26 June 2020. Based on the

current share price, that implies a dividend yield for the Law

Debenture share of 5.0%(2) .

Part of the reason for the confidence in our dividend is that we

have done this for a long time. The business itself was founded as

a Corporate Trustee 131 years ago; in every single one of the last

41 years we have either increased or at least maintained that

dividend. Indeed, in the last 10 years the dividend has more than

doubled. We intend to pay two further interim dividends of 6.5

pence per ordinary share in October 2020 and January 2021.

Shareholders will be asked to vote on a final dividend to be paid

in April 2021 at the Corporation's 2021 AGM. It is the Board's

current intention to recommend the final dividend payment be at

least 6.5 pence per share, thus sustaining our dividend at a time

of persistent market cuts.

1 Group retained earnings as at 31 December 2019 as disclosed on

page 81 of the annual report and accounts.

2 Based on a closing share price of 522 pence as at 29 July

2020.

Our Investment Portfolio

The impact on global stock markets of the Covid-19 pandemic has

been profound. Every business has been affected in some way, as our

way of life changed overnight. For many businesses, at least

initially, this impact has been a negative one. For a smaller

proportion, the impact has been positive, as change drove strong

demand for certain pockets of products.

Your investment portfolio has shared in some of that pain. At

the peak of market dislocation on 23 March, the FTSE Actuaries All

Share Index against which we benchmark our performance was down

34.3%. With a predominately UK portfolio of quoted stocks, combined

with a widening of discounts across the sector, our share price at

that point in the cycle had declined by 33.4% from the start of the

year.

Since then, we have seen a partial recovery from markets and a

strengthening of demand for our shares which, as I write to you

today, have gained 24.8%(5) from that low. The net asset value

total return performance (with debt at par) for the first half of

2020 declined by 16.5%, compared to a decline of 17.5% by the

benchmark. With a mandate to grow capital for our shareholders, we

can never be comfortable reporting such a decline. We can, and do

however, take comfort from our outperformance of the benchmark on a

year to date, one, three, five and 10 year performance metric(6)

.

The unique combination of our IPS business with our investment

portfolio, as we have noted above, provides a significant advantage

for our Investment Managers with regards to portfolio construction.

Put simply, the cash that we generate from that IPS business has

allowed James and Laura to avoid potential value traps, as other

income funds may be forced into a narrower selection of stocks to

maintain their own dividend yield. You can hear from James and

Laura in their own words later in this results statement on the

drivers behind the performance of the portfolio for the period and

their outlook on markets in these challenging economic

circumstances.

We are fortunate to have secured their expert services for a

management fee of 30 basis points. Our ongoing charges ratio is

currently 48(3) basis points compared to a sector average of 103(4)

basis points, which we believe makes the trust excellent value for

money. In light of continued market volatility, we will be

providing a daily NAV to the market from the start of August. This

is another step in our journey of increasing transparency for our

shareholders.

Independent Professional Services

DIVISION Revenue(7) Revenue(7) Growth

30 June 30 June 2019/2020

2019 2020

GBP000 GBP000 %

------------------- ---------- ---------- ----------

Pensions 5,098 5,839 14.5

Corporate Trust 4,372 4,878 11.6

Corporate Services 5,991 5,735 (4.0)

Total 15,461 16,470 6.5

----------------------- ---------- ---------- ----------

3 Calculated based on data held by Law Debenture for the year

ended 31 December 2019.

4 Source: Association of Investment Companies industry average

(excluding 3i) as a31 December 2019.

5 Based on a closing share price of 522 pence as at 29 July

2020.

6 Outperformance compares NAV total return with debt at par to

the FTSE Actuaries All-Share Index Total Return.

7 Revenue shown is net of cost of sales.

We have often talked about the advantage of our unique

structure, but it is at points like this in the cycle where that

benefit is even more pronounced. Firstly, the capital valuation of

the IPS business (which currently accounts for 17% of the net asset

value of the Group), while linked to, is not directly correlated

with markets. This provides a diversification of risk for our

investors, compared to broader market movements. Secondly, as noted

above, it allows James and Laura a genuine flexibility in portfolio

construction. Thirdly, within the IPS business, our diverse revenue

streams have afforded our shareholders a great deal of resilience

in these challenging economic circumstances.

Over the course of the first half of 2020 we have been able to

grow our revenues by 6.5% and earnings per share by 6.6% compared

to 2019. This builds on revenue growth of 9.0% and earnings per

share growth of 9.2% in 2018 and on revenue growth of 7.5% and

earnings per share growth of 8.5% in 2019. Over the past two and a

half years we have grown revenue by 20.8% and earnings per share by

22.1%. We are proud that our business has been able to deliver

these results for shareholders in such a difficult economic

environment.

.

Our Pensions business

Our Pensions business has posted its fourth year of positive

growth, with revenue increasing by 14.5% compared to the first half

of 2019. Today, we service more than 200 schemes, with oversight of

over GBP350bn of assets, providing pension benefits to more than

three million families.

The requirement for excellent governance of pension schemes is

not dependent on economic conditions. In fact, with extreme market

dislocation comes heightened risk. Covid-19 has brought many

challenges to the pensions industry, including the weakening of

employer covenants; cash constraints in large corporates to fund

deficits; and concerns around the administration of schemes and the

payment of pensions in light of remote working requirements. In

these circumstances, the focus of the management teams of the

sponsor may legitimately be elsewhere. This highlights the benefit

of our sole trustee and Pegasus offerings to take away the

administrative burden of a highly complex area. Over the past two

years, our Pegasus business, which provides outsourced pensions

executive services, has doubled the size of its' team and grown

revenue by 85%, Revenues for the first half of 2020 have more than

doubled compared to the same period in 2019.

In addition to supporting our clients on a day to day basis

through these turbulent times, we have also been providing

innovative solutions to broader strategic problems. We have been

involved in several transformational deals and industry

initiatives, including playing an instrumental role in Premier

Foods PLC's landmark agreement regarding the restructure of its

pension schemes. Cash contributions required to the schemes have

reduced by between GBP115m and GBP145m. The shares in the company

have more than doubled since the changes were announced. We have

improved the security for British Bankers' Association scheme

members (a sole corporate trustee client) through the purchase of a

GBP95 million insurance policy with FTSE 100 Aviva. Two of our

trustees were also elected to the Legal & General Mastertrust

Board and the Legal & General Investment Management's

Independent Governance Committee respectively as we continue to

develop our defined contribution offering.

Our Corporate Trust business

Our Corporate Trust business is why we came into being in 1890,

providing services to act as a bridge between the issuers and

holders of bonds. Much of this revenue is predictable and inflation

linked, which is a considerable advantage when operating under

these type of market conditions. We started 2020 with almost two

thirds of our revenue secured and inflation linked.

In addition to this structural advantage, there is a strong

degree of counter-cyclicality to this business. In times of

economic stress, we are often required to do additional work for

our clients as they seek waivers or restructure their debt. Our

post issue work has seen a 47.6% increase in revenue in the first

half of 2020. compared to the same period in the prior year. This

in turn has contributed to overall revenue growth in the Corporate

Trust business of 11.6%. Following the global financial crisis in

2008, after an initial slowdown of revenue as a result of a drying

up of debt issuance, we ultimately saw revenues recover and grow

over the following three year period This crisis has fundamentally

different characteristics, with the possibility of increased

revenue from stressed situations. That said, we must be mindful

that in some circumstances default scenarios may involve the

business incurring cost and can take years to play out.

In addition to the stability and predictability of our revenues,

despite more than 130 years in this business, we still display the

ability to innovate. We have been quick to support new clients as

countries have needed to urgently source PPE to combat the Covid-19

crisis, providing a small, but absolutely critical contribution

through our escrow services to help to solve those procurement

issues. Working with both new and existing clients in the year, we

have acted as trustee on almost GBP30bn of bonds, notes and

certificates issued in the first half of the year. This brought the

total principal value on which we act as trustee to more than

GBP900bn as at 30 June 2020.

Our Corporate Services business

Our diversified pool of businesses has served us well during

this challenging period but our Corporate Services business

suffered the greatest collective headwinds. This line of business

is made up of three distinct revenue streams being core Corporate

Services, the Safecall whistleblowing business and Service of

Process.

Our company secretarial, special purpose vehicle accounting and

administrative services offering continued to grow nicely from a

small base, with a particularly strong first quarter. We made new

hires during the period and will continue to do so to stay ahead of

demand. We are relatively small compared to the market opportunity

and are confident we can significantly increase our footprint.

Our Safecall whistleblowing business had a bright start to the

year in January and February and wins during the period included

Channel 4, Morgan Sindall and Westminster Council. On 27 January,

The House of Lords had its first reading of the Office of the

Whistleblower Bill which establishes the UK frameworks for

whistleblowing legislation. Helpful too, in the medium term, is the

European Whistleblowing Directive that comes into force in 2021.

The Directive requires all companies with over 50 employees or

EUR10m in turnover in the EU to have a whistle blowing regime in

place. These regulatory tailwinds will be supportive to our long

term growth ambitions. Equally important are the numerous examples

of the high quality work that we completed on behalf of our

existing clients during the period.

With the onset of Covid-19 in March, the growth of this business

did slow from the c.20% seen in the prior two calendar years, as

many purchasing decisions were understandably placed on hold.

Conversely, the value of our proposition to the management teams

and boards of our clients has never been clearer. Employees used

our service to raise concerns around working conditions, allowing

employers to quickly adapt to new working practices. We have

received much unsolicited praise for our work and have an increased

confidence in both the quality and value of our product. As we

start the second half of the year, new business enquiries are

returning to more normal levels. We remain optimistic regarding our

ability to grow our market share around the world.

Our service of process business is highly transactional and is

our business with the least contractual recurring revenues. Put

simply, sharp contractions in the global economy mean less deals

are signed, which in turn reduces demand for a service of process

agent. History tells us that the drop off in revenues that we saw

from March onwards is similar to the sharp drop off that we saw in

2008 at the height of the global financial crisis. History tells us

too that demand should recover well as the subsequent restructuring

phase of economic hardship gets a full head of steam. We have deep

relationships around the globe that have been built over many

decades, and remain sanguine that our opportunities will increase

as the world economy begins to recover. In the meantime we continue

to invest in the technology platform that supports this business

and in developing digital distribution channels that we believe

will differentiate our offering.

Outlook

The next six months will undoubtedly bring ongoing challenges

due to the pandemic and the UK's exit from European Union. We feel

optimistic for the rest of year and excited to see what the longer

term future will hold for your Company.

As announced previously Katie Thorpe, our Chief Financial

Officer, will be leaving us in October. Katie has made a hugely

positive contribution to our business and we wish her every

continued success in her new endeavours. I am delighted to announce

that Hester Scotton will be promoted to replace Katie as CFO. We

continue to invest in creating a platform for sustainable and

controlled growth in all of our businesses, and we have also

promoted Kelly Stobbs to the role of General Counsel.

We have listened to our investors who are seeking regular,

reliable income and have moved to a quarterly dividend cycle. We

are currently providing a dividend yield of 5%, which we have

sustained at a time of profound and widespread dividend cuts across

the wider market. Our dividend is underpinned by the diversified

and highly repeatable nature of the revenues of our professional

services business. We believe, and our track record over the past

three years demonstrates, we can continue to grow over time. We

have an excellent long term track record of outperformance versus

our benchmark and believe we are at a favorable point in the

investment cycle to identify quality companies that have been

mispriced by the market.

Despite these unprecedented challenges, our Independent

Professional Services business was able to produce a plethora of

outstanding outcomes for our clients and a positive result for our

shareholders. I suspect though, the real value creation for our

shareholders from the IPS business over last six months will be

harvested over time, as the litany of best in class experiences has

added materially to our reputation for operational excellence. We

also remain alert to any prospective acquisitions that we feel

could accelerate growth in returns for our shareholders.

This combination of factors underpins my belief that the Law

Debenture investment proposition is, in fact, stronger now than it

was at the end of last year. On behalf of the Board, I would like

to thank all of our shareholders who have trusted us with their

hard earned capital, and to reassure you that we are working

tirelessly to reward the faith you have shown in us over this

unprecedented crisis.

Denis Jackson

Chief Executive

30 July 2020

Investment manager's review

Investment approach and process

The challenges facing the global economy as a result of the

Covid-19 pandemic are well documented, albeit the longer term

implications are still uncertain. For managers looking to provide a

much needed source of income as well as a long term capital return

to shareholders, the almost unprecedented dividend cuts implemented

by companies have made the markets in 2020 particularly difficult

to navigate.

In markets such as these, the advantages of the investment trust

structure, when compared to open ended investment products, become

even more pronounced. Specifically we know the Board had the

advantage of entering this period of global uncertainty with the

strongest reserves position in the UK equity income sector(1) .

Coupled with that, we have the unique advantage of the diversified

source of revenue provided by the IPS business, which has funded

35%(2) of Law Debenture's dividends to its shareholders over the

past ten years. As a result of the continued robust nature of the

IPS revenue, we have not been forced into the value traps that may

have ensnared other income investors as they search for yield to

maintain their own dividend payments to their investors.

We have a diversified investment portfolio, which aims to be a

one-stop-shop for investors seeking quoted market exposure to

quality companies. Our overall approach of the portfolio has not

changed, either as a result of the current pandemic or the change

in sector from the AIC's Global sector to the UK Equity Income

sector, slightly over a year ago. What we believe has changed over

that same period is the opportunity set when we look at global

valuations. 2020 has continued the theme of the second half of

2019, rotating out of overseas stocks on the grounds of valuation

and rotating into UK stocks we feel have been disproportionately

penalised by the market in the current economic environment.

The majority of the portfolio, 80.3%, was in UK stocks at the

half year end, little changed from 80.7% at 31 December 2019. Of

the UK portfolio, around 55% of the portfolio is invested in the

FTSE 100, with the remainder in small and medium sized

companies.

Although our focus remains the UK, we will continue to

confidently go to other geographies for companies that do not have

a credible UK equivalent where we perceive we can add value to the

overall portfolio. This approach remains entirely consistent with

the approach we have applied historically and has not been affected

by the change in sector. Looking to the global element of the

portfolio, we have reduced our exposure to North America, primarily

as a result of the stretch in valuation levels.

Our long standing benchmark is the FTSE Actuaries All-Share

Index Total Return. The portfolio performance for the period is

discussed in more detail below.

Portfolio performance and activity

The trust's NAV fell 16.5% on a total return basis (with debt at

par) in the first half of 2020. While it is always disappointing to

see the NAV decline in absolute terms, this decline was modestly

less than the FTSE All-Share benchmark which fell 17.5% during the

same time period. We go into more detail in the portfolio

attribution section below, but predominantly the outperformance was

driven by two alternative energy names held (Ceres Power and ITM

Power), as well as holding comparatively less than the benchmark in

the oil & gas industry following a material fall in the oil

price. On a debt at fair value basis, the NAV fell 18.6%, modestly

underperforming the benchmark. This is because in an environment of

falling bond yields the fair value of the debt was revised

upwards.

The largest change in positioning year to date is that we were

sizeable net investors during the period, investing GBP33m in total

and taking the gearing at period end to 19%. The majority of this

net investment took place in March during a period of heightened

market weakness; in recent months we have been largely neutral with

buying and selling approximately matched.

Net investment during the six months was concentrated in the UK

and Continental Europe. In contrast, in North America we reduced

the exposure by GBP16m, exiting long held positions including

Microsoft and Johnson & Johnson. In both cases the positions

were sold on valuation grounds following strong performance rather

than as a result of fundamental concerns.

New positions established during the six months included Anglo

American, Marks & Spencer, Linde, Tesco, Boku and Ricardo.

There is deliberately no common theme across these additions; they

range from small to large companies, domestically focused to

international, and the impact on their businesses of Covid-19

varies widely. For example Boku, which sells mobile payments

technology, has benefitted during the period with mobile payment

volumes growing materially as consumers transitioned to spending

online. For Tesco, the effect of Covid-19 has been broadly neutral,

with higher sales largely offset by additional costs, while for

Marks & Spencer the effect has been negative as the majority of

their clothing & home sales were temporarily paused (although

the share price, in our view, more than reflects this difficult

trading period).

If there were to be a commonality across the additions to the

portfolio it would be that the majority have chosen to temporarily

suspend their dividends as a result of Covid-19. This is not a

coincidence. It has come about because, in our view, the best total

return opportunities in the market currently reside in areas that

have been most affected by the virus and have therefore chosen to

temporarily suspend payments. When these companies return to paying

dividends, and some have already signalled their desire to do so,

the prices that we have been purchasing the shares will, we think,

result in an attractive dividend yield in the future. The unique

structure of Law Debenture with the income provided by the IPS

business means that we can confidently purchase these shares that

are currently not paying a dividend, while knowing that the Trust

as a whole can still pay an attractive dividend yield to

shareholders.

Portfolio attribution

At the sector level, the largest positive contributor to returns

relative to the FTSE All-Share benchmark was oil & gas. This

splits into two distinct categories; the larger position in

alternative energy names (Ceres Power and ITM Power), which

contributed strongly to performance at both an absolute and

relative level, and the relatively smaller holding in traditional

oil & gas companies (specifically Royal Dutch Shell and BP),

which contributed positively to relative performance.

Conversely the largest detractor from returns relative to the

benchmark was the sizeable position in the industrials sector,

specifically companies exposed to civil aerospace including

Rolls-Royce and Senior. We go into those companies in more detail

in the detractors section below.

1 Source: Investec.

2 Dividends paid to shareholders between 1 July 2010 and 30 June

2020.

Top five contributors

The following five stocks produced the largest absolute

contribution for 2020:

Share price

total return Contribution

Stock (%) (GBPm)

Ceres Power 103.1 12.4

-------------- ---------------

ITM Power 275.2 6.3

-------------- ---------------

Flutter Entertainment 19.5 1.8

-------------- ---------------

Microsoft 14.5 1.4

-------------- ---------------

Cellnex Telecom

Sau 51.0 1.0

-------------- ---------------

Source: Bloomberg calendar year share price total return as at

30 June 2020.

As the need to reduce global carbon emissions becomes evident,

there is a growing interest in alternatives to fossil fuels. One

area of focus is the role that hydrogen can play in the transition

to a lower carbon economy. We have two companies exposed to the

area, Ceres Power, which designs fuel cells and licenses the

technology to partners including Bosch and Weichai, and ITM Power,

which produces electrolysers that can be used to generate hydrogen

from electricity and water (ideally 'green hydrogen' with

electricity generated from renewable energy sources). Both

companies have performed well as they move closer towards

widespread commercialisation of their technologies by forming

agreements with large partners.

ITM Power announced a joint venture with industrial gases

company Linde (also held in the portfolio), and Ceres Power

announced that Bosch would be increasing their stake in the company

and taking a seat on the Ceres Board. These partners provide

external validation of the technologies and could also accelerate

commercialisation because of the relationships and balance sheets

that they bring. In both cases following strong share price

performance we have reduced the positions.

Another strong performer during the period was Flutter

Entertainment (formerly Paddy Power Betfair), which completed the

acquisition of US company Stars Group giving them exposure to the

fast growing US gambling market. Following strong performance we

have recently taken modest profits in the position.

As noted above, we have now exited the Microsoft position on the

basis of valuation following strong performance. Cellnex, a Spanish

telecoms infrastructure business, also performed well, benefitting

from its defensive revenue streams at a time of high economic

uncertainty and also from the perception that large, incumbent

telcoms companies will continue to sell their tower assets to

specialist tower companies.

Top five detractors

The following five stocks produced the largest negative impact

on the portfolio valuation for 2020:

Share price

total return Contribution

Stock (%) (GBPm)

Royal Dutch Shell -45.3 -12.7

-------------- ---------------

Hammerson -73.4 -7.6

-------------- ---------------

Rolls Royce -60.5 -6.8

-------------- ---------------

Senior -57.9 -6.5

-------------- ---------------

Carnival -72.9 -6.0

-------------- ---------------

Source: Bloomberg calendar year share price total return as at

30 June 2020.

The largest detractor from returns on an absolute basis was

Royal Dutch Shell. The sharp fall in the oil price as a result of

falling demand (particularly in transportation) meant their ability

to generate free cash flow was substantially reduced. As a result

the Board took the (in our view logical) decision to reduce the

dividend by two thirds to a level which we now view as sustainable,

and which has the potential to grow if the oil price recovers. The

share price performance has been disappointing and (with hindsight)

the company was over-distributing. However, at the newly rebased

level the shares are still paying an approximately 4% dividend

yield and on an oil price recovery the shares could recover.

One of the main detractors from performance at the sub-sector

level has been civil aerospace, where we have three holdings

exposed materially to the supply chain; engine maker Rolls-Royce

and components manufacturers Senior and Meggitt. The sharp fall in

flying hours that will occur this year has been a seismic shock for

the aerospace industry; considerably worse in terms of the hit to

passenger miles flown than the financial crisis of 9/11. It will

likely take several years for passenger numbers to recover to 2019

levels. This backdrop creates a challenging environment for the

supply chain in terms of, for example, excess capacity that needs

to come out and likely pricing pressure from Boeing and Airbus.

However, we need to view these challenges in the context of how

weak the shares have already been, the cost savings programmes that

are being accelerated, and the other businesses that the companies

operate in (for example all three companies also operate in defence

as an end market, which is proving resilient). In our view the very

challenging end market in civil aerospace is well known and

understood, and on balance we have decided to maintain our exposure

to the area.

Also among the largest detractors were retail property owner

Hammerson and cruise ship operator Carnival, both of which had

their business models severely disrupted as a result of Covid-19.

In the case of Hammerson, the majority of their tenants had to

close stores during 'lockdown' and as a result rental receipts were

poor. This came at a time when retail property values were already

under pressure from the shift in consumer spending to online. In

our view these structural factors will persist but there will

continue to be a value for prime retail properties, such as

Bicester village (in which Hammerson own a stake) or the Bullring

in Birmingham. Cruise operator Carnival, in a similar manner to the

airline industry, had to temporarily suspend its cruises and the

timeline to re-starting in some countries (such as the US) remains

unclear. The valuation is low on a return to historic levels of

profitability, but in the short term there is a lack of

visibility.

Income

Investment income during the period fell to GBP9.1m, compared to

GBP15.1m in the first six months of 2019. This fall was a result of

widespread dividend suspensions in abroad variety of sectors

including retailers, housebuilders, industrial companies, non-life

insurers and banks. Other sectors including life insurers,

pharmaceuticals, utilities, consumer goods and alternative asset

classes (such as renewable energy) are proving more resilient, as

are the overseas holdings. As a result of the diversified nature of

the portfolio we expect the fall in investment income in 2020 to be

less than the fall in the overall market, although still

material.

Given the strength of the reserves and the contribution of the

IPS business, the Board recently announced its intention for the

2020 dividend to be at least equal to the 2019 level of 26.0p per

share (paid in quarterly instalments). We fully support this

decision and crucially do not think that it impacts the way the

portfolio has always been managed, which is to treat income as an

output and focus on growing the capital.

Outlook

There is large divergence in economic forecasts from reputable

analysts. It is not clear how consumers and corporates in aggregate

are going to behave as 'lockdown' is eased. The consumers saving

ratio has substantially risen while peacetime has never seen

government indebtedness expand faster. Companies, given the

increased cost of production as they comply with social distancing,

may use an increase in demand to raise prices while the changes to

trading patterns forced by the approach of Brexit are unclear.

We take comfort from the fact that Law Debenture's portfolio is

not a proxy for the UK economy, but rather a diverse mix of

holdings in companies with strong management teams that are well

placed to cope with adversity. It is a focus on excellence of

product or service that is the best solution in dealing with an

erratic economy. The valuation of the overall portfolio holdings is

low given their longer-term earnings prospects. This is why after

share price weakness we have increased gearing, positioning the

portfolio for a pick-up in economic activity, as confidence slowly

returns.

James Henderson and Laura Foll

Investment Managers

30 July 2020

Sector distribution of portfolio by value

30 June 2020 31 December 2019

% %

Oil and gas 10.4 9.7

------------- -----------------

Basic materials 8.6 6.4

------------- -----------------

Industrials 21.2 23.2

------------- -----------------

Consumer goods 6.0 5.2

------------- -----------------

Health care 8.6 8.9

------------- -----------------

Consumer services 9.6 10.2

------------- -----------------

Telecommunications 1.4 1.1

------------- -----------------

Utilities 4.7 4.0

------------- -----------------

Financials 27.5 28.9

------------- -----------------

Technology 2.0 2.4

------------- -----------------

Geographical distribution of portfolio by value

30 June 2020 31 December 2019

% %

United Kingdom 80.3 80.7

------------- -----------------

North America 6.7 8.3

------------- -----------------

Europe 10.2 7.8

------------- -----------------

Japan 1.2 1.1

------------- -----------------

Other Pacific 0.9 0.9

------------- -----------------

Other 0.7 1.2

------------- -----------------

Fifteen largest holdings

at 30 June 2020

Approx. Valuation Appreciation Valuation

% of Market 2019 Purchases Sales /(Depreciation) 2020

Rank Company portfolio Cap. GBP000 GBP000 GBP000 GBP000 GBP000

----- ------------------ ---------- --------- ---------- ------------ -------- ----------------- ----------

1 GlaxoSmithKline 3.91 GBP82bn 29,792 - - (2,386) 27,406

2 Ceres Power 3.09 GBP924m 12,052 - (2,869) 12,428 21,611

3 Rio Tinto 2.43 GBP57bn 16,884 - - 173 17,057

4 Royal Dutch Shell 2.18 GBP96bn 27,994 - - (12,694) 15.300

5 Relx 2.00 GBP37bn 14,288 - - (263) 14,025

6 National Grid 1.99 GBP37bn 13,307 - - 618 13,925

Herald Investment

7 Trust 1.86 GBP1bn 12,580 - - 476 13,056

8 Severn Trent 1.77 GBP6bn 12,575 - - (180) 12,395

9 Dunelm 1.75 GBP2bn 11,097 - - 340 12,247

10 Prudential 1.62 GBP32bn 13,506 - - (2,125) 11,381

11 AstraZeneca 1.49 GBP111bn 13,609 - (3,962) 789 10,436

12 HSBC 1.42 GBP78bn 15,606 - - (5,629) 9,977

13 BP 1.40 GBP62bn 15,091 - - (5,262) 9,829

Urban Logistics

14 REIT 1.33 GBP258m 9,933 - - (620) 9,313

Morgan Advanced

15 Materials 1.32 GBP688m 11,095 979 - (2,795) 9,279

Calculation of net asset value (NAV) per share

Valuation of our IPS Business

Accounting standards require us to consolidate the income, costs

and taxation of our IPS business into the Group income statement.

The assets and liabilities of the business are also consolidated

into the Group column of the statement of financial position. A

segmental analysis is provided which shows a detailed breakdown of

the split between the investment portfolio, IPS business and Group

charges.

Consolidating the value of the IPS business in this way failed

to recognise the value created for the shareholder by the IPS

business. To address this, from December 2015, the NAV we have

published for the Group has included a fair value for the

standalone IPS business.

The current fair value of the IPS business is calculated based

upon historical earnings before interest, taxation, depreciation

and amortisation (EBITDA) for the second half of 2019, and the

EBIDTA for half year 2020, with an appropriate multiple

applied.

The calculation of the IPS valuation and methodology used to

derive it are included in the previous annual report at note 14. In

determining a calculated basis for the fair valuation of the IPS

business, the Directors have taken external professional advice.

The multiple applied in valuing IPS is from comparable companies

sourced from market data, with appropriate adjustments to reflect

the difference between the comparable companies and IPS in respect

of size, liquidity, margin and growth. A range of multiples is then

provided by the professional valuation firm, from which the Board

selects an appropriate multiple to apply. The multiple selected for

the current year is 8.7x, which represents a discount of almost 39%

on the mean multiple across the comparable businesses.

It is hoped that our initiatives to inject growth into the IPS

business will result in a corresponding increase in valuation over

time. As stated above, management is aiming to achieve mid to high

single digit growth in 2020. The valuation of the business has

increased by GBP21.6m/23.8% since the first valuation of the

business as at 31 December 2015.

Valuation guidelines require the fair value of the IPS business

be established on a stand-alone basis. The valuation does not

therefore reflect the value of Group tax relief from the investment

portfolio to the IPS business.

In order to assist investors, the Company restated its

historical NAV in 2015 to include the fair value of the IPS

business for the last ten years. This information is provided in

the annual report within the 10 year record.

Long-term borrowing

The methodology of valuing all long-term borrowings is to

benchmark the Group debt against A rated UK corporate bond

yields.

Calculation of NAV per share

The table below shows how the NAV at fair value is calculated.

The value of assets already included within the NAV per the Group

statement of financial position that relate to IPS are removed

(GBP23,179,000) and substituted with the calculation of the fair

value and surplus net assets of the business GBP112,056,000. The

fair value of the business has declined by 3.6% in light of the

impact on multiples of the Covid-19 pandemic and resulting market

instability, partially offset by the increase in EBITDA. An

adjustment of (GBP47,680,000) is then made to show the Group's debt

at fair value, rather than the book cost that is included in the

NAV per the Group statement of financial position. This calculation

shows an NAV fair value for the Group as at 30 June 2020 of

GBP642,705,000 or 543.93 pence per share:

30 June 2020 31 December 2019

GBP000 Pence GBP000 Pence

per share per share

--------------------------------------------- ----------- ----------- ----------- -----------

Net asset value (NAV) per Group statement

of financial position 609,206 515.58 775,272 655.76

--------------------------------------------- ----------- ----------- ----------- -----------

Fair valuation of IPS: EBITDA at a multiple

of 8.7x (2019: 9.2x) 102,086 86.40 105,938 89.61

Surplus net assets 9,970 8.44 16,367 13.84

Fair value of IPS business 112,056 94.84 122,305 103.45

Removal of assets already included in

NAV per financial statements (23,179) (19.62) (30,445) (25.75)

Fair value uplift for IPS business 88,877 75.22 91,860 77.70

Debt fair value adjustment (47,680) (40.36) (36,992) (31.29)

Dividend (7,698) (6.51) - -

--------------------------------------------- ----------- ----------- ----------- -----------

NAV at fair value 642,705 543.93 830,139 702.17

Group income statement

for the six months ended 30 June 2020 (unaudited)

30 June 2020 30 June 2019

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------------------- --------- ------------ ------------ ---------- --------- ---------

UK dividends 6,654 - 6,654 11,990 - 11,990

UK special dividends 458 - 458 893 - 893

Overseas dividends 1,986 - 1,986 2,131 - 2,131

Overseas special dividends - - - 85 - 85

9,098 - 9,098 15,099 - 15,099

Interest income 88 - 88 358 - 358

Independent professional

services fees 18,633 - 18,633 17,634 - 17,634

Other income 16 - 16 27 - 27

--------- ------------ ------------ ---------- --------- ---------

Total income 27,835 - 27,835 33,118 - 33,118

Net gain on investments

held at fair value

through profit or loss - (152,698) (152,698) - 62,730 62,730

----------------------------------- ------------------ ------------ ------------ ---------- --------- ---------

Total income and capital

(losses)/gains 27,835 (152,698) (124,863) 33,118 62,730 95,848

Cost of sales (2,163) - (2,163) (2,172) - (2,173)

Administrative expenses (11,943) (1,145) (13,088) (11,114) (1,166) (12,280)

--------------------------------------------

Operating profit(loss) 13,729 (153,843) (140,114) 19,831 61,564 81,395

Finance costs

Interest payable (660) (1,979) (2,639) (660) (1,979) (2,639)

Profit/(loss) before taxation 13,069 (155,822) (142,753) 19,171 59,585 78,756

Taxation (650) - (650) (642) - (642)

Profit/(loss) for the period 12,419 (155,822) (143,403) 18,529 59,585 78,114

-------------------------------------------- --------- ------------ ------------ ---------- --------- ---------

Return per ordinary share

(pence) 10.51 (131.86) (121.35) 15.68 50.42 66.10

Diluted return per ordinary

share (pence) 10.51 (131.86) (121.35) 15.68 50.42 66.10

Statement of comprehensive income

for the six months ended 30 June (unaudited)

30 June 2020 30 June 2019

Revenue Capital Total Revenue Capital Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------- -------- ----------- ----------- -------- -------- --------

Profit/(loss) for the period 12,419 (155,822) (143,403) 18,529 59,585 78,114

-------------------------------- -------- ----------- ----------- -------- -------- --------

Other comprehensive income

for the period - - - - - -

Foreign exchange on translation

of foreign operations - 489 489 - 12 12

Total comprehensive income

for the period 12,419 (155,333) (142,914) 18,529 59,597 78,126

-------------------------------- -------- ----------- ----------- -------- -------- --------

Group statement of financial position

Unaudited Unaudited Audited

30 June 2020 30 June 2019 31 December 2019

GBP000 GBP000 GBP000

Assets-Non-current assets

Goodwill 1,966 1,952 1,930

Property, plant and equipment 78 89 64

Right-of-use asset 5,632 - 1,057

Other intangible assets 73 135 104

Investments held at fair

value through profit or

loss 701,014 761,784 822,316

Retirement benefit asset 3,180 2,969 2.700

Total non-current assets 711,943 766,929 828,171

--------------------------------- -------------- -------------- ------------------

Assets-Current assets

Trade and other receivables 9,208 6,866 7,213

Other accrued income and

prepaid expenses 5,822 6,540 6,438

Cash and cash equivalents 25,504 86,467 71,236

--------------------------------- -------------- -------------- ------------------

Total current assets 40,534 99,873 84,887

--------------------------------- -------------- -------------- ------------------

Total assets 752,477 866,802 913,058

--------------------------------- -------------- -------------- ------------------

Current liabilities

Trade and other payables 13,376 11,525 13,010

Lease liability 240 - 730

Corporation tax payable 814 662 710

Deferred tax liability 150 - 83

Other taxation including

social security 714 656 540

Deferred income 5,417 4,719 5,625

Total current liabilities 20,711 17,562 20,698

--------------------------------- -------------- -------------- ------------------

Non-current liabilities

and deferred income

Long-term borrowings 114,179 114,135 114,157

Deferred income 2,451 3,106 2,463

Lease liability 5,803 - 350

Provision for onerous contracts 127 135 118

--------------------------------- -------------- -------------- ------------------

Total non-current liabilities 122,560 117,376 117,088

--------------------------------- -------------- -------------- ------------------

Total net assets 609,206 731,864 775,272

--------------------------------- -------------- -------------- ------------------

Equity

Called up share capital 5,922 5,919 5,921

Share premium 9,171 8,916 9,147

Own shares (1,533) (1,332) (1,332)

Capital redemption 8 8 8

Translation reserve 2,386 2,123 1,897

Capital reserves 541,297 663,018 697,119

Retained earnings 51,955 53,212 62,512

Total equity 609,206 731,864 775,272

--------------------------------- -------------- -------------- ------------------

Net Asset Value (pence)

per share 515.58 619.37 655.76

--------------------------------- -------------- -------------- ------------------

Group statement of cash flows

Unaudited Unaudited Audited

30 June 2020 30 June 2019 31 December 2019

GBP000 GBP000 GBP000

------------------------------------- -------------- ---------------- ------------------

Operating activities

Operating (loss)/profit before

interest payable and taxation (140,114) 81,395 136,638

(Losses)/gains on investments 153,843 (61,564) (97,644)

Foreign exchange (gains)/losses (26) (1) 20

Depreciation of property, plant

and equipment 21 - 1,101

Depreciation of right-of-use

assets 572 29 55

Interest on lease liability 35 - 99

Amortisation of intangible

assets 37 56 104

(Increase) in receivables (811) (713) (958)

Increase/(decrease) in payables 163 (344) 1,298

Transfer (from) capital reserves (798) (867) (1,680)

Normal pension contributions

in excess of cost (480) (469) (1,000)

Cash generated from operating

activities 12,442 17,522 38,033

Taxation (479) (168) (663)

Operating cash flow 11,963 17,354 37,370

------------------------------------- -------------- ---------------- ------------------

Investing activities

Acquisition of property, plant

and equipment (31) (17) (21)

Expenditure on intangible assets (6) (5) (23)

Purchase of investments (89,827) (70,098) (163,106)

Sale of investments 58,089 33,445 102,888

Cash flow from investing activities (31,775) (36,675) (60,262)

------------------------------------- -------------- ---------------- ------------------

Financing activities

Interest paid (2,639) (2,639) (5,277)

Dividends paid (22,976) (15,272) (23,050)

Payment of lease liability (613) - (1,777)

Proceeds of increase in share

capital 25 12 245

(Purchase) of own shares (201) (366) (366)

Net cash flow from financing

activities (26,404) (18,265) (29,625)

------------------------------------- -------------- ---------------- ------------------

Net (decrease) in cash and

cash equivalents (46,216) (37,586) (52,517)

------------------------------------- -------------- ---------------- ------------------

Cash and cash equivalents at

beginning of period 71,236 124,148 124,148

Foreign exchange gains/(losses)

on cash and cash equivalents 484 (95) (395)

Cash and cash equivalents at

end of period 25,504 86,467 71,236

------------------------------------- -------------- ---------------- ------------------

Group statement of changes in equity

Share Share Own Capital Translation Capital Retained

capital premium shares redemption reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- --------- --------- ---------- ------------ ------------ ------------ ----------- ------------

Balance at

1 January

2020 5,921 9,147 (1,332) 8 1,897 697,119 62,512 775,272

--------------- --------- --------- ---------- ------------ ------------ ------------ ----------- ------------

Net loss

for the

period - - - - - (155,822) 12,419 (143,403)

Foreign

exchange - - - - 489 - - 489

--------------- --------- --------- ---------- ------------ ------------ ------------ ----------- ------------

Total

comprehensive

income for

the period - - - - 489 (155,822) 12,419 (142,914)

Issue of

shares 1 24 - - - - - 25

Dividend

relating

to 2019 - - - - - - (22,976) (22,976)

Movement

in own shares - - (201) - - - - (201)

Total equity

at 30 June

2020 5,922 9,171 (1,533) 8 2,386 541,297 51,955 609,206

--------------- --------- --------- ---------- ------------ ------------ ------------ ----------- ------------

Group segmental analysis

Independent professional

Investment Portfolio services Group charges Total

---------------------------------- ------------------------------------- --------------------------- -------------------------------------

30 30 30 30 30 30 31 30 30 31

June June 31 June June 31 June June Dec June June Dec

2020 2019 Dec 2019 2020 2019 Dec 2019 2020 2019 2019 2020 2019 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

Revenue

Segment

income 9,098 15,099 29,201 18,633 17,634 36,815 - - - 27,731 32,733 66,016

Other

income 12 21 17 4 6 3 - - - 16 27 20

Cost

of sales - - - (2,163) (2,173) (5,026) - - - (2,163) (2,173) (5,026)

Adminis-tration

costs (1,034) (865) (2,186) (10,909) (10,249) (20,536) - - (113) (11,943) (11,114) (22,835)

Release

onerous

contracts - - - - - - - - 113 - - 113

-----------------

8,076 14,255 27,032 5,565 5,218 11,256 - - - 13,641 19,473 38,288

Interest

(net) (600) (360) (822) 28 58 209 - - - (572) (302) (613)

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

Return,

including

profit

on ordinary

activities

before

taxation 7,476 13,895 26,210 5,593 5,276 11,465 - - - 13,069 19,171 37,675

Taxation - - - (650) (642) (1,370) - - (50) (650) (642) (1,420)

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

Return,

including

profit

attributable

to

share-holders 7,476 13,895 26,210 4,943 4,634 10,095 - - (50) 12,419 18,529 36,255

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

Return

per ordinary

share

(pence) 6.33 11.76 22.18 4.18 3.92 8.54 - - (0.04) 10.51 15.68 30.68

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

Assets 714,209 825,358 870,944 38,218 41,387 42,021 50 57 50 752,477 866,802 913,015

Liabilities (128,105) (123,636) (126,399) (15,039) (11,167) (11,226) (127) (135) (118) (143,271) (134,938) (137,743)

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

Total

net assets 586,104 701,722 744,545 23,179 30,220 30,795 (77) (78) (68) 609,206 731,864 775,272

----------------- ---------- ---------- ---------- ----------- ----------- ----------- ------- ------- --------- ----------- ----------- -----------

The capital element of the income statement is wholly

attributable to the Investment Portfolio.

Principal risks and uncertainties

The principal risks of the Corporation relate to the investment

activities and include market price risk, foreign currency risk,

liquidity risk, interest rate risk, country/region risk and

regulatory risk. These are explained in the notes to the annual

accounts for the year ended 31 December 2019. In the view of the

board these risks are as applicable to the remaining six months of

the financial year as they were to the period under review.

Since the year end the Board has considered the risks faced by

the Corporation arising from the Covid-19 pandemic on both the

investment portfolio and the ability of the IPS business to

operate. More information on the impact is given in the half-yearly

management report and in the Investment Manager's report.

The principal risks of the IPS business arise during the course

of defaults, potential defaults and restructurings where we have

been appointed to provide services. To mitigate these risks we work

closely with our legal advisers and, where appropriate, financial

advisers, both in the set up phase to ensure that we have as many

protections as practicable, and at all other stages whether or not

there is a danger of default.

Related party transactions

There have been no related party transactions during the period

which have materially affected the financial position or

performance of the Group. During the period transactions between

the Corporation and its subsidiaries have been eliminated on

consolidation. Details of related party transactions are given in

the notes to the annual accounts.

Directors' responsibility statement

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU and gives a true and fair view of the assets, liabilities,

financial position and profit of the Group as required by DTR

4.2.4R;

-- the half yearly report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period.

On behalf of the board

Robert Hingley

Chairman

30 July 202

Basis of preparation

The results for the period have been prepared in accordance with

International Financial Reporting Standards (IAS 34 - Interim

financial reporting).

The financial resources available are expected to meet the needs

of the Group for the

foreseeable future. The financial statements have therefore been

prepared on a going concern basis.

The Group's accounting policies during the period are the same

as in its 2019 annual financial statements, except for those that

relate to new standards effective for the first time for periods

beginning on (or after) 1 January 2020 and will be adopted in the

2020 annual financial statements.

Notes

1. Presentation of financial information

The financial information presented herein does not amount to

full statutory accounts within the meaning of Section 435 of the

Companies Act 2006 and has neither been audited nor reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual report and financial statements for 2019 have been filed

with the Registrar of Companies. The independent auditor's report

on the annual report and financial statements for 2019 was

unqualified, did not include a reference to any matters to which

the auditor drew attention by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

2. Calculations of NAV and earnings per share

The calculations of NAV and earnings per share are based on:

NAV: shares at end of the period 118,159,734 (30 June 2019:

118,162,211; 31 December 2019: 118,224,400) being the total number

of shares in issue less shares acquired by the ESOT in the open

market.

Income: average shares during the period 118,169,964 (30 June

2019: 118,168,197; 31 December 2019: 118,181,082) being the

weighted average number of shares in issue after adjusting for

shares held by the ESOT.

3. Listed investments

Listed investments are all traded on active markets and as

defined by IFRS 7 are Level 1 financial instruments. As such they

are valued at unadjusted quoted bid prices. Unlisted investments

are Level 3 financial instruments. They are valued by the directors

using unobservable inputs including the underlying net assets of

the instruments.

4. Portfolio investments

A full list of investments is included on the website each

month.

5. Half-yearly report 2020

The half-yearly report 2020 will be available on the website in

early August via the following link:

https://www.lawdebenture.com/investment-trust/shareholder-information/regulatory-financial-reporting

Registered office:

Fifth Floor, 100 Wood Street, London EC2V 7EX Telephone: 020 7606 5451

(Registered in England - No. 00030397)

LEI number - 2138006E39QX7XV6PP21

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FIFFDDVILVII

(END) Dow Jones Newswires

July 31, 2020 03:29 ET (07:29 GMT)

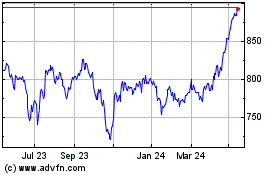

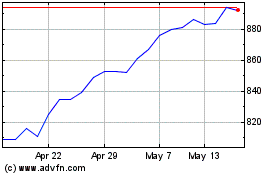

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Law Debenture (LSE:LWDB)

Historical Stock Chart

From Jul 2023 to Jul 2024