Kenwood Appliances - Holding in Company

January 12 1999 - 6:03AM

UK Regulatory

RNS No 123a

KENWOOD APPLIANCES PLC

12th January 1999

KENWOOD APPLIANCES plc

("the Company")

The Company was advised yesterday, (11th January 1999) by Schroder Investment

Management Limited of the following:

"KENWOOD APPLIANCES PLC .

l0p ORDINARY SHARES ("SHARES")

"Schroder Investment Management Limited have an interest in 5,222,278 shares

which are held in portfolios managed by them on a discretionary basis for

clients under investment management agreements.

"Included in this figure are:-

(i) 1,095,975 shares registered or to be registered in the name of a

wholly-owned subsidiary nominee company, Schroder Nominees Limited,

(ii) 3,932,553 shares held in (a) unit trust(s) operated and managed by

another wholly-owned subsidiary, Schroder Unit Trusts Limited (SUTL), and

registered or to be registered in the name of Popeshead Nominees Limited,

and

(iii) 193,750 shares registered or to be registered in the name of Nortrust

Nominees Limited,

They believe that they and their subsidiary companies are therefore interested

in an overall aggregate of 5,222,278 shares, representing some 11.387% of the

total number of shares in issue, namely 45,860,008 shares.

This notification is made:

(a) in respect of their interest as investment managers and also by

virtue of the fact that they are the parent company of SUTL,

(b) on behalf of SUTL in relation to the interests it is treated as having

under the Companies Act 1985 (the Act), and

(c) on behalf of Schroders plc., their holding company, which is treated as

having an interest in all of the above shares under the Act by virtue of

its ownership of Schroder Investment Management Limited".

END

HOLBGGBBRDBCCCD

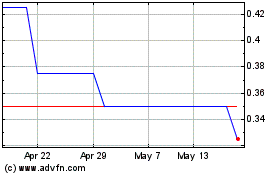

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

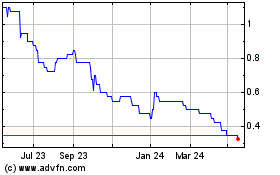

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024